Keeping Yourself Sane & Making A Profit When Starting A New Business

Starting a new business can be scary. We get it, particularly if you've sunk all your savings into this new venture and are giving it your all. But it's important to keep a level head and a clear mind when starting your own business. Understand the risk you're taking and plan for it well in advance. Here's how to get started with your business's finances, so that you understand what you need to do, all the while turning a profit.

What To Do If You Can't Afford An Accountant

You're probably aware that most small businesses hire accountants to perform their financial business. While this may be an option someday, they all started like you did: on their own, with no professional financial support, outside their bank. Here are some practical steps you can take to familiarize yourself with your business's finances.

Separate Your Personal & Business Finances

If you've been using a personal debit card to pay for business expenses, you need to stop doing that immediately. While it may be fine when you're just starting, if you're making large purchases, things can get murky in terms of your taxes. It's easier to keep personal and business finances separate.

Start With A Financial Roadmap

Drawing up a financial plan is a huge first step in taking control of your new business's finances from day one. You have to ensure you pay yourself and make the business profitable. Figure out what you need to make every year to keep the business "in the green".

Familiarize Yourself With Your Tax Responsibilities

We all hate life's second certainty: taxes. Business taxes make it a whole lot more complicated. Register your business with state and federal authorities, then get a tax professional to look over your tax plans and obligations and ensure you're meeting all the requirements.

Build A Detailed Business Budget

You must start by building a detailed business budget. Look at all your revenue sources and add them up, then look at it over as many months as you've been in business, or the last 12 months if you've been in business for more than a year. After you've got those, subtract your fixed costs like property taxes, rent/mortgage, employee salary, etc. Then, subtract your variable expenses, giving you an operating cost.

Build Up An Emergency Fund

Similar to a personal emergency fund, your business should also have one. This can be used to replace things that break down suddenly. It should be kept in a separate but accessible bank account from your business account, perhaps in a secondary savings account to your business's checking account.

Vitalii Vodolazskyi, Shutterstock

Vitalii Vodolazskyi, Shutterstock

How Do I Fund My Emergency Fund?

One of the first things you should do is to set aside a certain percentage of your income into that business emergency fund every month. Some financial experts recommend setting aside about 15% of your monthly income. Start with that number and set it up to automatically be transferred into that savings account.

Vitalii Vodolazskyi, Shutterstock

Vitalii Vodolazskyi, Shutterstock

Determine Your Profits

Once you've set aside that emergency fund money, determine how much profit you've made for as long as you've been open, or annually if you've been open for over 12 months. Once you've determined your profits, you'll better understand your overall financial picture. Then, it's time to create two short- and one long-term plan.

What Does A Short-Term Financial Plan Look Like For Your Business?

Short-term financial plans are an excellent way to orchestrate a change in business practices, policies, or expenses that will get you out of a hole in the next six months to a year. Whether that's shopping for new suppliers that aren't charging you an arm and a leg, or changing the way you market your business to increase profitability. Work out what a short-term financial plan looks like; this will give you a viable roadmap moving forward that you'll be able to execute.

Cash Flow Is King

The old saying "You've got to spend money to make money" is one of the truest statements ever. In business, it's cash flow that matters most—getting paid when you need it to ensure that your rent is paid on time, your supplier is paid, and any cyclical debts are taken care of on-time. Here are some cash flow best practices to implement today.

Always Keep Your Book Up-To-Date

However you manage your cash flow, whether that's an Excel spreadsheet, an accounting software, or even a pencil-and-paper ledger, it's always best to keep your books up-to-date. It's less hassle come tax time and will give you peace of mind throughout the year. Try to make it a weekly habit on a Friday evening after you close for the day.

