Does wealth determine who ties the knot?

Marriage still carries cultural weight, but fewer Americans feel able to reach it. Financial pressure and widening inequality are quietly redefining who marries and when.

Is Marriage Vanishing?

Marriage has not disappeared from American life, but its role has shifted dramatically. Fewer people marry young, yet those who do often stay married longer. This change reflects evolving economic pressures, cultural expectations, and a redefinition of what commitment is supposed to represent.

A Quiet Divide In Who Marries And Who Does Not

A growing gap separates Americans who marry from those who never do. Higher-income and college-educated adults are far more likely to wed. Meanwhile, rates have fallen sharply among working-class communities.

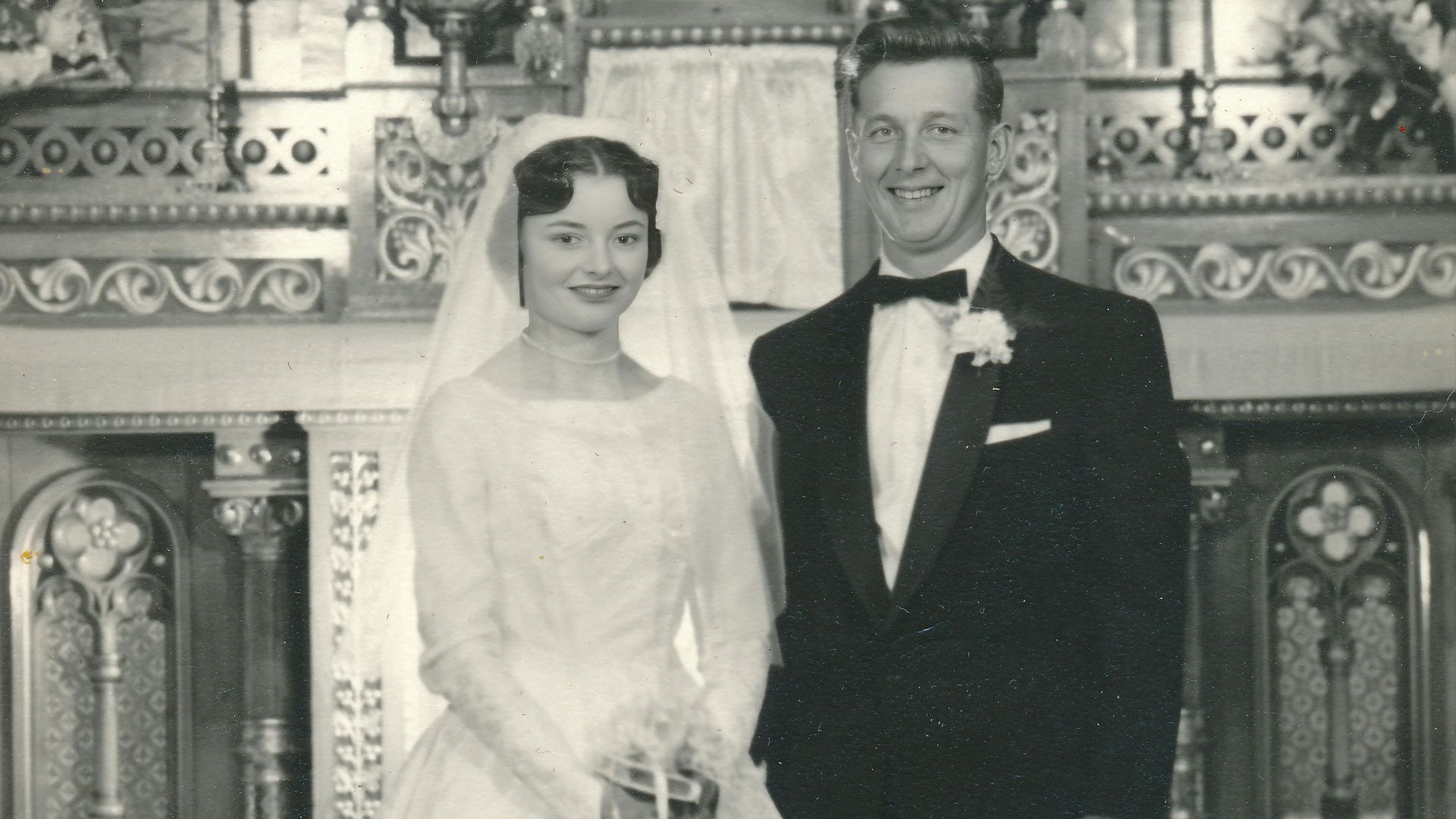

When Marriage Was Once A Common Starting Point

For much of the 20th century, matrimony often came early in adulthood. Couples married before owning homes or finishing education, building financial security together over time. Marriage functioned as a foundation for adult life, not a final milestone.

Then, Economic Security Became A Prerequisite

Over time, economic instability changed attitudes toward unions. Steady employment and savings gradually became expectations rather than aspirations. As wages stagnated and costs rose, many Americans began viewing wedlock as risky without a firm financial footing for security.

