Maximize Your Savings

Paying property taxes feels separate from doing taxes. It isn’t. The connection shows up later, buried in forms and choices that affect what you owe or keep at the end of the filing process.

Nataliya Vaitkevich, Pexels, Modified

Nataliya Vaitkevich, Pexels, Modified

Understanding Deductions

Property tax deductions let homeowners subtract what they pay to local governments from their federal taxable income. Think of it as the IRS acknowledging you're already supporting public services like schools and roads. This isn't automatic money back—it reduces your taxable income.

Basic Requirements

Here's the deal: your property taxes must be based on your home's assessed value and charged uniformly across your community. The revenue needs to fund general public welfare, not specific services like trash collection or water delivery. You can only deduct taxes you actually paid during that tax year.

Who Qualifies

Homeowners who itemize deductions on Schedule A qualify for this tax break. You must own the property when taxes were assessed and actually pay them during the tax year. Renters typically don't qualify unless they're paying property taxes directly as part of their lease agreement.

Itemization Required

You face a choice every tax season: take the standard deduction or itemize. For 2026, the standard deduction sits at $16,100 for singles and $32,200 for married couples filing jointly. Your property taxes, mortgage interest, charitable donations, and medical expenses combined must exceed these amounts to make itemizing worthwhile.

Standard Deduction

Calculating whether to itemize requires honest math about your total deductions. Add up your property taxes, state income taxes, mortgage interest, and charitable contributions. If this sum falls below your standard deduction amount, you're leaving money on the table by itemizing.

Nataliya Vaitkevich, Pexels, Modified

Nataliya Vaitkevich, Pexels, Modified

SALT Cap

The state and local tax deduction, which is nicknamed SALT, combines property taxes with either state income or sales taxes. Since 2018, this total had been capped at $10,000 annually for most filers, or $5,000 if married filing separately

2025 Changes

Major relief arrived in 2025 when the One Big Beautiful Bill Act quadrupled the SALT cap to $40,000 for most taxpayers. This temporary increase applies through 2029, rising one percent annually. However, high earners with modified adjusted gross income exceeding $500,000 face a phasedown.

Income Limits

The new SALT cap doesn't apply equally to everyone. If your modified adjusted gross income hits $500,000 as a single filer or married filing separately at $250,000, the deduction begins phasing out. For every dollar above this threshold, your available deduction shrinks by thirty cents.

Primary Residences

Your main home qualifies for the full property tax deduction up to the SALT cap. This includes houses, condominiums, co-ops, mobile homes, and even houseboats with proper facilities. The IRS doesn't care about square footage or property value.

Second Homes

Owning a vacation cabin or beach house will not disqualify you from deducting property taxes. The IRS allows deductions for one primary residence and one additional home, provided both meet the standard requirements. Your total property taxes from both homes still fall under the $40,000 SALT cap for 2026.

Esteban Santiago Gonzalez, Pexels

Esteban Santiago Gonzalez, Pexels

Vacation Properties

The IRS draws a sharp line at fourteen days when classifying vacation homes. Rent your property fewer than fifteen days annually, and that income remains completely tax-free. Cross that threshold, though, and you're in mixed-use territory where personal days versus rental days determine your deductions.

Rental Properties

Everything changes when your property becomes a rental. Property taxes shift from itemized personal deductions to business expenses reported on Schedule E, completely bypassing the $40,000 SALT cap. You'll deduct taxes alongside mortgage interest, insurance, repairs, utilities, and depreciation against your rental income.

Mixed-Use Rules

Split your time between personal enjoyment and rental income? The IRS requires mathematical precision. Calculate the percentage of days used personally versus rented, then apply that ratio to every expense, including property taxes. Rent your beach house for 200 days and use it personally for thirty days.

Business Properties

Commercial real estate operates under different rules from residential property. If you own office buildings, retail spaces, warehouses, or land used for business purposes, property taxes become ordinary business expenses with zero caps. Report these on Schedule E for sole proprietors or appropriate business tax forms for corporations.

Escrow Accounts

Here's where homeowners commonly stumble. You can't deduct escrow payments, only actual tax payments made to authorities. Your monthly mortgage payment includes estimated property taxes held by your lender, but that money remains yours until the servicer pays your local government.

Payment Timing

The IRS follows strict cash-basis accounting for property tax deductions. Only taxes actually paid between January 1 and December 31, 2025, count on your 2025 return, regardless of what tax year they cover. Prepaying December 2026's installment in 2025 won't work.

