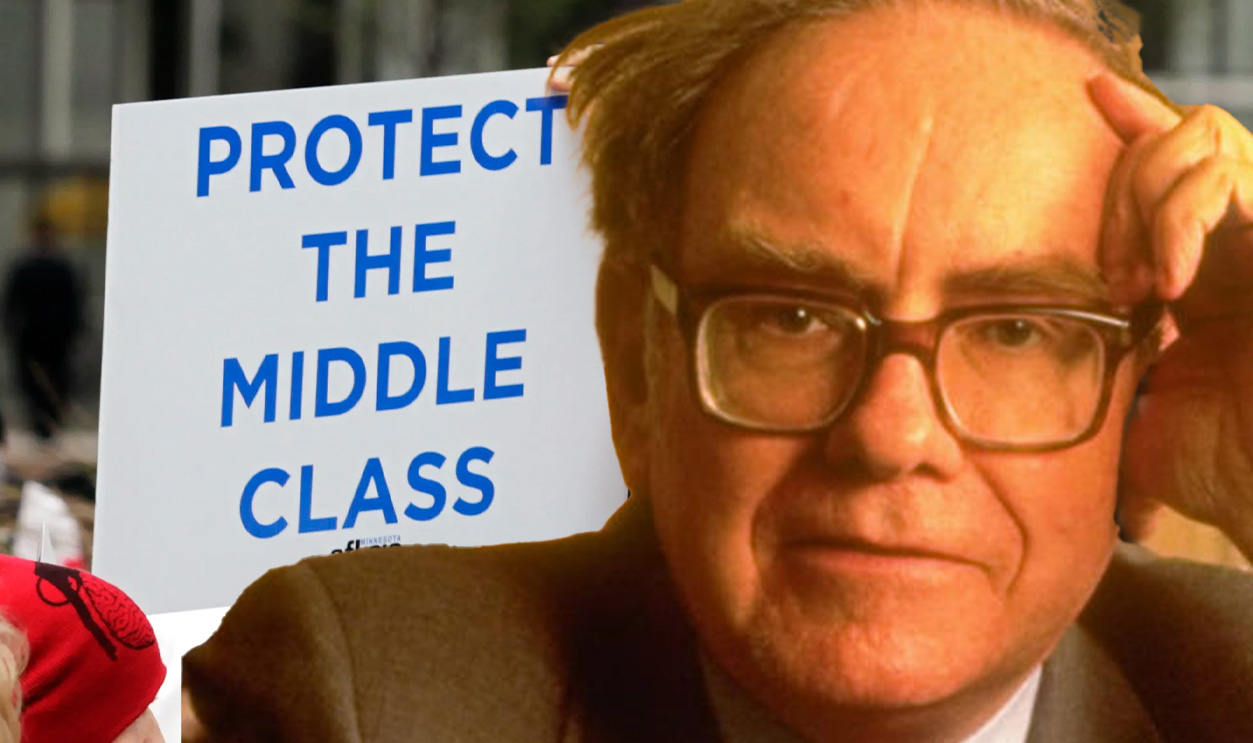

If You're In The Middle-Class, This Advice Is For You

Managing money is a skill that comes with experience and putting into practice some fairly basic financial advice. But for an ever-shrinking American middle class—about 50% of the American population, according to recent polling—Warren Buffett has some excellent money advice for you, especially if you're struggling to make ends meet.

How Does The Middle-Class Waste Money?

Before we dive into how the "Oracle of Omaha" thinks you should behave with your money if you find yourself in the "middle class," let's explore how Buffett thinks you might waste money.

The White House, Wikimedia Commons

The White House, Wikimedia Commons

Not Distinguishing Wants From Needs

This is a lesson we learn as children: the ability to distinguish something we want versus something we need. But we can lose this lesson as we age, particularly when it comes to our finances. Buffett says that not distinguishing wants from needs is detrimental to any budgeting we attempt.

Overpaying For Below-Par Quality Items

While everything is overpriced, people pay much more than they should for sub-par quality items. Advertising and marketing convince us that we need the latest and greatest, and Buffett says this costs us dearly on an annual basis. He also says he doesn't mind spending large amounts of money on high-quality items, but will wait until what he wants is offered at a discounted price.

Procrastinating When Creating Good Financial Habits

It's easy to say, "I'll do that tomorrow," when you're talking about your money. "I'll open a savings account tomorrow". Or, "We'll do a household budget the next time I get paid". Buffett warns against procrastination. Action is the only thing that's going to create good financial habits—and there's never a "right" time.

Normalize Debt

Normalizing debt is another thing that enables the middle class to waste money. Borrowing money unnecessarily will eventually erode your wealth because of the interest you'll pay on that debt. Buffett says that taking on a (sensible) mortgage is fine, but using debt to pay for your life is a never-ending cycle.

Not Prioritizing Personal Development

"Personal development" means different things to different people, but Buffett warns that too many middle-class Americans neglect personal development in exchange for impulse buys and things they don't need. Learning a new language? Too expensive. That new couch that was hundreds of dollars more expensive? Yes, please. The Oracle says you should prioritize personal development over personal items.

Not Understanding What You're Investing In

If you choose to move some money into investments, then you'd better understand what it is you're investing in—and indeed how investment works. Buffett says too many amateur investors throw all their money into risky stocks, cryptocurrency, Bitcoin and more, without understanding the risk they're taking. Learn, understand, then invest if you wish.

Sabotaging Long-Term Financial Growth

One of the worst money mistakes you can make is to sabotage your long-term financial future for short-term financial gain. For example, if you have money sitting in an investment account and it's gaining compound interest annually, the worst thing you can do is to interrupt that growth by withdrawing it for a spur-of-the-moment purchase. Leave it alone, says Buffett, and secure long-term financial growth, thanks to the magic of compound interest.

Buffett's Money Advice For The Middle Class

Now that you've learned how you waste money as someone in the middle class, Buffett's got some fantastic advice for turning that waste into growth.

USA International Trade Administration, Wikimedia Commons

USA International Trade Administration, Wikimedia Commons

Prioritize Saving: Pay Yourself First

This is a save first/spend later approach to budgeting, but it forces you to do two things at once: cut down on needless expenses and save, save, save! Identify a goal that you're saving towards and then with each paycheque, budget to put as much money into savings as you can while having enough left over to cover your expenses.

Reduce Your Unnecessary Expenses

As part of your budgeting plan to attack your debts or save up for a big purchase, reduce your unnecessary expenses as much as possible. Identify them first. They could be your morning Starbucks coffee and snack at $10/day—that's $2,600 per year. By reducing these unnecessary expenses, you'll save more money.

Invest In The S&P 500

Yes, Warren Buffett definitely has many, many millions more than you do right now. But much of that money was made because he invested in the S&P 500. While now may not be the best time to invest due to market volatility, investing in the S&P 500 is the key to long-term wealth. "Buy a low-cost S&P 500 index fund and keep it through thick and thin, but especially thin," says Buffett.

Be Frugal But Not Miserable

Despite all of Buffett's advice on living frugally and saving money wherever possible, this doesn't mean that you need to reduce your life to a meaningless pursuit of savings. Live a balanced, healthy life by being frugal where possible, without sacrificing the enjoyment of the moment.

Which Of Warren Buffett's Advice Are You Taking?

If you're struggling with your money as a middle-class American, which of Warren Buffett's middle-class money advice are you implementing? Share your stories in the comments below.

You May Also Like:

Daily Routines Of Successful People

Zero-Based Budgeting: A Different Way of Looking At Your Finances

Companies Built Around A Single Product

Sources: