Security Feels Shaky

Retirement planning sounds straightforward on paper. Save money, stop working, enjoy life. But thousands of middle-class Americans discover too late that they missed something important as their nest egg cracks under pressure.

Relying Only On A Pension

The stark reality that pensions and Social Security typically replace just 40–60% of pre-retirement income underscores a critical vulnerability in single-source retirement planning. This significant income gap becomes especially precarious when faced with unexpected costs, policy changes, or institutional insolvency, making income stream diversification essential.

Underestimating Healthcare Costs

Many folks mistakenly assume Medicare will fully shield them from healthcare costs in retirement, but reality tells a different story. From unexpected prescription charges to uncovered dental procedures, out-of-pocket expenses mount steadily with age. These overlooked costs can severely drain retirement savings.

Not Adjusting Lifestyle After Retirement

The transition from earning to retirement often reveals a surprising financial reality: expenses rarely decline as dramatically as expected. While paychecks shrink, the cost burden stubbornly persists across multiple categories, from essential healthcare expenses to discretionary spending on travel and leisure activities, catching many retirees off guard.

Failing To Diversify Investments

Research from the Alliance for Lifetime Income says that retirees who concentrate their savings in a single asset class are walking a financial tightrope. Whether it's keeping too much in cash or failing to age-adjust investment mixes, this lack of diversification leaves middle-class retirees vulnerable to market volatility.

