Wrapping Your Head Around The Problem

You paid off your loan more than a year ago, but your credit report still shows it as open. To make matters worse, your credit score has dropped. It’s a frustrating situation, especially when you’ve worked hard to pay down debt. Let’s get to the bottom of why this happens and what you can do about it.

Why Closed Accounts Still Show As Open

Credit bureaus rely on lenders to report account status updates. If your lender failed to update the loan as “paid and closed,” the account will more than likely still appear as open. This isn’t uncommon and can cause unnecessary confusion regarding your financial status when others are reviewing your report.

Photo By: Kaboompics.com, Pexels

Photo By: Kaboompics.com, Pexels

How Reporting Errors Impact Your Credit

A loan still showing as open doesn’t always hurt your score, but it can. Inaccurate reporting can change how your credit utilization shows up or create uncertainty for potential lenders. Inaccuracies interfere with your efforts to rebuild credit; this is why it’s essential to correct the error quickly.

Payment History Is King

Your payment history makes up the biggest share of your credit score. If a loan is still incorrectly showing as open, it may continue to display payment history inaccurately. Even without missed payments, this misreporting creates uncertainty that can damage your overall credit profile.

The Impact Of Credit Mix

Credit scoring models factor in the diversity of all your different accounts. Having both installment loans and revolving credit improves your score. Paying off your only loan can reduce your credit mix. This may lower your score temporarily, even if the account is reported correctly.

Closed Accounts Help Over Time

When reported accurately, closed accounts remain on your report for up to 10 years, and these are a positive for your history. They reflect successful repayment and strengthen your credit. The problem would lie in incorrect reporting, which makes it look like your responsibilities are on the active side of the ledger.

Review Your Credit Reports

Start by checking your credit reports from Equifax, Experian, and TransUnion. If you use AnnualCreditReport.com you can access them for free. Look closely at how the loan is listed: does it show as open, closed, or paid in full? Pinpointing the error is the first step to fixing it.

