Money Meets Mindset

Every great idea begins in an ordinary moment. A young man once noticed the gap between how people earn and how they grow rich. That gap became his lifelong study of financial independence.

Early Life

Born in Hawaii in 1947, the well-known Robert Kiyosaki grew up observing financial contrasts between his educated but struggling biological father and his friend's entrepreneurial “rich dad”. This laid the foundation for his future teachings on wealth and financial independence.

Military Service

After attending the US Merchant Marine Academy, Kiyosaki worked as a helicopter gunship pilot during the Vietnam War. Here, he earned an Air Medal before being honorably discharged in 1974 from the Marine Corps. Kiyosaki was stationed from 1972 to 1973.

DoD photo by U.S. Army Sgt. Kalie Jones, Wikimedia Commons

DoD photo by U.S. Army Sgt. Kalie Jones, Wikimedia Commons

Marine Experience

This man’s Marine experience, including flying with Marine Medium Helicopter Squadron (HMM)-264, significantly influenced his later business success and personal philosophies. He credits the Marine Corps with instilling in him values such as discipline, toughness, courage, integrity, and honesty.

JO1 Snaza, U.S. Navy, Wikimedia Commons

JO1 Snaza, U.S. Navy, Wikimedia Commons

First Ventures

Kiyosaki's entrepreneurial journey began in 1977 when he founded "Rippers," a company that created the first nylon and Velcro surfer wallets—an innovative product that achieved initial popularity, especially within the surfer community in Hawaii. Despite early success and media attention, the business eventually went bankrupt.

Brigittebourger Brigitte Bourger, Wikimedia Commons

Brigittebourger Brigitte Bourger, Wikimedia Commons

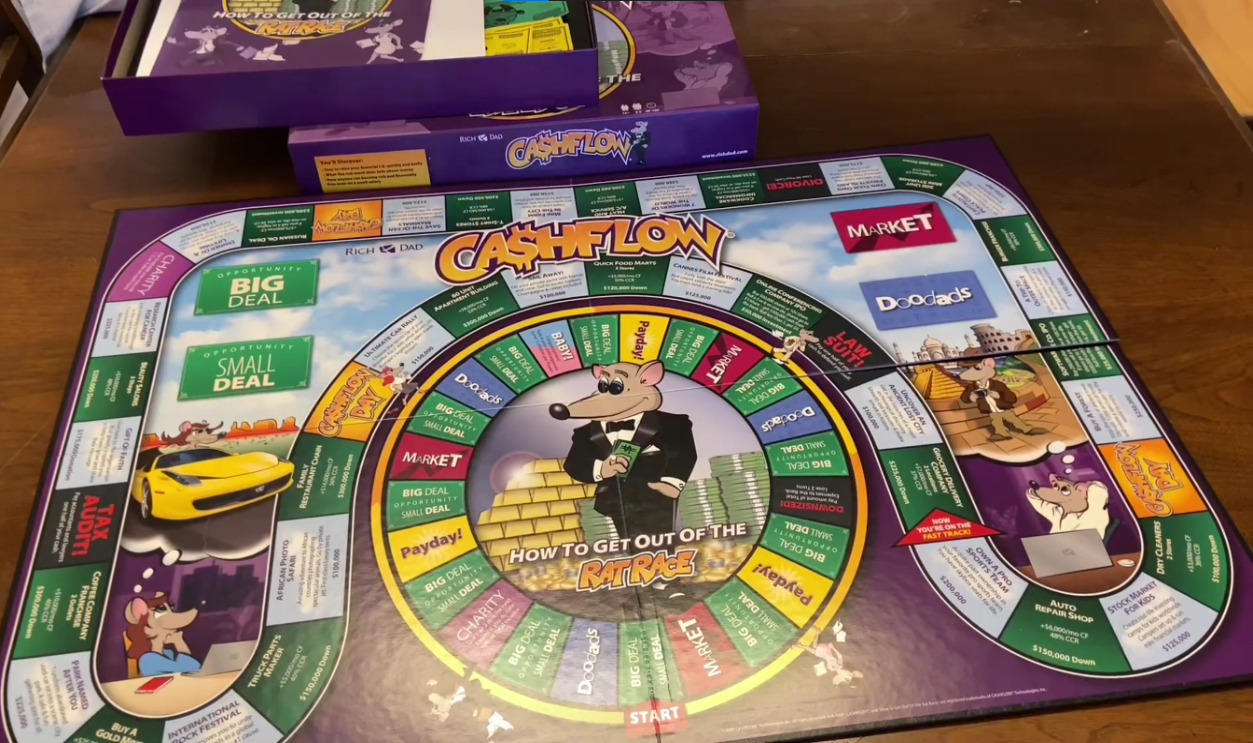

Education Company

Then, in the 1980s, Kiyosaki founded the Excellerated Learning Institute, offering business education seminars. This venture marked his transition into the educational realm, where he started developing his philosophies about money and investing. He even created the educational board game CASHFLOW.

