How They Actually Do It

Turns out, the best things in life really are free—or close enough. Those who’ve mastered frugal living prove that creativity and contentment cost a lot less than you’d think. Some rules may be unconventional, but they work.

Cook All Meals At Home Using Bulk Staples

A stocked pantry is a money-saver’s best friend. Bulk staples like beans, rice, and oats cost little yet feed you for days. Home-cooked food tastes better and lasts longer. Every reused ingredient keeps more dollars in your wallet and less waste in the bin.

Downsize To A Smaller Apartment Or Shared Room

Big spaces feel nice until rent day arrives. Moving into a compact spot—or splitting one—cuts expenses faster than any coupon. Smaller rooms mean fewer utilities and less upkeep. For every square foot you skip paying for, it becomes steady breathing room in your budget.

Cut All Streaming Subscriptions

Subscriptions sneak up like small leaks in a tire. And canceling them feels liberating, not limiting. Free platforms or library movies fill the gap just fine. This way, entertainment shifts. That quiet monthly charge you erase quickly turns into grocery or gas money.

Use Public Transportation Exclusively

Each bus ride adds up to serious savings in several ways. First, you don’t pay for insurance or oil changes. Second, no parking tickets or fees leaking from your frugal budget. Public transit is frugal living’s hidden gem because it's predictable and environmentally friendly.

Shop Only At Discount Grocery Stores

Walking into a discount market feels like stepping into a secret club. Here, prices drop and options widen. Shoppers who plan meals from store deals spend less without giving up quality. All receipts you trim prove food budgeting is more math than magic.

Grow Basic Herbs Or Vegetables Indoors

Sunlight, soil, and patience are your ticket to free flavor. Windowsill basil, mint, cilantro, or scallions grow easily with minimal care. Fresh herbs enhance any dish while trimming grocery runs. Indoor gardening teaches thrift through practice, turning every harvest into a small, tasty win for your wallet.

Use Free Community Resources Like Libraries And Wi-Fi

Libraries quietly replace half your paid subscriptions because it’s community money well spent and yours to use. Free books, fast Wi-Fi, streaming access, and even workshops live under one roof. Many frugal folks treat the library as their co-working space—and their budget loves it.

Batch Cook And Freeze Meals

Cooking once, eating many times—it’s the oldest trick in a frugal kitchen. Large portions save energy and prevent midweek takeout cravings. Frozen leftovers taste freshly made when reheated properly. Freezers become financial safety nets, keeping homemade food ready long after the stove cools.

Buy Secondhand Clothes And Household Items

Secondhand is seasoned. The beauty is that you can get everything, from quality jackets to vintage lamps, often for less than new items. Thrift stores and yard sales reveal treasures hiding in plain sight. The thrill lies in scoring value where others saw clutter, and this stretches dollars creatively.

Negotiate Rent Or Utilities With Landlords/Providers

Renters who ask for renewal discounts or bill adjustments often succeed. Providers value steady payments more than new customers. So, in that regard, keep records, stay polite, and request your negotiations in writing. Real savings frequently start not with spending less, but speaking up.

Use Cash Envelopes For Budgeting

There’s power in paper. Label envelopes for all expenses and fill them with exact cash. Once the envelope’s empty, that category stops. Physical money makes spending real again—no tapping, no drifting—and that simple discipline helps many stay firmly under their monthly cap.

Cancel Gym Memberships And Exercise Outdoors

Fresh air beats fluorescent lights any day. You can walk trails or use outdoor fitness zones for bodyweight routines that build strength without gear for zero dollars. You also save on fees and commute time, proving that the best workouts often happen beneath open skies.

Learn Simple DIY Home Or Clothing Repairs

A loose button or dripping tap doesn’t need a service call. The remedy is learning basic fixes that save you hours and cash. YouTube tutorials even make it effortless. Once you patch your own jeans or reseal a leaky faucet, all repaired items feel like money earned, not spent.

Use Minimal Electricity—Air-Dry Clothes, Unplug Devices

Why pay for something you can get free? Take, for instance, laundry. Here, you can hang clothes by a window or outside on a windy or sunny day. When it comes to other electronics, charge items only when needed, and let daylight do the lighting. Small power habits turn into yearly savings.

Avoid Dining Out Entirely

Restaurant meals vanish fast—money and all. Home-cooked food keeps flavor high and prices low. Prepping lunches, brewing coffee, or hosting potlucks lets you keep social life alive without receipts piling up. A single avoided dinner out can equal a week of groceries.

Use Meal-Sharing Or Food-Rescue Apps

Apps now connect locals who trade extra meals or claim unsold food from cafes. Delicious dishes find new homes instead of dumpsters. Users cut grocery costs drastically, while businesses reduce waste. It’s modern frugality that helps both sides stay full.

Take Advantage Of Local Free Events For Entertainment

Concerts in the park or trivia nights—most towns host them for free. Checking city calendars replaces pricey nights out. Entertainment doesn’t have to drain savings when the community already funds it. Locals in the know fill weekends without spending a dime.

Find Side Gigs Or Barter For Services

A few weekend hours can reshape your budget. Babysitting, dog walking, tutoring, or mowing lawns add flexible income streams. Bartering—trading skills for food, rides, or repairs—still thrives in small communities. The modern side hustle isn’t about greed; it’s about independence and financial breathing space.

Reuse Containers And Eliminate Disposables

Old jars and tins have second lives. They first store leftovers. Then, they hold supplies and replace organizers you’d otherwise buy. Households that reuse daily see trash shrink and savings climb. Frugality often hides in the recycling bin, waiting to be discovered.

Buy Generic Brands Only

Brand labels charge for reputation, not ingredients. Generic products often come from the same factories as premium ones. Shoppers who compare packaging codes spot this secret. Choosing store brands slashes grocery bills by up to a third while keeping shelves stocked with the same essentials.

Limit Phone Plan To Basic Talk And Text

Switching to a basic talk-and-text plan instantly trims costs. Free Wi-Fi handles streaming and apps when needed. A stripped-down plan feels lighter and perfectly functional for staying connected without the monthly shock of overage fees.

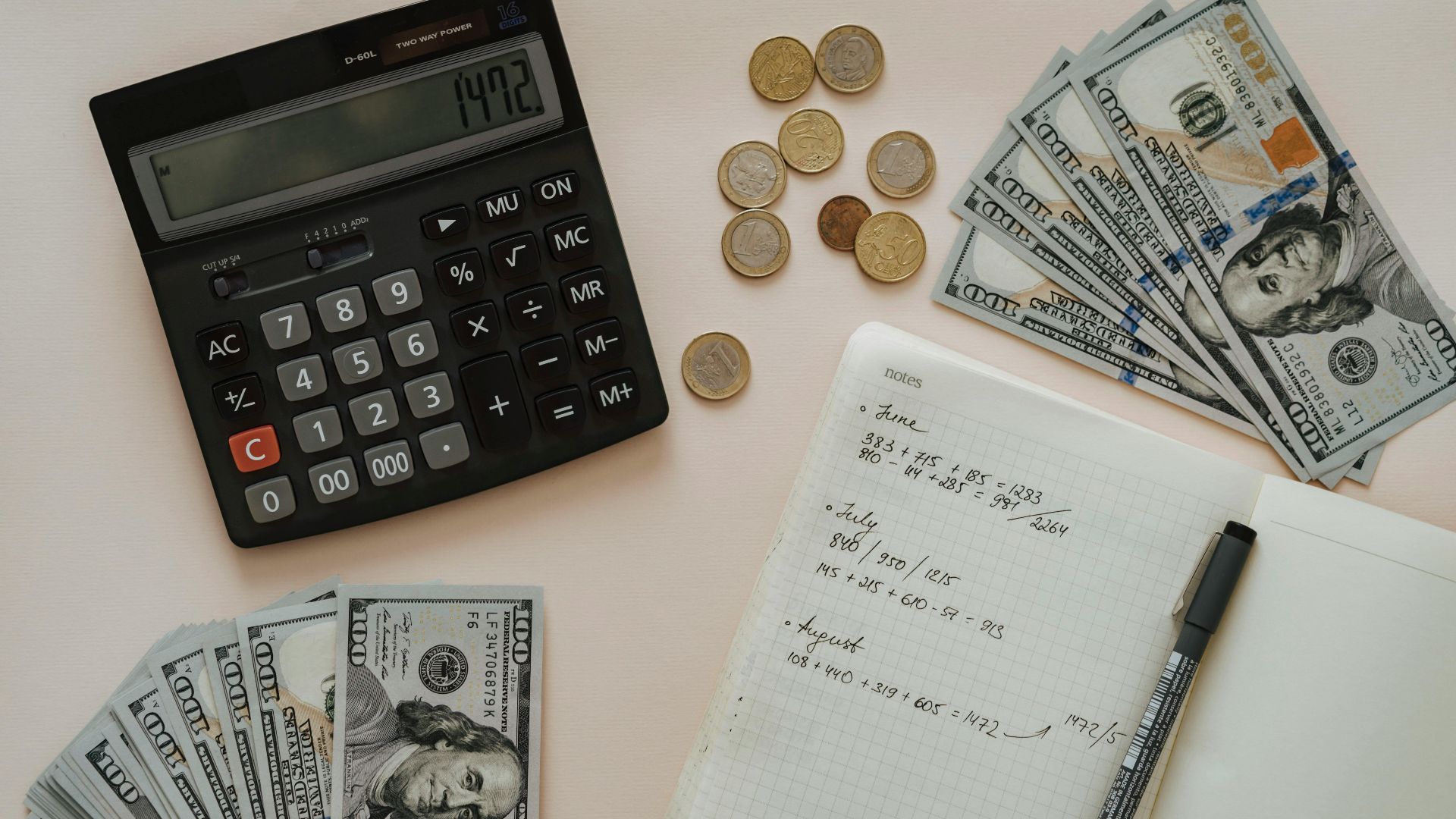

Track Every Expense Daily

Write it down or log it—every cent counts. Recording expenses forces awareness and stops impulse buying in its tracks. Even small entries reveal spending patterns over time. Consistent tracking transforms your wallet into a map, showing exactly where to tighten or ease.

Share Utilities With Roommates

Splitting bills stretches budgets in half without much effort. Shared water, Wi-Fi, and electricity reduce the bite of monthly costs. Smart households set up clear payment routines early. Such cooperative living is financial teamwork that keeps everyone’s share predictably low.

Reduce Water Usage Strategically

Using water consciously makes surprising differences. Water bills drop fast when routines shift slightly. Installing inexpensive aerators or leak fix kits adds even more savings. Conservation-minded renters often notice double benefits—lower costs and fewer maintenance calls.

Explore Curbside Finds

Furnished doesn’t have to mean fancy. Many neighborhoods offer free curbside treasures on move-out weekends. Most of the time, these pieces just need minor touch-ups. With a little sanding or paint, discarded furniture becomes unique decor, and those savings stay where they belong: in your pocket.