What To Do If You're Being "Invited" To Retire, But Don't Want To

Sometimes, whether due to "restructuring" or just pure bad luck, your boss may "invite" you to retire from work early. Maybe they'll offer you a severance package, but if you're just about to become of retirement age (65 or older), this can be a real financial kick in the teeth. What if you're good at your job and don't want to retire early? Do you have options? Let's explore the benefits (and downsides) of early retirement and what to do if you receive this "invitation" from management.

The Conversation Usually Goes Something Like This

"Bob, we value your contribution to the company over the past 20 years and know that you're getting older and want to spend more time with the grandkids. So, we'd like to offer you the opportunity to retire early from your position". You feel blindsided. There was no hint of this outcome at any time prior, you love your job, and the stats show that you're good at it—so why are you being let go?

LinkedIn Sales Navigator, Pexels

LinkedIn Sales Navigator, Pexels

Why Do Some Companies Try To Force Their Older Employees To Retire Early?

Let's be clear: a company has no legal right to force you to officially retire, but they can lay you off or offer you a severance package to "quit" your job. This occurs when companies are trying to restructure, or bring in new and cheaper-wage employees rather than paying the more senior (and higher-waged) staff for the next five years until they can legally retire. So, companies try to force your hand. Here's what to do if this happens to you.

Consult An Employment Attorney

One of the first things you should do is consult an employment attorney before you blindly accept their offer of severance. It's possible that their contractual obligations to you necessitate a larger settlement than they initially offer you. Bring your employment contract and their severance letter to your consultation. If they're on solid legal ground, then it's time to consider their offer.

Ask If They'll Provide A Good Reference Letter

While you're considering their severance offer, ask your employer if they would provide you with a good letter of reference for any future employer. Even if you're getting up there in years and are considering taking their "retirement" package, a good reference letter may be essential for future employment. If they'll write you one, that's great.

What's In A Good Severance Package?

If you've been told by a lawyer that the severance offer you're presented with is legal, then check to make sure it's as good as you're going to get. You can negotiate your severance. The standard practice is that you receive two weeks' pay for every year you've worked for the company. If your severance is less than this, reject it outright. Although your company may offer an extension of things like health benefits in lieu of more severance money.

Do You Want To Retire Early?

Sure, you didn't see yourself retiring early, but now that reality is hitting you, it's time to ask the question of whether or not you want to retire early. There are upsides and downsides to early retirement, but the main question you should ask yourself is: Do I want to retire early?

What Can I Do Instead Of Retiring Early?

If it's becoming apparent that your old (?) job is immovable about your "retirement" from the company, then it's time to accept that and move on. What could you do instead of retiring early? Even if you can afford to retire before you're 66, what are your options instead of taking Social Security?

Find A New Job

Depending on your age, skillset, and position in your old company, you may be able to waltz into a new job at a different company without a problem. Sure, finding a new job isn't always that easy—so here are some tips on how to navigate the world of job searching as an older person.

Stay Within Your Industry

The easiest thing to do is to find positions within the industry you already operate in. You'd likely have to do minimal re-training and could even be head-hunted by companies who are looking for older, more experienced candidates. This is particularly true if you work in a specialized field.

Branch Out Into Other Work

If you choose to see your "early retirement" as a blessing in disguise, then maybe the severance package is exactly the financial boost you need to re-train in an industry you're passionate about. There's no time like the present to start living a life that you truly enjoy. As the saying goes, "If you find a job you love, you'll never work a day in your life".

Go Part-Time

If you really don't want to leave your current job, ask if there is an option for you to work part-time. If your work is "downsizing", this may fit well in their new restructuring plans. If not, then wave adios to them and try to find a part-time position elsewhere.

Upgrade Your Education

Your severance package that work provides could be a great opportunity for you to go back to school. Even if you're in your latter years, going back to school for a one-year diploma may allow you to keep working until you're able to retire, either with the same, or an even higher pay packet than you had before.

See If Your Old Job Offers Career Transition Services

It's possible that, if you worked at your old job for decades and achieved a senior position, they may offer "career transition services," aimed at helping people who are forced out of companies due to "restructuring" find new career paths, job placements, and general help navigating a post-employment world.

How To Negotiate For A Better Severance

If you think that what you're being paid is too low for your performance over the last 20+ years, then you can absolutely ask that your severance be reviewed. Start by knowing how much you're worth to the company—do this by calculating how much money your employer thinks you're worth every year. This figure becomes your bargaining chip.

Understanding Your Value

Are you a major project leader within your firm? Do people come to you and nobody else? Do you have a relationship with major clients that you've built up over the years? Things like these in the workplace add enormous value to you as an employee. If you do things that nobody else could, or have relationships with others that nobody else does, your company would have to work hard to replace you. This is your value.

Come Up With A Figure & Stand Firm

Even though you may have been "asked" to retire early, your company still has to spend a lot of time and money to replace you, especially if you're a high performer with multiple clients and relationships that last decades. This time and productivity cost is huge and part of your value as an employee. Work out your dollar value and stand firm on it. Your company may push back, but, in general, they'll probably pay you out what you've asked for, particularly if they're "downsizing" as they've claimed.

Ask Yourself If You Want To Retire

Retirement is a choice up until you reach the age of 66. After which, you're required to make withdrawals from Social Security. These are known as Required Minimum Distributions, or RMDs. Before that date, you can choose to officially retire (or not). Ask yourself if you want to retire early and if you can afford to do it on the retirement income you'll receive. If you do, that's wonderful—happy retirement! If not, then you have to look at other options.

Your First Stop: The Bank

If you've accepted your work's offer of an "early retirement" and a generous (acceptable) severance package, then your first stop should be to the bank. But, not to deposit that cheque—no, set up an appointment to speak with a financial advisor. If you already have one, speak to them. If not, then set up your first appointment.

Take Time To Gather Your Documents

Before your "post-retirement" meeting with a financial advisor, take time to gather your documents. You'll need pay stubs, bank statements, legal documents, your letter of termination and your severance agreement. This will help the advisor to paint a financial picture of your life before you lost your job and your possible income afterwards.

Create A Plan Of Action

Your financial advisor should be able to help you craft a plan of action for your life after you've left your job of 20 years with a generous severance. Even if you have to go back to work, making a plan for what the next 6-12 months will look like will save you a lot of stress and uncertainty.

How To Prepare Yourself For The Financial Hit

Losing a job would rock anyone's world. Suddenly, the paycheck you relied on is no longer there, and you'll have to make ends meet without it. Here's how to prepare yourself and your family for the financial hit of losing that steady paycheck (even temporarily).

Make A Plan For Your Severance

You need to make a plan for how your severance will be spent, particularly if you're a one-income household. If not, then incorporate your partner/spouse's income into this plan. The goal is to make your severance last as long as possible, while using it to get things done that you need or want to do.

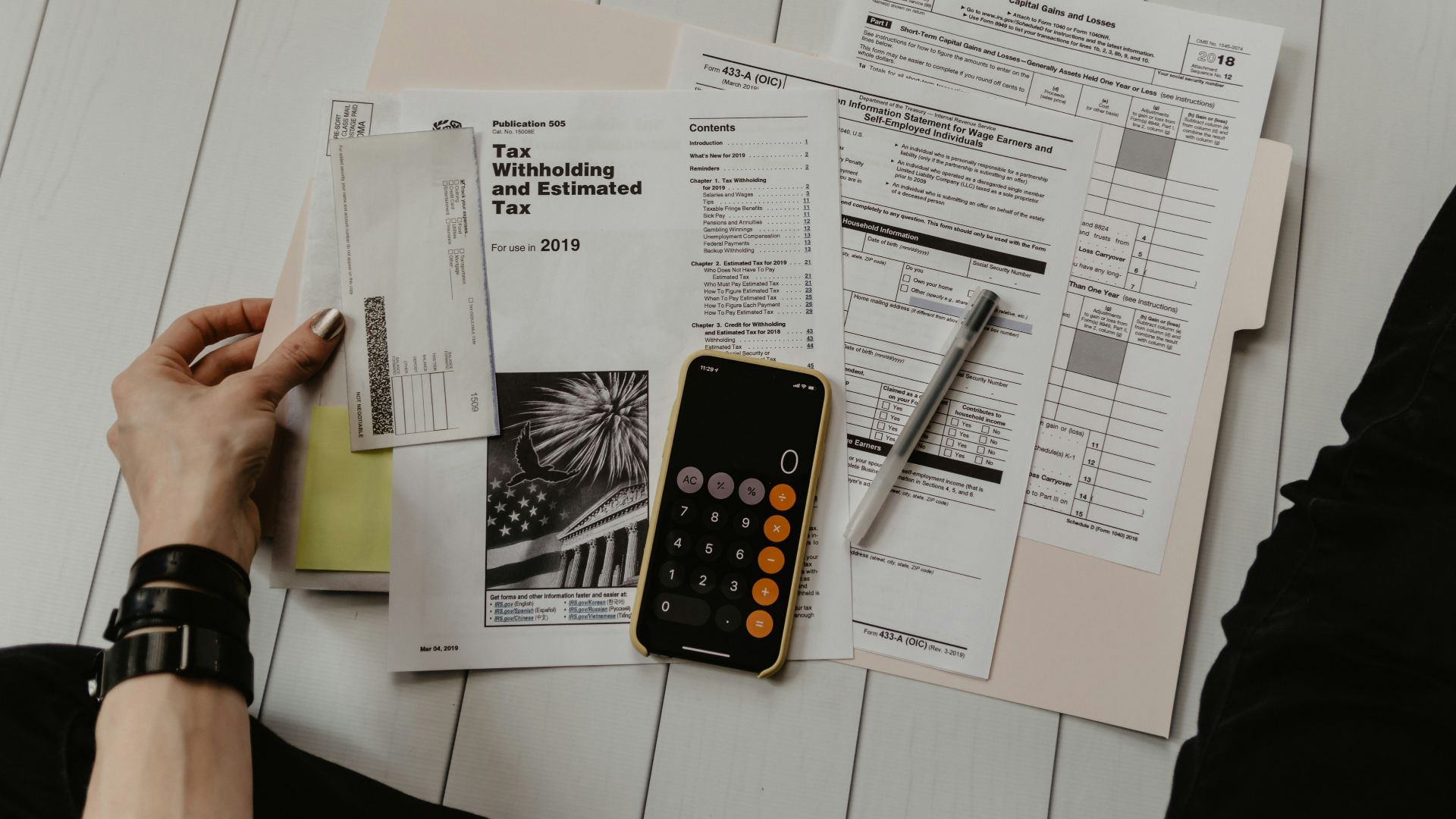

Work Out If You Can Afford To Retire Earlier Than 66

Most financial experts will tell you that you need approximately 70-80% of your annual income (after taxes) to be able to retire comfortably. Come up with a retirement budget that incorporates this figure into your annual income.

Centre for Ageing Better, Pexels

Centre for Ageing Better, Pexels

How To Build A Retirement Budget

Building a retirement budget is the same as building a budget outside of retirement, just decrease your overall income by about 25%. List all of your possible income streams, including Social Security and investments that pay dividends (or, work out how much you'd receive if you sold your investments), and build a zero-based budget.

Why Is A Zero-Based Budget Effective In Retirement Planning?

A zero-based budget, as opposed to a traditional budget, prioritizes intentionality in your spending. With a zero-based budget, your income minus your expenses must equal zero. Rather than having extra money sitting around in your account doing nothing for you every month, a zero-based budget forces you to give every dollar a purpose.

On A Limited Income, Intentionality Is Key

Because you'll be on a limited income in your retirement, being intentional with how you spend every dollar is key. Make sure you've got your basics covered with your retirement pay, then set aside extras to pay for things like an annual vacation (you may have to switch it, going away every other year instead) or repairs to your home.

Photo By: Kaboompics.com, Pexels

Photo By: Kaboompics.com, Pexels

Ensure You Have An Emergency Fund

Whether you're using your severance to sustain yourself or go straight back to work, it's imperative that you create an emergency fund. First, save up $1,000 for a starter emergency fund. Put this money in a traditional savings account, where it's easily accessible.