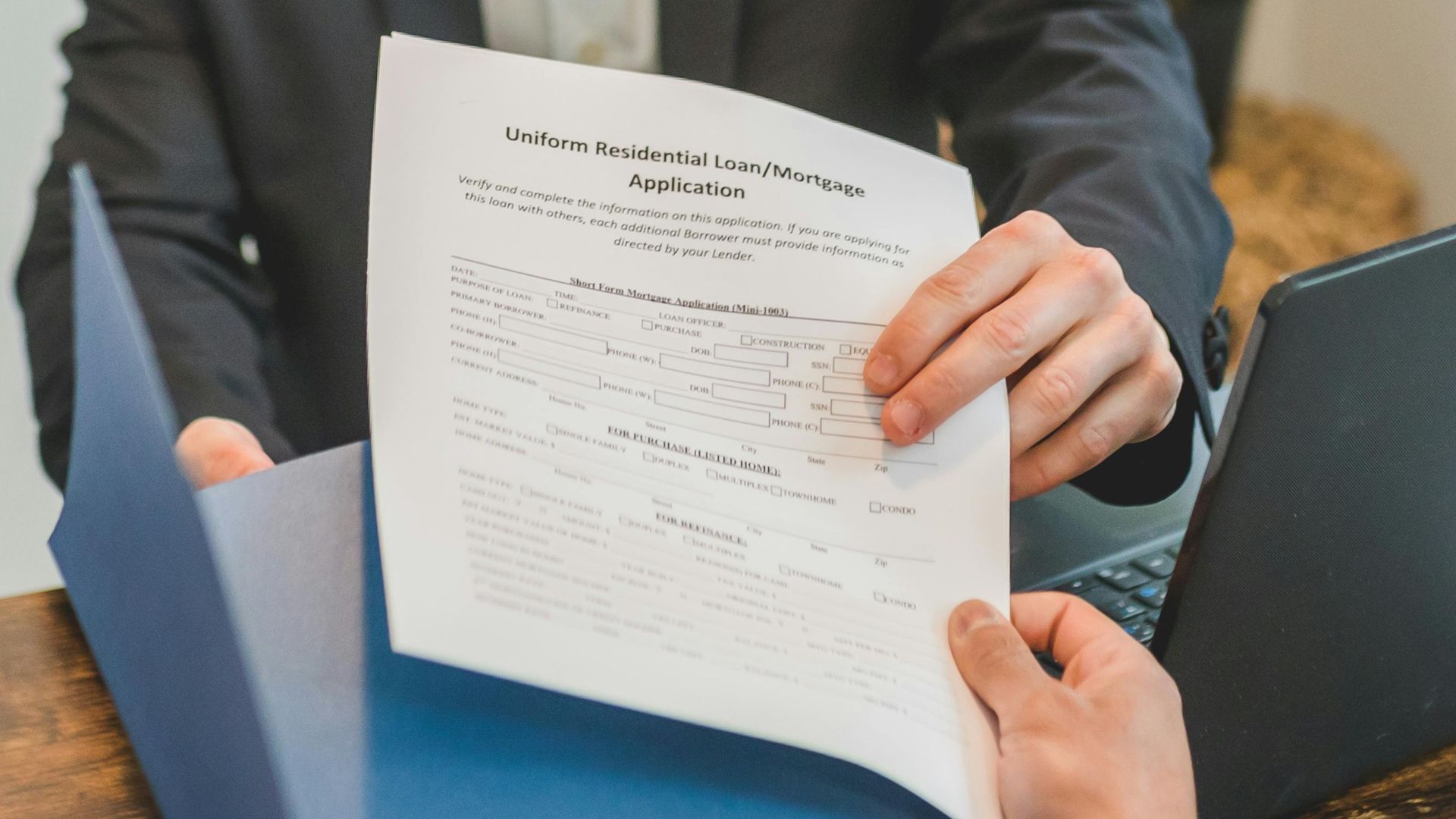

File A Dispute With Credit Bureaus

If the loan does turn out to be listed incorrectly, file a dispute with each credit bureau. Give them documentation, like your loan payoff statement or bank records. Bureaus have to investigate within 30 days and correct inaccuracies. This guarantees your report reflects the true status of your debt.

Contact Your Lender For Corrections

Sometimes the error lies with the lender. Reach out to confirm if they actually reported your loan closure to the credit bureaus. If they haven’t, tell them to do so immediately. Get written confirmation from the lender: it’ll bolster your case even more if you need to dispute.

Monitor Credit Score Changes

Even after the problem is fixed, your score might not bounce back right away. Credit scores tend to adjust gradually as a reflection of your overall profile. Keep monitoring your score using free tools from banks or credit card companies. With time, the positive impact of the updated, accurate reporting will show up.

Why Your Score Dropped After Paying Debt

It’s a bit counterintuitive, but paying off a loan can cause a temporary credit score to go down. The reason this happens is because your credit mix and active accounts change. It’s a normal part of credit scoring models and doesn’t mean you did anything wrong. Your score will bounce back over time.

Photo By: Kaboompics.com, Pexels

Photo By: Kaboompics.com, Pexels

Maybe A Small Installment Loan?

Some consumers open a small installment loan, like a credit-builder loan, just to keep some diversity within their accounts. This may help to offset the dip caused by closing your last loan. Don’t do this unless it actually fits your financial goals; you never want to take on unnecessary debt just to boost your credit score.

Avoid New Debt Pitfalls

Now’s not the time to turn to credit repair scams or high-interest loans to “fix” your credit. These often make the problem worse. Instead, focus on disputing errors, maintaining good payment habits, and letting your score recover naturally. Quick fixes rarely deliver the exact results you want.

Photo By: Kaboompics.com, Pexels

Photo By: Kaboompics.com, Pexels

Protect Yourself From Other Credit Report Errors

Review your credit reports on a regular basis, even if you’re not applying for new credit. These kinds of mistakes are more common than most people think. Proactive monitoring will help you nab a problem before it affects loan approvals, interest rates, or employment background checks.

Your Legal Rights Under The FCRA

The Fair Credit Reporting Act (FCRA) gives you the right to accurate credit reporting. If bureaus fail to correct errors after disputes accordingly, you can take legal action. Knowing your rights means you’re not powerless when you’re dealing with unresponsive lenders or bureaus.

Photo By: Kaboompics.com, Pexels

Photo By: Kaboompics.com, Pexels

Use Credit Counseling Services

If you’re overwhelmed, nonprofit credit counseling services can help. They can help you understand reports, dispute errors, and build better credit. With expert support on your side you’ll dial down the stress level and be confident that you’re addressing the problem effectively.

Build Long-Term Positive Credit Habits

While correcting errors, keep building your score through consistent habits. Pay all your bills on time, keep credit utilization under 30%, and refrain from opening any unnecessary accounts. Consistent long-term behavior outweighs short-term dips and builds a robust credit profile over time.

Photo By: Kaboompics.com, Pexels

Photo By: Kaboompics.com, Pexels

Use Free Credit Tracking Tools

Most banks and credit card issuers now offer free access to credit scores. You may as well use these tools to track your progress and keep an eye out for any sudden changes. When you see improvements over time helps you’ll be even more determined to stay on track.

Turn This Situation Into A Lesson

Treat this frustrating experience as a learning opportunity. Now you’re fully aware of the need to monitor your credit and act quickly when mistakes show up. Use this as motivation to stay vigilant, protect your profile, and avoid these kinds of setbacks in the future.

Move Forward With Confidence

You’ve already demonstrated financial discipline by paying off your loan. By disputing errors and maintaining good financial habits, your score will eventually rebound. Treat this only as a temporary setback and not as a permanent problem. With time, your financial diligence and attention to detail will pay off.

You May Also Like:

The Serious Implications of a Bad Credit Score