It’s About More Than Money

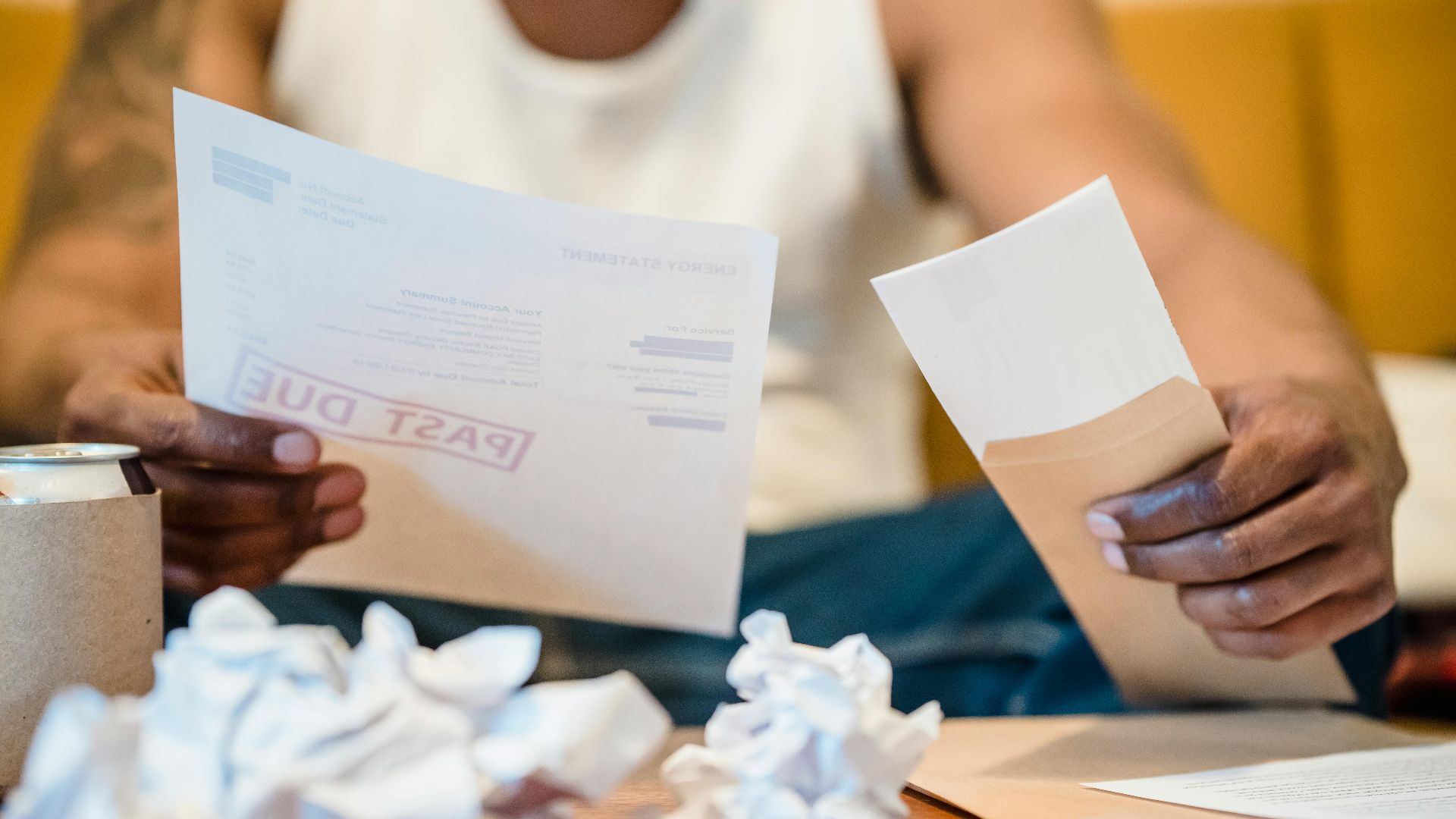

Your dad left equal shares of the estate to you and the rest of your siblings. But now your sister is demanding a larger share of the inheritance because she lived closer to your dad and provided emotional support. Now you’re stuck in a dilemma between honoring the will, respecting family boundaries, and avoiding a legal nightmare. Here’s how to navigate this predicament without allowing emotions to destroy your finances.

What Does The Will Actually Say?

In estate disputes, the written will is always the legal starting point. A will generally supersedes personal opinions about who “deserves” more money. If the will clearly states that you all get equal shares, then equal shares are the legal default outcome. Emotional labor may feel like a perfectly valid thing to your sister, but it rarely changes distribution unless the will specifically says otherwise.

Don’t Rush Into A Legal Battle

Your first step shouldn’t be to threaten a lawsuit. High-conflict inheritance disputes can quickly escalate out of control, and legal fees can ruin the value of any inheritance. Start by clarifying what the disagreement is really about at its heart. Is your sister asking for more money, reimbursement, or recognition? Sometimes the fight is more of an issue of emotional validation than a dollar figure.

Know What Counts As Caregiving

Caregiving doesn’t always have a cut-and-dried amount that can be reimbursed. Courts and probate rules make a distinction between informal help and documented professional responsibility. Unless there was a signed contract, caretaking agreement, or the will directly specifies compensation, “emotional labor” doesn’t normally entitle someone to additional inheritance. This by no means invalidates her feelings, but it matters for the law.

Get Receipts Or Proof Of Financial Contribution

If your sister claims she paid for expenses, improvements, or caregiving costs, ask her for documentation. Probate courts need to see evidence: receipts, invoices, bank statements, or agreements. If she can’t provide that proof, her request might be unsupported. It’s not about calling her a liar, but it’s important to protect the estate from unfounded claims.

Separate Emotional Needs From Financial Decisions

Family members often tend to associate grief with compensation. Your sister may feel overlooked, overworked, or under-appreciated. You can acknowledge her effort without agreeing that she deserves a bigger piece of the inheritance pie. Emotional validation and financial fairness are two separate conversations. Don’t let guilt turn into a gateway to financial manipulation.

Check The Executor’s Legal Duties

The executor’s role isn’t to settle disputes based on people’s feelings. Their job is to follow the will, inventory assets, pay debts, and distribute according to the will’s written instructions. If you are the executor, you have to follow legal obligations, not pressure from family members. If someone else is the executor, hold them accountable to those duties.

Keep The Estate Funds Separate

Don’t distribute money early or informally until the conflict has been resolved. Mixing accounts, verbally promising money, or splitting assets before probate closes is a classic recipe for legal trouble. You want a clear paper trail, not a tangled financial mess. Probate rules were put in place to prevent exactly this kind of chaos.

Offer A Mediation Conversation First

This can be as informal as a structured family meeting or it could be a formal gathering with a neutral third-party mediator. A mediator can help everyone separate their emotional concerns from legal requirements. Mediating early is cheaper, faster, and often more successful than turning the dispute into a courtroom battle or an out-and-out free-for-all.

When Extra Shares Are Warranted

On the other hand, there are cases where unequal distribution or reimbursement is reasonable. If your sister can prove that she covered medical bills, funeral expenses, property repairs, or essential caregiving costs, she may be entitled to reimbursement, but not a larger inheritance share. Be careful to note that the two things are separate legal processes handled through probate.

Don’t Give In Just To “Keep The Peace”

You may feel pressure to hand over more than your legal share in order to get out of being labeled selfish. But that’s how small disputes metastasize into permanent financial damage. You can be compassionate and still stick up for your legal rights. Too often, the most agreeable sibling loses the most.

Document Every Conversation And Agreement

Text messages, emails, receipts, and mediator notes matter. If your sister escalates the conflict later, especially if lawyers get involved, it’s precisely that documentation that protects you. Even simple summaries of verbal conversations give you some kind of a record. Assume that anything you say may need to be laid bare in probate.

Try To Figure Out The Real Motivation

Truth be told, this may not even be about inheritance. It might be grief, resentment, family favoritism, unresolved trauma, or feeling overlooked during caregiving. Address that part separately. Being understanding doesn’t mean caving in to every whim or demand, but it can reduce conflict and stop a financial dispute from boiling over and tearing the family apart.

Know When To Compromise

Sometimes a small concession, like sharing funeral costs or allowing one sibling a sentimental item, can be enough to resolve a bigger fight. Not every battle has to be won to protect your legal share. But only compromise when the cost is less than your personal aggravation and legal fees.

Know When Not To Compromise

If the dispute threatens your legal rights, your financial security, or the validity of the will, you can’t afford to make emotional concessions. Once you give away your share, you can’t take it back. Sometimes the best financial decision is to stand firm.

Bring In A Probate Attorney Early If Needed

A probate attorney can quickly separate out what is and isn’t enforceable. You don’t have to threaten legal action, you just need to get legal clarity on where you stand. Many attorneys offer free consultations. They can help you avoid the classic missteps that accidentally strengthen your sister’s claim.

Think Mediation Before Litigation

Mediation settles more inheritance conflicts than lawsuits do and is significantly cheaper as well. It helps both sides get a chance to be heard while also keeping the estate intact. Litigation should be your last option, not your first.

Protect Your Relationship If You Can

Families often come unglued over inheritances, and it’s not because of greed, but grief. Try to maintain compassion and boundaries. Protect your financial interests without turning the inheritance into a permanent festering wound.

The Will Is Your Best Protection

At the end of the day, the court honors what your father wrote, not anyone else’s personal beliefs about who worked harder or cared more. The will outlines in cold legal terms exactly what your legal rights are and ensures the estate follows your father’s wishes, not subjective interpretations or impressions.

Don’t Let It Define Your Family

Whether you resolve this dilemma through discussion, mediation, or legal clarity, always remember that your father wanted this inheritance to help you, not divide you. The goal is to protect the estate, your peace of mind, and your long-term financial well-being.

You May Also Like: