Financial Freedom Starts With Suze Orman’s Essential Money Rules

Money often feels like an overwhelming subject. But Suze Orman, a trusted voice in personal finance for decades, has built a career demystifying its challenges and empowering people to take control of their financial lives.

Use Tax-Advantaged Retirement Accounts

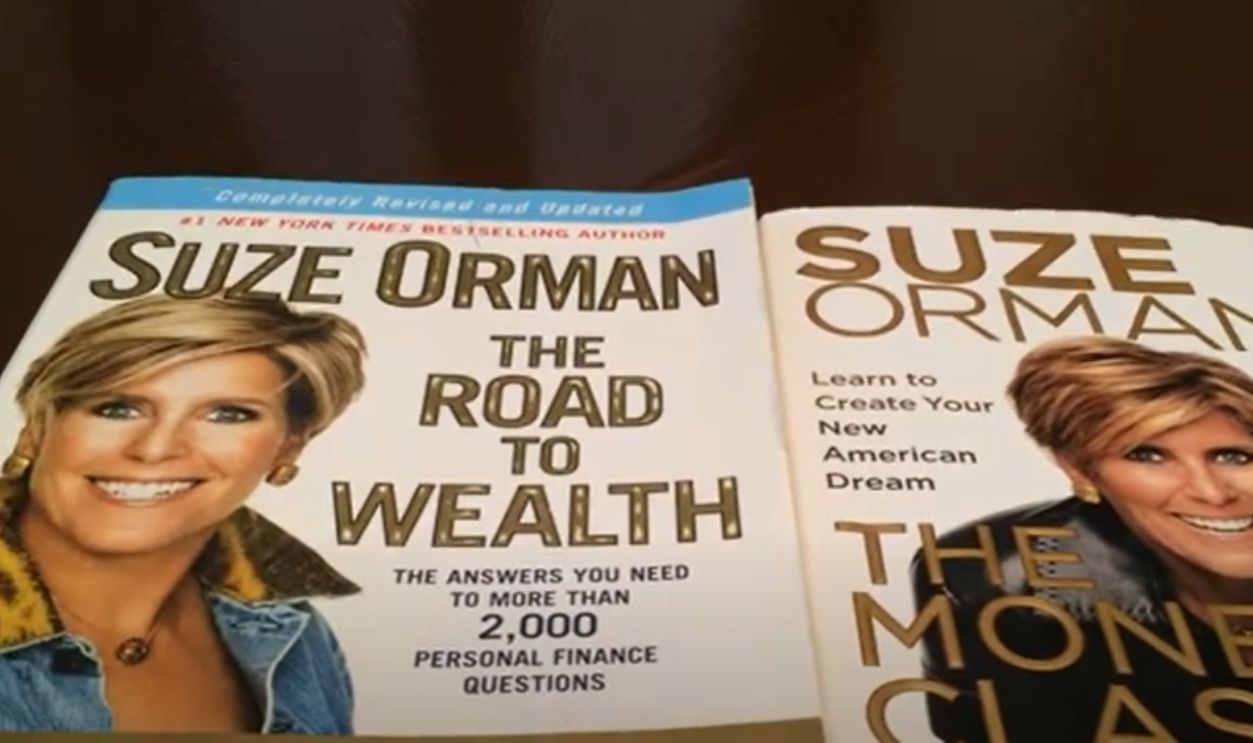

In The Road to Wealth, Suze Orman explains the power of tax-advantaged retirement accounts like 401(k)s, Roth IRAs, and traditional IRAs. These accounts offer significant tax benefits that help your savings grow faster over time and allow you to build a substantial retirement fund.

The Road to Wealth, by Suze Orman - Book Review by Li Lu

The Road to Wealth, by Suze Orman - Book Review by Li Lu

Use Tax-Advantaged Retirement Accounts (Cont.)

Work on your employer-sponsored 401(k), especially if there’s a company match—this is essentially free money. If you don’t have access to a 401(k), open an IRA. Maximize your contributions each year, and consider Roth accounts for tax-free withdrawals in retirement.

Focus On Building A Strong Credit Score

Suze Orman highlights the importance of a solid credit score, especially for young adults. A good credit score secures favorable interest rates and lower costs over the long term. The foundation of a strong credit score is consistently paying bills on time.

Focus On Building A Strong Credit Score (Cont.)

Schedule automatic payments to avoid delays. It can save you thousands in interest and fines. You should at least pay the minimum due on credit, strive to pay balances in full when possible, and monitor your credit report regularly.

Avoid Risky Investments As You Near Retirement

You’ve Earned It, Don’t Lose It was published in 1995 to help people work on their retirement plans. In her book, Orman advises people to shift their investment strategy from high-risk ventures like stocks or speculative assets to more stable options such as bonds and blue-chip dividend-paying stocks.

Avoid Risky Investments As You Near Retirement (Cont.)

The author explains that people in their 50s and 60s should review their investment portfolios with a financial advisor to ensure they are appropriately diversified and weighted toward less volatile options. This provides a financial safety net and creates a predictable income stream for living expenses.

Build An Emergency Fund

How much should you save? Many people ask this question. Orman is a strong advocate for emergency funds and she recommends having at least 6-12 months’ worth of living expenses saved to protect yourself from unexpected events like medical emergencies.

Vitalii Vodolazskyi, Shutterstock

Vitalii Vodolazskyi, Shutterstock

Build An Emergency Fund (Cont.)

Calculate your monthly expenses, including housing, utilities, food, and insurance, and set a savings goal. Start by automating a portion of your paycheck into a high-yield savings account. Treat this fund as untouchable unless a true emergency arises. This tip eliminates the need to rely on credit cards or loans.

Photo By: Kaboompics.com, pexels

Photo By: Kaboompics.com, pexels

Financial Education Should Be A Top Priority

After publishing Women & Money: Owning the Power to Control Your Destiny in 2007, she revised and updated her book to include more relevant tips. One of them was stressing that financial knowledge is the key to success in managing finances and making informed decisions.

Andrii Yalanskyi, Shutterstock

Andrii Yalanskyi, Shutterstock

Financial Education Should Be A Top Priority (Cont.)

Remaining uninformed may lead to poor decisions, such as accumulating unnecessary debt or missing out on investment opportunities. Orman emphasizes the importance of financial education, particularly for women, as a cornerstone of independence and empowerment. Understanding investing, saving, debt management, and more—allows individuals to take control of their financial destiny.

