Troubled Inheritance

Your dad added you to his bank account—but now he’s gone, and the family is divided. Suspicion swirls, and emotions are louder than reason. You can’t rewrite the past, but you can choose how to respond to it. These steps will help you protect yourself and move forward clearly.

Take A Moment To Understand Their Perspective

It may feel unfair, but your sibling’s anger often begins in confusion, not calculation. Losing a parent is emotionally disorienting, and when money enters the picture, grief can quickly harden into suspicion. That’s why it’s essential to pause and consider how things might look from their side before responding.

Recognize That Grief Often Clouds Financial Judgment

During mourning, people may interpret financial arrangements as secretive or self-serving. A joint account—though legal—can appear like a private favor rather than a planning tool. Emotions can distort facts, which is precisely why clarity and tone become key when you explain what happened.

Avoid Jumping To Defend Yourself Immediately

Saying “That’s not true!” right away may sound more like a denial of guilt than an assertion of honesty. Quick defenses can fuel the belief that something’s being hidden. Instead, take a moment to breathe and let your thoughts settle so your response is grounded in facts, not frustration or panic.

Let Each Sibling Speak Without Interrupting

Resisting the urge to interject shows restraint, which in turn earns trust. Mediators often recommend allowing everyone to express themselves, even if it’s not always fair or equitable. Listening without pushing back helps lower emotional heat and increases the chance they’ll hear you when it’s your turn.

