A Spectacular Downfall

Ivan Boesky’s rapid rise and stunning downfall was emblematic of 1980s Wall Street excess. Once hailed as a financial genius, Boesky became the face of insider trading and out-of-control greed. His scandal not only reshaped securities regulation but also inspired Hollywood’s most notorious symbol of ambition with no moral compass: Gordon Gekko.

The Rise Of A Wall Street Star

In the late 70s, Ivan Boesky went straight to the top as one of Wall Street’s most daring traders. Armed with a Harvard MBA and boundless ambition, he built a fortune through speculation on corporate mergers. Some thought Boesky was just the biggest example of the aggressive spirit of a new generation of financiers: driven, brilliant, and totally unafraid to push the limits.

The Culture Of The 1980s

The decade of excess was now in full force. Wall Street’s culture was marked by leveraged buyouts, junk bonds, and conspicuous wealth. Boesky had a field day in this environment. His lavish lifestyle, sharp pinstriped suits, and bold wheeling and dealing mirrored the era’s obsession with image and profit. For a time, Boesky was the toast of the town as the ultimate self-made success story.

How The Scheme Worked

Boesky was living large but his empire was built on insider information. He made huge profits by buying up stocks of companies rumored to be acquisition targets. He used tips obtained through a secret network of corporate insiders and investment bankers. These trades weren’t just the lucky guesses of a guy on a hot streak; they were calculated moves that clouded the line between legitimate trading and outright fraud.

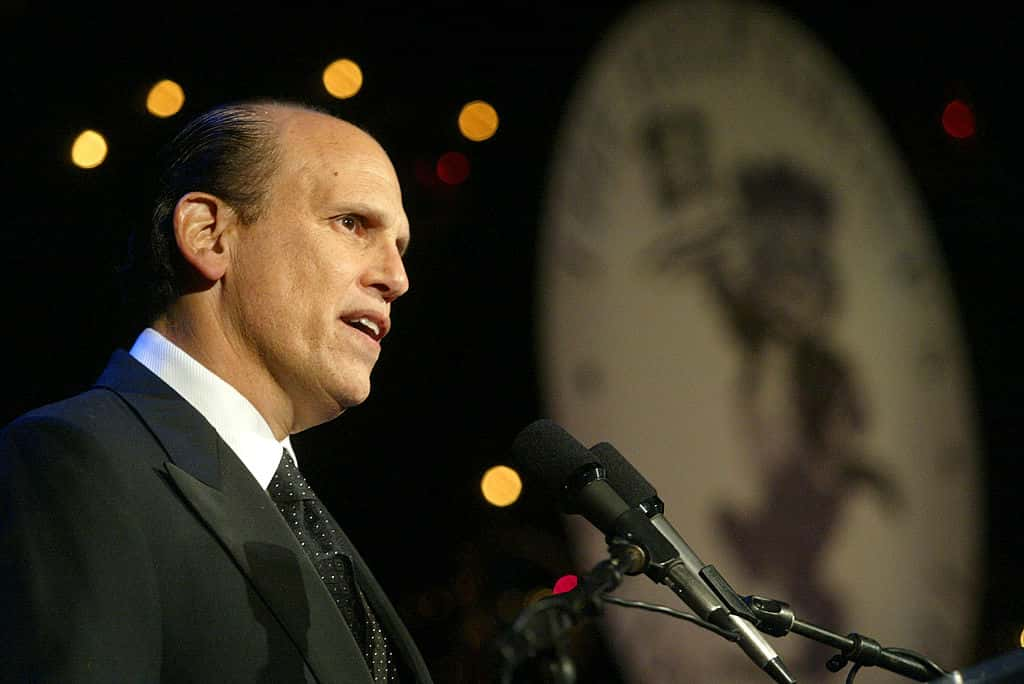

From Arbitrage To Infamy

Initially, Boesky’s success was hailed as the masterwork of a financial genius. His public appearances and high-profile speeches all showed him as a master of strategy. But beneath the layer of charm was an attitude of arrogance. He once quipped that he 'did fine until [he] hooked up with the mob,' a darkly ironic musing of his willingness to engage in corruption. There is a lot of truth in jest, as the saying goes.