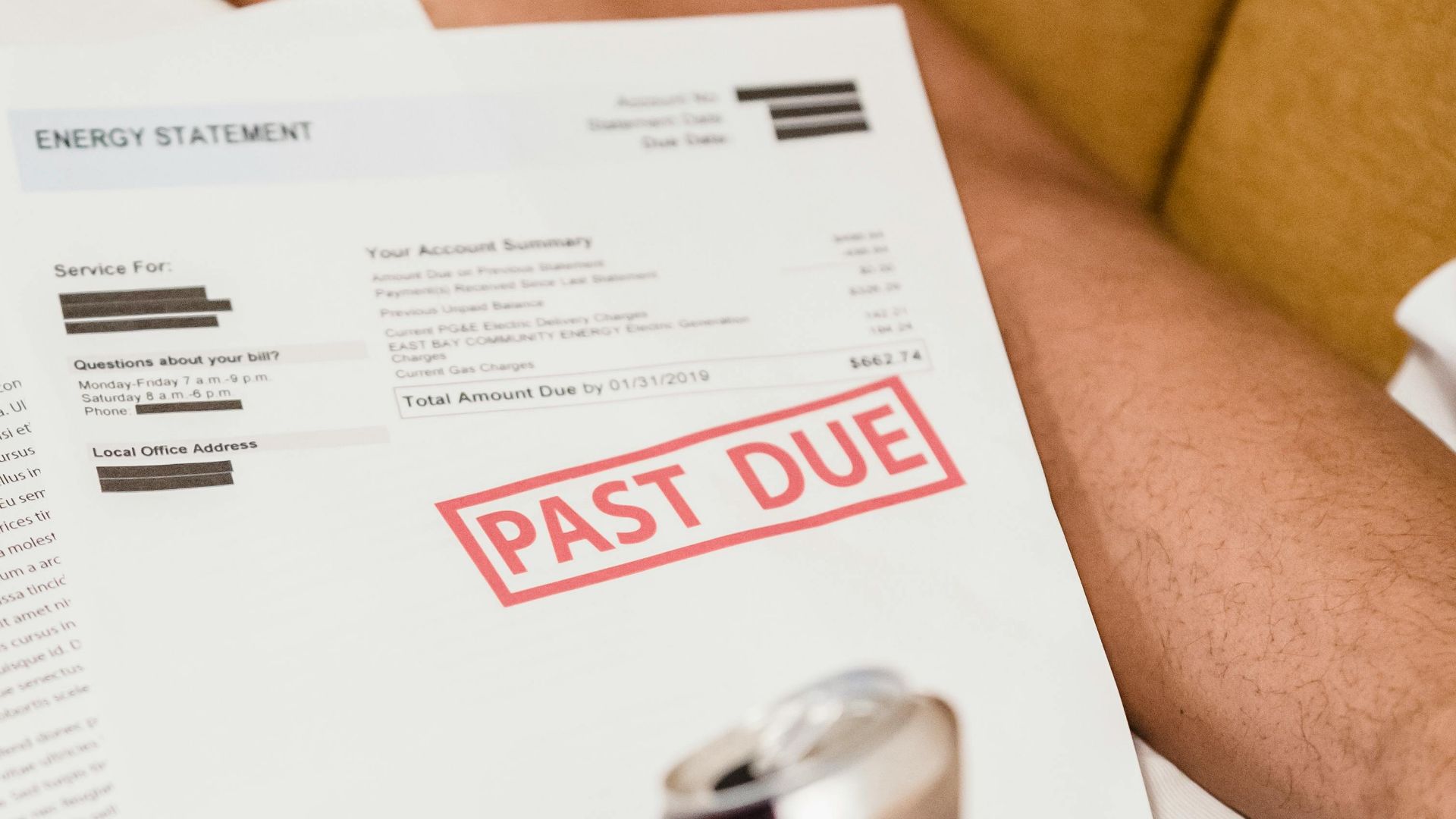

Carrying Debt

Interest rates harbor a deceptive power in retirement, silently converting manageable debts into financial quicksand when regular paychecks cease. For lower-middle-class boomers, seemingly sustainable mortgages and credit card balances can rapidly snowball, steadily draining limited savings and undermining financial resilience.

Supporting Adult Children Financially

A startling number of retirees jeopardize their financial security by continuing to support adult children well into retirement years. From covering monthly rent payments to managing student loan debt and handling emergency expenses, this pattern of assistance depletes retirement savings that should be preserved for essential healthcare.

Photo By: Kaboompics.com, Pexels

Photo By: Kaboompics.com, Pexels

Ignoring Inflation’s Impact

The ripple effects of overlooking inflation in retirement planning cascade through retirees' financial futures with devastating precision. What starts as a simple planning oversight triggers an annual decline in purchasing power, forcing middle-class retirees to downgrade their standard of living steadily.

Poor Tax Planning

Tax experts consistently warn that such withdrawals are a minefield of costly mistakes, with many retirees facing shocking tax bills that drain their savings faster than anticipated. When multiple income streams collide without proper planning, higher tax brackets can impact retirement income.

Not Having Long-Term Care Insurance

Long-term care insurance stands as a critical shield protecting retirement dreams, yet it remains surprisingly overlooked by middle-class Americans. This vital coverage helps safeguard against one of retirement's most devastating financial threats: nursing home costs exceeding $100,000 annually, which can drain decades of savings.

“Too Good To Be True” Investment Schemes

When the SEC reports billions in annual losses to senior investment fraud, it reveals a troubling reality. Retirees face depleted savings and mounting costs for healthcare, travel, and family support, making them prime targets for sophisticated scams. Financial literacy gaps leave many vulnerable to Ponzi schemes.

Over-Investing In Real Estate

Many retirees view real estate as a stable cornerstone of their retirement, only to discover a more complicated reality. Their dream of property-based security gradually erodes as maintenance costs, insurance payments, and property taxes steadily drain resources. Such over-concentration in real estate can severely restrict access to cash.

Failing To Downsize Early

When retirement dollars can stretch twice as far in certain regions, staying put in an oversized home in a high-cost area creates a double financial burden. Beyond draining savings through relentless maintenance, utilities, and property taxes, this reluctance to downsize early leaves retirees with reduced cash flow.

Neglecting To Update Financial Plans

Financial advisors warn that retirement strategies must evolve through regular updates, yet many middle-class retirees disregard this guidance by treating their plans as permanent documents. This failure to adapt leads directly to outdated expense projections and misaligned strategies that ignore mounting healthcare costs, inflationary pressures, and shifting personal circumstances.