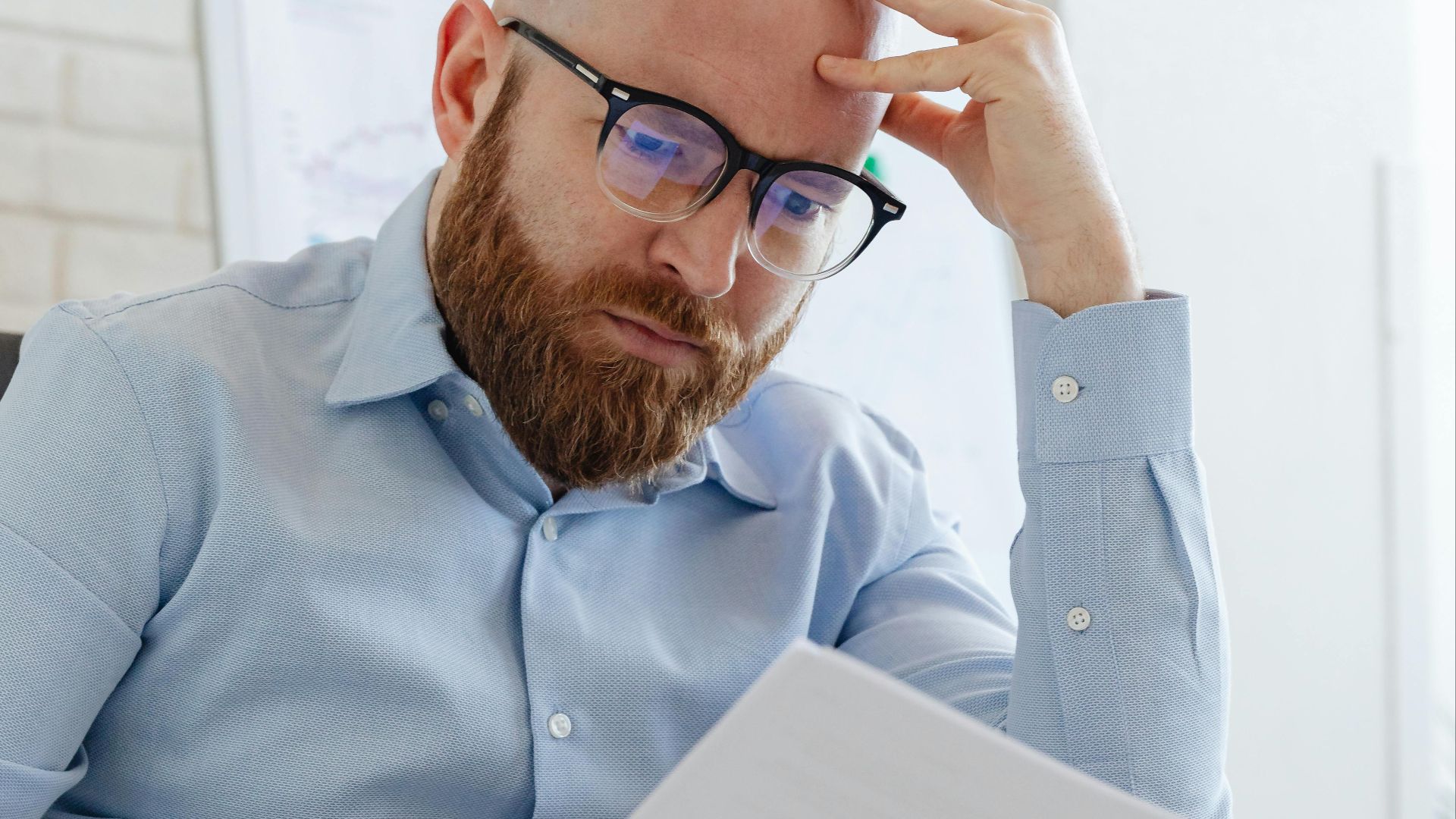

Photo By: Kaboompics.com, Pexels

Photo By: Kaboompics.com, Pexels

Hold Off On Sharing Paperwork Too Early

The instinct to clear your name with documents is strong, but releasing records too soon can have unintended consequences. If emotions are high, facts can get twisted into evidence of wrongdoing. It’s wiser to wait until everyone is calm or guided by a neutral party before presenting anything.

Photo By: Kaboompics.com, Pexels

Photo By: Kaboompics.com, Pexels

Start Making A Timeline Of Account Changes

Before tensions rise or legal questions start flying, take a moment to begin drafting a timeline, as clarity begins with the basics. Note the date your name was added, and then connect each significant transaction with your father’s involvement. That single timeline can clarify what words often complicate.

Focus On Facts, Not Family Roles

Courts don’t consider who was closest to your father or who spent the most time with him. What matters is what was signed and when it was signed. Stay focused on documented actions because emotional attachments do not carry legal weight when ownership is in dispute.

Check Whether The Account Had Right Of Survivorship

The right of survivorship allows the surviving account holder to inherit the funds directly. This bypasses probate, a court-supervised process for validating wills and distributing assets. However, since not all joint accounts include this feature, you must confirm if your father’s account has it.

Understand That Joint Ownership Overrides The Will

Even if your father’s will says all assets should be split evenly, a joint account with the right of survivorship typically isn’t governed by that. It passes directly to the surviving owner. Many people are unaware that a will and a joint account can legally conflict with each other.

Look At How The Account Was Titled On Bank Documents

“Joint owner” isn’t the same as “authorized signer”. The account’s titling matters more than what anyone remembers or assumes. Request the bank to provide official account documents. Whether it says “joint tenant with right of survivorship” or something else will directly impact how the funds are viewed legally.

Find Out Whether The Account Was Funded Only By Your Dad

One key detail that courts examine is the source of the money; if your father deposited every dollar, that weighs heavily in your favor. On the other hand, if you also added funds, that can complicate things. Trace each deposit using statements before the account is questioned.

Know That State Laws Vary On Joint Account Ownership

Find out what your state presumes about joint accounts because this one detail can change everything. While some jurisdictions treat them as tools of convenience, others assume full shared ownership. Your legal footing shifts depending on where your father lived and how the law sees it.

Speak To An Attorney Specializing In Estates And Trusts

Estate law doesn’t always follow what feels reasonable, and assumptions can lead to costly mistakes. An experienced attorney can explain how the rules apply to your situation and help you avoid unintended consequences before emotions or misinformation exacerbate the problem.

