The Month Everything Was Supposed To Change

You did everything right: you served, you were injured, you filed the paperwork, and you were told with confidence that your VA disability benefits would start this month, so you planned your life around that promise—rent, groceries, stability, maybe even a little breathing room—only to be told at the last minute that it will actually take another six months. If you feel panicked, angry, or completely betrayed by the system, that reaction is not only understandable, it is rational, because this article exists for people stuck in that exact gap who need to survive it without losing their housing, their credit, or their sanity.

First, Let’s Name The Real Problem

This situation is not the result of bad budgeting or poor planning, but a sudden cash-flow crisis caused by bureaucracy colliding with real-life expenses that do not pause for paperwork or processing backlogs. Understanding that distinction matters, because the solution is not guilt or grind culture, but temporary bridge strategies designed to get you from today to the moment your benefits finally arrive.

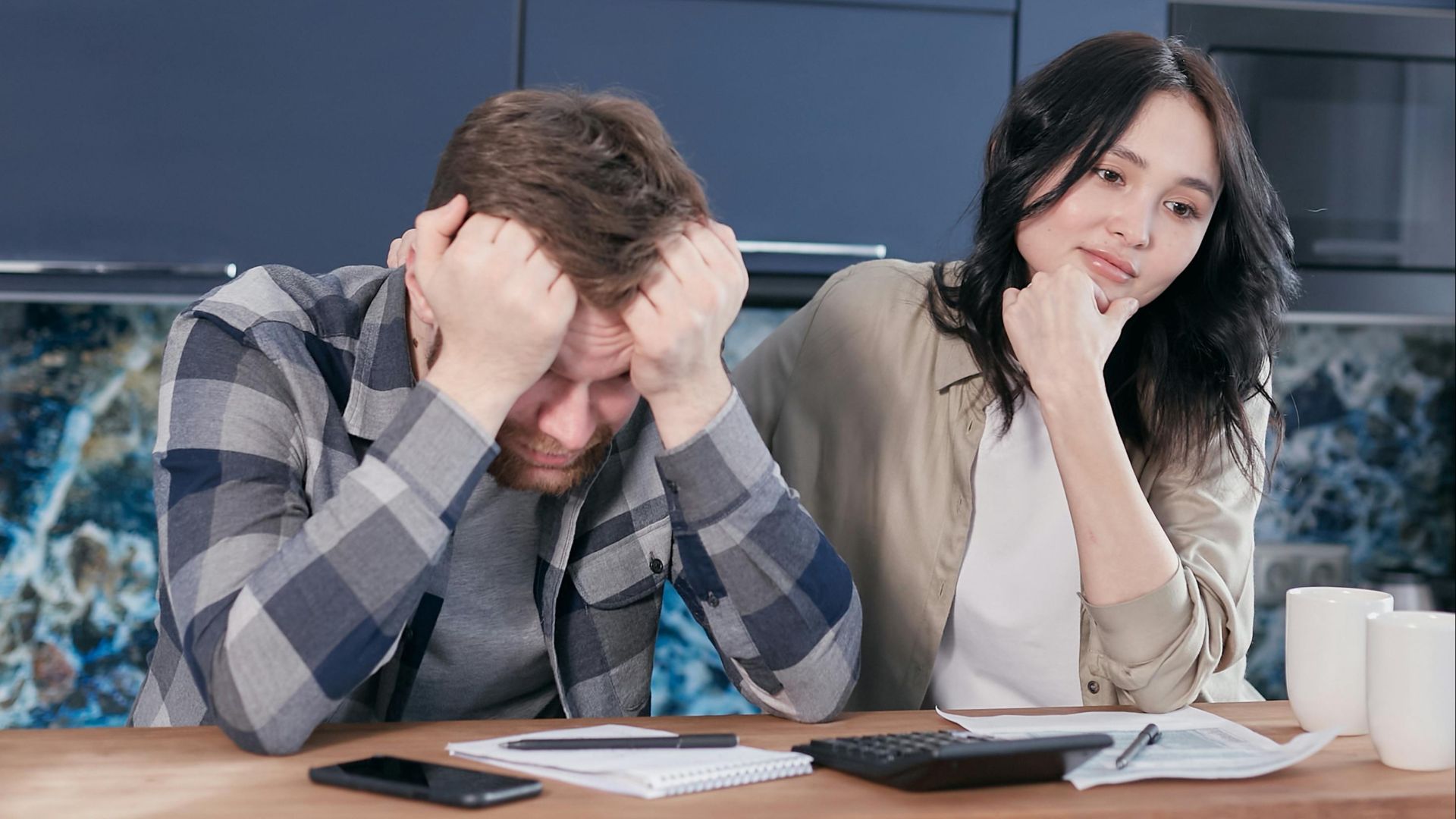

Take Inventory Before Panic Takes Over

Before fear spirals into paralysis, it helps to sit down and clearly list what money you have, what bills must be paid to keep you housed and safe, what debts have deadlines, and whether any income is still coming in at all. This exercise is not about self-judgment, but about clarity, because panic thrives in uncertainty and loses its power when the numbers are clearly defined.

Call The VA Again—Yes, Again

As exhausting as it feels, calling the VA again is necessary, because you need to confirm whether the delay is estimated or firm, whether hardship flags are available, and whether back pay is guaranteed once the claim is approved. Sometimes claims stall simply because no one has touched them recently, so polite persistence paired with careful documentation of names, dates, and summaries can make a real difference.