The Crack In The Facade

By 1985, regulators at the SEC had begun looking into an expanding web of insider trading across Wall Street. Patterns in Boesky’s trades raised red flags. As investigations intensified, his reputation as an investing mastermind gave way to suspicions that his success was based on nothing more than inside information that ordinary traders could never legally access.

A Network Of Greed

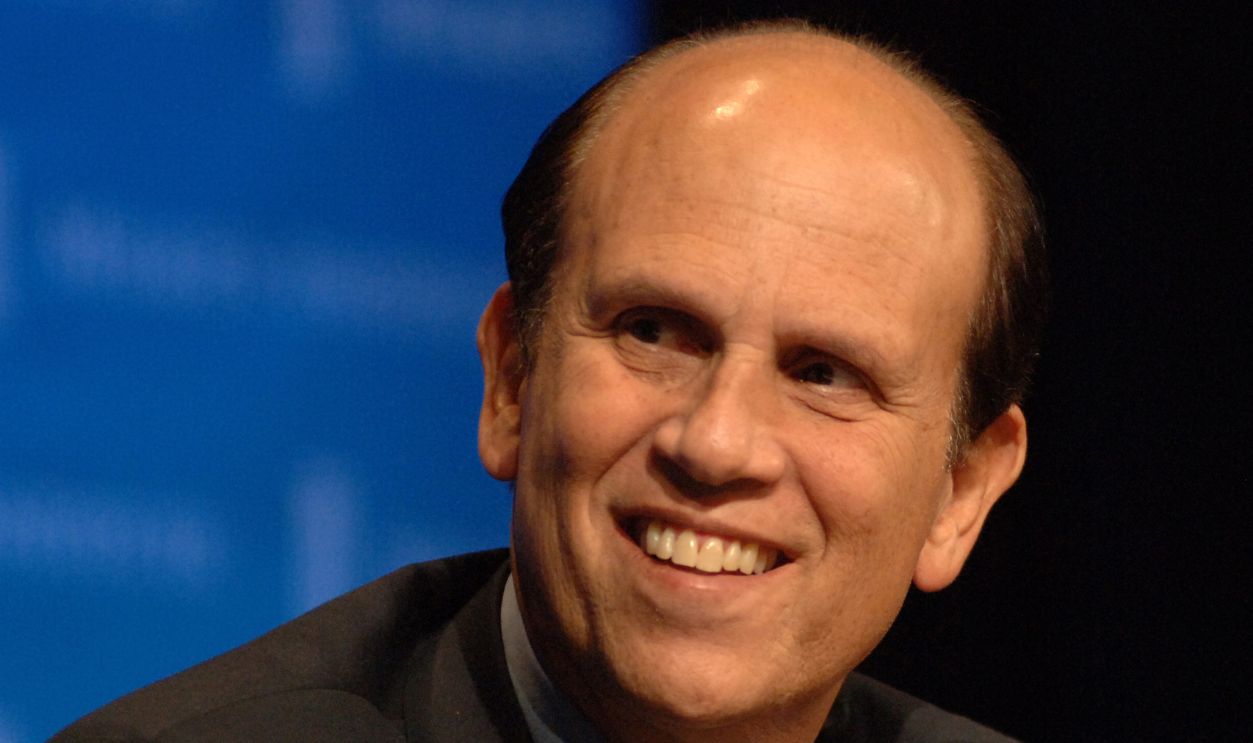

Boesky was part of a wider ecosystem that thrived on moral flexibility. Alongside figures like Michael Milken, Dennis Levine, and Martin Siegel, he operated in a world where insider tips, junk bonds, and backroom deals made fortunes for those in the inner circle. Each man believed he was untouchable. But one by one, they all fell, just like dominoes.