Ask If A ‘Constructive Trust’ Could Be Imposed

Even if the account lists you, a court might rule the money belongs to the estate if your father’s intent isn’t clear. A constructive trust can help protect your claim by preventing others from keeping property that was clearly meant for you, even without a formal agreement.

Request The Original Account Application Details From The Bank

When the account was created or later modified, your father signed forms indicating how it should be handled, and those forms are essential. Since banks keep these on file, request a copy. Compared to memories or conversations, written instructions typically carry far more legal weight.

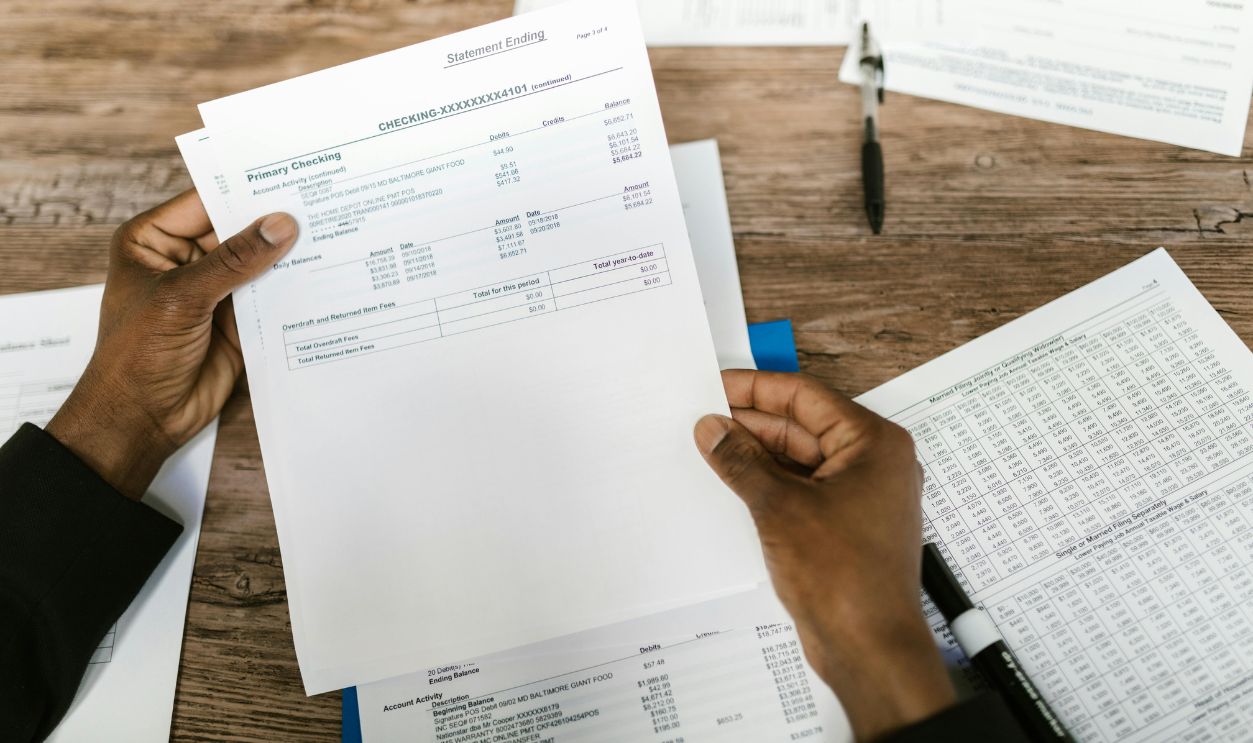

Get Copies Of Account Statements From The Past Few Years

If the account saw regular activity, then the statements will reveal who was using it and for what purpose. Because courts and mediators rely on patterns to understand intent, those withdrawals—if they match your father’s known expenses—can quietly reinforce your position without you needing to explain.

