The Dream Of Tacos, Sunshine, And A Cheaper Life

For a lot of Americans, retiring in Mexico isn’t just a fantasy, it’s a financial strategy that actually makes sense. Warm weather, beautiful beaches, charming mountain towns, slower living, and a cost of living that usually makes Social Security stretch way further? Sign us up. But before you pack your bags and practice your “gracias,” the big question looms: How much do you really need saved to live comfortably in Mexico at 62?

The good news is that the answer is often lower than you’d expect, but it still requires planning. Let’s break it all down so your future margarita budget stays intact.

What “Living Well” In Mexico Actually Looks Like

“Living well” can mean beachside margaritas for some and cozy colonial-city living for others. In Mexico, living well generally means renting a nice place in a safe area, eating out regularly, having reliable healthcare, traveling occasionally, maintaining hobbies, and not stressing every time you check your bank account. Mexico lets your money stretch farther, but it’s not universally cheap—some expat hotspots rival US cities in price.

Start With The Monthly Budget (Your Magic Number)

In most Mexican cities popular with retirees, a comfortable monthly budget ranges from $1,800 to $3,000 per month for a single retiree, depending on lifestyle and location. Simpler lifestyles in smaller towns can run closer to $1,500. High-demand beach cities can creep up near $3,500. The cost of living is flexible, but your budget will shape your savings target.

Housing: Rent Or Buy?

Renting is the favorite option for new expats. A modern, furnished one-bedroom apartment in cities like Mérida, Querétaro, or Oaxaca typically costs $500–$900 USD/month. In beach towns or expat-heavy areas like Puerto Vallarta, Playa del Carmen, or Los Cabos, rent can jump to $1,200–$2,000+ for similar comfort. Buying property in Mexico is possible, but doing so requires knowledge of fideicomisos (bank trusts for foreigners) and comes with legal complexities. Renting first is almost always the smarter choice.

Groceries And Eating Out: Fresh And Affordable

Mexico has incredible grocery options that cost far less than in the US. Fresh produce, meat, and basics are typically 30–50% cheaper. Eating out is even better—a local meal might cost $6, while a nice restaurant dinner often lands around $12–$20. If you like going out often, Mexico won’t punish your wallet the way the US does.

Utilities, Internet, And Everyday Costs

Expect to spend around $100–$150/month for electricity if you use air conditioning sparingly, more if you run it constantly. Water, gas, garbage, and internet combined rarely exceed $80–$100. A prepaid cell phone plan with unlimited data might cost $20–$30. Altogether, daily utilities are usually far below US averages.

Transportation: Drive Or Ditch The Car?

Car ownership is optional in many walkable cities. Buses and taxis are extremely affordable. Rideshare services like Uber or Didi often cost $2–$5 per trip. If you do own a car, fuel and maintenance cost less than in the US, though toll roads can be pricey. Many retirees find they save hundreds per month by going car-free.

Healthcare: One Of Mexico’s Biggest Perks

Healthcare in Mexico is a huge reason retirees move there. Many Americans are shocked to learn that private care is high-quality yet enormously cheaper. A routine doctor visit might cost $20–$40, while a specialist might run $40–$70. Most retirees buy private insurance, which typically costs $1,500–$4,000 per year depending on age and coverage. If you’re retiring at 62, your premiums will be higher than they’d be at 50, but still dramatically lower than US coverage.

Medications And Pharmacies

Prescription medications often cost a fraction of US prices—sometimes 70–80% cheaper. Many common medications are available over the counter. Health savings plans stretch much further here.

Travel And Entertainment

Weekend trips to nearby towns, cultural events, beach days, and exploring archaeological sites add joy to retirement without draining your budget. Monthly entertainment and travel expenses vary, but many retirees spend $200–$400 per month on experiences, or more if they like to travel frequently within Mexico.