Starting Retirement Savings Too Late

The cascade of financial pressures facing middle-class Americans—from unexpected emergencies to mounting debt and daily expenses—frequently forces early withdrawals from retirement accounts, severely undermining compound growth potential. This pattern helps explain why nearly half of households have less than $65,000 saved.

Photo By: Kaboompics.com, Pexels

Photo By: Kaboompics.com, Pexels

Early Withdrawals

A staggering one-third of middle-class workers resort to early retirement account withdrawals, which is a troubling pattern of financial strain. While these premature distributions offer quick relief for emergencies and daily expenses, they trigger a double blow of taxes and penalties for those under 59.

Photo By: Kaboompics.com, Pexels

Photo By: Kaboompics.com, Pexels

Social Security Assumptions

The precarious state of middle-class retirement planning has reached a critical point, with nearly half having minimal savings set aside. This shortfall becomes more alarming since Social Security replaces just 40% of pre-retirement income, far below the 70–80% experts say is needed.

LEONARDO DASILVA, Wikimedia Commons

LEONARDO DASILVA, Wikimedia Commons

Ignoring Estate And Will Planning

Many middle-class retirees find estate planning overwhelming or confusing, leading them to push it aside for “someday”.This hesitation often results in outdated beneficiary designations and neglected legal documents, setting the stage for costly complications and family disputes. Yet thoughtful estate planning offers a practical way to minimize taxes.

Technology And Scams Awareness

Limited retirement savings and outdated technology skills create a dangerous vulnerability for today's retirees. As cybercriminals deploy increasingly advanced online scams, older adults' lack of digital literacy makes them prime targets, especially when combined with financial anxieties stemming from modest nest eggs averaging just $66,000 for middle-class households.

Overspending On Hobbies

Leisure activities in retirement draw a complex financial matrix. Travel expenses multiply with increased free time, hobby pursuits expand to fill open schedules, and entertainment costs compound across more frequent outings. These discretionary spending categories exceed retirees' initial estimates, requiring careful tracking and predetermined limits.

Vidar Nordli-Mathisen, Unsplash

Vidar Nordli-Mathisen, Unsplash

No Passive Income/Part-Time

Beyond financial necessity, part-time work during retirement offers valuable social connections that enrich daily life. Yet many people overlook how combining these engaging opportunities with passive income streams, such as rental properties and dividend investments, creates a comprehensive approach that protects against unexpected costs and enables greater lifestyle flexibility.

No Emergency Fund

Those who build emergency funds navigate retirement's uncertainties with resilience, while those without face stark consequences: 28% resort to 401(k) loans for emergencies, and 21% for credit card debt. Where prepared households weather financial shocks steadily, unprepared retirees see their savings rapidly eroded by medical bills.

Photo By: Kaboompics.com, Pexels

Photo By: Kaboompics.com, Pexels

Neglecting Spousal Financial Education

Financial advisors consistently warn against the precarious practice of single-spouse financial management, citing heightened risks of exploitation, poor decision-making, and instability in retirement. Research demonstrates that couples who jointly understand household finances are better equipped to handle transitions like illness or widowhood.

Failing To Account For Longevity

As the "Peak 65" generation emerges as America's largest-ever wave of retirees, the financial implications are profound. 40% of middle-class Americans fear outliving their savings and investments. This widespread concern is validated by data showing retirees consistently underestimating their longevity, prompting a notable shift toward annuities.

Trusting Friends/Family With Investments

Financial advisors unanimously caution against entrusting investment decisions to friends or family members, citing the dangerous mix of emotional ties and financial judgment. This professional consensus is backed by SEC warnings about affinity fraud, where informal investment schemes exploit trusted relationships.

No Risk Tolerance With Age

A critical retirement planning misstep occurs when investors maintain aggressive portfolios without adapting to age-related changes in risk tolerance. This oversight leaves retirees dangerously exposed to market volatility during their most vulnerable years, when recovery time is limited. Proper retirement security demands regular portfolio reassessment.