When Your Nest Egg Starts Asking Big Questions

You’re 55, sitting on $900,000 in savings, and—best of all—completely debt-free. On paper, that sounds like the dream. But retirement isn’t just about hitting a number. It’s about timing, lifestyle, risk tolerance, and whether that money can realistically last as long as you do. The short answer? You might be able to retire now—but whether you should depends on a handful of crucial factors most people overlook.

Below, we break down the decision using practical early-retirement principles, long-term planning strategies, and a healthy dose of reality.

What $900K Really Means At 55

Having $900,000 saved by 55 puts you ahead of the curve. But retirement math changes when you stop working early. That money may need to last 35–40 years, not 20–25, which dramatically alters how aggressively—or cautiously—you can spend it.

The 4% Rule And Why It Gets Tricky Early

The classic 4% rule suggests you can safely withdraw about $36,000 per year from $900K. The catch is that the rule was designed for traditional retirements, not people stopping work in their mid-50s with decades ahead of them.

Centre for Ageing Better, Pexels

Centre for Ageing Better, Pexels

Your Spending Matters More Than Your Balance

If you can comfortably live on $35,000–$40,000 a year, retirement looks much more realistic. If your lifestyle requires double that, waiting—or working part-time—may be the smarter move.

Healthcare Is The Silent Budget Killer

Retiring before Medicare eligibility means footing your own healthcare bills. Premiums, deductibles, and surprise expenses can easily eat up thousands annually, so this line item deserves special attention.

Sequence Of Returns Risk Is Real

Early retirement exposes you to market downturns at the worst possible time—right when you start withdrawing. A bad first few years can permanently damage your portfolio, even if markets recover later.

The Power Of Working A Few More Years

Delaying retirement until 58 or 60 doesn’t just add savings—it shortens the time your money must last. Those extra years can dramatically improve your long-term odds, even if you don’t love your job.

Coast FIRE Might Be Your Sweet Spot

Instead of fully retiring, some people shift to lower-stress work that covers expenses while investments grow untouched. This approach preserves freedom without draining your nest egg too early.

How Social Security Changes The Equation

Claiming Social Security later boosts your monthly benefit. Waiting until 67—or even 70—can significantly reduce how much you need to withdraw from savings early on, protecting your portfolio.

Inflation Is The Long Game Threat

A dollar today won’t buy what it does 20 years from now. Retirement plans must assume rising costs for food, housing, and healthcare—or risk slow financial erosion.

Investment Mix Matters More Than Ever

Your asset allocation should balance growth and protection. Too conservative, and inflation wins; too aggressive, and volatility becomes dangerous when withdrawals begin.

Taxes Don’t Retire When You Do

Even debt-free retirees pay taxes. Withdrawals from registered accounts, capital gains, and government benefits can push your tax bill higher than expected if not carefully planned.

