The Upcharge Backlash

There's a quiet rebellion happening in checking accounts across the country. People are canceling, switching, and refusing to pay for things they've tolerated forever. Turns out convenience costs more than anyone realized.

Overpriced Coffee Shop Drinks

The rebellion against $7 lattes is real, and it's brewing in kitchens across America. What started as a convenient morning ritual has turned into a budget-busting habit. Coffee lovers are discovering that the premium pricing at specialty shops reflects far more than just the cost of beans and milk.

Overpriced Coffee Shop Drinks (Cont.)

It's basically paying for prime real estate, barista labor, and carefully cultivated brand positioning. When you break down the math, that handcrafted espresso-based beverage costs dramatically more than basic brewed coffee, and the markup can feel hard to justify when you're ordering the same drink five days a week.

Cable And Satellite TV Packages

Picture this: you're paying for 200 channels but only watching about 15 of them. This wasteful reality has finally pushed Americans past their breaking point with traditional cable and satellite packages. The frustration compounds when you realize that bundled packages force you to subsidize sports networks you never watch.

Cable And Satellite TV Packages (Cont.)

Those contract terms and early-termination fees add insult to injury, locking customers into long commitments even when better options emerge, or when viewing habits change. Instead of accepting whatever comes in a massive channel bundle, viewers can now pick specific services that match their actual interests.

Bank Maintenance And Overdraft Fees

Banks have been quietly charging customers for the privilege of holding their own money, and Americans are saying, “enough is enough”. Monthly maintenance fees for basic account upkeep, unless you maintain specific minimums, create a perverse system where those with less money pay more to access banking services.

Bank Maintenance And Overdraft Fees (Cont.)

These charges might seem small individually—$12 here, $15 there—but they accumulate into hundreds of dollars annually for families already watching every penny. The system feels particularly unfair because these fees rarely correspond to any actual service or value provided.

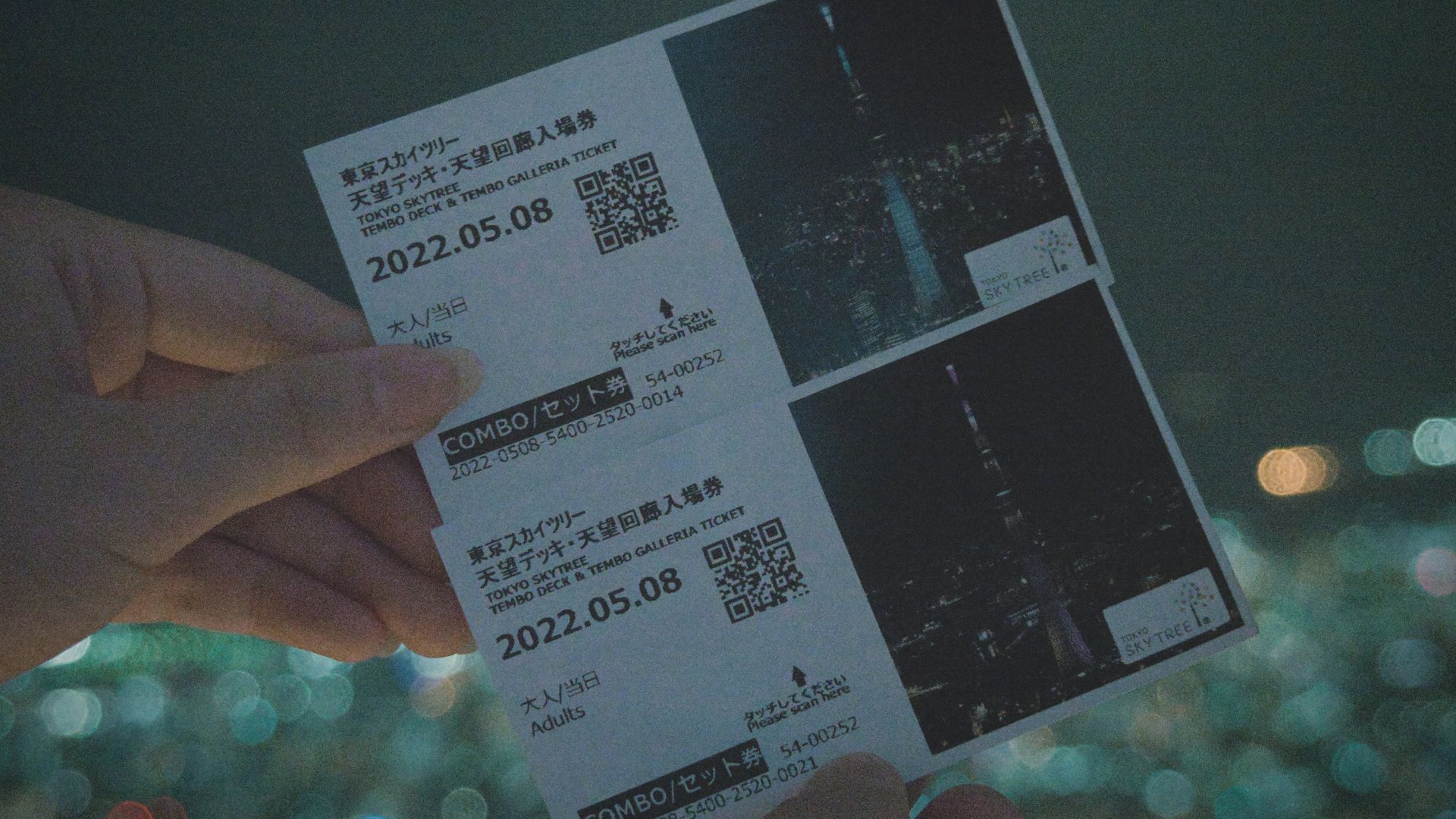

Ticket Convenience And Processing Fees

The moment of excitement when you score concert or sporting event tickets gets instantly deflated at checkout when "convenience" fees appear. Ticket sellers routinely add processing charges that can inflate costs by 20–30% or more beyond the advertised base price.

