Sudden Impact: The Fall Of SVB

You probably heard how Silicon Valley Bank collapsed in March 2023, sending waves of panic through the startup world, venture funds, fintech, and the banking industry. But how did a bank that seemed so secure fail in just 48 hours? The answer comes down to a mix of rapid growth, bad timing, and avoidable mistakes. We look back at what happened to Silicon Valley Bank and why it matters.

Beginnings And Rapid Growth In Start-Up Banking

SVB started in 1983 but it took a very different approach from most other banks. Instead of serving everyday consumers or regular companies, it focused on tech startups, venture capital and future Silicon Valley giants. This gave the bank a reputation as the financial backbone of innovation. SVB knew the tech industry and loved taking big bets that the other banks didn’t have the stomach for. The model worked spectacularly for decades.

Minh Nguyen, Wikimedia Commons

Minh Nguyen, Wikimedia Commons

The Tech Boom: A Surge Of Deposits

During the 2010s and especially through 2020 and 2021, venture capital went wild. Billions of dollars poured into tech startups, and SVB became the default banking choice for many of the new companies. Deposits exploded. Flush with cash from clients who weren’t spending much yet, SVB had an amazing amount of liquidity. It looked like a success story that other banks were eager to copy. The business model was ideal for the booming tech sector.

Minh Nguyen, Wikimedia Commons

Minh Nguyen, Wikimedia Commons

Investment In Long-Term Bonds And Treasuries

With so much money flowing in, SVB did what a lot of banks do: they bought government bonds and long-term securities. Treasuries are normally ultra-safe investments and guarantee returns over time. SVB believed deeply that these investments were conservative and secure. The bank had every expectation that those deposits would remain stable or continue growing. At first, it looked like a simple, smart way to generate profit with low risk.

Michael M. Santiago, Getty Images

Michael M. Santiago, Getty Images

Artificially Low Interest Rates: A Risky Strategy

For years interest rates stayed historically low, tempting SVB to keep buying long-term bonds without much worry. That low-rate environment made bonds look like a solid option — until the economic conditions changed. The strategy worked only as long as the world stayed predictable. In reality, SVB was stacking risk without much of a gameplan for what would happen when rates skyrocketed.

Startups Slow Down: Deposits Turn To A Trickle

By late 2021 and through 2022, funding started getting tight. Tech valuations dropped, venture capital was suddenly scarce, and startups began to dip into the cash they had deposited at SVB. Instead of pouring in money, depositors began taking it out. The financial tide was now going out. SVB now had far less cash on hand. The same customers who fueled the bank’s rise were now unintentionally draining its lifeblood.

Interest Rate Hikes: 2022–2023

As inflation surged, interest rates jumped rapidly. That was no minor inconvenience; it ruined the value of the long-term bonds SVB bought. The bank could no longer sell them at full price. The very assets meant to protect the bank had now turned into serious liabilities. Suddenly, a safe investment became a financial boat anchor dragging the balance sheet down into the cold inky depths of disaster.

Unrealized Losses Build On Balance Sheet

Banks don’t have to report losses until they sell assets. So SVB held on to these bonds, and the losses sat quietly on the books. On paper, the losses weren’t doing any harm—yet. But in reality, they were creating a huge hole. If depositors were to suddenly demand their money, selling those bonds would mean losses up into the billions. The moment when all hell broke loose wasn’t long in coming.

Growing Deposit Outflows: Liquidity Crisis Looms

Startups and venture firms continued to withdraw large sums of money. SVB’s liquidity evaporated. And because the bulk of its assets were tied up in long-term bonds, the bank couldn’t sell them quickly without taking an enormous hit. The race between withdrawals and liquidity wasn’t a slow erosion, but a gathering avalanche. SVB was now in a classic cash-shortage crisis.

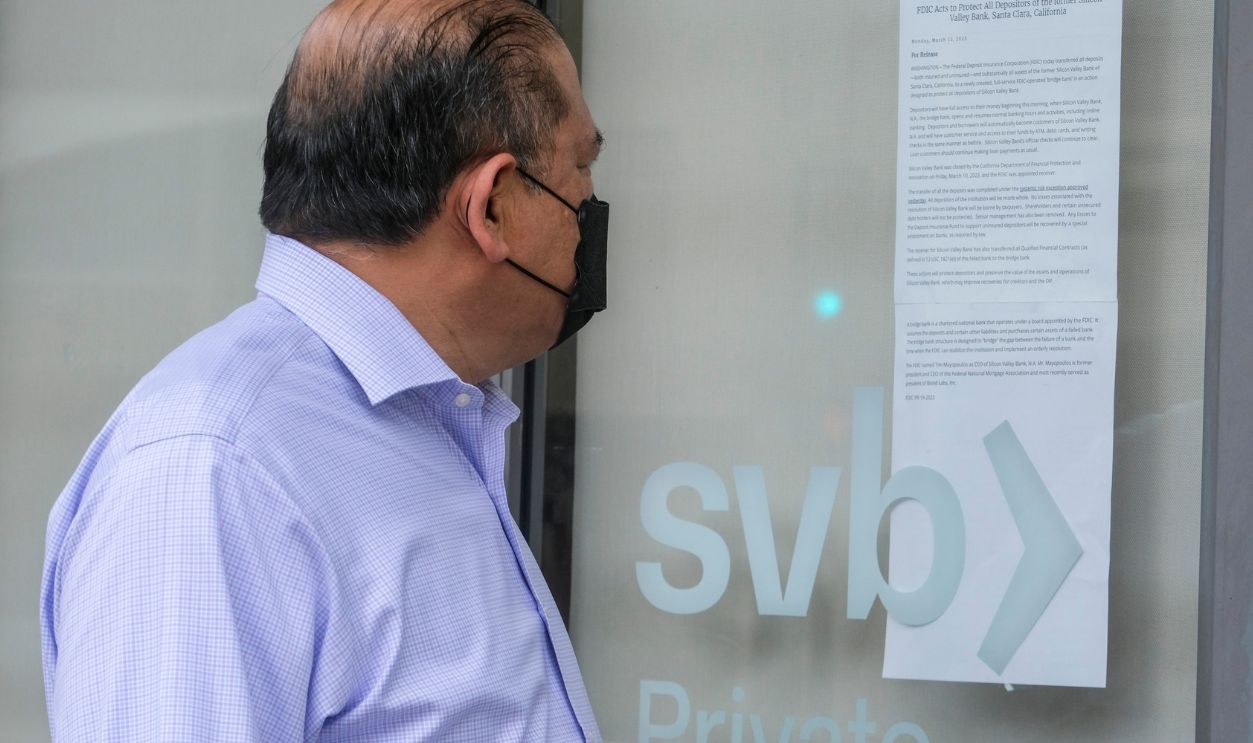

The Trigger: SVB’s Public Announcement On Losses And Capital Raise

In early March 2023, SVB announced a loss of $1.8 billion from selling securities and said that it needed to raise capital immediately. The message was intended to reassure markets, but it ended up having the opposite effect. Startups and investors saw it as a warning sign on the road ahead. Confidence spiraled down the drain in an instant. What could have been a manageable situation evolved into a panic-stricken stampede for the exits.

Bank Run: Clients Pull Out Funds By The Billions

Within hours of hearing the announcement, founders, executives, and VC firms encouraged each other to pull their money. A digital bank run took off. Billions left the bank almost overnight. Because deposits were so heavily concentrated in a small industry, panic spread like wildfire. The speed of withdrawals left SVB no time to react. The bank simply couldn’t meet the sudden demand for cash, and the crisis burst forth like a dam breaking.