Identify Who Opened The Account And Who Was Added Later

Now that you’ve reviewed the original application form from the bank, take a closer look at when your name was added. If the timing aligns with a significant life event—such as declining health or estate planning—it may reveal exactly why your father made that decision. Kindel Media, Pexels

Kindel Media, Pexels

Document Any Notes Or Letters Left By Your Dad

Even a short note scribbled in a drawer can carry weight, but only if its origin is verified. Courts often check handwriting and context. If your dad’s writing style or signature matches known records, that note is a win. Depending on the entries, it could clarify his intent more than assumptions ever could.

Find And Review The Will Or Living Trust Documents

When a will or trust aligns with your version of events, it becomes powerful supporting evidence. Even if the account skips probate, those documents can still provide insight; they may mention the account directly or reflect your father’s intentions in a way that supports your explanation.

Look For Financial Power Of Attorney Forms Signed Before Passing

If you had power of attorney before your father passed, it’s essential to know when it started and what it covered. These forms are proof that he trusted you to manage his affairs, especially if they were created near the time the account changes occurred.

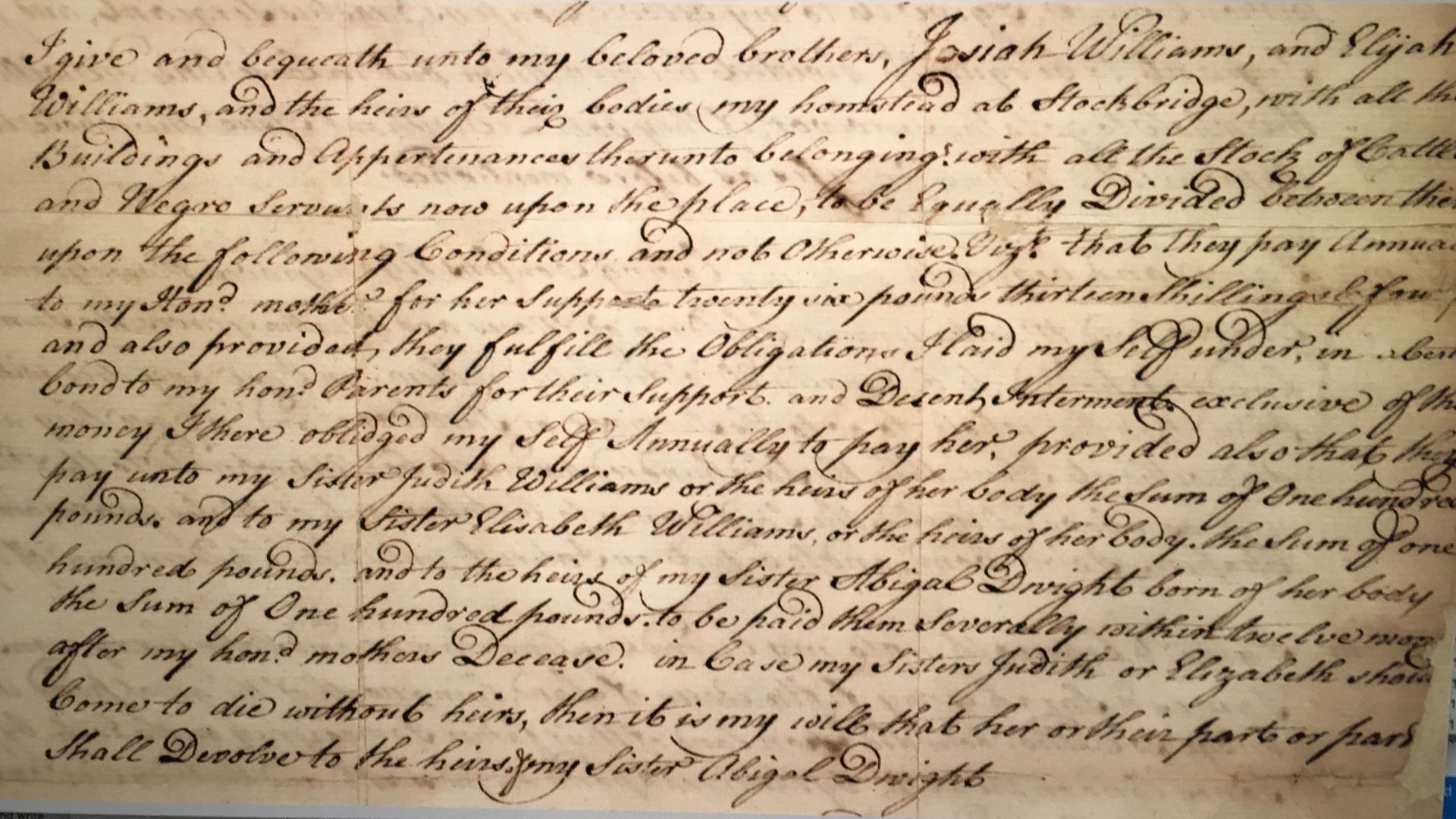

James D. Sims, Wikimedia Commons

James D. Sims, Wikimedia Commons

Preserve Every Financial Record And Don’t Alter Anything

As accusations swirl, it can be tempting to clean up files or toss what feels irrelevant. Don’t. Every document, whether a statement or an email, could become important. Even unintended edits can raise questions. Maintaining integrity strengthens your credibility when you are challenged.

Describe The Account’s History In Detail

Your calm explanation can make a difference when emotions run high, as people often trust steadiness over a reaction. So, walk them through how the account worked during your father’s life and why your name was added. Avoid uncertain details because clarity often builds more trust than emotion.

Stick To Your Involvement And What You Know

If you didn’t know your father’s full intent, say so without guessing. Courts value honesty more than unverified confidence. That’s why it’s important to speak only about what you experienced firsthand. The moment you start interpreting others’s thoughts, your credibility becomes easier to question.

Mention Why You Think Your Dad Added You

You may never know the whole reason, but offering context matters. Did he want you to help pay bills, or was he trying to avoid probate? Point to any habits or conversations that show consistency. Intent, even if informal, helps explain decisions that now seem controversial.

Photo By: Kaboompics.com, Pexels

Photo By: Kaboompics.com, Pexels

Avoid Statements That Sound Like Blame Or Guilt

Defensiveness can turn neutral observers against you. Avoid phrases like “It wasn’t my idea” or “I didn’t ask for it”. Instead, speak with clarity. Try, “I handled what I was asked to” or “He made this choice—my role was to follow through”.

Use Simple Language That Can’t Be Twisted

Long or technical explanations can often be confusing, primarily during tense conversations. So, it’s better to use clear and straightforward language. For example, instead of saying something formal, say, “My dad added me to help with bills,” because plain words leave little room for misunderstanding or misinterpretation.

Avoid Playing Mediator Yourself

Trying to fix everything on your own might seem noble, but it rarely works. When you’re involved in a conflict, others often see you as biased. Let the family speak, and avoid positioning yourself as the one who needs to smooth things over.

Let A Lawyer Or Mediator Speak On Your Behalf If Needed

When conversations feel tense or unproductive, letting someone neutral step in can shift the tone. A lawyer or mediator focuses the discussion on facts instead of emotions. They can reframe accusations in practical terms and prevent personal tensions from clouding the legal issues at hand.

Propose A Family Meeting With A Neutral Agenda

Create a written agenda that outlines what each sibling wants to discuss, and share it in advance. This maintains the structure’s neutrality and focus. Then, propose a family meeting where everyone has the opportunity to speak so that things don’t escalate into personal or emotional conflict.

Offer Access To Your Records Voluntarily

Instead of waiting to be asked, you can take the lead by offering documents—bank statements, emails, texts, or anything relevant. Doing this shows you’re not hiding anything, but timing is key. Wait until the group is calm and ready to receive the information without jumping to conclusions.

Acknowledge Their Emotions Without Agreeing With Their Accusations

You can say, “I understand this is upsetting”, and still avoid admitting guilt. Because recognizing pain doesn’t mean you caused it, this approach lowers tension while allowing you to stand firm. And when people feel heard, they are more likely to listen to your side as well.

Be Clear About What You’re Willing To Discuss

Not every question deserves an answer. You’re allowed to set boundaries when assumptions are flying. Say what you’re open to talking about, and gently redirect anything unfair or speculative. The less you overshare, the fewer details can be twisted into something they’re not.

Ask If They’d Agree To Mediation Before Going To Court

If conversations continue to go in circles, then it’s time to propose a mediator. Because trained professionals often help resolve disputes before lawyers get involved. This route is also less expensive and less damaging. And if your siblings resist, explain that mediation ensures everyone has a chance to be heard.

Get Legal Protection Before You’re Forced Into A Corner

Legal guidance is more straightforward to arrange early than to patch things up after harm is done. If the tension continues to rise, don’t wait for a formal warning. An attorney can intervene to protect your rights and handle communication before a conflict escalates into a legal issue.

Don’t Communicate Without A Lawyer If Things Turn Hostile

Sometimes, things may grow tense, and even a brief message can be misinterpreted and used out of context. That’s why, once hostility surfaces, it’s safer to pause and let your lawyer handle the communication. This prevents misunderstandings from snowballing into evidence that can be used against you.

Keep A Record Of All Accusations And Your Responses

An ongoing record builds a timeline, and if tensions rise, it can help protect you during legal or family disputes. To do this, create a digital or physical file to track every accusation and your responses over time. Be sure to include dates and any communication involved.

Refuse To “Buy Peace” With Money You Were Given Legally

Giving away money you’re legally entitled to can be seen as guilt, and that can complicate your position further. Hold your ground unless a legal ruling or agreement tells you otherwise. While offering a payout may seem like a quick fix, it often sends the wrong message.

Refuse To “Buy Peace” With Money You Were Given Legally (Cont.)

Once money is handed over, it’s nearly impossible to undo the gesture or reset expectations. Others may begin to assume you had something to hide all along. Instead, redirect the conversation toward documentation and facts so that any outcome rests on evidence, not appeasement.

Prepare For Court, But Stay Focused On Facts, Not Revenge

If legal action seems likely, organize your documents and review your story carefully. Courts don’t decide based on who is more upset—they rule on what is proven. By focusing on the facts, you protect your case and avoid being drawn into emotional arguments.

Ask Yourself What You Wish Had Been Done Differently

Regret often surfaces when estate plans are unclear, and that’s why it helps to reflect on what might have prevented this conflict. Whether it was more transparent communication or better tools like trust, these lessons can help you avoid repeating this pattern when it comes to your offspring.

When It’s Your Turn, Use Transfer-On-Death Accounts Or Trusts Instead

Transfer-on-death (TOD) accounts enable you to name a person who will receive the funds directly upon your passing, thereby bypassing probate. Since ownership stays with you until you pass and the beneficiary is listed in advance, this method helps prevent confusion and legal conflict.

Talk Openly With Your Own Family About Your Plans

Estate surprises often lead to broken trust. So, have conversations while everyone is calm and listening. Provide your reasoning and be ready to respond to any inquiries. A clear talk now, even if it feels awkward, is far better than confusion or resentment when it’s too late.

Let Go Of Blame That Isn’t Yours To Carry

You can’t control how others process loss or interpret decisions, especially when grief meets long-standing resentment. If you’ve acted in good faith, stop replaying their accusations in your head. The burden isn’t always yours to carry, and clarity often starts by letting go of that weight.

Trust That Time And Truth Will Eventually Align

Family conflict can make it harder to see the facts, particularly at the beginning. However, as time passes and documents are reviewed, clarity often follows. That’s why it helps to stay steady and patient—because even if minds don’t change quickly, truth usually finds its way through.