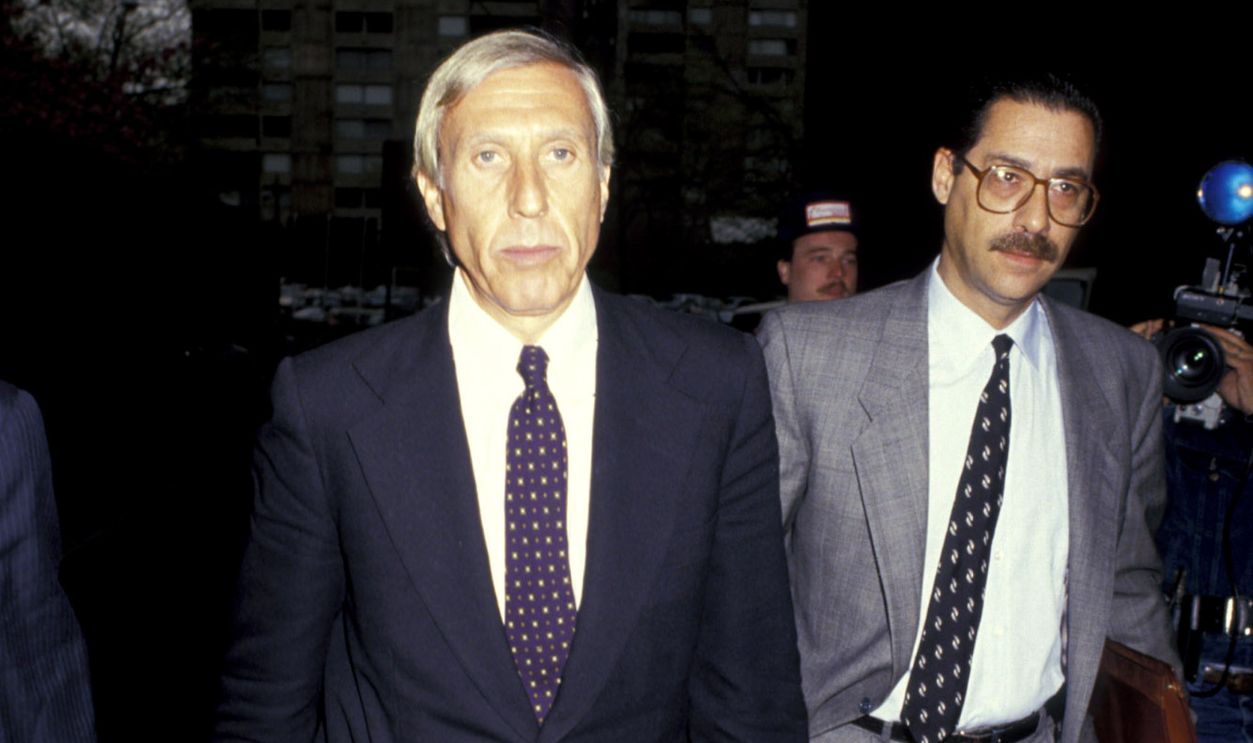

The Fall Of Ivan Boesky

In 1986, Boesky’s empire fell apart when he was caught using inside information for personal gain. He ended up pleading guilty to one count of insider trading, agreed to pay $100 million in penalties, and cooperate with federal investigators. His cooperation led to multiple convictions across the financial industry and was a turning point in Wall Street regulation.

From Admiration To Public Condemnation

Boesky’s journey from icon to outcast was swift. The man once lionized on magazine covers was now looked on as just another Wall Street swindler. His name was added to a growing list of disgraced financiers, a symbol of what happens when ambition casts aside ethics. The public no longer saw him as a genius.

The Making Of Gordon Gekko

Boesky’s story, along with those of the “Junk Bond King” Michael Milken and Dennis Levine, inspired Oliver Stone’s 1987 film Wall Street. The film’s central figure, Gordon Gekko, played by Michael Douglas, embodied their arrogance, ruthlessness, and moral decay. From his slick demeanor to his infamous 'Greed is good' speech, Gekko was a fictionalized version of Boesky’s real-world ethos.