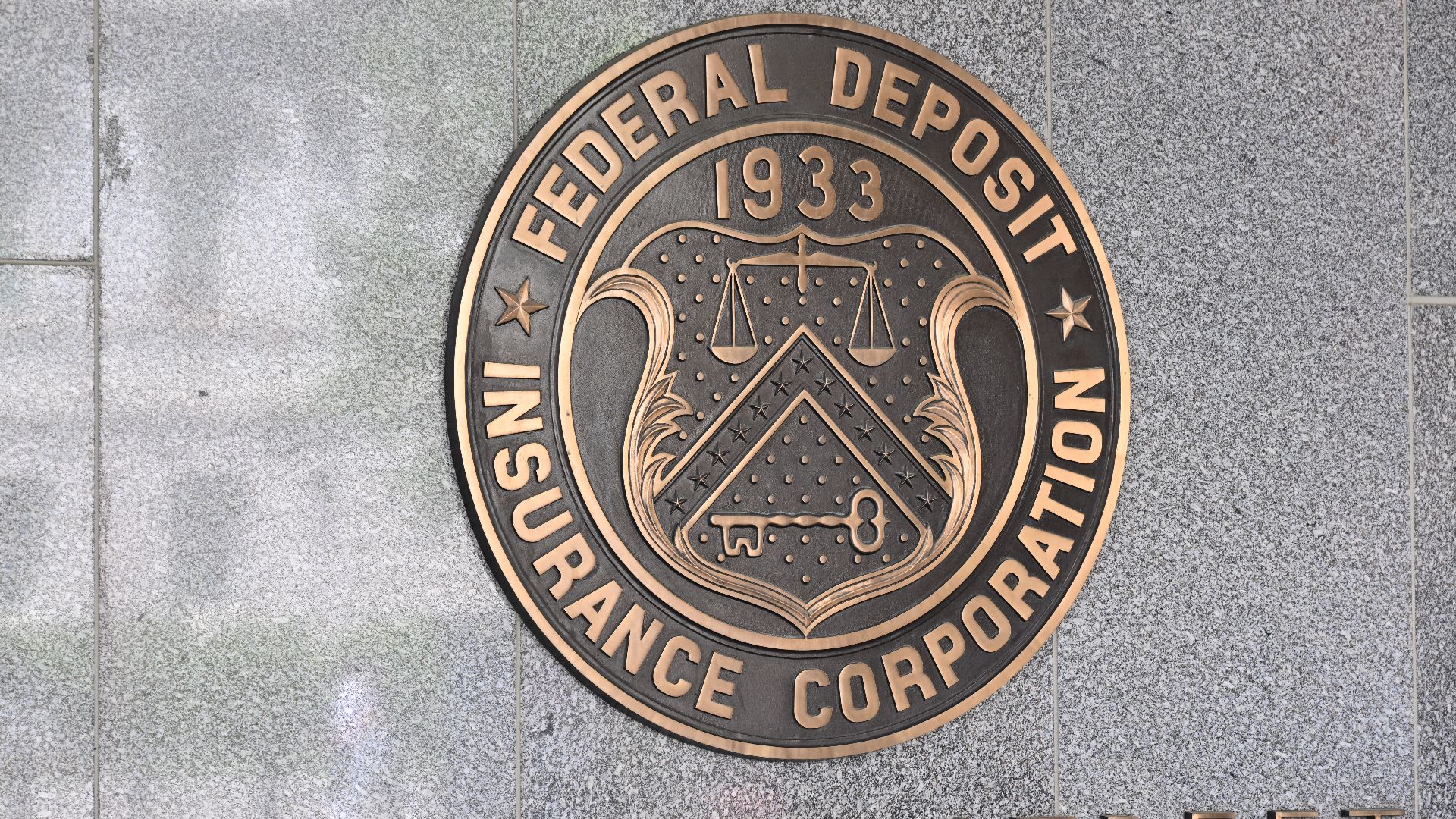

Regulatory Seizure And Collapse

On March 10, 2023, regulators stepped in, shut down the bank, and seized its deposits. It was now the second-largest bank failure in the checkered history of U.S. money and the biggest since 2008. The FDIC took the reins and issued guarantees of all the deposits. The collapse left businesses and lenders unsure of whether payroll, operating expenses, and savings would be available to them in sufficient amounts to make it through the next week.

G. Edward Johnson, Wikimedia Commons

G. Edward Johnson, Wikimedia Commons

Fallout Across Startups, Venture Firms, And Banking

The collapse of SVB didn’t stay contained inside one bank. Startups scrambled around looking for alternatives. Venture funds all moved their money. Regulators considered emergency measures. Other regional banks saw their stock prices go through the floor as frantic investors scanned their balance sheets. SVB’s fall was now a signal of a domino effect bringing imminent financial ruin through the entire sector.

Concentration Risk In A Single Industry Sector

One major reason for the collapse was that SVB depended almost completely on tech startups and venture funding. When that sector slowed, the bank didn’t have much of a diverse deposit base to fall back on. A lack of diversification is always risky for any business, but for a bank, it can be an absolute death knell when one sector runs into trouble.

Minh Nguyen, Wikimedia Commons

Minh Nguyen, Wikimedia Commons

Heavy Investment In Long-Term Securities

Over 75% of SVB’s assets were tied up in long-term Treasuries and mortgage-backed securities. That made the bank incredibly—and incredulously— vulnerable to fluctuating interest rates. When the rates rose, those assets instantly started hemorrhaging value. What should have been a conservative strategy now became one of the biggest risks on the balance sheet.

Unrealized Losses Hidden Until It Was Too Late

SVB didn’t seem like it was losing money, but that was because its losses weren’t realized. The danger was invisible, lurking like a shark just below the surface. Then, right at the moment that the bank needed access to that cash, the losses became unavoidable. If the bank sold the bonds to raise money, it would lock in billions in real losses. That catch-22 wiped out public confidence and made the crisis irreversible.

Liquidity Mismatch: Cash Needed, Cash Unavailable

SVB’s problem wasn’t just of solvency it was liquidity. It owned huge assets but couldn’t convert them into cash quickly enough to meet the sudden onslaught of withdrawals. That mismatch between accessible cash and long-term investments meant that the deposits were solid on paper but unavailable when customers wanted access to their funds.

TIMOTHY A. CLARY, Getty Images

TIMOTHY A. CLARY, Getty Images

Weak Risk Management And Lack Of Hedging

SVB did not hedge interest-rate risk effectively. This means that banks normally use swaps, diversification, or other financial manipulations to protect against drastic or unforeseen market swings. SVB didn’t do this. When rates increased, the value of its assets took a nose-dive. The bank had no structural protection against the most predictable financial threat of the decade. Later criticism also focused on SVB's lack of a Chief Risk Officer for long periods leading up to the fall. Such a role might've been able to take steps to ward off the crisis.

Overconfidence In Low-Rate Conditions

For years the SVB brain trust assumed, as did many others, that interest rates would stay low. That confidence was based on the financial environment from 2008–2021. But the economic world changed quickly, and the bank didn’t catch on to the change quickly enough. The belief that conditions would remain the same turned into a blind spot that led directly to the collapse.

Tony Webster, Wikimedia Commons

Tony Webster, Wikimedia Commons

Big Lesson: Diversify And Prepare For Risk

SVB’s collapse shows that a past track record of success isn’t enough. Without diversification, liquidity, and protection against market changes, even the strongest-looking business can fold like a house of cards. It just goes to show that no matter how good things are, you can’t assume it will last forever.

The Perfect Storm Of Bad Timing And Bad Decisions

Silicon Valley Bank imploded due to a combination of growth, sector concentration, long-term investments, interest-rate hikes, and most importantly, a sudden collapse in depositor confidence. When all those things converged, the bank collapsed within hours. The takeaway, as with any sudden spectacular financial meltdown, is to always prepare for risk even while you’re making money, because markets can turn faster than you expect.

You May Also Like:

Enron: The Anatomy Of A Fiasco