Everyday Money Mistakes To Steer Clear Of

Have you ever looked at your bank account and wondered, “Where did all my money go?” You're not alone, as small money mistakes can add up quickly and wreak havoc on your finances. The good news? These mishaps are avoidable once you know what to watch for.

Having Unrealistic Financial Goals

You probably already know that you should save for the future and budget your expenses. But if you aim too high or underestimate expenses tied to a goal, you’ll deal with the consequences. Set SMART—Specific, Measurable, Achievable, Relevant, Time-bound—financial goals. And break big goals into smaller milestones to maintain motivation.

Photo By: Kaboompics.com, Pexels

Photo By: Kaboompics.com, Pexels

Assuming All Loans Are the Same

We could misunderstand the differences between various types of loans. Recognizing the traits of fixed-rate, variable-rate, secured, unsecured, short-term, and long-term loans can permanently change your life. Educate yourself about the different types of loans and their terms before borrowing. Don’t forget to compare options from multiple lenders.

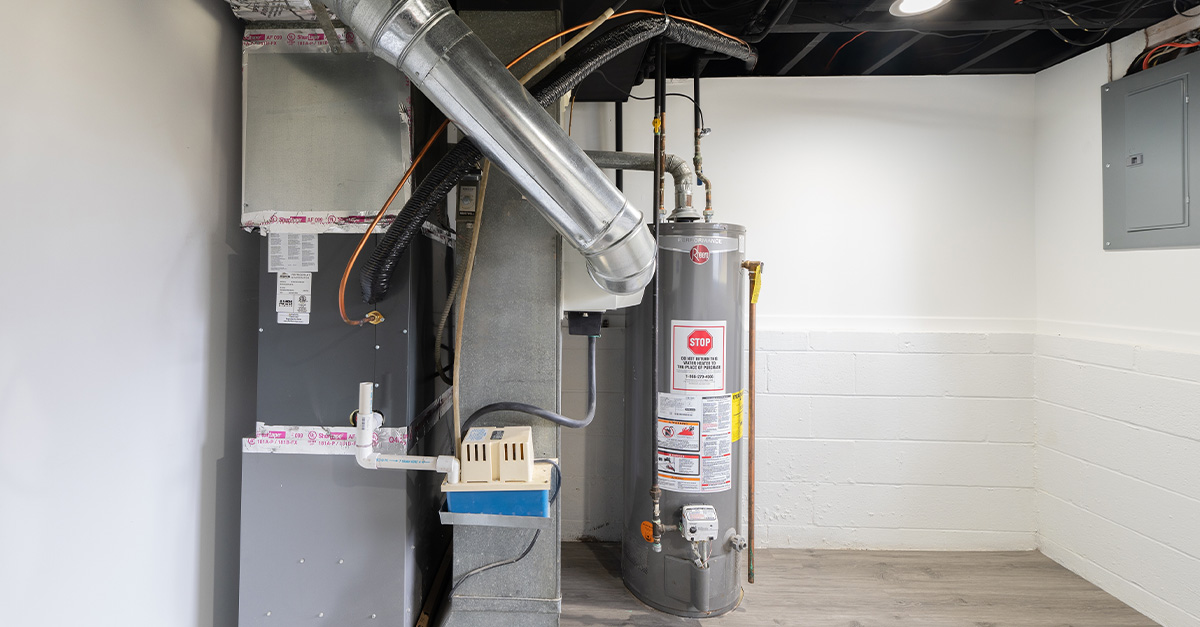

Neglecting Insurance

Insurance often feels like an unnecessary expense until you need it. Many people either assume nothing bad will happen to them or view insurance premiums as a burden. Evaluate the types of insurance you need and shop around for competitive rates and bundle policies when possible.