Ask About A VA Hardship Advancement

Many veterans are never told that the VA can expedite claims when there is documented financial hardship, especially when housing, utilities, or medical care are at risk. Using clear, direct language about eviction risk or loss of basic necessities helps bureaucracies understand urgency in the terms they actually respond to.

File For Everything You Might Qualify For

While waiting on the VA, applying for programs like SNAP, Medicaid, state disability, or temporary assistance can provide crucial breathing room during the delay. This is not exploiting the system or doing something wrong, but using the safety nets designed for exactly this kind of administrative gap.

Your State May Be Faster Than The Feds

State and county assistance programs often move more quickly than federal ones, and many have emergency rental or utility aid specifically aimed at veterans. Local Veterans Service Organizations and county human services offices are often far more effective at navigating these programs than trying to handle them alone.

Talk To Your Landlord Before They Talk To You

Having an early, honest conversation with your landlord about the delay, while emphasizing that benefits are postponed rather than denied, can open the door to temporary payment plans or deferred rent. While not every landlord will cooperate, many prefer flexibility over eviction, especially when communication happens before payments are missed.

Utilities Have Hardship Programs Too

Utility companies frequently offer hardship or medical deferment programs that can temporarily reduce payments or prevent shutoffs during documented financial strain. Calling proactively and explaining the situation is far more effective than waiting until services are about to be disconnected.

Creditors Prefer Negotiation To Default

Lenders generally respond better to borrowers who communicate early, and many will offer short-term forbearance, reduced payments, or waived fees when circumstances are explained. Missing payments without notice damages credit far more than asking for temporary help ever will.

If You’re Working, Adjust Expectations—Not Pride

If your injury allows for some level of work, even part-time or remote, it can help to view temporary income as a survival tool rather than a reflection of long-term ambition. This is not the season to build a dream career, but to stabilize your life until promised support arrives.

Short-Term Work Counts As A Win

Temporary or gig work does not define your worth or future, but it can reduce anxiety and slow the accumulation of debt during a prolonged waiting period. Six months of imperfect income is often far better than six months of constant financial fear.

Be Careful With High-Interest “Solutions”

Payday loans and predatory lenders target moments of desperation like this one and frequently leave borrowers worse off than before. If an offer feels insulting or impossible to repay, that instinct is usually correct and should be trusted.

Personal Loans: Proceed With Caution

A small personal loan from a credit union can sometimes make sense if the interest rate is reasonable, the payments will be manageable once benefits begin, and the amount borrowed is kept minimal. These loans should function as a short bridge, not a long-term financial commitment.

Friends And Family Are Not ATMs—But They Are Humans

Asking for help from people you trust is uncomfortable, but framing the request as temporary, specific, and tied to confirmed back pay can make the conversation easier for everyone involved. Clear expectations protect relationships while providing necessary short-term support.

Karolina Grabowska www.kaboompics.com, Pexels

Karolina Grabowska www.kaboompics.com, Pexels

Veteran Nonprofits Exist For Exactly This Moment

Organizations created to support veterans often provide emergency grants, food assistance, or housing help specifically for situations involving benefit delays. Reaching out to them is not a failure, but a practical use of resources built for this exact problem.

Your Pride Is Not A Payment Method

Accepting help does not erase your independence, service, or dignity, even if it feels deeply uncomfortable at first. Needing support during a bureaucratic delay is not a personal failure, but a systemic one.

Build A Bare-Bones Survival Budget

For the duration of the delay, the only financial priorities should be shelter, food, and health, while everything else is temporarily deprioritized. This approach is not permanent deprivation, but a strategic pause designed to preserve stability.

Karolina Grabowska www.kaboompics.com, Pexels

Karolina Grabowska www.kaboompics.com, Pexels

Preserve Your Credit Where You Can

While survival matters more than a perfect credit score, communicating clearly and documenting agreements can prevent unnecessary long-term damage. Future stability often depends on the small administrative steps taken during crisis moments.

Use Back Pay As A Reset Button

Because most VA benefits include back pay to the original eligibility date, planning ahead for how that money will be used can prevent it from disappearing under emotional pressure. Using it to catch up on housing, eliminate high-interest debt, and rebuild savings creates a stronger foundation moving forward.

Mentally Separate Delay From Denial

A delay often feels personal and final, but it is usually procedural rather than a judgment on worth or legitimacy. Protecting mental health means reminding yourself that slowness does not equal rejection.

If Mental Health Is Slipping, Speak Up

The combination of injury, financial stress, and uncertainty can be overwhelming, and reaching out for professional or personal support is a necessary part of survival. Financial endurance means little if emotional health collapses along the way.

Keep A Paper Trail Like A Professional

Saving letters, emails, and notes from every conversation builds leverage and clarity if escalation becomes necessary. Documentation turns frustration into usable power.

Know When To Escalate

If months pass without movement, tools like congressional inquiries, formal complaints, or VSO escalation exist to apply pressure within the system. These steps are not dramatic, but appropriate when standard processes stall.

You Are Allowed To Be Angry And Strategic

Anger does not prevent effectiveness, and it can fuel persistence when channeled into action rather than paralysis. It is possible to be both frustrated and capable at the same time.

This Season Will End

Six months feels endless when bills are due now, but this period is a chapter rather than the full story. Surviving the military proves you can survive bureaucracy, especially with strategy and support.

The Bottom Line

When VA benefits are delayed, the goal is endurance rather than elegance, achieved by stacking temporary supports, communicating early, and avoiding financial traps that worsen the future. This moment is not about toughness or pride, but about getting through—and you will.

You May Also Like: