Beat The Bills: Your Action Plan For A More Energy-Efficient Home

Have you ever looked at your energy bill and winced? Managing your home's energy consumption might feel overwhelming at first. With so many devices and appliances running simultaneously, where do you even start?

With a few clever swaps and the right equipment, you can significantly slash your monthly energy bills. Here's a guide to help you take that first energy-saving leap.

1. Energy-Efficient Appliances: A Worthy Investment

Older appliances may have sentimental value, but they're likely energy guzzlers. Energy-efficient appliances might be more expensive upfront, but they can save you a significant amount in the long run.

By upgrading to energy-efficient appliances, you'll consume less energy without compromising functionality. Many manufacturers produce appliances bearing the Energy Star label – a mark of energy efficiency.

For example, consider the LG WM9000HVA washing machine, which is designed to use 30% less energy than standard models.

2. Programmable Thermostats: The Smart Temperature Regulator

Maintaining a comfortable home temperature doesn't have to mean soaring energy bills. With programmable thermostats, you can schedule temperature changes to align with your routine, thereby reducing energy waste.

A product like the Google Nest Learning Thermostat adjusts your home's temperature based on your schedule and can save you up to 10% a year on heating and cooling costs.

3. Light the Way: Natural and LED Solutions

Make the most of natural light during the day. Open blinds and curtains to let in sunlight, reducing the need for artificial light.

However, be mindful of how much heat the sun can generate during warmer months; it might be worthwhile closing window treatments on south and west-facing windows during peak summer heat.

Harnessing natural light in your home is the most cost-effective lighting solution. But when artificial lighting is necessary, opting for LED bulbs can help you save.

LEDs, such as the Philips Hue range, consume less energy and last much longer than their incandescent counterparts.

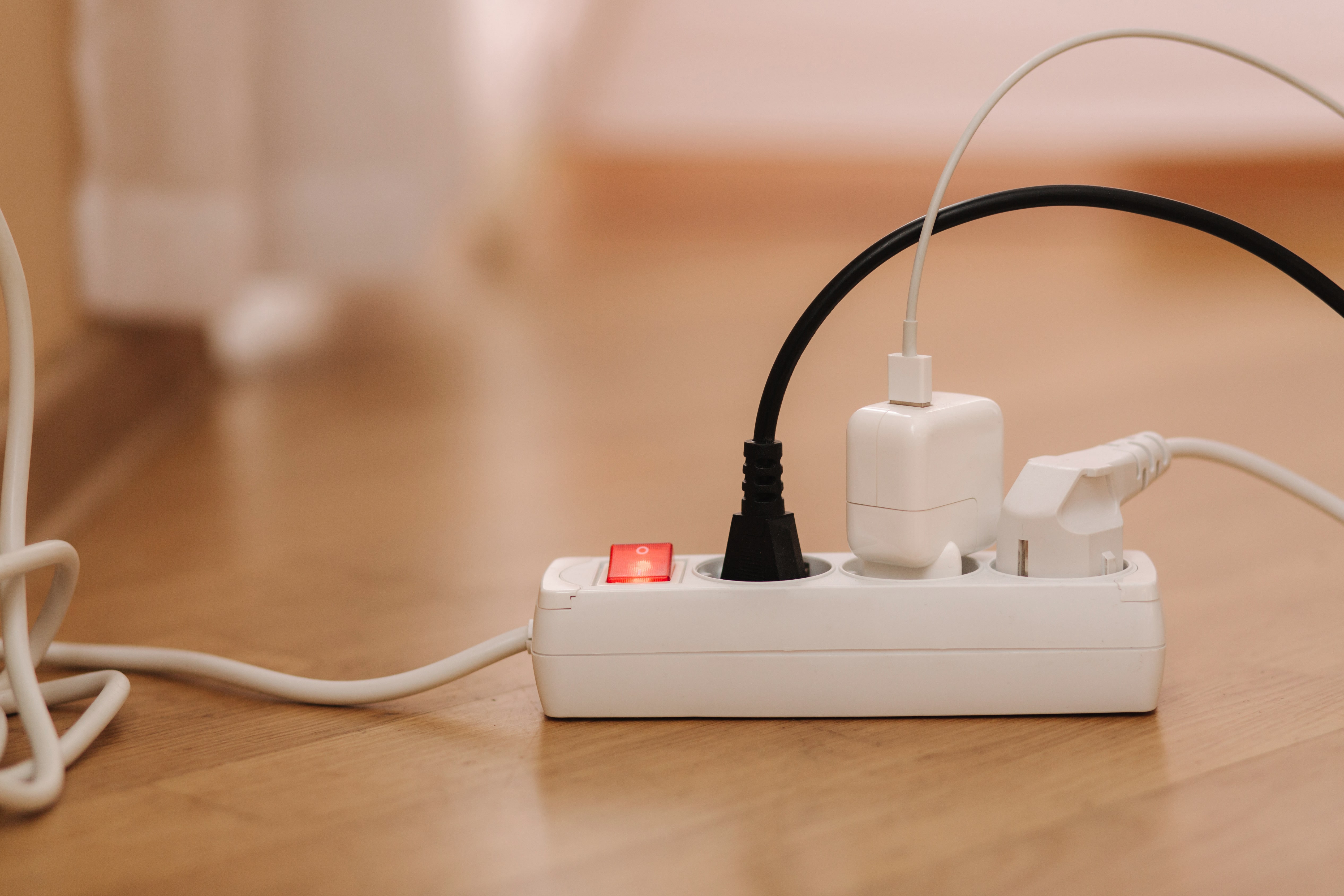

4. Phantom Power: Standby Energy Waste and Its Remedy

Many electronic devices and appliances continue to consume power even when they're turned off, a phenomenon known as “phantom load”.

Unplug devices when they're not in use, or use power strips with an on/off switch to make it easier to cut power to multiple devices at once.

Combat this by using smart power strips, like the Belkin Conserve Switch or the TP-Link Kasa Smart Wi-Fi Power Strip, which can cut power to your electronics when they're not in use.

5. Insulation Improvements: A Barrier to Energy Loss

A well-insulated home is more energy-efficient, comfortable, and quiet. It can also cut your energy bill by up to 20%. Check your attic, external walls, and any basement or crawl spaces to ensure they are properly insulated.

Johns Manville and Owens Corning offer excellent insulation solutions.

Additionally, consider weatherstripping doors and sealing windows to prevent air leaks. A product like the Duck Brand Heavy-Duty Weatherstrip Seal can help ensure airtight doors and windows.

Making your home more energy-efficient might require a small investment upfront, but the potential savings on your energy bill are more than worth it.

Start with the area where you can make the most impact and work from there. Here's to more savings and a greener planet!