Global Impact

Translated into dozens of languages, Kiyosaki's books have reached millions worldwide. His Rich Dad Company has expanded globally, offering seminars, coaching, and educational products promoting financial literacy across diverse cultures. He is widely celebrated today for his six passive income ideas.

Real Estate Investments

Forget the notion that real estate investing means becoming a full-time landlord chasing rent checks and fixing leaky faucets. The reality? Smart investors leverage property management companies to handle tenant relations and maintenance headaches, turning rental properties into hands-off income streams.

Real Estate Investments (Cont.)

As Robert Kiyosaki teaches, well-managed properties generate consistent passive income through regular rent payments, requiring minimal ongoing effort once systems are in place. While many shy away from taking on mortgages, Kiyosaki draws a critical distinction between "good debt" and “bad debt”.

Real Estate Investments (Cont.)

Good debt finances income-producing assets, while bad debt drains wealth. This strategic use of leverage, combined with professional management, allows investors to build substantial real estate portfolios while maintaining their day jobs. Better still, properties tend to gain value over time.

Dividend-Paying Stocks

Many investors view stocks as mere gambling chips in the market's casino, but dividend-paying stocks bring to light a different truth. They're genuine wealth-building machines. These investments quietly deposit real money into shareholders' accounts through regular monthly or quarterly payments.

Dividend-Paying Stocks (Cont.)

This represents a slice of each share's value. Picture a tree that bears fruit without needing constant attention. Yup, that’s pretty much Kiyosaki's definition of true assets that put money in your pocket rather than eliminate it.

Dividend-Paying Stocks (Cont.)

While he primarily advocates for tangible assets like real estate and gold, Kiyosaki acknowledges dividend stocks as legitimate sources of passive income. The real magic happens through dividend reinvestment plans (DRIPs), where each payment automatically buys more shares, creating a snowball effect of wealth accumulation.

Royalties From Intellectual Property

A few focused months of creative work can open decades of financial returns. This stark contrast defines the unique power of intellectual property assets. Authors pour their energy into crafting manuscripts and musicians dedicate themselves to composing songs, but the real magic emerges after completion.

Royalties From Intellectual Property (Cont.)

When? The moment these works turn into self-sustaining income generators. Each book sale and music stream triggers automatic royalty payments, resulting in a steady flow of passive income that can persist for years or even generations. Robert Kiyosaki recognized this temporal advantage early.

Royalties From Intellectual Property (Cont.)

He positioned books and courses as prime assets precisely because they continue producing cash flow long after their creation. His own bestseller, Rich Dad Poor Dad, stands as a living proof of this principle, still generating royalties years after its initial publication.