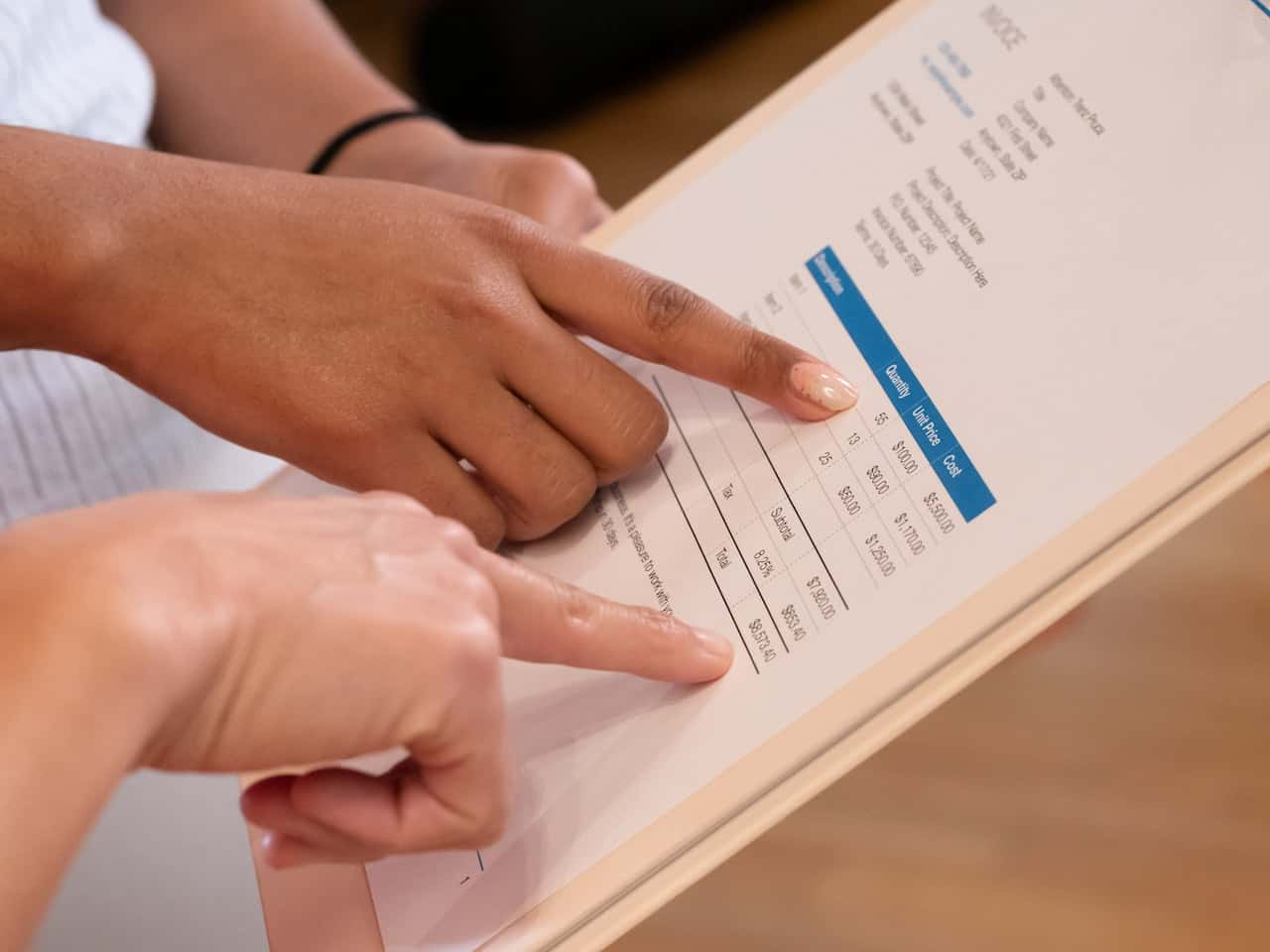

Come Up With An Invoicing Strategy For Customers

Most customers will pay you up front, or once you've completed their project or provided the product they've asked for. But, for those that choose not to, come up with a polite but firm invoicing strategy. This could be as simple as a reminder email that's automatically generated by invoicing software.

Use Digital Tools To Your Advantage

Even if you're used to the analog way of doing things, there are huge advantages to using digital tools like QuickBooks or other accounting software. Even free accounting software has automated features—things like automating your bill payments can go a long way to easing your financial burden.

Use Accounting Software That Generates Financial Reports

You should use accounting software that has the ability to generate financial reports on a weekly, bi-weekly, monthly, quarterly, or annual basis. These will be incredibly detailed financial reports that include profit-and-loss statements, cash flow statements, balance sheets, and more.

Why Automate Your Accounting?

Sure, you could pay your friend who's good with numbers to do your accounting when you first start, but there are plenty of free accounting-style software that will perform accounting tasks for you, without exposing your business accounting to things like human error. Automating these processes will also give you more time to focus on critical aspects of your business, like marketing.

Buy In Bulk

This is good advice if you own the kind of small business that has a relatively slow start to your year, but tends to finish out the year strong. Or, perhaps this is an on-demand business that helps buy in-bulk. Not only will you have enough stock to last for several weeks or months, but you won't have to worry about running out of business essentials. Sure, you're spending the money upfront, but hopefully you won't have to place that big of an order for materials again anytime soon.

Continuously Monitor Your Business Spending

Because you'll have already separated your business expenses from your personal expenses, it will be easier to monitor your business spending. Ensure you're keeping a detailed budget with every business expense inputted and receipts for expenses kept. You can use apps like Receiptify to generate a PDF of your physical receipts and keep them organized in detail.

chillchill_lanla, Shutterstock

chillchill_lanla, Shutterstock

Ensure You Have A Debt Management Strategy

Whether you're paying off $5,000 worth of debt or $25,000 worth, it's critical that you have a debt management and repayment strategy. Whether you use the debt snowball method or the debt avalanche method to repay them doesn't matter; what matters is that debt payments are made on time. Once you pay off your debts, you'll have more cash to inject into the business for equipment upgrades.

Regularly Reconcile Bank Statements With Internal Records

Checking that your bank statements match your internal business records is known as "reconciling". Doing this once a month will ensure that what's on your bank statements matches your internal records. This should help you identify any inaccuracies in your accounting, or even fraudulent activity.

Keep An Eye Out For Funding Opportunities

Depending on your sector or type of business, you may be eligible for certain state, local, or federal funding opportunities. There are non-repayable small business grants you could apply for, or local non-profit organizations that sometimes offer one-time payments for small businesses. Always keep an eye out for opportunities to obtain external funding that isn't tied to a bank or financial institution with high-interest debt.

What Challenges Did You Face When You Started Your Small Business?

Are you a small business owner? What was the biggest challenge you faced when you first started? Let us know how you got your finances under control when it was just you and your friend who was good with numbers. Share your tips for others in the comments below!

You May Also Like: