Mind The Generational Wealth Gap: How To Stop Your Generational Wealth From Falling Through The Cracks

Building generational wealth can be difficult for most people, but did you know those who manage it lose most within three generations? That statistic has been quoted at 70%, according to Nasdaq. If you've found yourself fortunate enough to be the inheritor of a large sum of money, or are looking ahead and want to break the "generational wealth curse", as it's known, then here's some practical advice to help you mind the (generational wealth) gap.

What Is Generational Wealth?

Generational wealth is the passing down of assets and accrued financial wealth from generation to generation. These assets can take almost any form, as long as they have value. Your grandparents' home, or where you lived with your mother and father as a child, could be considered "generational wealth". So, too, could stocks and bonds that your grandfather left to you in his will.

Why Doesn't Generational Wealth Last?

Reports indicate that most generational wealth inherited will be depleted by 70% by the second generation, and down to 90% by the third generation. Generating wealth doesn't seem to last beyond the third generation for many reasons. Let's explore why and how to fix it to secure your family's financial future.

Lack Of Financial Education

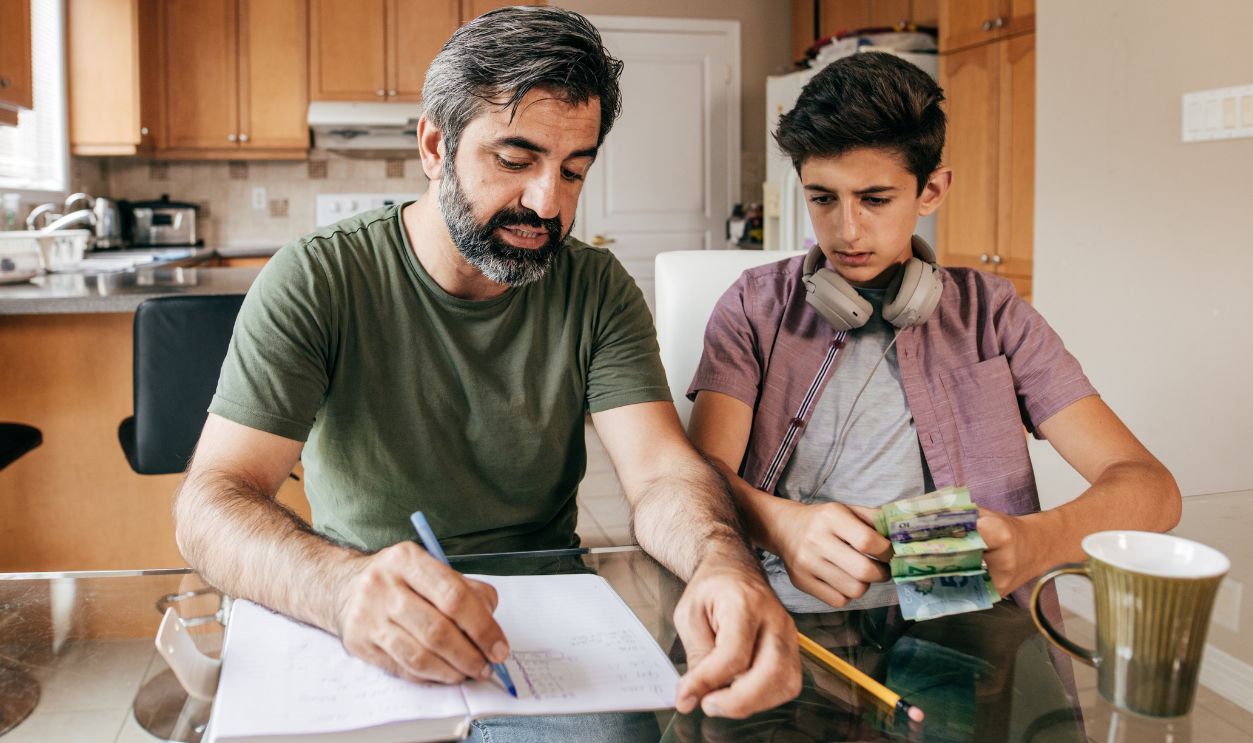

Dealing with inherited wealth requires a responsible person to steward that wealth and use it effectively to set future generations up for success. Unfortunately, far too many aren't financially educated to inherit and then use generational wealth effectively. Early financial literacy is critical. Here's how to start turning that tide.

Teach Your Kids About Budgeting Early On

Budgeting is a critical life skill that kids should learn as early as possible. Whether you teach them at five years old or 15 years old, learning to budget their money will not only teach them its value, but also how to make it go as far as possible. You can start off with traditional budgeting, before moving into the more complex world of zero-based budgeting, one of our favorite budgeting methods.

Give Them An Allowance Sooner Rather Than Later

Of course, when you introduce your children to the concept of having their own money is entirely up to you, but by offering them an allowance sooner rather than later, you'll teach them a few valuable financial lessons: money is finite, they have to use their money to buy what they want, basic mathematics and economics. Even if you're supplying them with $2/week when they're five, this will help them feel empowered to make purchases, as well as teach them about the mathematics of money.

Effective Communication About Money

There's a reason why your grandparents are sometimes known as the "silent generation". This extends to plenty of things in their lives, but one of them is money. It wasn't really discussed in your grandparents' household. Maybe your parents also didn't talk to you about money that much—this is one of the pitfalls of generational wealth.

How To Talk Effectively About Money

While we understand that personal finances are, well, personal, there's not enough communication between families about money. That needs to change with your generation, if that inherited wealth is going to last. Have conversations about money with your significant other or spouse. Talk to your kids about money. Of course, if you're struggling, you don't want to worry them, but not talking about money is not a recipe for success.

Set Expectations, Responsibilities & Goals Openly

One of the most important things to communicate to your family about is expectations when it comes to managing money. Set your expectations for how your significant other and/or children will manage their inheritances. Encourage responsible financial decision-making and talk about the family's financial goals.

Build Financial Roadmaps To Encourage Savings

If you want to encourage your children to save money, sit down with them and build financial roadmaps to success. Ask them what they want to save up for—this could be a physical thing, or something like contributing money toward the cost of a family trip (or having their own money to take on that trip). Map out the total amount they need, what they earn (even if it's just an allowance), and how much they'll need to save and at what rate to meet that goal.

A Lack Of Shared Vision Can Cause Generational Wealth To Disappear

It's important that you and your significant other have a shared vision for what you want to do with the money that you have. You don't have to agree on everything, nobody does, but a general sense of shared purpose is important. For example, if you want to use a portion of an inheritance to buy a home but your significant other would rather spend it on a dream vacation, then you may have different financial values that could cause problems later on.

Communication & Compromise Makes Money Go Further

In this case, or any other applicable scenario you can think of, effectively communicating your desires for the money is the best way to handle the situation. Make your significant other feel heard and included (even if the money is legally yours), you're in this together. You can come up with a compromise to make the inherited wealth go further.

A Compromise: Sacrifice The Immediate For The Future

In the above example, maybe set a portion of inheritance aside for a down payment (paying less into the down payment initially) and having a smaller vacation. Or, you could say, "We'll use this money for a large down payment, but create a savings plan for the dream vacation within a reasonable timeframe".

Feeling Entitled To Spending Generational Wealth

Unfortunately, one of the curses of inheriting generational wealth is that people can become entitled about it. "It's my money and I'll spend it how I want". While this may be an understandable reaction, particularly if you've never had much money before, it's ultimately destructive and can lead to reckless squandering of money.

Encourage Responsibility & Gratitude

One of the most important things you can teach your children is to be grateful for the money they have, especially if this inherited wealth. By teaching them to be grateful for their wealth, they'll be less likely to spend it frivolously.

eyecrave productions, Getty Images

eyecrave productions, Getty Images

A Lack Of Succession Planning

In some ways, building or maintaining generational wealth is all about planning—planning how you're going to spend what you've got in such a way that enriches you and future generations. But it doesn't start there. Effective generational wealth-building starts at the beginning of the "custody chain" of money.

Ensure That You Have A Plan For Your Financial Assets

Whatever you do, do not leave your family without a will that outlines what is to happen with your financial assets. Succession planning is incredibly important to avoid disputes over who gets what and mismanagement of funds. Don't leave your money up to a court-appointed administrator. Get yourself a will and come up with a clear plan of what happens to your money when you're gone.

Jacob Wackerhausen, Getty Images

Jacob Wackerhausen, Getty Images

Lifestyle Inflation

Another reason why generational wealth disappears within three generations is lifestyle inflation. If you're not used to having money but then you suddenly come into a bunch of it, it's no surprise (nor necessarily a bad thing) that you spend some of it lavishly. But long-term inflation of a lifestyle that you can't sustain is a recipe for disaster.

Avoid Lifestyle Creep By Locking Money Away

Lifestyle creep can be tempting as expectations and desires for luxury goods look a whole lot more achievable with a significantly inflated bank account balance. But, it's important to recognize that building generational wealth means that you sacrifice that instant gratification for future success. Use a Certificate of Deposit account to lock funds away for a fixed period (with a fixed interest rate) if you think you're susceptible to spending significantly.

Setting A Budget Will Help With This, Too

Budgets don't just have to be tools to help you get from one month to the next, they can also be used on a larger scale. Create a simple budget that reflects your financial goals and how you plan to spend, save, or invest your inherited wealth. This will help you stay on track and avoid making exorbitant (and unnecessary) lifestyle creep purchases that take large chunks out of your inheritance.

Family Conflicts Derail Generational Wealth-Building

This is part of the reason why communication is so important, it reduces the likelihood of conflict in the family. If you've suddenly come into an inheritance but your significant other, siblings, or even distant family members are suddenly very interested in acquiring a piece of it, it may be time to set some financial boundaries.

Conflict Diminishes The Value Of Generational Assets

Sometimes, family conflict over money can go to the extreme. We're talking a huge breakdown of the family unit, even going so far as siblings taking each other to court over entitlement claims to an estate. It may sound crazy, but it happens often. These types of conflict can cause the diminishing of the value of generational assets over time. For example, if you've spent a year fighting with your sibling over Dad's classic Ford Mustang, that car is now worth less than it was on the day you inherited it. You gain nothing and lose a lot.

Economic Downturns Can Reduce Liquid Assets To Rubble

While it can be hard to plan for economic downturns, they're one of the key factors in why generational wealth disappears. This is part of the reason why financial literacy is important: it will help you know what to do and how to navigate hard financial times.

Come Up With A Strategy To Manage Money In An Economic Downturn

Economic downturns can really mess up your finances, especially when inflation is factored in. It's important that you come up with a family strategy for managing inherited wealth during an economic downturn, to avoid using the cushion you've been gifted to pay for (now more expensive) items. Here's a few strategies to manage money during a downturn.

Budget Accordingly

Even though things are slightly more expensive now, it's important that you adapt your budget to reflect this increase in cost. This will help you not blindly throw money at a problem and actually make your money last by accurately accounting for any increases.

Think Long-Term With Your Inherited Wealth

This is a mindset shift, but it's important. Shifting your thinking to long-term will allow you to ride economic waves with the certainty that your generational wealth isn't for the here-and-now, it's for 15, 20, 30, 50 years down the line. Set aside a portion (hopefully sizable) of your inherited wealth for long-term investments that can ride out economic downturns.

The Best Accounts For Long-Term Investments

There are a few options when it comes to long-term investments for your inherited wealth. The first is an individual retirement account known as a Roth IRA. Both contributions and capital gains within the Roth are tax-free, as they're financed with after-tax dollars. Other than a Roth, you could also open a Certificate of Deposit within a savings account.

Certificate Of Deposits Offer Security & Peace Of Mind

One of the most effective ways to lock money away and ride out the waves of economic downturns and inflation is to use Certificate of Deposit accounts. These are fixed-term, fixed-interest rate accounts that are guaranteed by the FDIC. So, you won't lose money in the account, but will only gain a fixed interest rate over the duration of the term. This interest is usually less than you would earn on the stock market, but they do offer additional security and peace of mind.

Becoming Reliant On Your Inheritance As Income

It can be tempting when you receive a large enough inheritance to quit your job and use the inheritance as your single source of income. This is a sure-fire way to end generational wealth really fast. Don't quit your job because you've received a large inheritance. Keep working and save or invest that inheritance for the future.

Photo By: Kaboompics.com, Pexels

Photo By: Kaboompics.com, Pexels

Lack Of Professional Guidance

It can be tempting to go it alone when you've inherited a large amount of money, but ultimately, not seeking professional guidance may cause you to make critical mistakes that could cost you everything—for example, investing a large portion in cryptocurrencies without understanding the volatility and risk. Seek professional guidance when you first come into a large amount of inherited wealth.

Do You Have A Generational Wealth Story?

Share with us your tips for maintaining generational wealth, or your own generational wealth story in the comments below. Did you once inherit life-changing wealth and lose it all? What would you do differently next time?

You May Also Like:

Are You Terrified Of The Money Side Of Starting Your Own Business?