Rich Dad Poor Dad by Robert Kiyosaki Book Review by George Vlasyev

Rich Dad Poor Dad by Robert Kiyosaki Book Review by George Vlasyev

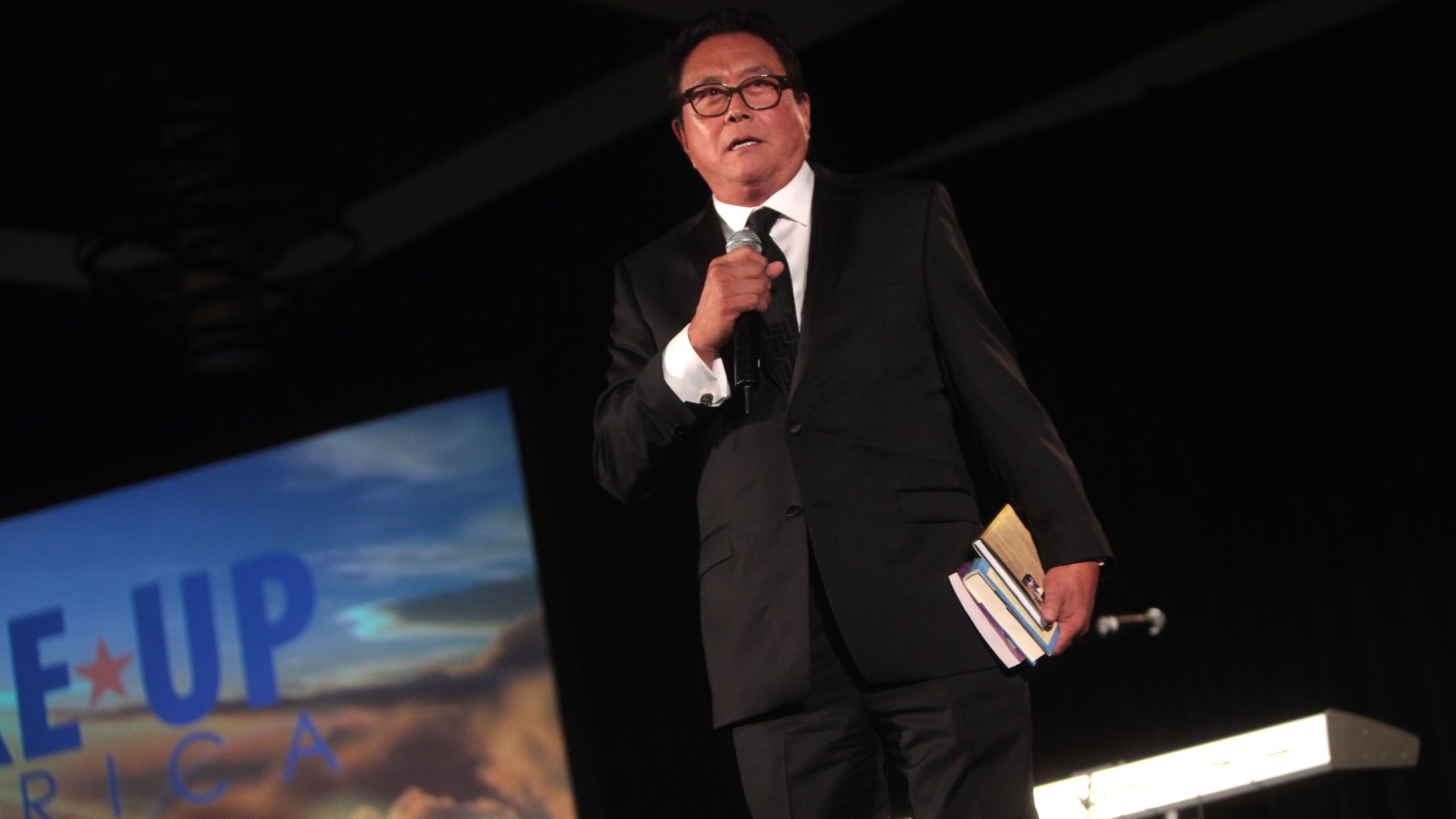

Create A Business That Operates Without You

Picture the daily grind: another entrepreneur chained to their business, watching hours slip away while profits remain tied to their presence. This is the exhausting reality for many business owners, until they discover Kiyosaki's transformative shift to the "B" quadrant of his Cashflow Quadrant.

Create A Business That Operates Without You (Cont.)

Here lies the escape route: building a business that operates as a self-sustaining system, rather than a demanding taskmaster. Through strategic automation of core processes and careful selection of capable team members, the business evolves beyond requiring the owner's constant attention.

Create A Business That Operates Without You (Cont.)

This systematic approach personifies Kiyosaki's central teaching that the wealthy don't work for money. They create assets and systems that generate passive income independently. The result is true entrepreneurial liberation, where the business continues producing revenue whether the owner is present or not.

Gage Skidmore from Peoria, AZ, United States of America, Wikimedia Commons

Gage Skidmore from Peoria, AZ, United States of America, Wikimedia Commons

Peer-To-Peer Lending

At first glance, peer-to-peer lending seems like a straightforward path to passive income. You lend money, borrowers pay interest, and the cash flows in. Through dedicated platforms, everyday investors can become mini-banks, funding loans to individuals and small businesses while collecting regular interest payments.

Peer-To-Peer Lending (Cont.)

But as with many financial opportunities, the reality gets more complex under the surface. Careful borrower screening becomes important, and the risks start to emerge. Perhaps this explains why Kiyosaki, despite acknowledging P2P lending as a passive income source, doesn't count it among his primary wealth-building strategies.

Peer-To-Peer Lending (Cont.)

Instead, he consistently steers investors toward assets such as real estate, stocks, and intellectual property—investments that offer both cash flow and true ownership. His philosophy suggests that building lasting wealth requires assets that have the potential to appreciate in value.

Gage Skidmore from Surprise, AZ, United States of America, Wikimedia Commons

Gage Skidmore from Surprise, AZ, United States of America, Wikimedia Commons

Cash Flowing Assets

What separates the wealthy from everyone else? Following Kiyosaki's investigative trail reveals a fascinating discovery. Apparently, the rich have mastered the art of acquiring assets that generate consistent cash flow without demanding their constant presence.

Cash Flowing Assets (Cont.)

Like skilled detectives piecing together clues, we can trace how rental properties, dividend stocks, and automated businesses create wealth while their owners sleep. The evidence points to a revolutionary shift away from trading time for money.

Cash Flowing Assets (Cont.)

Instead of working harder, successful investors let their assets do the heavy lifting. This breakthrough insight forms the backbone of Kiyosaki's wealth-building philosophy, where multiple streams of passive income work in harmony to accelerate the path to financial freedom.