The Pay Surge

Remember when asking for fifteen bucks an hour seemed impossible? That battle changed everything. Now we're watching the biggest coordinated wage boost in modern history play out in real time across the nation.

Historic Raises

On New Year's Day 2026, something remarkable happened across America—millions of workers woke up to bigger paychecks. This wasn't just another routine adjustment; it marked one of the largest coordinated wage increases in recent US history, touching nearly every corner of the nation from coast to coast.

19 States

Arizona, California, Colorado, Connecticut, Hawaii, Maine, Michigan, Minnesota, Missouri, Montana, Nebraska, New Jersey, New York, Ohio, Rhode Island, South Dakota, Vermont, Virginia, and Washington state all implemented increases simultaneously. The diversity is striking. Both Republican and Democratic states took action, proving that fair wages transcend political divides.

January 2026

The timing wasn't coincidental. Most states strategically schedule minimum wage hikes for January 1st, aligning with new fiscal years and making payroll transitions smoother for businesses. However, some states like Alaska, Florida, and Oregon will follow later in 2026, with Michigan uniquely increasing to $13.73 on January 1, 2026.

8.3 Million Workers

The Economic Policy Institute estimates these raises will directly benefit 8.3 million workers, but the real impact extends much further. When minimum wages rise, employers often adjust entire wage ladders, meaning workers earning slightly above minimum wage also see raises.

Washington Leads

Washington state now boasts the nation's highest state minimum wage at $17.13 per hour—a 2.8% increase from 2025's $16.66. This didn't happen overnight; Washington voters passed Initiative 1433 in 2016, raising the wage to $13.50 by 2020 and tying all future increases to inflation.

Top Five States

Behind Washington, the elite wage club includes New York at $17.00 (for NYC, Long Island, and Westchester), Connecticut at $16.94, New Jersey at $15.92, and California at $16.90. Washington DC, though not a state, is at $17.50 as of January 2026, increasing to $17.95 effective July 2026.

Local Champions

While states compete, cities crush those numbers. Tukwila, Washington, claims America's highest minimum wage at $21.65 per hour—higher than most professional starting salaries elsewhere. Seattle follows at $21.30, with Burien at $21.63 for large employers, and Renton reaching $21.57 by mid-2026.

SounderBruce from Seattle, United States, Wikimedia Commons

SounderBruce from Seattle, United States, Wikimedia Commons

Regional Variations

The wage landscape creates a patchwork quilt across America. Twenty states still cling to the federal minimum of $7.25 or have no minimum wage law at all, concentrated heavily in the South. A worker in Mississippi earns $7.25, while their counterpart just across state lines in Arkansas now makes $11.00—over 50% more for the same work.

