ANTONI SHKRABA production, Pexels

ANTONI SHKRABA production, Pexels

The doorbell rang at 7 am, and the envelope that slid under the door carried an unmistakable weight. Inside, legal language spelled out a three-day notice to pay or quit—the formal beginning of eviction proceedings. Those discounted electronics and half-price furniture suddenly felt like anchors dragging a household toward homelessness. When anyone decides to spend designated rent funds on retail therapy creates a cascade of legal consequences that move faster than most people realize, and once a landlord files eviction paperwork, the timeline becomes ruthlessly mechanical. Stalling tactics exist, but they operate within strict legal boundaries that vary dramatically by state, and misunderstanding these rules accelerates rather than delays the process. Understanding what options remain requires separating Hollywood myths from actual tenant law.

The Clock Ticks Faster Than Expected

Eviction timelines follow state-specific statutes that leave little room for improvisation. Most jurisdictions require landlords to serve a pay-or-quit notice ranging from three to 30 days before filing court papers, with California's three-day notice and New York's 14-day notice representing opposite ends of the spectrum. Once that deadline passes without payment, landlords can file an unlawful detainer lawsuit, and tenants typically receive five to 10 days to respond with a written answer. Missing this answer deadline results in a default judgment—an automatic win for the landlord requiring no further court appearance.

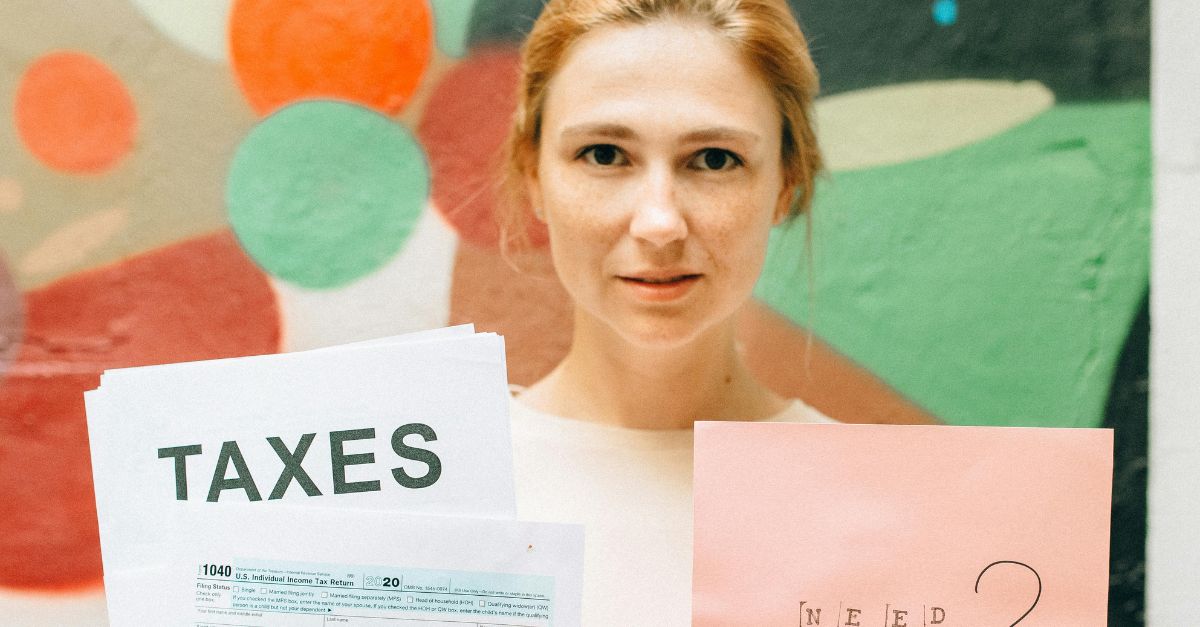

The entire process from initial notice to sheriff-enforced lockout spans roughly 30 to 60 days in most states, though judicial backlogs in metropolitan areas like Los Angeles or Chicago sometimes extend timelines to 90 days. Federal pandemic-era eviction moratoriums expired in August 2021, eliminating those temporary protections. Some states still offer emergency rental assistance programs funded through the Emergency Rental Assistance Program, which distributed $46.5 billion since 2021, but application approval takes weeks and doesn't automatically stop eviction proceedings already in motion.

Legal Maneuvers With Real Consequences

Filing an answer to the eviction complaint creates the first legitimate delay, and it forces a court hearing where both sides present evidence. This response must address specific legal grounds—disputing the amount owed, claiming improper notice service, or asserting habitability defenses where landlord maintenance failures violate housing codes. Simply claiming financial hardship without a legal basis doesn't constitute a valid defense under landlord-tenant law. Courts in jurisdictions following the Uniform Residential Landlord and Tenant Act allow continuances when tenants demonstrate good-faith efforts to secure funds, but judges rarely grant more than one postponement lasting 7 to 14 days.

Requesting a jury trial, a right available in some states, including Texas and Florida, adds approximately 30 to 90 days to the timeline since jury scheduling takes longer than bench trials. However, this strategy backfires if the case lacks legitimate defenses—juries show little sympathy for tenants who diverted rent money to discretionary purchases. Bankruptcy filing triggers an automatic stay that temporarily halts eviction proceedings, but this nuclear option damages credit scores for seven to 10 years and costs $300 to $350 in filing fees that most people facing eviction can't afford. More importantly, landlords can request relief from the automatic stay in bankruptcy court, often receiving approval within two to three weeks when rent remains unpaid.

Realistic Paths Forward Start Now

Communication with the landlord before papers arrive offers the best chance for negotiated outcomes. Proposing a payment plan with specific dates and amounts demonstrates commitment while acknowledging responsibility for the shortfall. Many property owners accept structured repayment rather than pursue costly eviction proceedings that average $3,500 in legal fees and lost rent during vacancy periods. Offering partial payment immediately—even scraping together just 25% to 50% of the owed amount—signals good faith and may buy additional negotiation time. The time you desperately need to make a plan.

Local legal aid societies provide free consultation for tenants facing eviction, with organizations like the National Housing Law Project maintaining state-by-state directories of available resources. Emergency assistance programs through churches, nonprofit organizations, and municipal social services sometimes provide one-time rental grants, though funding limitations mean applications often exceed available resources. Returning purchased items for refunds recovers at least some misallocated funds, and most retailers extend return windows through January for holiday purchases. The harsh reality remains that no legal maneuver creates infinite delay—every strategy simply provides breathing room to either secure funds or arrange alternative housing before the sheriff arrives.