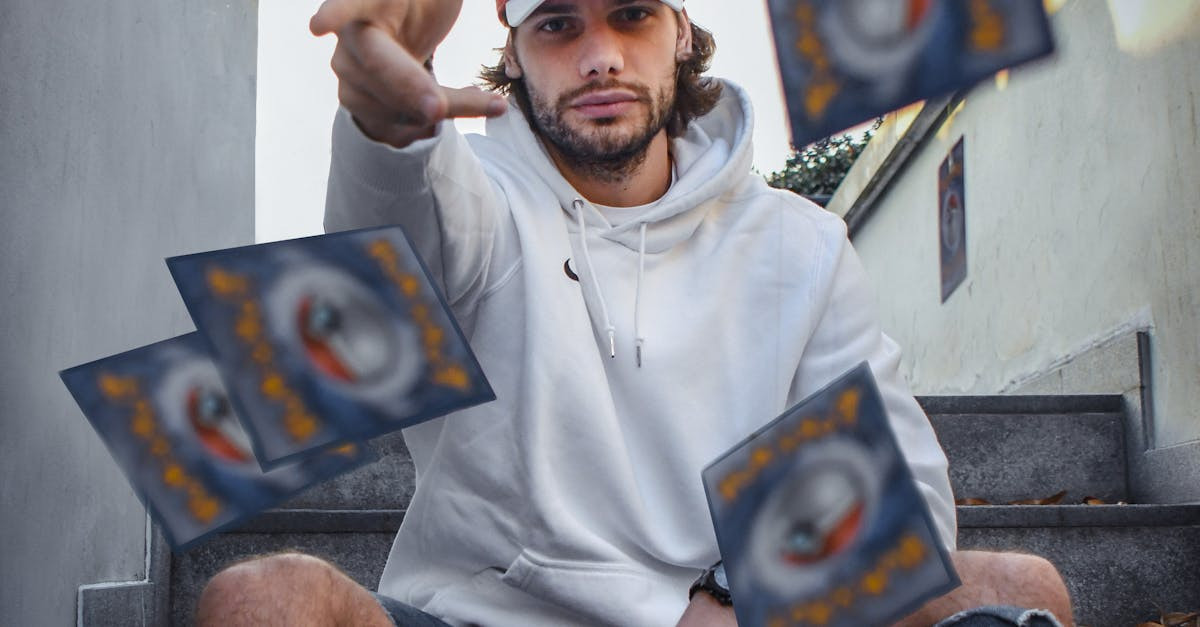

There’s bad timing, and then there’s what you’re dealing with. A reduction in your work hours means you’re already in financial survival mode—and then you discover your boyfriend, your supposed partner in stability, has blown next month’s rent on Pokémon cards. You’re angry, anxious, and rightfully asking: What now? The answer involves tough love, real talk, and maybe rethinking everything.

Start With A Reality Check

First, take a breath and assess your situation. You’ve lost income, your rent isn’t covered, and your trust in your boyfriend has taken a major hit. Before deciding what to do with the relationship, you need to get a clear picture of what you're facing financially. Add up your current resources, calculate the shortfall, and identify what bills must be covered immediately.

Talk To Your Landlord Immediately

Delaying this conversation won’t help. Contact your landlord to explain the situation as clearly as possible—your reduced work hours and unexpected inability to pay rent. Many landlords are willing to work out payment plans if they’re given advance notice. Offering even a partial payment could demonstrate good faith. The sooner you talk to them, the more options you'll have to avoid penalties or eviction.

Confront The Behavior, Not Just The Cards

Now comes the uncomfortable part—confronting your boyfriend. Focus less on the Pokémon cards themselves and more on the irresponsibility behind the decision. Spending rent money on collectibles isn’t quirky or harmless; it’s reckless and shows a complete disregard for your shared obligations. This isn’t about a hobby—it’s about trust, priorities, and whether he takes adult responsibilities seriously.

Demand Financial Transparency

You’re sharing expenses, so you deserve to know what’s happening with shared funds. If your boyfriend spent the rent money without consulting you, that’s a breach of financial trust. Insist on financial transparency going forward. If he resists or becomes defensive, it may signal a deeper incompatibility when it comes to money—a huge red flag in any long-term relationship.

Consider Setting A Deadline

If your boyfriend has any means of recovering or replacing the money—such as reselling the cards or borrowing from a family member—now’s the time to act. Set a clear deadline for when the rent must be paid. Be firm: if he’s not willing to fix the problem he caused, you’ll need to decide whether staying with him is even feasible. Love doesn't mean tolerating financial sabotage.

Look For Emergency Help

If the money isn’t coming back in time, look into emergency rental assistance. Many local charities, nonprofits, and government programs offer short-term help for people at risk of eviction due to reduced work hours or sudden expenses. You might also consider side gigs—freelancing, rideshare, or short-term contract work—to temporarily offset the gap, though that’s easier said than done when you’re emotionally drained.

Re-Evaluate The Relationship

What your boyfriend did is more than just a bad purchase—it’s a betrayal of shared trust and stability. Relationships can survive a lot, but they rarely thrive under repeated irresponsibility. Ask yourself: Is this someone you can build a future with? If this behavior is part of a pattern, it may be time to cut ties and focus on building your life without someone who drags it down.

Make A Plan For Yourself

Whatever happens with the relationship, take this as a wake-up call to prioritize your own financial independence. If your hours have been cut, start looking for other opportunities—whether that means picking up additional part-time work, applying for unemployment benefits, or looking for full-time employment elsewhere. The more financially independent you are, the less you’ll have to rely on anyone else’s decisions.

Set Clear Boundaries Going Forward

Whether you choose to stay with your boyfriend or not, make sure this never happens again. If you continue the relationship, require that all shared finances be jointly managed or completely separated. If you move on, be wary of entering any new situation where money isn’t treated with mutual respect and seriousness. This was a painful but powerful lesson.

Take Control Of What Comes Next

Yes, your current situation is a mess. But it’s not beyond saving, and it’s certainly not the end of your story. Use this crisis as a chance to reclaim control over your finances and your future. You deserve a partner who respects your struggles, supports your goals, and knows the difference between a rare Charizard and next month’s rent.

You May Also Like:

Every Generation's Worst Money Habits & How To Break Them

How To Rebuild A Depleted Emergency Fund

Shortsighted People Reveal Their Most Regretful Purchase