Ticket Convenience And Processing Fees (Cont.)

That infamous term "convenience fee" itself has become darkly ironic since there's nothing convenient about paying extra money for the standard digital transaction that's actually cheaper for sellers than traditional box office operations. These fees oft

Bottled Water At Events And Venues

In case you aren’t aware, the markup on bottled water at concerts, stadiums, and theme parks has reached genuinely absurd levels. We're talking $6 to $8 for something that costs mere cents at any grocery store. Venues justify these prices by citing captive audiences and operational costs.

Printer Ink Cartridges

The printer industry has perfected one of capitalism's most frustrating tricks: selling the hardware cheaply and making fortunes on the consumables. Manufacturer replacement ink cartridges carry retail prices that, when calculated per ounce, make them more expensive than premium champagne or even human blood.

Food Delivery App Service Fees

Ever notice how a $15 restaurant meal somehow becomes $28 by checkout on delivery apps? The fee structure has gotten so convoluted that it's almost intentionally confusing. Delivery apps add service fees, delivery fees, and sometimes small-order fees, turning affordable takeout into a premium expense.

Food Delivery App Service Fees (Cont.)

What makes it worse is that restaurants often raise their menu prices on delivery platforms to cover the hefty commissions these apps charge—sometimes 15–30% per order. You're essentially paying inflated prices for the food itself, then paying again in various fees for the privilege of having it brought to your door.

Out-Of-Network Atm Fees

Few things sting quite like needing $40 and losing $6 of it to ATM fees before you've even spent a dollar. Using an ATM outside your bank's network triggers a double-whammy: the ATM operator charges you, then your own bank adds a surcharge for letting you access your own money.

Vyacheslav Argenberg, Wikimedia Commons

Vyacheslav Argenberg, Wikimedia Commons

Out-Of-Network Atm Fees (Cont.)

These fees typically run $2–4 per transaction, which might not sound catastrophic until you calculate the percentage; that's effectively a 10–15% tax on small withdrawals. For people living paycheck to paycheck or managing tight budgets, these charges represent real money that could have gone toward groceries, gas, or other necessities.

Streaming Service Price Hikes And Ad Tiers

Streaming services periodically raise subscription prices or introduce ad-supported tiers, often with little notice and no corresponding improvement in content libraries. What started as one or two affordable services has metastasized into a landscape where having access to the shows you want requires subscriptions to five, six, or seven different platforms.

Counter-Service Tipping Prompts

You order a muffin at a bakery counter, the cashier rings you up, and suddenly you're staring at a screen suggesting a 20% tip for a transaction that involved zero table service. Digital payment terminals have created an uncomfortable new social dynamic where customers face pressure to add gratuities.

Hotel Resort And Destination Fees

The advertised room rate is a lie, and hotels know it. Those attractive nightly prices that lure you into booking get sabotaged by resort or destination fees tacked on separately from the advertised rate, sometimes adding $30–50 per night to your final bill.

Hotel Resort And Destination Fees (Cont.)

These fees supposedly cover amenities like Wi-Fi, pool access, gym use, or local services, but here's the catch: you pay them whether you use any of those amenities or not. Don't use the pool? Tough, you're paying for it. Already have unlimited cellular data and didn’t touch the Wi-Fi? Doesn't matter.

Credit Card Annual Fees

Credit card annual fees represent a straightforward value proposition gone wrong for many cardholders. Companies charge yearly fees—ranging from $95 to $695 or more—for premium benefits and rewards programs that sound impressive in marketing materials but may not match actual spending patterns.

Credit Card Annual Fees (Cont.)

The calculation seems simple: if your rewards exceed the annual fee, you're ahead. But many people end up paying for perks they rarely use, whether it's airport lounge access they never have time for, travel insurance on trips they don't take, or concierge services that go untouched.

Airline Seat Selection And Baggage Charges

Airlines have become masters of unbundling, converting what used to be included in a ticket price into an a la carte menu of upcharges. The base fare might look reasonable until you realize it includes only a personal item that fits under the seat; everything else costs extra.

Meutnake Ah ManHO, Wikimedia Commons

Meutnake Ah ManHO, Wikimedia Commons

Airline Seat Selection And Baggage Charges

If you choose where you sit instead of being randomly assigned a middle seat in the back row, then that'll be $15–60, depending on the flight and seat location. Suddenly, that $200 ticket becomes a $300+ journey before you've even arrived at the airport.

Car Rental Insurance And Toll Add-Ons

Car rental counters have become high-pressure sales environments where declining coverage feels like tempting fate. Rental companies offer collision damage waivers and supplemental insurance at daily rates that can match or exceed the base rental cost—sometimes $20–40 per day for coverage you might already have through other sources.

Harrison Keely, Wikimedia Commons

Harrison Keely, Wikimedia Commons

Forgotten Subscription Auto-Renewals

That $9.99 charge on your credit card statement might trigger a moment of genuine confusion about what "DigitalStreamPro" is and why they are billing you. It's a streaming service you signed up for eighteen months ago during a free trial, watched exactly twice, then completely forgot existed.