20th Century Studios, Wall Street (1987)

20th Century Studios, Wall Street (1987)

The 'Greed Is Good' Era

The phrase 'Greed is good' became a leading mantra of 1980s finance. Though it came from the film, it closely echoed Boesky’s own public pronouncements, including a 1986 speech where he told Berkeley students, 'Greed is all right, by the way.' That speech, and his subsequent downfall, cemented his role as the real-life model of cinematic excess.

When Arbitrage Became Crime

Boesky’s downfall was a classic example of the razor-thin boundary between sophisticated arbitrage and criminal behavior. Legal arbitrage makes use of publicly available information; insider trading weaponizes secrets. Boesky’s willingness to cross that line showed how the pursuit of profit can push sound judgment out of the picture.

The Cost Of Hubris

Boesky’s financial empire disintegrated as quickly as it rose. Beyond the fines, he faced professional exile and imprisonment. Once worth hundreds of millions, he was barred from the securities industry for life. His name became shorthand for arrogance and the illusion of invincibility that defined 1980s Wall Street.

Regulators Strike Back

The Boesky case galvanized the SEC and Justice Department. New enforcement tools and whistleblower protections were brought into force. His conviction showed that even Wall Street titans could be held to account. The case also showed how one insider’s cooperation with the law could expose an entire culture of corruption.

A Mirror For Wall Street

Boesky’s rise and fall forced Wall Street to confront its own moral vacuum. In the rush for profits, the distinction between innovation and illegality had broken down. His scandal became yet another example of an industry most people thought was driven by speculation, megalomania, and unchecked greed.

The Men Behind The Myth

Other figures from the era, like Milken, Levine, Siegel and others also played their own roles in the decade’s unraveling. Together, they symbolized an elite circle of traders who feasted on manipulation and influence. Their very real stories were the raw material for Hollywood’s portrayal of financial sin and redemption.

LarryWeisenberg, CC BY-SA 3.0, Wikimedia Commons

LarryWeisenberg, CC BY-SA 3.0, Wikimedia Commons

Cultural Fallout And Public Distrust

The insider-trading scandals of the 80s reshaped public opinion of Wall Street. Many Americans thought the market no longer represented opportunity, but was nothing more than a sink of corruption. Boesky’s name became synonymous with corporate greed, while Wall Street the film captured the nation’s growing disillusionment with its financial gladiators.

Twentieth Century Fox, Wall Street (1987)

Twentieth Century Fox, Wall Street (1987)

Personal Collapse And Exile

After serving out two years of his three-and-a-half-year prison sentence, Boesky largely withdrew from public life. He made various attempts to reinvent himself in private business but never regained his former credibility. His lavish estates were sold off, and former associates distanced themselves from him. The man who once was a symbol of success was now a ghost of a bygone era of excess.

Patrick McMullan, Getty Images

Patrick McMullan, Getty Images

The Lessons Endure

Boesky’s scandal is still a case study for discussions of financial ethics. It taught regulators, investors, and students that unrestrained ambition can destroy fortunes and reputations. In classrooms and boardrooms, his story is still used to illustrate that integrity cannot be substituted by taking illegal shortcuts. Unfortunately, future examples of financial corruption have happened many times over since the 80s.

The Legacy Of 'Greed Is Good'

While Boesky’s name faded from the headlines, the culture he represented didn’t. Decades later, echoes of his philosophy cropped up again in the 2008 financial crisis and other corporate scandals. His legacy is not so much as a person, but as the symbol of a certain way of looking at the world; we can all see what happens when markets reward risk without conscience.

The Moral Of The Story

Ivan Boesky’s fall from grace was a turning point for American finance. His ‘greed is good’ attitudes reshaped regulation and inspired cinematic portrayals; but his downfall reminded the world that unchecked ambition comes at a heavy cost. The 80s may have glorified excess, but Boesky’s story showed that even titans can collapse under the problems of their own making.

You May Also Like:

Enron: The Anatomy Of A Fiasco