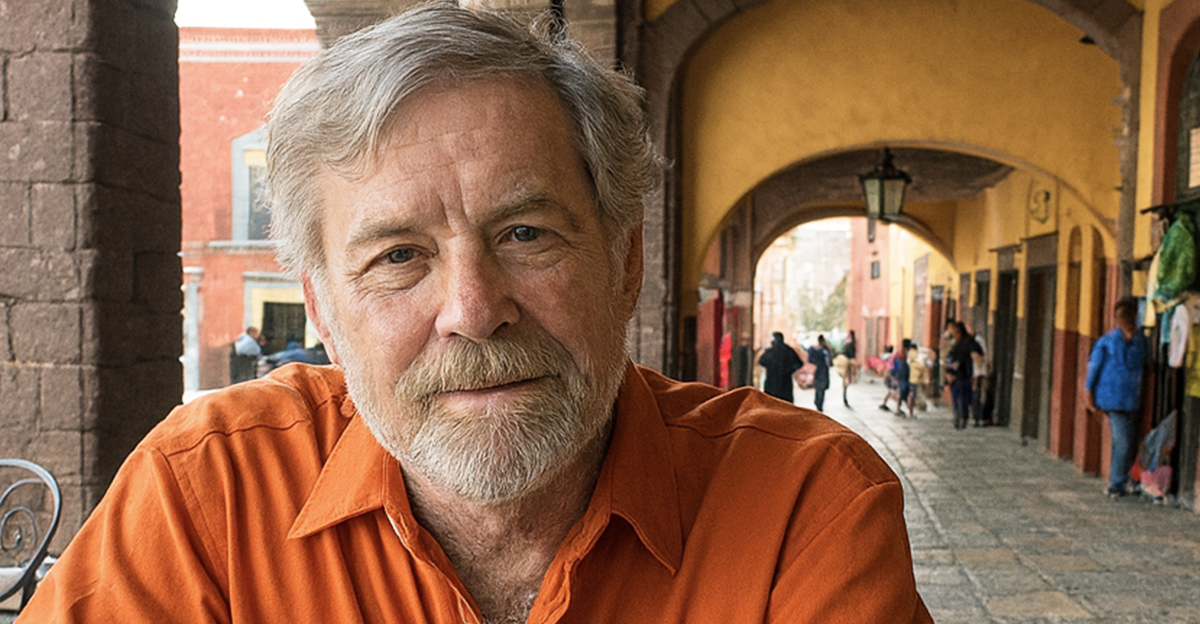

Daniel Schwen, Wikimedia Commons

Daniel Schwen, Wikimedia Commons

So, How Much Do You Need Saved? Let’s Talk Numbers

A good general rule for retiring abroad is to save enough to cover 25–30 years of expenses if retiring at 62. If you plan to spend $2,000/month ($24,000/year), you’d ideally want:

- $600,000–$750,000 saved for long-term independence.

If you expect to spend $3,000/month ($36,000/year), aim for:

- $900,000–$1,100,000+ saved.

These numbers assume no mortgage, moderate healthcare costs, and Social Security starting at 62 or later. Many retirees live comfortably in Mexico on far less, but this range keeps you protected against emergencies and inflation.

Factor In Social Security (A Big Piece Of The Puzzle)

If you claim Social Security at 62, expect smaller monthly checks. The average benefit at 62 is about $1,342/month (as of November 2025). Many retirees cover half their expenses with SS and supplement the rest with savings. If you can delay benefits until 67 or 70, you’ll get significantly more. In Mexico, higher Social Security payments can go extremely far.

Taxes: Yes, You Still Owe The IRS

Retiring in Mexico does not exempt you from US taxes. You must file annually and pay taxes on your worldwide income. Mexico has its own tax system, but most retirees living on passive income or Social Security owe little to Mexico. Consult a cross-border tax specialist before moving.

Residency Requirements: Temporary Or Permanent?

Mexico offers two main residency paths for retirees:

- Temporary Residency (1–4 years)

- Permanent Residency

For retirement-based visas, you must show financial solvency. Requirements change yearly, but usually involve either:

- Monthly income of roughly $3,000–$3,500, or

- Savings totaling roughly $50,000–$60,000

Get up-to-date requirements from the nearest Mexican consulate before planning your move.

Jonathan Salvador , Wikimedia Commons

Jonathan Salvador , Wikimedia Commons

Banking And Moving Money Internationally

You can keep your US bank accounts and transfer funds as needed. Just watch for currency exchange rates and transfer fees—they can add up. Many retirees use Wise, Schwab, or local Mexican banks once they establish residency. Mexico is increasingly card-friendly, but keeping some pesos on hand is still smart.

Where You Retire Matters (A Lot)

Mexico has enormous regional cost differences. Some popular options:

- Affordable Cities: Mérida, Oaxaca, Puebla, Morelia

- Moderate: Querétaro, Guadalajara, Mexico City (non-tourist areas)

- Pricey Expat Hubs: San Miguel de Allende, Puerto Vallarta, Playa del Carmen, Tulum, Los Cabos

Think carefully about lifestyle, budgets, climate, and medical access.

https://www.flickr.com/photos/jiuguangw/, Wikimedia Commons

https://www.flickr.com/photos/jiuguangw/, Wikimedia Commons

Inflation And Exchange Rates: The Silent Variables

Mexico’s inflation tends to be steadier than the U.S., but currency swings can impact your monthly costs. A strong dollar helps you; a weak dollar hurts. Build buffer room into your budget to stay safe.

Test-Drive Your Retirement Before You Move

Spend 3–6 months living in the area you want to retire in before committing. Rent long-term, shop locally, use local healthcare, and get a feel for daily life. Plenty of would-be expats fall in love with the idea of a place but not the reality.

Emergency And Long-Term Planning

Make sure you have:

- An emergency fund kept in USD

- A plan for major medical events

- Updated estate documents valid in both countries

- A communication plan with family back home

Mexico is wonderful, but cross-border logistics require preparation.

The Bottom Line

Retiring in Mexico at 62 can be financially freeing, deeply enjoyable, and incredibly fulfilling—but only if you plan wisely. With a monthly budget of $1,800–$3,000 and retirement savings ranging from $600K to over $1M depending on your lifestyle, you can live well without stress. Mexico offers rich culture, affordable living, and a slower pace of life that lets your retirement look and feel like an actual retirement. With smart planning, the dream becomes not just possible—but practical.

You May Also Like:

I want to retire early but I also really, really want a Lamborghini. Can I have both?