The Shift From Early Commitment To Earned Stability

Tying the knot currently marks the completion of personal and financial goals rather than their beginning. Many adults delay this step until their careers feel secure and their lifestyles feel settled. This mindset highlights broader uncertainty about security and the consequences of making irreversible choices in modern American life.

As Financial Readiness Impacts Romantic Choices

Money concerns now influence dating decisions in ways previous generations rarely faced. Concerns about income stability, health insurance, shared assets, and affordability affect whether people feel ready for serious steps.

The Rising Cost Of Feeling Prepared For Marriage

Readiness now often includes expectations like savings, a stable career, and a comfortable living situation. Higher healthcare, childcare, mortgage, and everyday expenses have raised the perceived entry cost of matrimony for many.

Vodafone x Rankin everyone.connected, Pexels

Vodafone x Rankin everyone.connected, Pexels

Education And Income As Invisible Gatekeepers

Educational attainment and income quietly influence who feels eligible for long-term partnerships. College degrees often lead to steadier jobs and predictable schedules, which support smart planning. Without these advantages, many adults feel this step is financially irresponsible.

Why Affluent And College-Educated Couples Still Marry

Affluent and college-educated Americans continue to tie the knot at higher rates because they face fewer economic barriers. With stable incomes, they enjoy employer benefits and access to housing, which reduces financial risk.

While Job Instability Delays Commitment

Unpredictable work schedules and frequent job changes make future planning difficult. When income feels uncertain, long-term partnerships can feel risky. Job instability affects not just finances, but confidence in sustaining a shared life.

With The Fear Of Financial Entanglement

Student loan debt has become a major psychological barrier to wedlock. Many borrowers worry about merging finances due to shared liability and long repayment timelines. Even manageable debt can feel overwhelming when paired with such ambiguity.

Housing Costs That Put Family Plans On Hold

Housing affordability strongly influences timing if someone is thinking about starting a family. High rents and rising home prices make it harder to imagine shared stability. Without secure housing, many couples delay legal commitments, viewing it as impractical until living arrangements feel permanent.

The Emotional Toll Of Economic Unpredictability

Financial instability does more than strain budgets; it negatively impacts emotional well-being. Constant worrying about income and emergencies decreases confidence in planning. For many adults, this stress makes a legal union feel overwhelming.

Cohabitation As A Stand-In

Living together has become a common alternative to spousal partnership, especially among younger and lower-income couples. Cohabitation offers companionship without legal or financial obligations. Although it provides flexibility, it often lacks the stability and social recognition even in American culture.

Why Love Alone No Longer Feels Enough

Romantic connection remains important, but many Americans no longer see it as sufficient for wedlock. Practical concerns like debt and housing now weigh heavily. Love may start relationships, yet long-term commitment increasingly depends on whether shared finances feel sustainable.

How Class Affects Expectations Around Commitment

Social class influences how people define readiness for a legal union. Well-off families often model stable relationships supported by resources, while economic hardship exposes risks of instability. These experiences teach some to view legal partnership as achievable and others to see it as precarious.

A Symbol Of Stability And Success

Marriage has taken on symbolic meaning beyond partnership. For many, it represents having “made it” economically and socially. This perception reinforces delays, as people wait to feel accomplished enough, which turns wedlock into a visible marker of success.

The Compounding Advantages Of Dual-Income Households

Married couples are more likely to benefit from combined incomes and employer benefits. Over time, these advantages compound through savings, homeownership, and retirement security. This dynamic helps explain why a long-term commitment increasingly reinforces economic inequality across American households.

How Unequal Patterns Affect Children

Children are more likely to grow up in married households when parents have stable incomes. This often brings greater financial consistency and time resources. As legal union becomes concentrated among the affluent, children’s experiences increasingly reflect broader economic divides.

Social And Emotional Consequences

Unmarried adults often report weaker social support networks and greater isolation, especially as peers pair off. Over time, this can affect mental health and access to informal caregiving across adulthood. The result? A society that feels more disconnected.

Cultural Stories That Reinforce The Divide

Media and family expectations often frame unions as the reward for stability rather than a tool for building it. These narratives reinforce the idea that only those who are financially settled should marry, subtly discouraging others from seeing marriage as attainable.

Why Declining Wedlock Rates Hit Some Groups Harder

The decline in marriage rates does not affect all Americans equally. Communities facing wage stagnation and limited mobility experience sharper drops. Because a spousal partnership can provide some economic and social buffering, its absence may intensify existing vulnerabilities.

Is Marriage Becoming A Luxury Institution?

As financial expectations rise, wedlock increasingly resembles a privilege rather than a universal norm. When stability and homeownership feel mandatory, marriage begins to mirror other lifestyle milestones accessible mainly to those with economic advantage and predictable futures.

Photography Maghradze PH, Pexels

Photography Maghradze PH, Pexels

Rethinking Tying The Knot In An Unequal Economy

These trends raise broader questions about how commitment should function in an unequal economy. If a legal partnership requires security many can’t reach, Americans may need new ways to support stable relationships and family life without linking them so tightly to wealth.