Flat Tax? Sounds... Flat-Out Radical

Imagine this: every American, from billionaires to baristas, pays the exact same tax rate. No brackets, no loopholes, no deductions. A flat rate across the board, full stop. It’s a bold vision, but is it brilliant...or just bonkers?

How Uncle Sam Gets Paid Now

Currently, the U.S. has a progressive tax system. That means the more you earn, the higher your tax rate. In 2024, federal income tax rates range from 10% to 37%, depending on your taxable income.

stevepb, CC0, Wikimedia Commons

stevepb, CC0, Wikimedia Commons

A Quick Tour of the Tax Brackets

Here’s a snapshot:

- 10% on income up to ~$11,600 (single filers)

- 22% on income ~$47,000–$100,000

- 37% on income over ~$609,350

It's not just one rate, you pay different rates on different chunks of income.

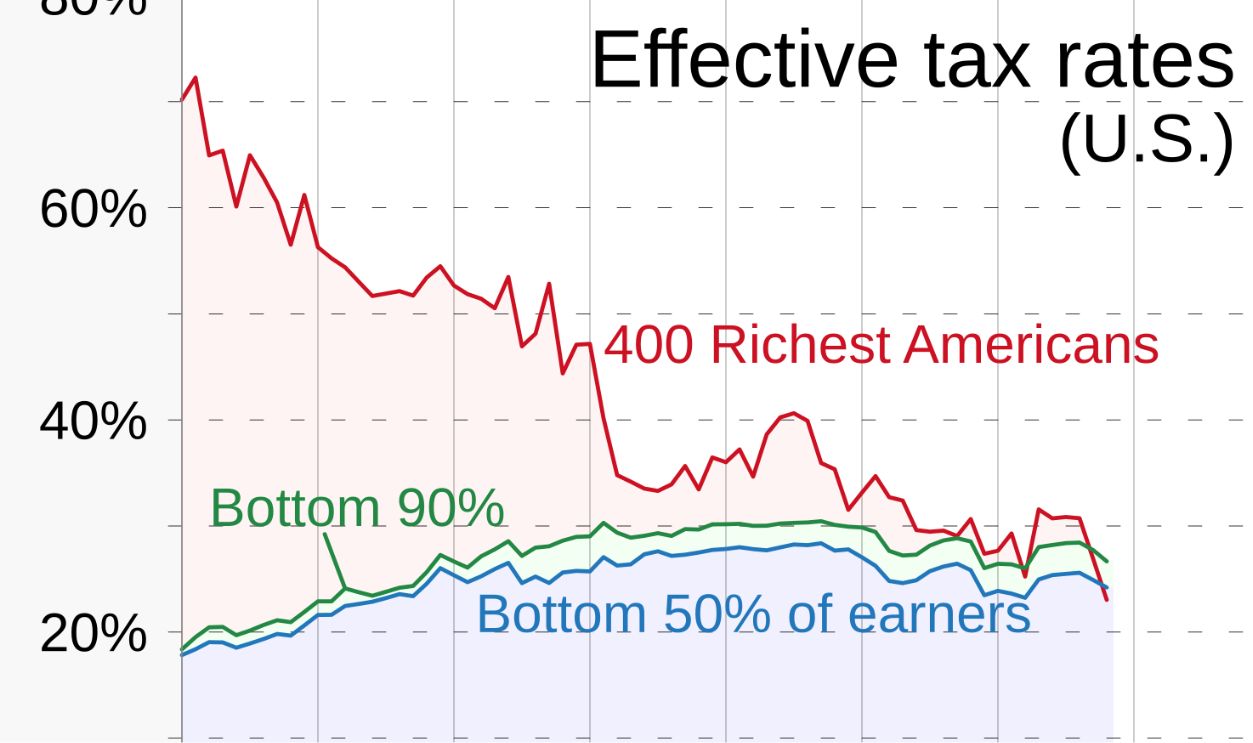

How the Top Really Pays

According to current IRS data, the top 1% of earners paid 25.99% effective income tax in 2020, while the bottom 50% paid just 3.1%. The more you earn, the larger your tax bill, on paper, at least.

Enter the Flat Tax Fantasy

Now imagine scrapping all that for a single rate. Everyone pays, say, 15% of their income, no matter how much they make. No deductions, no write-offs, no exemptions. Just flat and simple.

Why Would Anyone Want This?

Fans of a flat tax would argue it’s fairer, simpler, and more efficient. No more tax loopholes for the rich. No more tax-prep headaches for the middle class. Everyone contributes the same share of their income.

The IRS Might Cry Tears of Joy

One major win: simplicity. A flat tax could drastically shrink the IRS, cut compliance costs, and eliminate an entire industry of tax lawyers and accountants.

But Wait... What About Revenue?

There's something important to consider here: simple math. The federal government collected about $2.2 trillion in income tax in 2022. A flat tax must raise that same amount to keep things running, military, Medicare, highways, and a lot more.

Vitalii Vodolazskyi, Shutterstock

Vitalii Vodolazskyi, Shutterstock

Crunching the Numbers: A Hypothetical

Assume total taxable income in the U.S. is around $13 trillion (per IRS and BEA data). To generate $2.2 trillion, a flat tax would need to be around 17% of all income, plain and simple.

What That Means for the Rich

The top 1% (who now pay ~26% effective tax) would see a huge tax cut under a 17% flat tax. This would free up billions in disposable income at the top.

What That Means for the Poor

Meanwhile, the bottom half, currently paying an average of 3.1%, would see their taxes more than quintuple. Someone earning $30,000 might go from paying $930 to $5,100.

Middle Class Squeeze?

Those in the middle, say, households making $60K–$90K, would likely see a modest increase. Many currently pay an effective rate between 9%–12%, so 17% would be a step up.

Inequality: Up, Up, and Away

A flat tax might look “fair” mathematically, but it could worsen income inequality. Low earners spend nearly all their income, while the rich save and invest more, so the flat tax bites harder at the bottom.

Photo By: Kaboompics.com, Pexels

Photo By: Kaboompics.com, Pexels

Conservative Case for Flat Tax

Conservatives argue the flat tax encourages work, saving, and investment. By lowering taxes on high earners, it may stimulate job creation and economic growth.

But Would It Work?

Economists are split. Some say cutting top marginal tax rates boosts growth. Others argue the evidence is weak, and that past cuts have widened inequality without clear economic gains.

RCraig09, CC BY-SA 4.0, Wikimedia Commons

RCraig09, CC BY-SA 4.0, Wikimedia Commons

A Global Glimpse: Who’s Tried It?

Several Eastern European countries use flat taxes (e.g., Estonia, Lithuania). These nations saw early economic success, but their tax systems rely heavily on VATs and offer few government services.

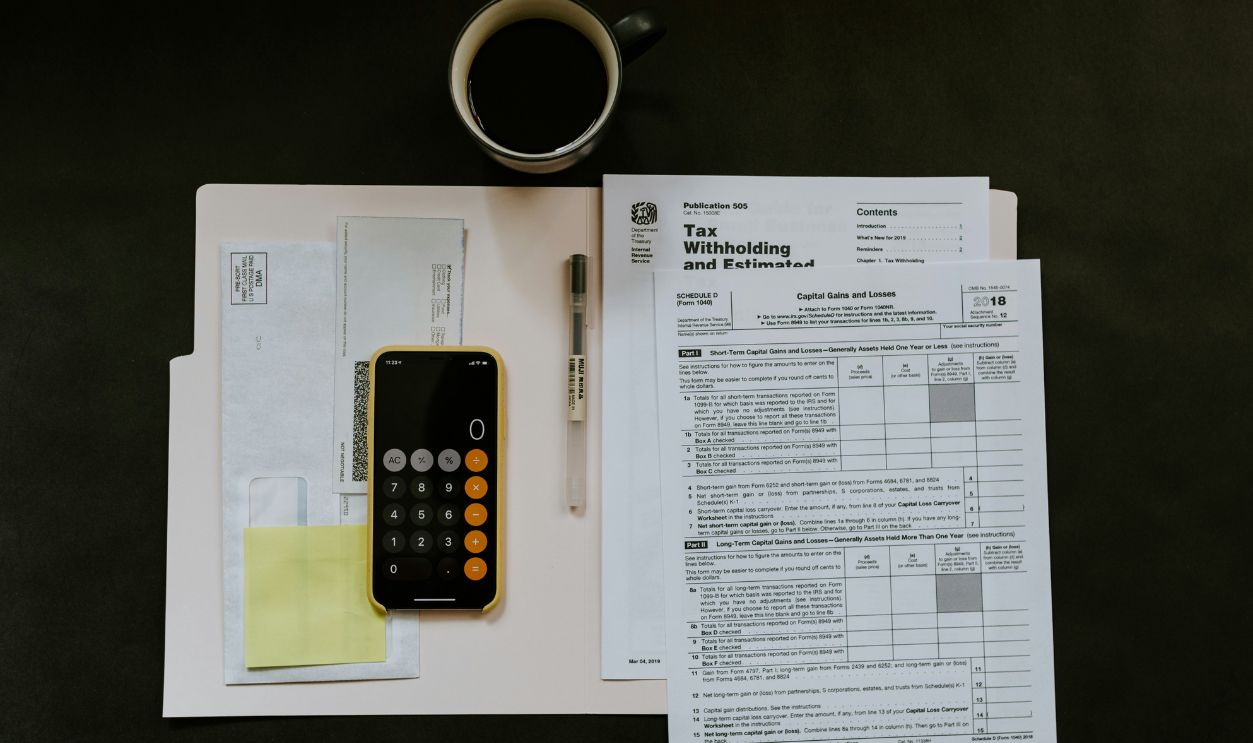

A Big American Hurdle: Entitlements

The U.S. spends trillions on Medicare, Social Security, and defense. A flat tax might not raise enough revenue to cover these, unless the rate is higher, which defeats the purpose for many.

Rix Pix Photography, Shutterstock

Rix Pix Photography, Shutterstock

State Taxes Still Complicate Things

You can't forget about the States either. Even if the federal government adopts a flat tax, states have their own income tax systems. Some are flat (like Colorado), some are progressive (like California), and some have none at all (like Florida).

Deductions and Loopholes, Gone?

Most flat tax proposals eliminate deductions for mortgage interest, charitable giving, and child tax credits. That could hurt families and nonprofits relying on these incentives.

Compliance Costs Would Drop

Americans spend over 6 billion hours and $240 billion annually on tax compliance. A flat tax could slash those costs, making tax season easier for everyone.

Politics: Expect Fireworks

A flat tax is, and always has been, a political minefield. Raising taxes on the poor and cutting them for the wealthy is a tough sell, even if it simplifies the code. Expect fierce opposition from progressives.

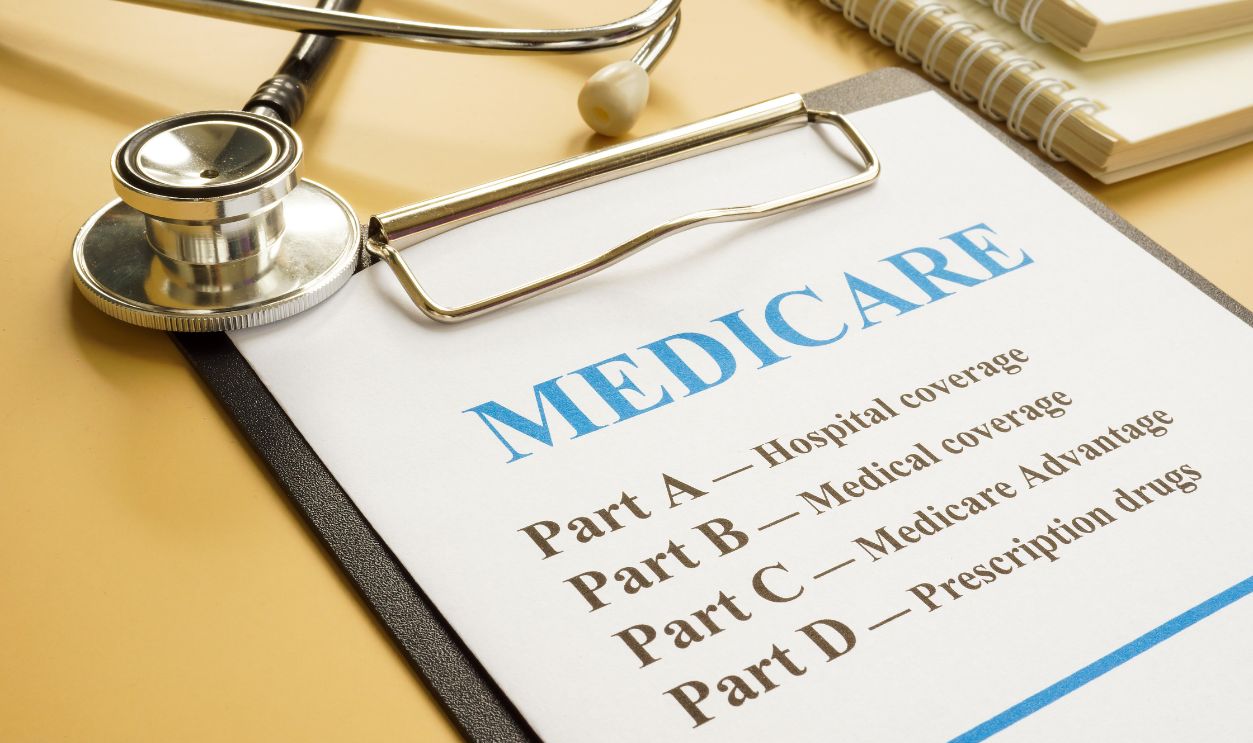

What About Corporate Taxes?

Some flat tax models include corporations; others don’t. If corporate taxes are flattened too, this could shift even more of the tax burden onto individuals.

Deemerwha studio, Shutterstock

Deemerwha studio, Shutterstock

The Hidden Cost of Simplicity

While simpler on the surface, a flat tax may ignore the complex realities of American life, like regional cost differences, family size, and medical expenses.

So… Would It Work?

In theory? Yes, it could be implemented. But in practice, a flat tax would mean big winners and big losers, with likely regressive effects and revenue risks unless carefully calibrated.

One Size Fits All… or Does It?

A flat tax sounds simple. But society isn’t. Making everyone pay the same rate could streamline the system, but it would also redistribute the pain, and not necessarily in a fair direction.