Small Paperwork Errors Can Have Huge Consequences

Most inheritance disasters do not start with greed or bad intentions. They usually begin with outdated forms, missing documents, or assumptions that turn out to be wrong.

Many Assets Do Not Follow Your Will

A will does not control everything you own. Assets like retirement accounts, life insurance, and many brokerage accounts generally transfer based on beneficiary designations.

Beneficiary Forms Usually Override A Will

In most cases, beneficiary forms control who receives retirement accounts and insurance proceeds. This is subject to important exceptions, including spousal rights and plan-specific rules.

Outdated Beneficiaries Are One Of The Most Common Errors

Old beneficiary designations can send money to an ex-spouse or unintended recipient. These forms must be updated intentionally and reviewed regularly.

Leaving Beneficiaries Blank Creates Risk

When no beneficiary is named, assets may default to the estate or follow institutional rules. That can trigger probate delays, higher costs, and tax complications.

Skipping Backup Beneficiaries Can Cause Delays

If a primary beneficiary dies first and no contingent beneficiary is named, the account may pass to the estate. The exact outcome depends on the plan’s governing rules.

Naming A Minor Child Directly Can Trigger Court Involvement

Minors generally cannot control inherited assets outright. Without a trust or custodial arrangement, a court may need to appoint a guardian or custodian.

Joint Ownership Is Not A Universal Fix

Joint accounts can bypass probate, but they can also create unintended inequality among heirs. In some states and account types, they may expose assets to a co-owner’s creditors.

Brokerage Accounts Are Often Overlooked

Non-retirement investment accounts are frequently missed in estate planning. Planning ahead can simplify transfers and reduce administrative delays.

Probate Is Rarely Fast Or Cheap

Probate costs, timelines, and complexity vary widely by state and estate size. Marketing claims that probate is always quick or inexpensive are unreliable.

Creating A Trust Is Not Enough By Itself

A trust only controls assets that are properly titled in its name. Unfunded trusts often fail to avoid probate for major assets.

Real Estate Titles Must Match The Estate Plan

Homes and land frequently cause problems when titles are outdated. Some states allow transfer-on-death deeds, but they must be executed correctly.

Estates Can Be Asset-Rich And Cash-Poor

An estate may hold valuable property but lack liquid cash. This can create pressure to sell assets quickly to cover taxes, debts, and expenses.

The Wrong Executor Can Slow Everything Down

Executors and trustees need organization, time, and emotional neutrality. Choosing the wrong person can increase delays and family conflict.

Financial Powers Of Attorney Matter Before Death

Powers of attorney help manage finances during incapacity. Without them, families may need court intervention even before inheritance issues arise.

Inherited Retirement Accounts Have Strict Rules

Most inherited retirement accounts are subject to distribution rules. The requirements depend on the account type, beneficiary classification, and the original owner’s status.

The 10-Year Rule Is Real But Not Universal

Many non-spouse beneficiaries must empty inherited retirement accounts within 10 years. In some cases, annual distributions are also required, depending on IRS rules.

Poor Withdrawal Timing Can Increase Taxes

Taking large withdrawals in a single year can push heirs into higher tax brackets. Thoughtful timing may reduce total taxes, depending on individual circumstances.

Inherited Property Often Receives A New Cost Basis

In many cases, inherited property receives a basis adjustment tied to its fair market value at death. This rule has exceptions and should be confirmed before selling.

Medicaid Estate Recovery Can Surprise Families

For individuals age 55 or older, states must seek recovery for certain Medicaid-funded services. This can affect homes and other estate assets.

State Taxes Can Apply Even When Federal Taxes Do Not

Some states impose estate or inheritance taxes with much lower thresholds than federal law. Federal exemption levels do not provide universal protection.

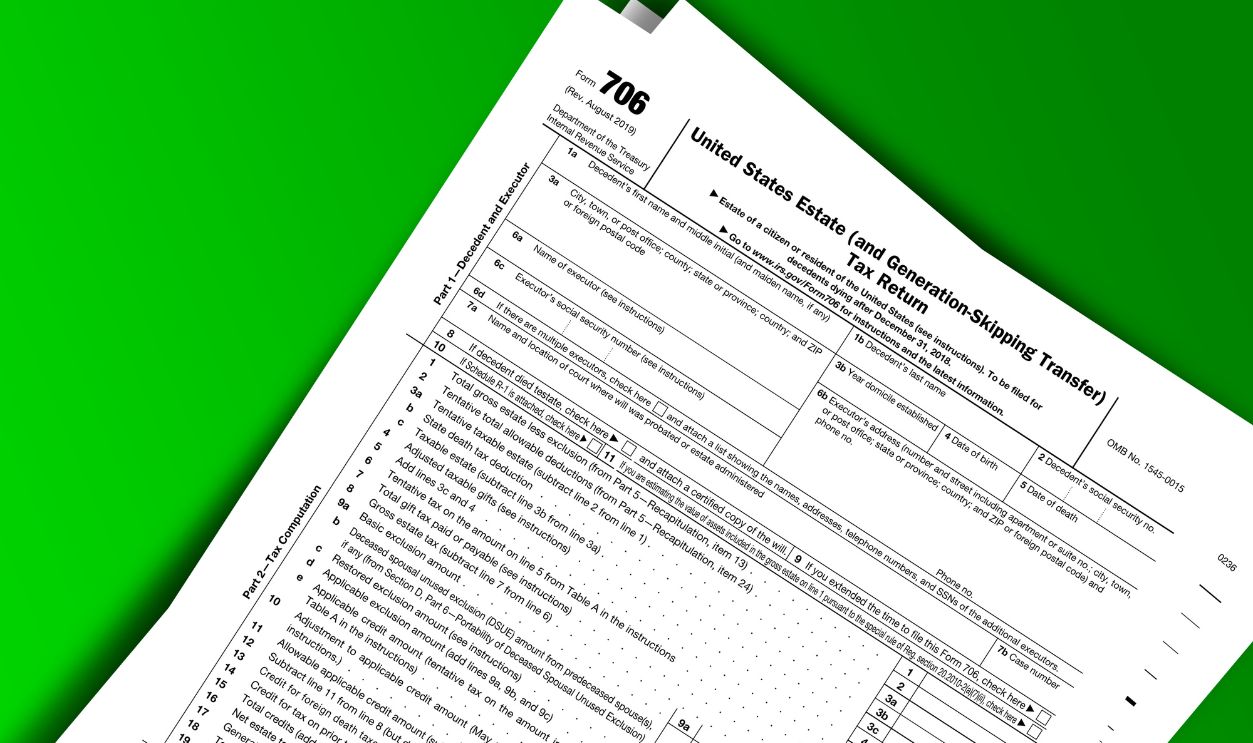

Portability Requires Timely IRS Filing

Married couples may preserve unused estate tax exclusion through portability. This generally requires filing a timely and complete IRS Form 706.

Buy this Image Now, Shutterstock

Buy this Image Now, Shutterstock

Missing Records Create Administrative Chaos

Executors need account statements, titles, and contact information. Missing records can add months of delay and unnecessary legal costs.

Digital Assets Are Easy To Lose Forever

Email accounts, photos, and crypto wallets may be inaccessible without proper authorization. Many states follow laws based on RUFADAA principles, but access still requires planning.

Survivor Benefits And Notifications Are Time-Sensitive

Families must report deaths and apply for survivor benefits promptly. Delays can result in missed payments or administrative problems.

Vodafone x Rankin everyone.connected, Pexels

Vodafone x Rankin everyone.connected, Pexels

Grieving Families Are Common Scam Targets

Scammers impersonate funeral homes and government agencies. The FTC warns families to verify all payment requests directly.

Verbal Promises Do Not Replace Written Plans

Courts rely on signed documents, not family expectations. If fairness is the goal, the plan must be written, clear, and current.

Estate Planning Is An Ongoing Process

Life changes make old plans unreliable. Annual reviews of beneficiaries, titles, and documents can prevent costly mistakes.