Spending Boom(ers)

Born between 1946 and 1964, the baby boomer generation grew up in a very different time than millennials (AKA: Generation Y), who were born between 1981 and 1996. It was a different world back then in more ways than one, and some of those differences have maintained themselves all these decades later—including financial ones. Like what folks spend their money on.

There are plenty of items that boomers still deem important and "worth the money", while millennials wouldn't drop a dime on most of these things. Like...

Landlines

While most millennials might remember having a landline in their home as a child—the thought of actually paying money to have one these days is absolutely ridiculous. But not for many boomers. While two-thirds of them own a cell phone, over 50% of boomers live in a home with a landline.

Motorcycles

This is easily one of the most surprising items on this list—as most people probably assume the younger of the two generations would be more interested in motorcycles. But that turns out not to be the case—as it is boomers who are out there spending the most money on motorcycles (especially higher-end models).

Greeting Cards

While many of us still get birthday cards from our grandparents on our birthday (sometimes still with five bucks in it), can you think of the last time you got a physical card from someone under 50? Sure, it still happens—usually from those whose parents reinforced the card-giving thing to them as children—but it happens a whole lot less often.

June, PexelsCruises

June, PexelsCruises

Millennials with children and some disposable income are more interested in cruises today than they used to be. However, without a doubt, baby boomers are the largest cruise ship demographic (and if you've been on a cruise lately, you can surely confirm that fact).

And it's not just cruises...

Matthew Barra, PexelsTravel

Matthew Barra, PexelsTravel

Travel, in general, sees baby boomers spending more than millennials. Not to say that millennials don't travel—because they do. They just tend to do it on a smaller budget. Boomers spend about a third more per trip than millennials.

Te lensFix, PexelsChecks

Te lensFix, PexelsChecks

Older boomers are still out there writing checks for things such as rent. But the only thing that probably makes less sense to millennials than using checks—is the fact that you actually have to pay your bank to get some. A fun report from the Federal Reserve Bank of Atlanta states that each year of age makes a person half a percent less likely to prefer checks.

Lottery Tickets

49% of all adults in the United States buy lottery tickets—so yes, millennials, boomers, Gen X, etc, we're all buying tickets sometimes. However, according to a poll from Gallup the discrepancy between boomers and millennials is pretty big (61% VS 31% respectively).

Bars Of Soap

No, we aren't saying that millennials don't wash themselves—just that when they do, they are much more likely to do it with liquid soap rather than bars of the stuff. Whereas boomers grew up before liquid soap was really even a thing, and many have stayed true to those good ol' bars.

Suits For Work

Boomers grew up in a time before casual Fridays. For boomers, wearing a suit to work wasn't a choice—it was just how things were done. And so it remains to this day for many of them. With the prevalence of relaxed dress codes these days, millennials who used to have a closet full of suits have more than likely switched to business casual mode—and that's just for the days they go into the office (thank you, remote work).

Golf

Despite Tiger Woods' influence and the rise in popularity of golf in the late 90s and 2000s, it always has been, and remains to this day, an older person's game. The cost and time commitment needed to do it well (or at least not terribly) lends itself to older folks and retired boomers who have a nice chunk of change in the retirement fund and free time on their hands.

Newspapers

Do you start your day with the physical newspaper and a cup of coffee? If you answered "yes," then—to paraphrase a famous Jeff Foxworthy bit—you might be a boomer.

And in that same vein...

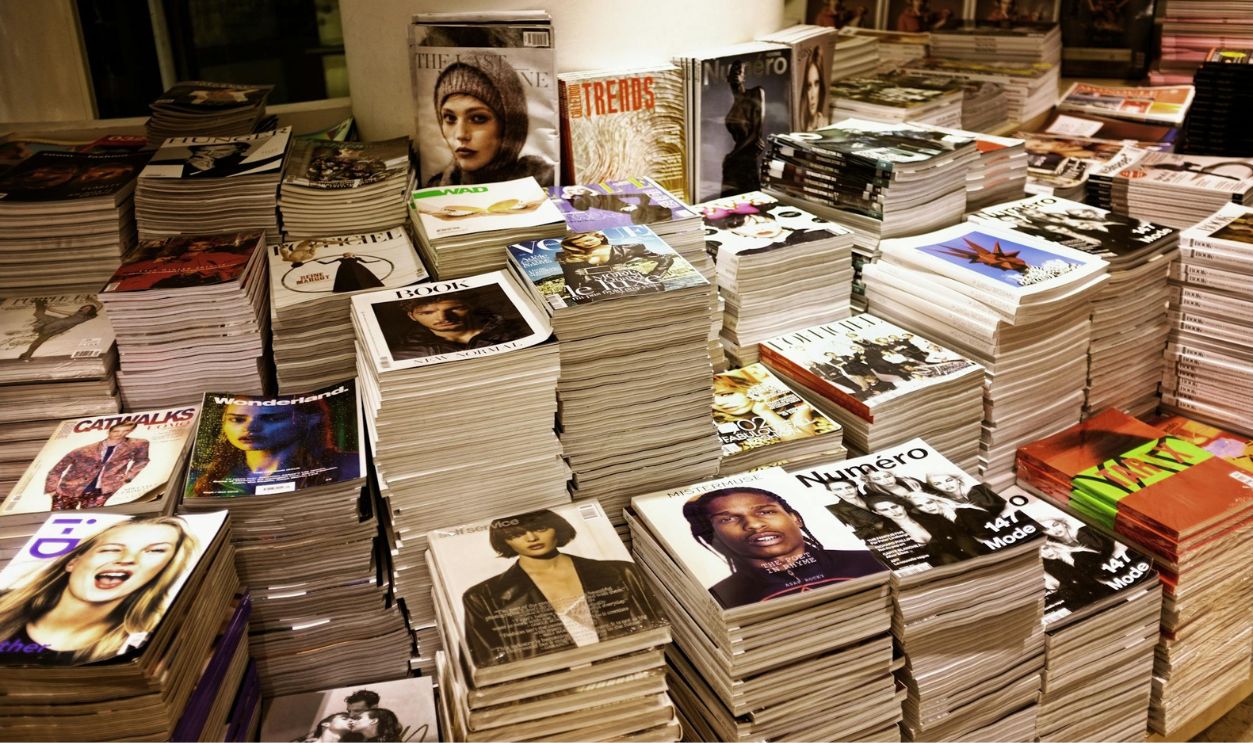

Magazines

These days, it seems like the only places you see physical magazines anymore are the dentist office and your grandparents house.

Electricity

Again, this isn't to say millennials don't use electricity—because they do (we all do). However, boomers—with their bigger homes, luxury appliances and such—spend, on average, $500 more per year than the younger generations.

In-Store Items

You might not think that boomers and Gen Z (1995-2012) have much in common—but it turns out that, while far apart age-wise, these are the two generations that prefer the in-store shopping experience. Whereas millennials and Gen X (1965-80) prefer doing it all online if possible.

Cable TV

Every year, the number of people subscribed to cable goes down. But one generation keeping the bundle alive and kicking is the baby Boomers. Sure, they have Netflix as well—but cable TV is a hard habit to break for this generation.

Timeshare Rentals

There's a whole legal industry that's evolved around helping people get out of expensive (and non-beneficial) timeshare contracts. We're going to take a wild guess that most of the clients are 60+.

Johann Jaritz, Wikimedia Commons

Johann Jaritz, Wikimedia Commons

Collectibles

Did you know that millennials and Gen Z are often referred to as the minimalist generations? These are people who grew up in homes filled with their parents' knickknacks and have rebelled against that cluttered style. Boomers, on the other hand, appreciate the sentimentality and value of certain items—and are spending much more money on collectibles.

Osviel Rodriguez Valdes, Pexels

Osviel Rodriguez Valdes, Pexels

Luxury Cars

Like we saw with travel, boomers and millennials have different attitudes on cars. While boomers still see their vehicle as a status symbol and are willing to pay more for bigger ones and luxury ones, millennials have cost-effectiveness front of mind and are more likely to purchase smaller, more eco-friendly vehicles.

Pets

We don't know if it's fancy collars, higher end food, or more sessions at the groomer—but according to one report, baby boomers spend about $200 more per year on their pets than millennials do.

Health Care

Given how much older boomers are than millennials, this one is probably pretty obvious. Nonetheless, we will mention that boomers spend about $2,500 more per year on health care than millennials do.

Specialty Kitchen Appliances

Millennials will splurge on a good coffee maker, but for the younger generations, it's all about convenience and home delivery and restaurants. It's more the boomers who will line their countertops with espresso machines, bread makers, and fancy mixers.

Dmitry Zvolskiy, PexelsYou might also like:

Dmitry Zvolskiy, PexelsYou might also like:

You've Just Inherited Over A Million Dollars, What Now?

If You're In Your Forties, Is It Too Late To Be A First-Time Homebuyer?

From Plane Tickets To A Dozen Eggs: Things You Used To Be Able To Buy For 5 Dollars