The Retirement Regret Haunting Gen X and Boomers

More than 8 in 10 Gen Xers and Baby Boomers share the same regret when it comes to retirement savings — they wish they had started earlier. This common mistake is creating anxiety, delaying retirement plans, and shrinking nest eggs. Let’s walk through why this happened, what the numbers look like, and how it’s affecting people now.

They All Say the Same Thing: “I Wish I Started Sooner”

According to a recent survey from Allianz Life Insurance Company of North America, a whopping 85% of Gen X and Boomers say their biggest financial regret is not saving for retirement sooner. This isn’t just hindsight — it’s a red flag about how unprepared many Americans feel as they approach retirement age.

Gen X Is Feeling the Heat

Gen X — those born between 1965 and 1980 — are especially worried. Many are juggling aging parents, kids in college, and rising living costs. Allianz found that only 62% of Gen Xers have any retirement savings strategy at all. That means over a third are heading toward retirement without a plan in place.

Boomers Aren’t Immune Either

Baby Boomers — born between 1946 and 1964 — are either retired or right on the edge. Even though they had longer to save, many still feel behind. About 47% say they don’t feel financially prepared for retirement, and almost half are counting on Social Security as their main income source, which might not be enough.

Why Didn’t They Save Sooner?

There are a few reasons. Many say they simply didn’t understand how compound interest worked or didn’t realize how much they’d actually need. Others had jobs without retirement plans or were too focused on daily bills to think long-term. Life, as they say, got in the way.

Inside Creative house, Shutterstock

Inside Creative house, Shutterstock

The Cost of Waiting

Saving early makes a huge difference. If you start saving $200 a month at age 25 with a 7% return, you’ll have around $500,000 by age 65. But if you wait until age 40 to start, you’ll only end up with about $150,000 — even if you double your monthly savings. Time really is money.

Social Security Won’t Cover It All

Many retirees depend on Social Security, but it’s rarely enough. The average monthly benefit in 2024 is about $1,900. That’s only $22,800 a year — far below what most retirees need. If you didn’t save enough, you may have to delay retirement or downsize your lifestyle.

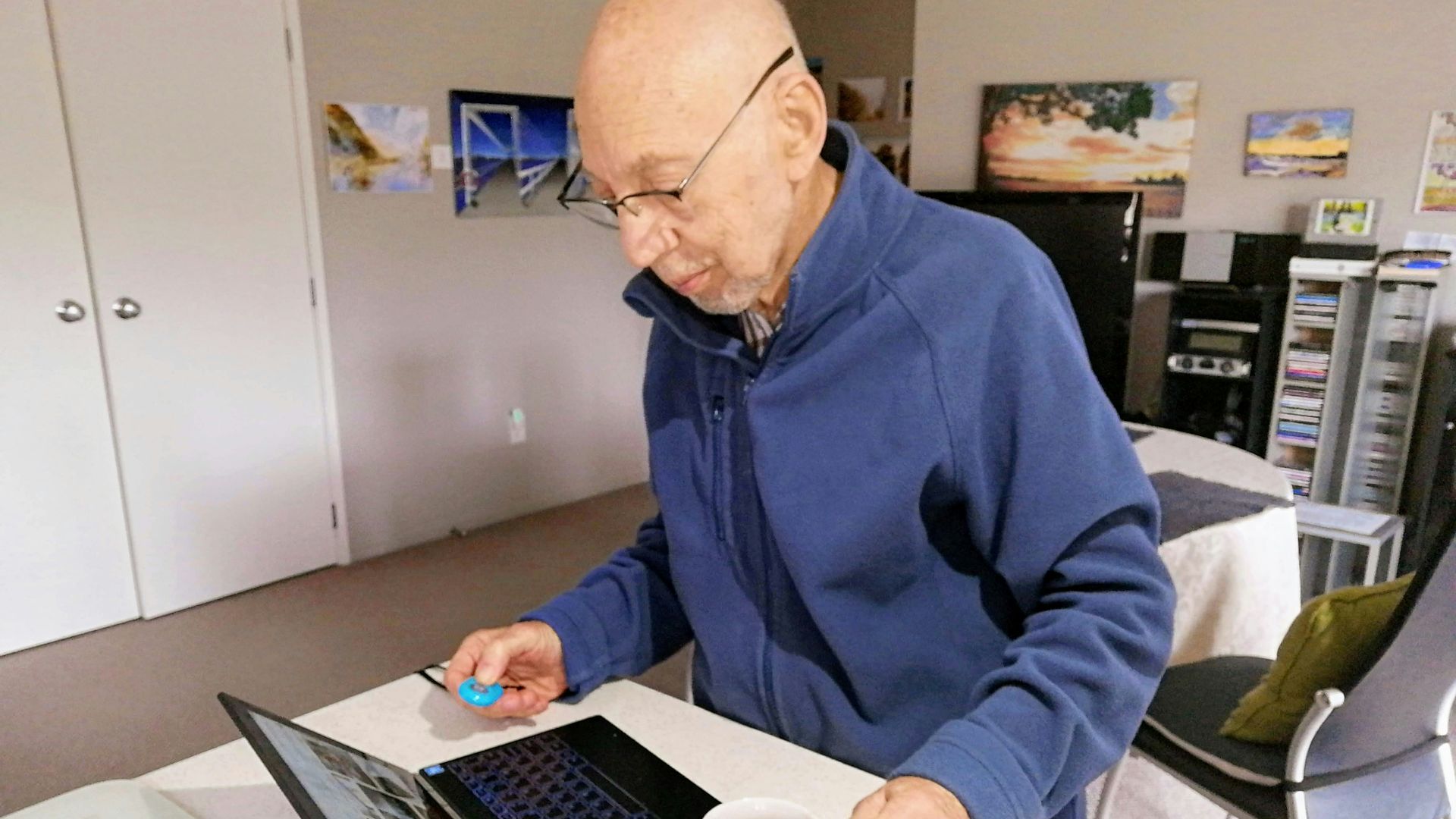

Rix Pix Photography, Shutterstock

Rix Pix Photography, Shutterstock

Retirement Is Getting More Expensive

Today’s retirees are facing higher costs than ever. Healthcare, housing, and food have all gone up. Fidelity estimates that a 65-year-old couple retiring in 2024 will need about $315,000 just to cover healthcare costs in retirement. That doesn’t include housing, travel, or other basics.

Many Regret Spending Instead of Saving

Looking back, many Gen Xers and Boomers say they spent too much in their 30s and 40s instead of building savings. Big houses, new cars, and credit card debt got in the way of long-term planning. Now, they’re playing catch-up in their 50s and 60s.

Catch-Up Contributions Are Helping — a Little

People over 50 can contribute extra money to retirement accounts. In 2024, catch-up limits are $7,500 for 401(k)s and $1,000 for IRAs. These boosts can help, but they’re still not enough to make up for decades of missed compounding growth.

The Role of Financial Literacy

One of the biggest gaps? Knowledge. Many people didn’t understand retirement planning until it was too late. Schools rarely teach it, and not everyone had access to financial advisors. That lack of information turned into missed opportunities.

What They’d Tell Their Younger Selves

In the same Allianz survey, many Boomers and Gen Xers said they’d give their younger selves one piece of advice: start saving now, even if it’s just a little. “Don’t wait until you think you have enough to start. Just start,” said one 58-year-old participant.

The Emotional Cost

Beyond dollars, there’s emotional strain. Anxiety about money in retirement can cause stress, delay plans to stop working, and affect overall well-being. Many people feel guilty or ashamed that they didn’t prepare better — but it’s never too late to take action.

Women Feel the Pressure More

Women are especially impacted. They often take time off for caregiving, earn less over their careers, and live longer. As a result, they end up with smaller retirement accounts and more worry about outliving their savings. 64% of women say they regret not saving earlier.

Retirement Delays Are the New Normal

More than half of Gen X and Boomers now expect to retire later than they originally planned. Some say they’ll work part-time in retirement, while others hope to delay retirement entirely until their late 60s or even 70s. It’s a big shift from what retirement used to look like.

LOGAN WEAVER | @LGNWVR, Unsplash

LOGAN WEAVER | @LGNWVR, Unsplash

Many Are Leaning on Home Equity

Some older adults are planning to use their home equity to fund retirement. That could mean downsizing or taking out a reverse mortgage. While this can help, it’s not always a perfect solution — and it often means giving up your long-term home.

Financial Planners Are Seeing This Trend

Certified Financial Planner Erin Wood told CNBC, “I hear this all the time from clients in their 50s and 60s. They wish they had started in their 20s, but life was just too busy or expensive.” Advisors now push younger clients to learn from these regrets.

The Power of Small Steps

It’s never too late to improve your retirement outlook. Even starting with $100 a month can help. Automating savings, reducing debt, and budgeting smartly all make a difference. The earlier you start, the better — but it’s better late than never.

What Gen Z and Millennials Can Learn

Younger generations have a chance to avoid this regret. Learning from Gen X and Boomers, they can start saving early, even if it’s a small amount. Using tools like Roth IRAs, 401(k)s, and even investing apps can put them ahead of the curve.

The Bottom Line

The biggest retirement regret for Gen X and Boomers is not starting to save sooner. It’s a reminder to take action now, no matter your age. Time, knowledge, and consistent saving are your best tools. Don’t wait — your future self will thank you.

You May Also Like:

My retirement fund is $700K, but I still owe $120K on my mortgage. Should I pay it off?