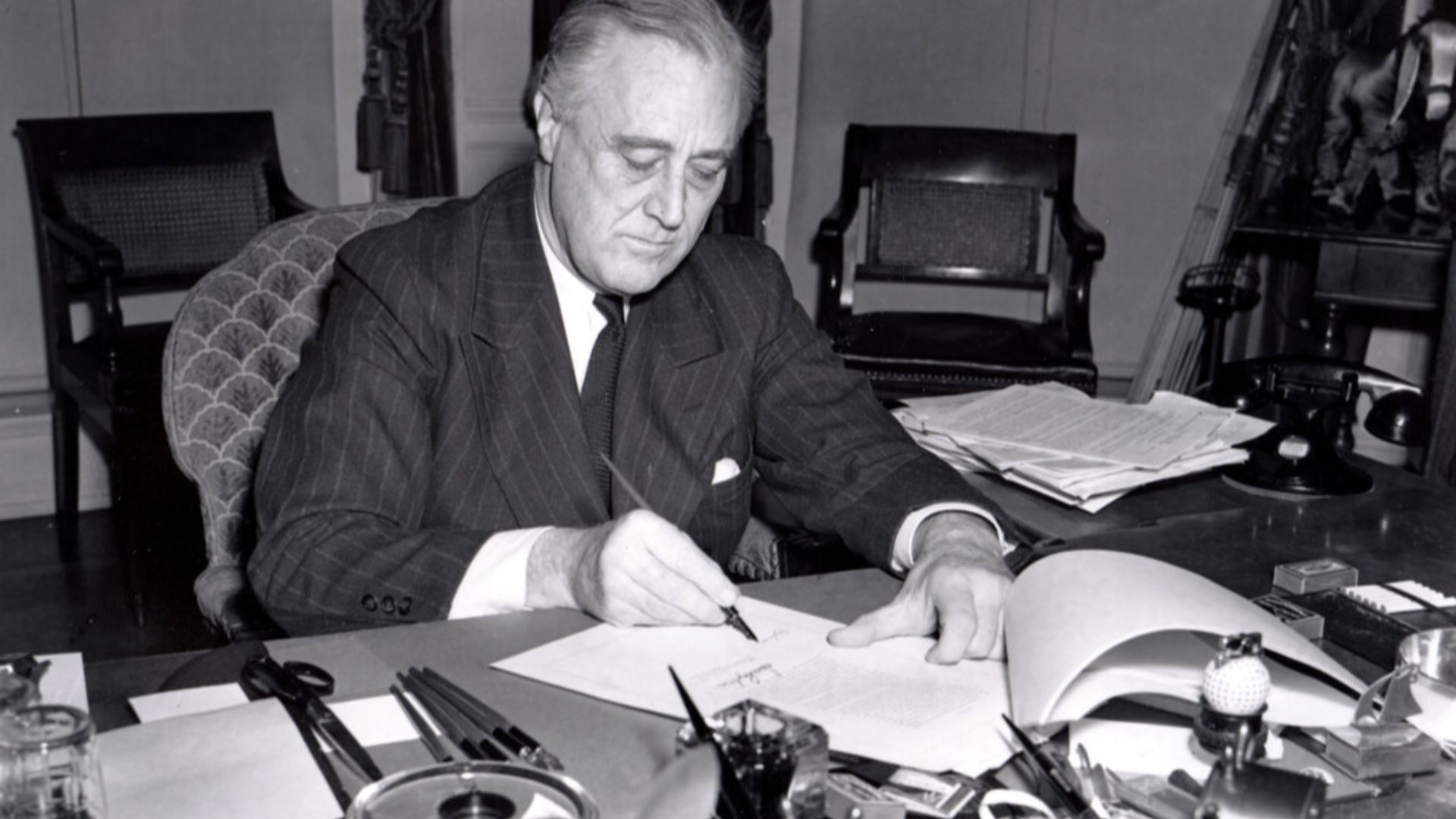

Federal Origins

America's minimum wage story begins in 1938 during the Great Depression, when President Franklin D Roosevelt signed the Fair Labor Standards Act. The initial rate? Just 25 cents per hour. Roosevelt envisioned it as a “minimum standard of living necessary for health, efficiency, and general well-being”.

Caddyshack01, Wikimedia Commons

Caddyshack01, Wikimedia Commons

1938 Beginning

Before 1938, no federal protections existed for American workers. Tens of thousands toiled in sweatshops for pennies weekly, and early attempts to mandate minimum wages were struck down by the Supreme Court as unconstitutional, deemed restrictions on workers' "freedom" to set their own prices.

Federal Stagnation

The federal minimum wage hit $7.25 on July 24, 2009, and hasn't budged since. During this period, inflation has eroded the wage's purchasing power by more than 30%. What bought groceries for a week in 2009 barely covers a few days now, leaving federal minimum wage workers effectively earning less.

15-Year Freeze

Congress has increased the federal minimum wage 22 times throughout history, typically every few years to match inflation and rising living costs. The current stagnation is unprecedented. By comparison, the minimum wage's purchasing power peaked in 1968 at $1.60 per hour.

M. Marshall, Wikimedia Commons

M. Marshall, Wikimedia Commons

Fight For $15

Everything changed on November 29, 2012, when 200 fast-food workers in New York City walked off their jobs demanding $15 per hour and union rights. The New York Times called it "the biggest wave of job actions in the history of America's fast-food industry”.

Annette Bernhardt, Wikimedia Commons

Annette Bernhardt, Wikimedia Commons

2012 Strikes

The movement exploded beyond anyone's expectations. From one city in 2012, strikes spread to 7 cities in 2013, then 50, then 100, then 270 cities by 2015. Fast-food workers were joined by home healthcare aides, airport employees, adjunct professors, childcare workers, and Walmart staff, all united under one demand.

Fibonacci Blue, Wikimedia Commons

Fibonacci Blue, Wikimedia Commons

Movement Victories

The Fight for $15 achieved what Washington politicians couldn't. Since 2012, the movement has secured $150 billion in wage increases for 26 million workers across state and local jurisdictions. Fifteen states, plus Washington DC, now have laws gradually reaching $15 or higher.

Fibonacci Blue, Wikimedia Commons

Fibonacci Blue, Wikimedia Commons

$150 Billion Won

Of that staggering $150 billion, $76 billion went directly to workers of color and $70 billion to women workers. The average affected worker receives approximately $5,700 in additional annual income. For Black workers specifically, state minimum wage increases boosted earnings by $5,100 annually on average.

Inflation Indexing

Nineteen states and Washington now tie their minimum wages to inflation through the Consumer Price Index, ensuring automatic annual adjustments without requiring new legislation. This mechanism prevents the erosion that plagued the federal salary. Minnesota, for example, saw a modest $0.28 increase in 2026 due to indexing.

Scheduled Increases

Rather than shocking businesses with sudden jumps, most modern minimum wage laws phase in increases over several years. California's 2016 law scheduled annual increases until reaching $15 in 2022. Michigan takes a unique approach with an increase to $13.73 in 2026.

Tipped Workers

The federal tipped minimum wage remains frozen at a shocking $2.13 per hour, which is unchanged since 1991. Employers are expected to make up the difference through tips. Eight states, including Alaska, California, Minnesota, and Montana, reject this system entirely, requiring employers to pay the full minimum wage before tips.

Implementation Dates

While January 1st dominates as the preferred date for wage increases, the calendar varies significantly. Washington adjusts every January 1st based on the previous year's Consumer Price Index. Oregon schedules increases for July 1st while Florida waits until September 30th.

Economic Impact

Research consistently demolishes the myth that higher minimum wages kill economies. When Missouri raised its wage from $13.75 to $15.00, full-time workers gained $920 annually. Additionally, Hawaii's jump to $16.00 added $1,346 per year.

Job Effects

The most comprehensive review of minimum wage studies by economists Arindrajit Dube and Ben Zipperer found that most research since 2010 shows employment effects very close to zero, meaning jobs aren't disappearing as critics predicted. The median response shows minimal job loss while workers gain substantially higher earnings.

Wage Gap Closure

Minimum wage increases powerfully combat racial and gender pay disparities. In states that raised wages above the federal minimum between 2013 and 2019, the Black-white wealth gap decreased by 40.3 percentage points, and the Latinx-white gap dropped by 29.4 points.

Remaining Challenges

Despite historic progress, 20 states still enforce the $7.25 federal minimum or lack state minimum wage laws entirely—concentrated overwhelmingly in the South, where 23% of Black workers reside. These states often prohibit cities from setting higher local wages, trapping millions in poverty.