Freedom on Four Wheels—or Financial Faceplant?

At 58, the open road can feel like the ultimate symbol of freedom. Imagine waking up by a mountain lake instead of a cubicle alarm. But while van life might seem like the minimalist retirement dream, it also raises big financial questions. Is this your road to independence—or a detour into disaster?

The Lure Of The Open Road

There’s something irresistible about packing up your life, turning the key, and chasing sunsets. The simplicity, the spontaneity, and the quiet hum of tires on the highway all whisper “freedom.” But behind those scenic Instagram posts is a reality check—fuel receipts, maintenance costs, and learning to live happily with less space and more uncertainty.

A Retirement Plan Without a ZIP Code

Retiring to a van isn’t just about travel—it’s a complete reinvention of how you live and think about money. Instead of property taxes and yard work, you’ll juggle camp fees and gas budgets. It’s adventure mixed with practicality, a retirement plan that trades permanence for possibility. You’ll gain freedom—but you’ll need flexibility, too.

The Financial Upside: Cutting Costs

Van life can drastically reduce expenses—no mortgage, rent, or utility bills eating away at your retirement fund. With careful planning, monthly costs can drop to half of traditional living. But the real key lies in discipline. Those savings can quickly disappear if wanderlust turns into constant travel, dining out, or splurging on high-end campsites.

The Big Expense: The Van Itself

Your van is both your castle and your chariot. A decent used camper can cost $25,000, while a fully tricked-out luxury build might run $100,000 or more. The temptation to “go big” is real—but remember, this isn’t an investment vehicle. It’s a depreciating asset that’ll lose value faster than your memories of rush hour.

Vassilis Sfakianopoulos, Pexels

Vassilis Sfakianopoulos, Pexels

Depreciation Doesn’t Take Vacations

Homes often appreciate, but vans almost never do. Expect your rig to lose 15–20% of its value every five years. Custom features like solar panels and fancy woodwork don’t change that math. It’s not a financial growth strategy—it’s a lifestyle purchase. Still, the emotional return on investment can be priceless if freedom is your goal.

Maintenance Miles Add Up

Every adventure comes with upkeep. Oil changes, brake pads, tire rotations—plus the occasional breakdown in the middle of nowhere. Expect at least $200–$300 a month for regular maintenance, but plan for more. When your home and vehicle are the same thing, every repair affects both your comfort and your ability to keep moving.

Fuel: The Invisible Mortgage

Freedom isn’t free—it’s fueled by gas. Cross-country travel can easily cost $300–$600 per month, depending on how often you roam. Stay parked longer, and your wallet breathes easier. Think of fuel like rent: the farther you wander, the higher it gets. Planning slower, scenic routes can save both money and sanity.

Health Insurance On The Move

Healthcare doesn’t retire when you do. Until Medicare kicks in at 65, you’ll need private insurance or ACA coverage. Plans for full-time travelers vary by state, and costs can range widely. Look for RV-friendly or nationwide options. The peace of mind knowing you’re covered—no matter where you break down—is worth every premium.

Wi-Fi, Not Just Campfires

In today’s world, connection matters. Whether it’s managing finances, checking in with family, or streaming your favorite show, you’ll need reliable internet. A strong mobile hotspot and extra data plan can run $100–$150 monthly. It’s one of those modern necessities you can’t just unplug from—even in the most beautiful remote forests.

Parking Isn’t Always Free

“Home is where you park it,” they say—but that parking space often comes at a price. National park sites, RV resorts, and even Walmart lots have limits or fees. Free camping exists but requires research and responsibility. Budget $10–$80 a night depending on location. Freedom feels best when you’re not trespassing to find it.

Groceries, Propane & Coffee Stops

The grocery store may replace your old commute. Cooking simple meals in a van is cheaper than restaurants, but costs still hover around $400–$600 a month. Propane for cooking, water refills, and the occasional café Wi-Fi splurge add up. It’s frugal living—but not deprivation. The trick is balancing comfort with creativity.

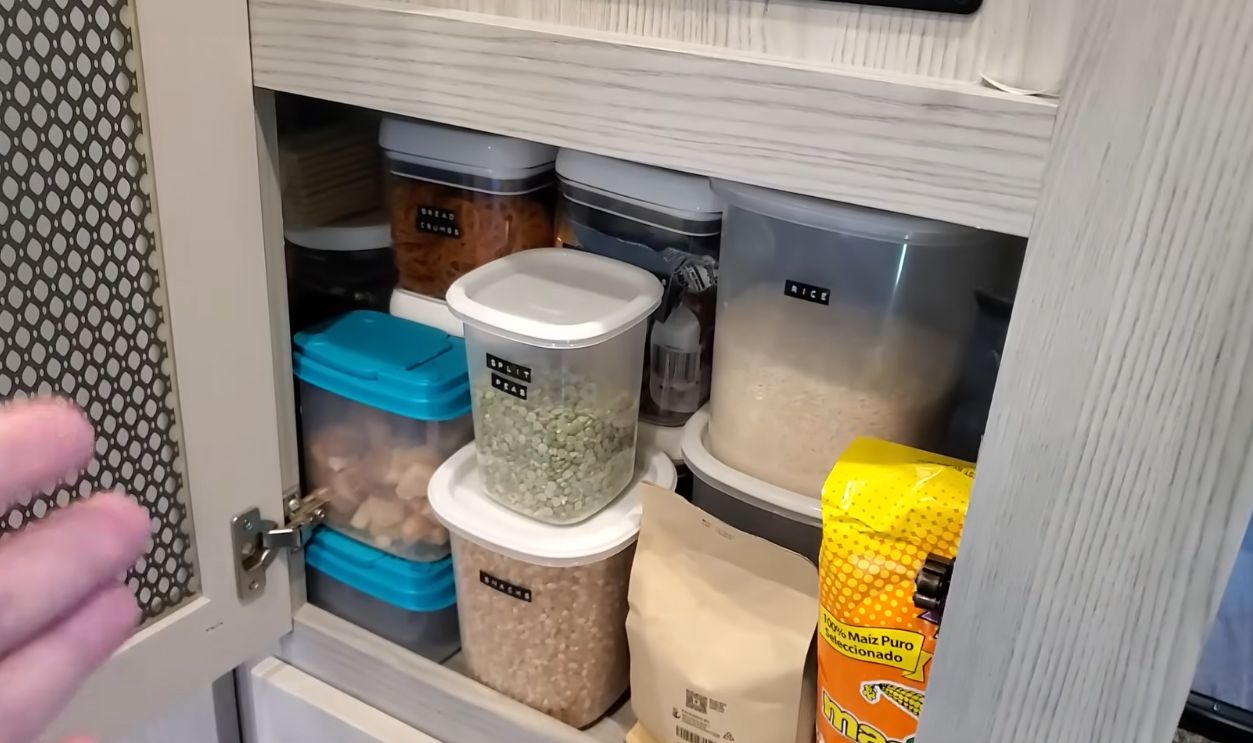

13 New RV Organization Hacks That ARE NOT Command Hooks or Dollar Tree!, Making My Abode On The Road

13 New RV Organization Hacks That ARE NOT Command Hooks or Dollar Tree!, Making My Abode On The Road

Safety & Security On The Road

Retirement adventures shouldn’t include unwanted surprises. Invest in locks, motion lights, and GPS trackers for peace of mind. Always trust your instincts when parking overnight—intuition is your best alarm system. Van life offers immense freedom, but it’s smart to mix it with a healthy dose of caution and awareness everywhere you roll.

What NO ONE Tells You About Driving a Class A RV!, Brazen Brits

What NO ONE Tells You About Driving a Class A RV!, Brazen Brits

The Emotional Learning Curve

Van life looks romantic online—but the reality can test even the most optimistic retiree. There’s loneliness, unpredictable weather, and the occasional mechanical meltdown. Yet, with time, many find joy in the quiet and pride in self-sufficiency. Emotional flexibility is your strongest asset—because freedom feels better when you’re mentally ready for it.

My Wife Drives (And Sets Up) Our RV Alone, Less Junk, More Journey

My Wife Drives (And Sets Up) Our RV Alone, Less Junk, More Journey

The Joy Of Minimalism

Once you downsize your possessions, you start to upsize your happiness. Van life teaches you to value experiences over things. No mortgage, no clutter—just the essentials. It’s surprisingly freeing to live without storage units or “junk drawers.” Minimalism isn’t about less joy; it’s about making room for more of what truly matters.

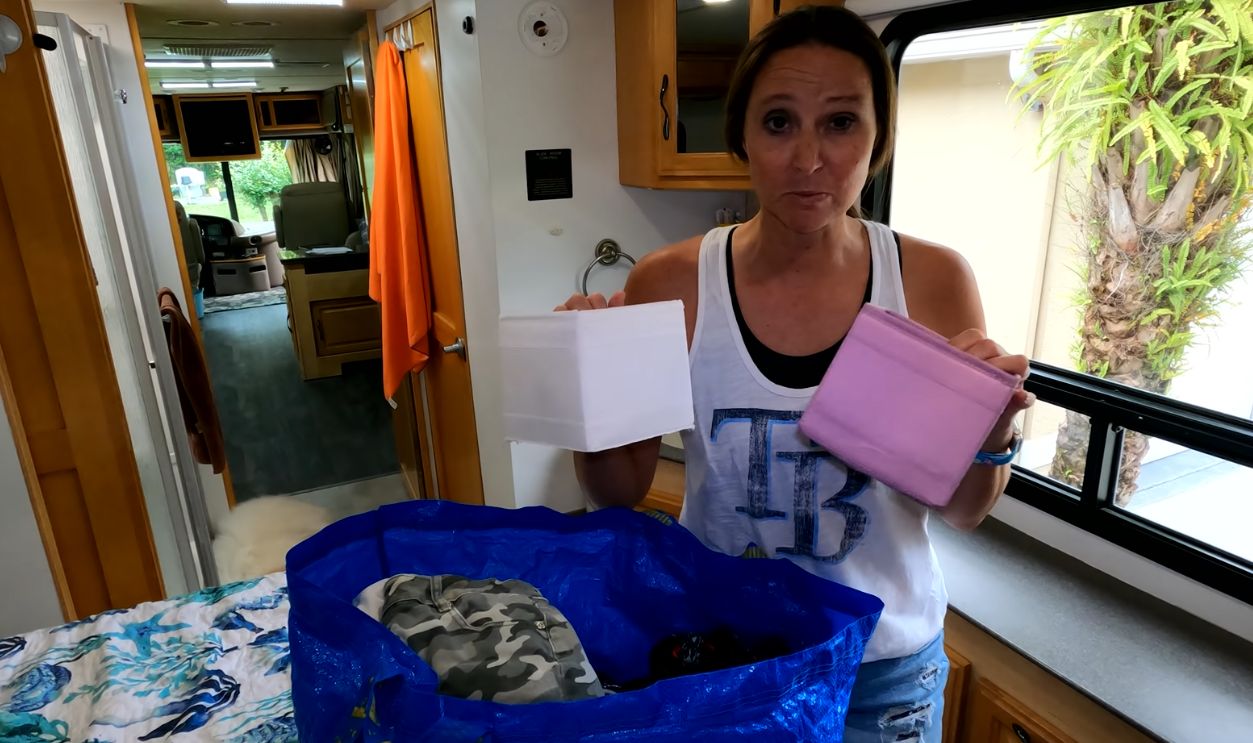

RV Set Up! HOW TO PACK & ORGANIZE AN RV To Hit The Road Fast, Grateful Glamper

RV Set Up! HOW TO PACK & ORGANIZE AN RV To Hit The Road Fast, Grateful Glamper

Finding Community On The Road

Lonely? Not for long. From desert meetups in Quartzsite to digital nomad gatherings, van lifers have built a thriving community. Online forums, apps, and Facebook groups connect travelers who share tips, stories, and friendship. You might lose your old neighbors—but gain a new tribe that spans states, seasons, and generations.

Where to Camp in Quartzsite, Arizona, Campendium

Where to Camp in Quartzsite, Arizona, Campendium

The Part-Time Freedom Option

Not ready to commit full-time? Try seasonal living. Spend half the year on the road and the rest in a rented apartment or family home. This hybrid lifestyle balances freedom with stability, giving you the best of both worlds—exploration when you crave it, comfort when you need a break from constant motion.

Sea Perch RV Resort | Yachats, Oregon, Idaho Voyager

Sea Perch RV Resort | Yachats, Oregon, Idaho Voyager

Tax & Residency Logistics

No home address doesn’t mean no paperwork. You’ll still need a legal domicile for taxes, licenses, and healthcare. Many van dwellers choose states like Texas, South Dakota, or Florida for simplicity and low taxes. Mail forwarding services can handle the rest. It’s bureaucracy on wheels—but manageable with a little planning.

Alvesgaspar, Wikimedia Commons

Alvesgaspar, Wikimedia Commons

Emergency Funds Still Matter

Freedom without a safety net is just risk in disguise. Set aside at least six months of expenses for emergencies—breakdowns, health issues, or family travel. Keep some cash accessible and the rest in a high-yield savings account. When things go wrong—and they will occasionally—you’ll be grateful you planned ahead.

Income On The Road

Retirement doesn’t have to mean zero income. Many van lifers teach online, sell crafts, freelance, or work seasonal jobs at parks and festivals. A few hundred dollars a month can cover your gas and groceries. Financial freedom isn’t always about being rich—it’s about keeping your lifestyle smaller than your income.

Environmental Footprint Check

Living in a van doesn’t automatically make you eco-friendly. Fuel use can be high, but solar panels, efficient batteries, and composting toilets help offset your impact. Conscious travel—fewer miles, more time in one place—saves both money and the planet. Think of it as sustainable wandering: freedom with a green conscience.

The Romance Vs. The Reality

Every lifestyle has trade-offs. Van life delivers stunning views, self-reliance, and simplicity—but it also means small showers, limited storage, and occasional isolation. Understanding both sides helps you decide if it’s freedom or fantasy. For the right mindset, it’s magic. For the unprepared, it’s more frustration than fun.

Stories From The Road

Talk to those already living the dream, and you’ll hear it all. Some say it’s the best decision they’ve ever made—life stripped to its essentials. Others admit they missed the comforts of home. These real stories reveal that van life’s success isn’t about money—it’s about mindset and adaptability.

How To Know If It’s Right For You

Ask yourself: do you crave experiences over possessions? Can you handle uncertainty with a smile? Do you love adventure more than predictability? If your answers are yes, then van life could be your next great act. If not, maybe start with shorter road trips before going full nomad.

Freedom—With A Financial Seatbelt

Retiring to a van can be pure liberation—or a recipe for regret. It all depends on preparation. If you plan, budget, and embrace flexibility, you’ll find a rich, meaningful retirement on the open road. Just remember: true freedom isn’t about escaping responsibility—it’s about mastering it on your own terms.

You May Also Like:

Jeff Bezos has advice for Millennials who say they can't get rich.

I want to retire early but I also want a Lamborghini. Can I have both?