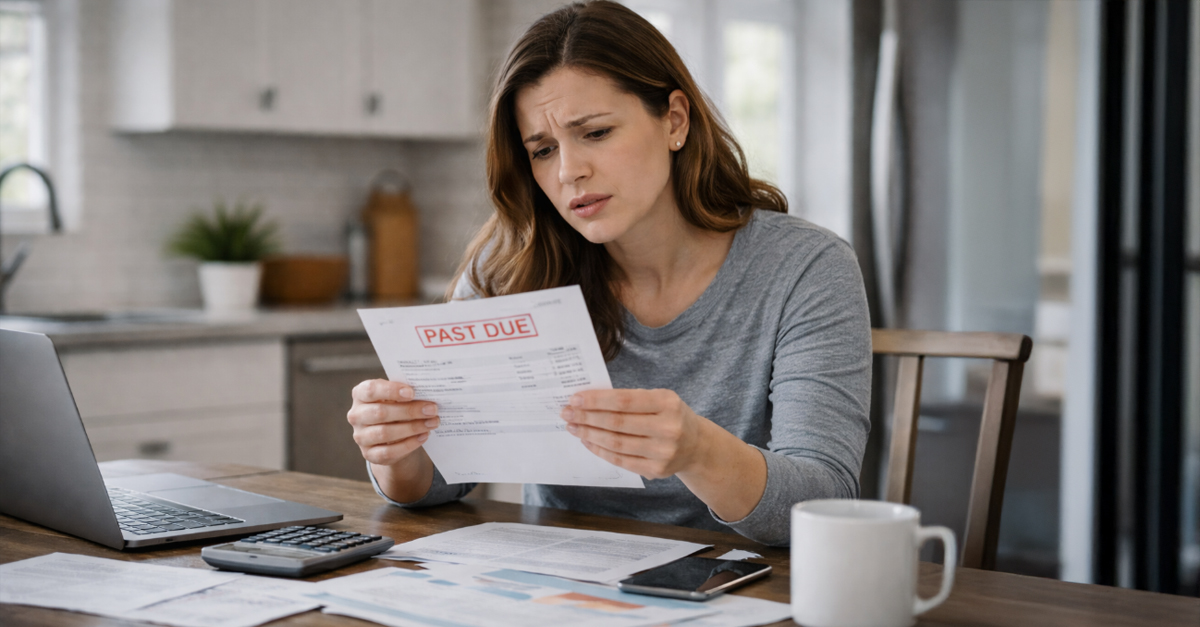

Spending More Than You Earn

Tempted to splurge? Credit cards and buy-now-pay-later schemes make overspending easier than ever. However, you should prioritize needs over wants and use budgeting tools to monitor spending. Commit to only charging what you can pay off in full each month to avoid debts.

Impulse Spending

Implement a 24-hour rule—wait a day to decide if you need to buy it, and it’s truly worth it. Retail therapy and online shopping make impulse spending hard to resist. Unfortunately, stress or boredom often leads to unplanned purchases. It’s best to create shopping lists for groceries and other expenses.

Spending Everything You Earn

Set aside a portion, let’s say 20%, of your income for savings before spending on anything else. Then, adjust your lifestyle to fit within the remaining 80%. Many people fall into the trap of spending their entire paycheck because they lack a plan or believe saving isn’t urgent.

Photo By: Kaboompics.com, Pexels

Photo By: Kaboompics.com, Pexels

Not Paying Off Debt Quickly

Debt, especially credit card debt, often snowballs due to high interest rates. We sometimes make minimum payments usually because we underestimate the impact of interest or prioritize other expenses. Pay high-interest debts or tackle all smaller debts first for some freedom.

Failing To Invest Early

How many times have you told yourself that it’s too early to invest? Many believe that they don’t earn enough or they need significant knowledge. Start small and take advantage of compound interest by investing as early as possible. Use retirement accounts or consider low-cost index funds.

Overlooking Hidden Fees

Don’t ignore the fine print. Review your bank, investment, and subscription accounts regularly to identify unnecessary fees. Opt for fee-free accounts or negotiate better rates. Also, cancel subscriptions you don’t use, and be mindful of charges when using ATMs or credit cards abroad.

Not Setting Financial Goals

Set short-, medium-, and long-term financial goals that could include paying off debt, buying a house, or saving for retirement. Without clear objectives, money management becomes reactive instead of proactive. People focus on day-to-day expenses without thinking about where they want to be financially in five or ten years.

Ignoring Retirement Planning

Retirement feels distant for many, leading them to prioritize immediate needs and wants. Start adding to your retirement account as early as possible, even if it’s a small percentage of your income. Take advantage of employer-matching programs and increase contributions as your salary grows.

Procrastinating On Saving For Big Purchases

Should you delay saving for a car or home until it feels urgent? This often leads to relying on loans or credit and increases the overall costs due to interest. Create a dedicated fund for major purchases and break down the total cost.

Photo By: Kaboompics.com, Pexels

Photo By: Kaboompics.com, Pexels

Not Tracking Spending

What would a $10 purchase do? Some underestimate how much they spend on coffee or dining out. Without tracking, it’s easy to lose sight. Use budgeting apps or spreadsheets to record all your expenses, no matter how minor, and review your spending weekly to identify patterns and make adjustments.

Photo By: Kaboompics.com, Pexels

Photo By: Kaboompics.com, Pexels

Relying Too Much On Credit Cards

Credit cards lead to overspending when treated as extra income instead of a payment tool. The delayed nature of payment makes it easier to ignore the consequences. Treat your credit card like a debit card—only charge what you can pay off.

Not Building A Diverse Income Stream

Relying solely on a single job feels simpler and more secure for many of us. Nevertheless, it leaves them vulnerable to financial instability during layoffs or unexpected changes. Explore side hustles like freelance opportunities or passive income streams like investments or rental properties whenever possible.

Ignoring Inflation's Impact

Some people often save money in low-interest accounts, unaware that inflation erodes its purchasing power over time. Move excess savings into higher-yield options like CDs and other investments with growth potential. Regularly review and fix your savings plan to stay ahead of inflation.

Failing To Plan For Major Life Events

Big expenses like weddings and having children can catch us off guard when we don’t anticipate the costs or start saving early enough. Identify upcoming major expenses and start a sinking fund—a separate savings account designated for a specific goal. Break the total cost into monthly contributions accordingly.

Overlooking Tax Planning

Taxes are often viewed as a once-a-year task rather than an ongoing consideration. Lots of us miss out on strategies that could lower their tax burden. Keep track of potential deductions, such as charitable donations or education expenses. If possible, consider consulting a tax professional.

Failing To Negotiate Expenses

Practice negotiating skills and remember that many expenses are negotiable, such as internet bills, rent, or even car insurance rates. The discomfort associated with negotiating can lead people to accept prices without question. Research competitive pricing and be prepared to ask for discounts or better terms.

Underestimating The Importance Of A Will

Do you feel that it’s too early to write a will? We usually believe a will is unnecessary if we don’t have significant assets. However, you should draft a basic one as soon as possible to outline how your assets should be distributed.

Failing To Account For Retirement Healthcare Costs

Yes, you’re healthy now and think that once you retire, you can travel the world. Retirement planning often focuses on living expenses but overlooks the rising costs of healthcare in later years. Contribute to a health savings account, as funds can grow tax-free and be used for medical expenses.

Not Teaching Financial Literacy To Children

Parents usually avoid discussing money with their children. They feel uncomfortable or believe money is too complex for them to understand. Introduce age-appropriate financial lessons and lead by example with smart practices. Also, involve children in discussions about family budgeting or major purchases to build their understanding.

Photo By: Kaboompics.com, Pexels

Photo By: Kaboompics.com, Pexels

Overlooking The Importance Of Credit Scores

Credit scores often feel unimportant until they affect someone’s ability to secure a loan. Many don’t monitor scores or understand how they work. Check your credit report for mistakes and monitor your score using free tools. Remember that a strong credit score opens doors to better financial opportunities.

Not Accounting For Medical Costs

Medical expenses are usually unpredictable, and many assume their health insurance will cover everything. But they’re wrong. Start a health savings a/c or flexible spending a/c if available through your employer. And research your insurance plan to understand coverage and out-of-pocket costs.

Skipping Regular Financial Reviews

How well are your financial plans going? Many individuals set financial plans but assume that one-time budgeting or investing is enough. Set a schedule to review your finances quarterly or annually. Assess your budget, savings, investments, and goals to ensure they align with your current situation.