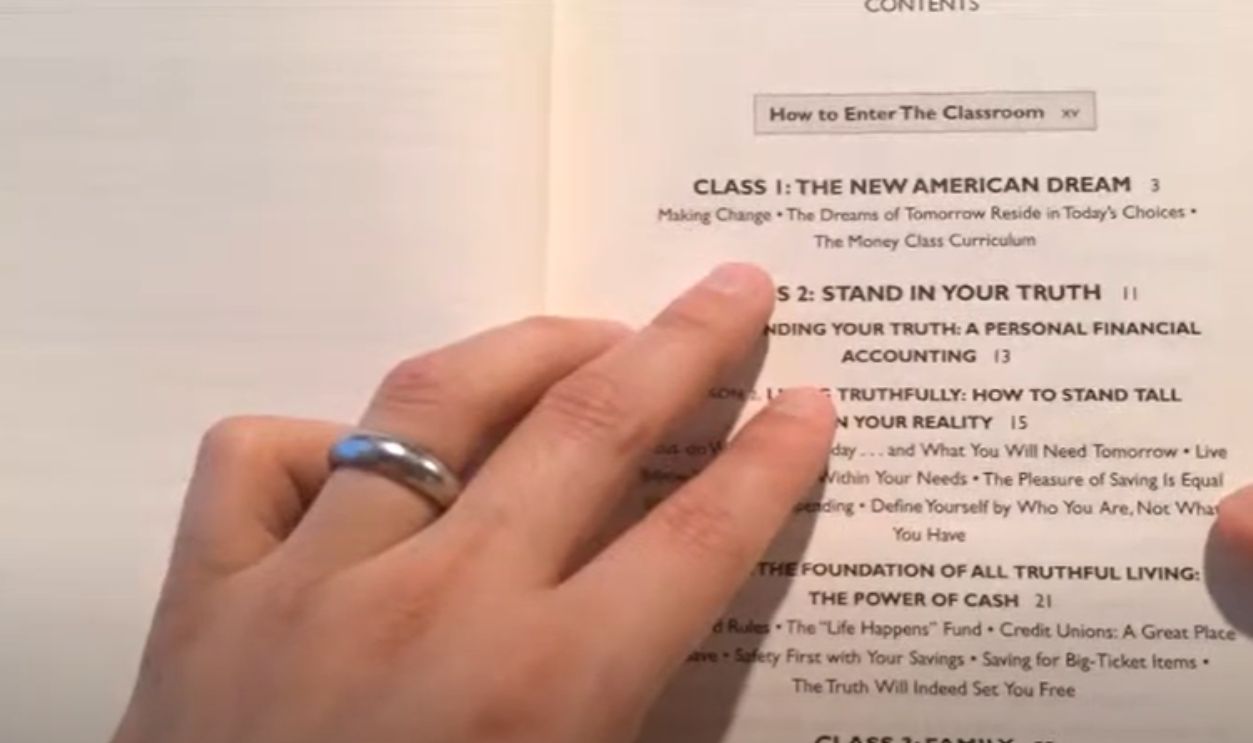

Start Planning As Early As Possible

Many people start planning for retirement when they’re already approaching it. In The Money Class, the author explains that delaying retirement savings means you’ll need to save more aggressively later, which may not be feasible. Eventually, it could lead to limited financial security during retirement years.

"The Money Class American Dream" Book by Suze Orman by HSNtv

"The Money Class American Dream" Book by Suze Orman by HSNtv

Start Planning As Early As Possible (Cont.)

Orman stresses that saving in your 20s or 30s gives your wealth time to grow through compound interest and reduces the burden of saving large amounts later in life. She urges her readers to enroll in a retirement savings plan as soon as they start earning income.

Set The Difference Between “Good Debt” And “Bad Debt”

Suze Orman distinguishes between “good debt,” which has the potential to increase your net worth like student loans, and “bad debt,” which doesn’t provide long-term benefits. Before taking on debt, ask yourself whether it will improve your position in the long term.

Set The Difference Between “Good Debt” And “Bad Debt” (Cont.)

For example, a mortgage allows you to build equity in a home, while credit card debt is typically tied to consumer spending with no lasting value. Recognizing this distinction is essential to making informed borrowing decisions. Prioritize paying off bad debt as quickly as possible, while managing good debt responsibly.

Always Tell Yourself The Truth About Your Money Situation

In The Laws of Money, the Lessons of Life, Suze Orman’s first law emphasizes the importance of complete honesty with yourself about your finances. Many people can be in denial about their income, expenses, savings, debts, and assets, which leads to bad financial decisions.

Always Tell Yourself The Truth About Your Money Situation (Cont.)

Only by confronting the truth can you begin to make meaningful changes. Start by assessing your financial health. Use tools like budgeting apps or spreadsheets to gain a clear view of your cash flow. It’s important to be honest about bad habits, like overspending, and address them head-on.

Long-Term Care Insurance Is A Must-Have

Suze Orman emphasizes the importance of long-term care insurance (LTCI) to cover costs associated with nursing homes, medical expenses, assisted living facilities, or in-home care. This advice aligns with the author’s goal of helping retirees anticipate and prepare for potential financial drains.

Long-Term Care Insurance Is A Must-Have (Cont.)

Look into purchasing LTCI in your 50s or early 60s when premiums are affordable, and it's less likely your coverage will be denied due to health issues. Shop around for a policy that provides comprehensive coverage and consider hybrid options that combine LTCI with life insurance.

Always Reevaluate Your Financial Strategy Every Five Years

This tip encapsulates From You’ve Earned It, Don’t Lose It: Mistakes You Can’t Afford to Make When You Retire’s proactive and adaptive approach to personal finance. By regularly revisiting and refining your financial strategy, you ensure that your retirement remains secure and your wealth is preserved.

Always Reevaluate Your Financial Strategy Every Five Years (Cont.)

Financial plans should never be static. Orman advises individuals to reassess their financial strategies every five years by considering changes in their personal circumstances and the economy. This keeps your financial plan aligned with your current and future goals and decreases missed opportunities for growth or tax savings.

Recognize The Emotional Impact Of Money

In The 9 Steps to Financial Freedom, Orman highlights the emotional relationship people have with money. She explains that fear, guilt, anxiety, and even happiness often dictate financial decisions and can lead to poor outcomes. It’s important to identify the emotions that arise when you think about money.

Recognize The Emotional Impact Of Money (Cont.)

By following this advice, you can reduce stress and make smarter, more rational financial decisions. At the same time, it’s a great tip to avoid overspending or unnecessary financial risks while living without financial worry, which can take its toll on your mental and emotional wellbeing.

Look At What You Have, Not What You Don’t Have

Rather than fixating on what you lack, Suze Orman advises recognizing the resources and opportunities you already possess. Evaluate your current financial strengths, such as income, skills, or assets, and build on them. Avoid lifestyle inflation or unnecessary comparisons to others.

Look At What You Have, Not What You Don’t Have (Cont.)

This tip promotes a positive mindset and helps you prioritize realistic goals instead of chasing unattainable desires. Overspending to “keep up with the Joneses” can create unnecessary debt, as people should live authentically and make sound financial choices rooted in self-awareness.

Create A Will To Ensure Your Financial Legacy Is Honored

Have you ever wondered how your loved ones will manage their finances? Creating a will is one of the most important steps toward financial freedom. It guarantees your wealth is distributed according to your desires and protects your loved ones from legal complications.

Create A Will To Ensure Your Financial Legacy Is Honored (Cont.)

Work with an attorney or use reputable online tools to draft a will. Make sure it includes details about asset distribution, guardianship for children, and an executor to carry out your wishes. This prevents family disputes over inheritance and gives you peace of mind.

Align Your Financial Goals With Your Personal Values

This principle, emphasized in The Courage to Be Rich, highlights the importance of ensuring your financial decisions align with your core values. Suze Orman believes that true financial freedom comes when your money serves what matters most to you, whether that’s family or personal growth.

Align Your Financial Goals With Your Personal Values (Cont.)

Start by identifying your personal values. Do you want to support your family? Travel? Or retire early? This can help you evaluate whether your financial goals reflect those values. Align your saving and spending habits with these priorities to maintain a sense of purpose and direction.

Marcos Mesa Sam Wordley, Shutterstock

Marcos Mesa Sam Wordley, Shutterstock

Stop Living Paycheck To Paycheck

List all your money sources and fixed expenses. Then, set funds for variable expenses like groceries and entertainment while keeping a portion for savings and debt repayment. Budgeting tools can help you track your progress and adjust as needed.

Stop Living Paycheck To Paycheck (Cont.)

In The 9 Steps to Financial Freedom, Suze Orman stresses the importance of breaking the cycle of living paycheck to paycheck by creating and sticking to a monthly budget. It allows you to take control of your money and avoid unnecessary spending.

Saving Should Be A Habit, Not An Option

You may struggle to handle emergencies unless saving becomes a habit, not an option. Additionally, living without savings leaves no room for growth or opportunity. Suze Orman believes that saving regularly isn’t just about accumulating wealth—it’s about creating freedom and security.

Saving Should Be A Habit, Not An Option (Cont.)

Automate your savings to ensure a fixed amount goes directly into a savings account or retirement fund before you even see it. Start small if necessary—saving just 5-10% of your income—and gradually increase the amount as your financial situation improves.

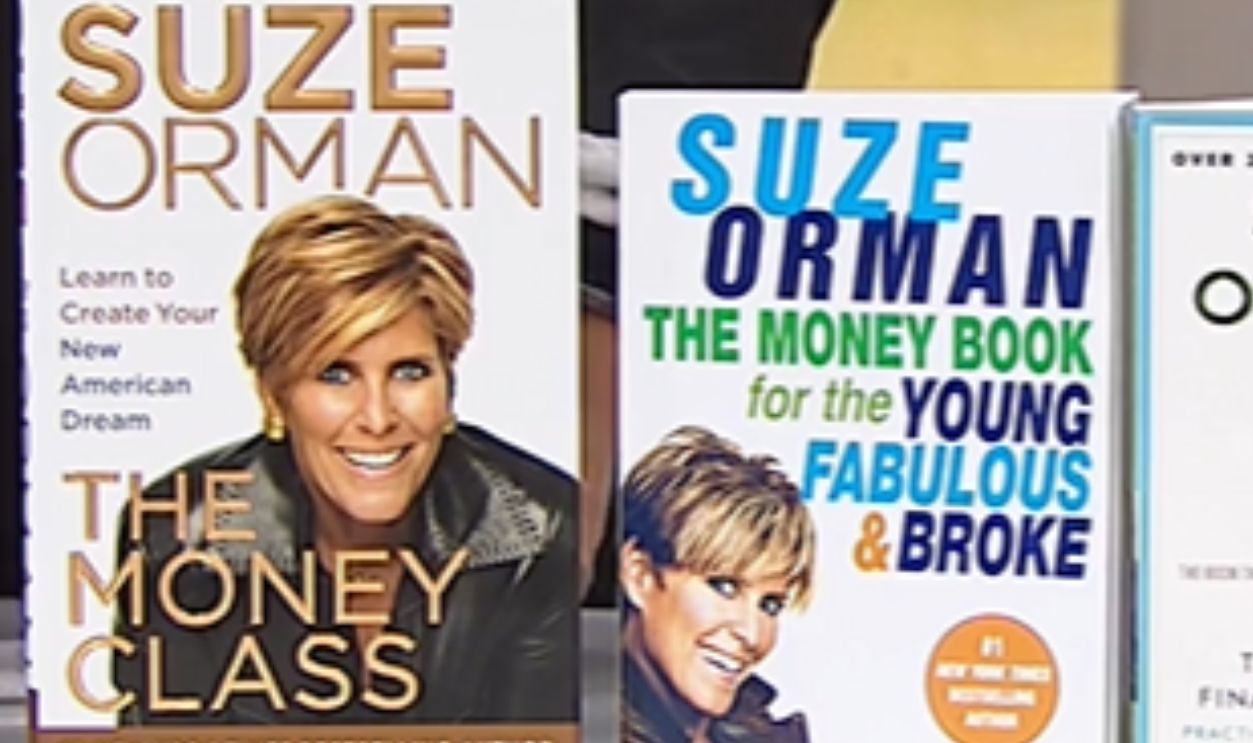

Focus On Financial Independence

In The Money Class, Orman advises against the pressure to conform to societal norms, such as buying expensive cars or gadgets just to fit in. Instead, she urges readers to prioritize financial independence—having enough money to live comfortably on your own terms.

The Money Class, by Suze Orman - Great Book Review by Li Lu

The Money Class, by Suze Orman - Great Book Review by Li Lu

Focus On Financial Independence (Cont.)

Set financial goals based on your unique values and aspirations rather than societal expectations. Then, track your progress and celebrate milestones. You should avoid obsessing over the material possessions of others as it protects you from debts and helps you achieve control over your life.

Don’t Underestimate The Value of Small, Consistent Investments

Do you think that small investments don’t matter? Orman talks about the power of compounding and explains how small, consistent investments can grow significantly over time. Even modest contributions, when made regularly, can lead to substantial financial growth thanks to compound interest.

Don’t Underestimate The Value of Small, Consistent Investments (Cont.)

The author discusses this tip in The Courage to Be Rich and encourages people to invest small amounts in a 401(k), IRA, or index fund, even if it’s just $50 or $100 a month. People should focus on long-term goals and resist the urge to pull out funds prematurely.

Vitalii Vodolazskyi, Shutterstock

Vitalii Vodolazskyi, Shutterstock

Save First, Spend Later

This principle flips the traditional mindset of spending and saving whatever is left over. It urges readers to pay themselves first and treat saving as a non-negotiable priority. Set up direct deposits into a savings or retirement account as soon as you’re paid.

Save First, Spend Later (Cont.)

Create a realistic budget that prioritizes savings over discretionary spending. For example, aim to save 20% of your income and adjust your lifestyle to live within the remaining 80%. This builds a strong financial safety net for emergencies and reduces the temptation to overspend since savings come first.

Having Enough, Not Necessarily Being Rich

Throughout the years, the author dealt with people who had misconceptions about financial freedom. She discusses one of them in The Money Class by redefining financial freedom as having “enough” to meet your needs and live comfortably, rather than amassing excessive wealth.

Having Enough, Not Necessarily Being Rich (Cont.)

There’s nothing wrong about wanting to be wealthy. However, Orman’s perspective shifts the focus from materialism to stability and security. You should assess your financial situation and define what “enough” means to you. It encourages mindful spending and saving habits.

PeopleImages.com - Yuri A, Shutterstock

PeopleImages.com - Yuri A, Shutterstock

Focus On Paying Down High-Interest Debt Before Investing

What if you already have a high-interest debt? In The Road to Wealth, Suze Orman highlights the critical importance of eliminating high-interest debt—like credit cards—before channeling your money into investments. High-interest debt can overshadow the returns you might earn from investing.

Focus On Paying Down High-Interest Debt Before Investing (Cont.)

The best way to do this is to identify all your debts and focus on those with the highest interest rates. Use strategies like the debt avalanche method or paying off high-interest debt first. You also can give the snowball method a try, where you pay off the smallest debts.

Don’t Rely On A Partner For Financial Security

Orman stresses the importance of financial independence, particularly for women who may have historically relied on a partner for security. Taking charge of your finances ensures autonomy and stability, regardless of your relationship status. As a result, she encourages women to open their own investment and savings accounts.

Don’t Rely On A Partner For Financial Security (Cont.)

Dependency on a partner can leave you vulnerable in the event of separation or loss. This advice aligns with the theme of empowerment in Women & Money. For financial independence, she encourages women to have a personal emergency fund with at least 6–12 months’ worth of living expenses.

Suze Orman's Women & Money Book Review + Free Access to Her Course! by Focused Spender ®

Suze Orman's Women & Money Book Review + Free Access to Her Course! by Focused Spender ®