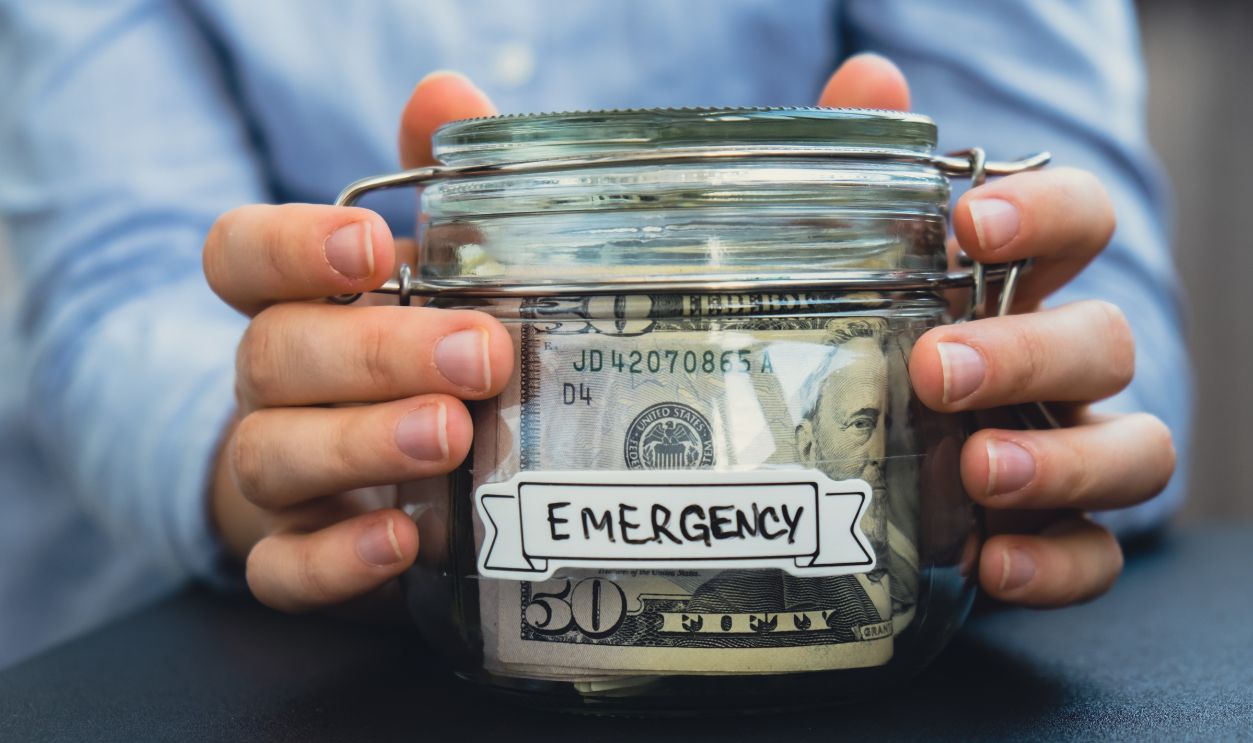

Emergency Funds Still Matter In Retirement

No paycheck means surprises hit harder. Maintaining a solid cash buffer prevents you from selling investments during market downturns, which can permanently hurt returns.

Longevity Risk Is Often Underestimated

Many people plan for retirement assuming they’ll live into their 80s. Living into your 90s—or beyond—requires far more financial stamina than most initial plans assume.

Lifestyle Flexibility Is A Superpower

Retirees who can adjust spending during bad market years fare much better. The ability to cut back temporarily can be the difference between success and running out of money.

Downsizing Can Be A Game Changer

Lower housing costs free up cash flow and reduce annual spending needs. Selling a high-cost home can sometimes unlock years of additional retirement security.

Why Early Retirement Needs A Written Plan

Hope is not a strategy. A written retirement plan forces you to confront numbers, risks, and trade-offs honestly—before emotions make the decision for you.

Part-Time Income Buys Peace Of Mind

Even modest income can dramatically reduce withdrawals. Earning $10,000–$15,000 a year early on can preserve hundreds of thousands over time, thanks to compounding.

Market Volatility Isn’t Just Emotional

Watching your balance swing wildly hits harder when it’s your only income source. Emotional stress causes many early retirees to abandon good plans at the worst moments.

The Psychological Side Of Retiring At 55

Retirement isn’t just leaving work—it’s redefining purpose. Those who plan their time as carefully as their money tend to thrive, while others feel unexpectedly adrift.

So—Can You Retire Now Or Should You Wait?

Yes, retiring at 55 with $900K and no debt is possible. But it’s not automatic. If your spending is modest, healthcare is planned, and you’re flexible, you may already be financially independent. If not, waiting a few years—or easing into retirement—could transform a risky leap into a confident step.

The smartest move isn’t choosing “now” or “later”. It’s choosing the version of retirement you won’t regret 20 years from today.

You May Also Like:

The cost of living squeeze isn’t one thing. It’s all these things at once.

The Retirement Mistake 85% of Gen X and Boomers Wish They Could Undo

I bought a car with a 22% interest loan. Am I as screwed as everyone says I am?