Photo By: Kaboompics.com, Pexels

Photo By: Kaboompics.com, Pexels

Use Your Severance If Necessary, Emergency Funds Are Non-Negotiable

A fully-funded emergency fund should be three to six months' worth of expenses. If you don't have a fully-funded emergency fund, it's imperative that you create one as soon as possible. If you can, use your severance to set up a fund that sits in a redeemable account like a redeemable Certificate of Deposit account (so that it's at least earning you some interest), then you can sit back and enjoy the rest of your severance money knowing that you're covered for almost any major emergency in life.

Pay Off Your Debts

If you still have debts when you enter retirement, it's imperative that you pay these off as soon as possible. Paying off debts will alleviate significant portions of your retirement that will go towards retirement fun, or paying off your mortgage faster (assuming you still have a mortgage).

Figure Out If You Need The Home You Live In

Selling your home is definitely a drastic option when it comes to generating retirement income, but most people's kids and grandkids have long flown the nest when they retire. If you're finding it difficult to keep up with home maintenance, either financially, physically, or both, then it might be time to consider downsizing to a smaller home.

If You're Not Selling, Pay Off Your Mortgage ASAP

If you and your spouse are completely opposed to selling your home and using that capital to fund the rest of your retirement, then you need to free up the most equity you've invested in the home ASAP. This means paying off your mortgage quicker than the normal timeframe. If you've snowballed down all your other debts but are spending that saved money elsewhere, funnel it into your mortgage instead.

Set Aside A Portion Of Your Severance To Do Something Big

Even if you're not planning on retiring just yet, your severance may have afforded you the financial capital to do something big with your life before you retire. Prioritize experiences, not things. If you've always wanted to take a big trip with the family, or a once-in-a-lifetime journey with your spouse across America in a VW van, now is the time to do it. Use part of your severance (if you can afford it) to do something you'll remember forever.

Tap Into Your 401(k) Or IRA Funds First

Just because you received a severance from your job, doesn't mean you have to use it right away. Put it into an accessible interest-earning account like a Certificate of Deposit, then tap into your company 401(k) or other Individual Retirement Accounts before you touch your severance. You must be 59 1/2 years old or older to tap into a company 401(k) or IRA.

Company 401(k)s May Provide The Cushion You Need While Searching For New Employment

If your company has provided a generous 401(k) plan throughout your employment and you're over the age of 55, you can begin withdrawing from this income stream without tax penalties. This will put you in a lower tax bracket, and you can even withdraw from them if you are "separated from service".

Photo By: Kaboompics.com, Pexels

Photo By: Kaboompics.com, Pexels

Convert Your Traditional IRA Into A Roth IRA

If you have a traditional IRA but haven't set up a Roth IRA yet, you've been missing out on the benefits! Roth IRAs offer tax-free withdrawals and growth within the account because they're funded by after-tax income. As you are now in a lower tax bracket, you may be exempt from the income limit restriction of contributing to a Roth: $146,000/year.

The Five-Year Wait Period Between Conversion & Access

Unfortunately, if you've only just opened a Roth IRA and have successfully converted your Traditional IRA into a Roth, you'll have to wait five years before you can extract income from your Roth IRA, tax-free. Otherwise, you'll incur hefty tax penalties from the IRS. Please make sure you have other income streams for this period.

Avoid Taking Social Security Benefits Early

Many people may consider taking their Social Security benefits as early as possible. This age is 62 years old, but that would be a huge, costly mistake. By taking your Social Security benefits early, you're actually losing income you would otherwise gain and reducing your benefit amount by as much as 25%.

Happy Retirement? If Not, Happy New Work/Better Life Balance!

If you've done the math and have decided to take your severance and ride it off into early retirement, congratulations and happy retirement! Even if you've decided to keep working, we hope that this new job provides you with a better work/life balance into your twilight years and that you use your severance to have a blast when you officially retire.

You May Also Like:

The Worst Assets To Leave Your Loved Ones & Why

Smart Ways To Cut Subscriptions You Forgot You Had

Credit Score Secrets: What Lenders Really Look At & How To Improve Yours