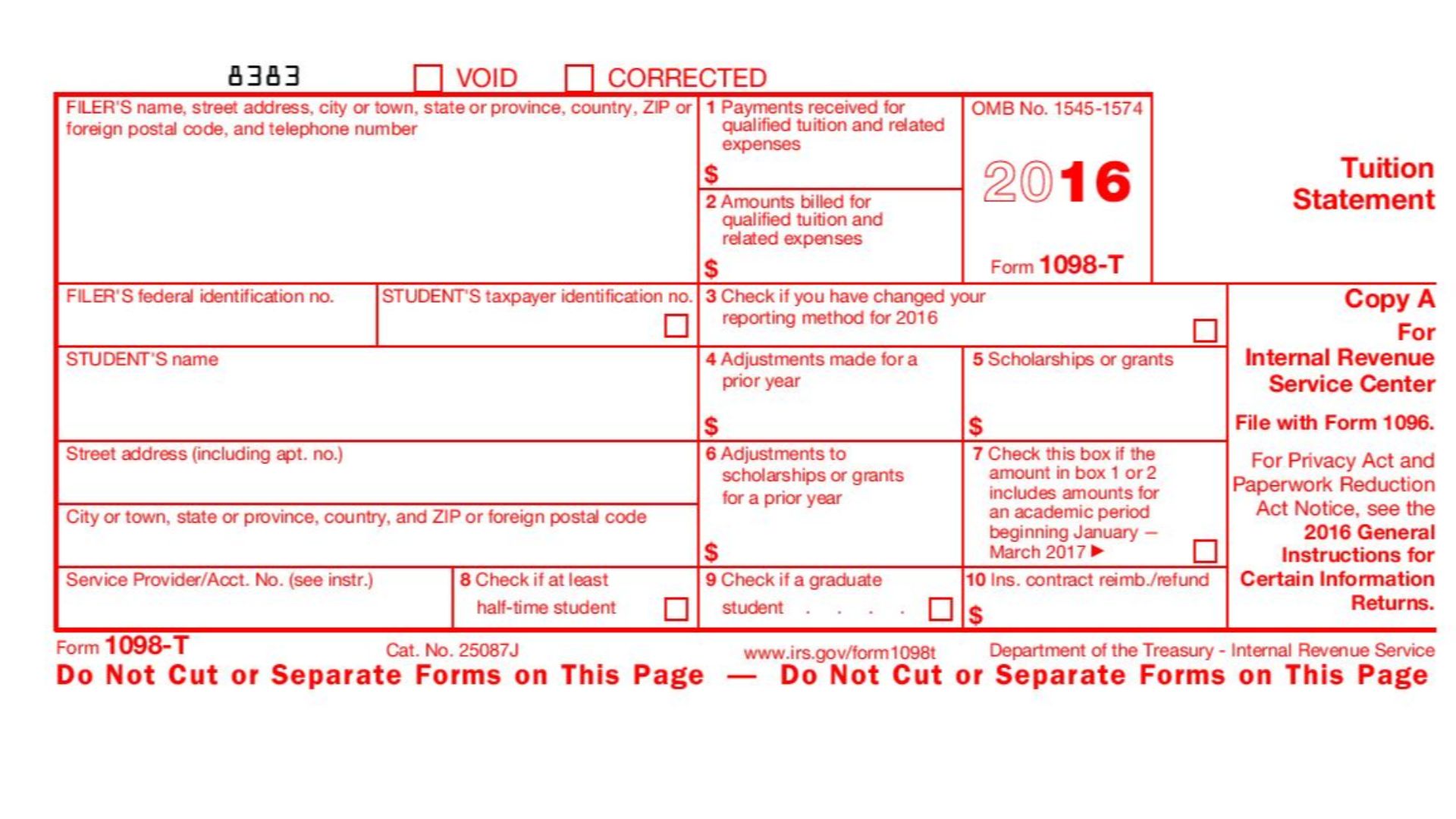

Form 1098

Every January, mortgage servicers send Form 1098, which summarizes the previous year's mortgage interest and property taxes paid from escrow. Box 10 specifically shows property taxes, though it's informational only. No 1098? You'll need cancelled checks, bank statements, or tax bills proving payment to the tax authority.

Documentation Needed

Beyond Form 1098, keep your property tax bills, payment receipts, escrow analysis statements, and closing documents from home purchases. When buying or selling mid-year, settlement statements show prorated tax allocations between buyer and seller, as both parties can deduct their respective portions.

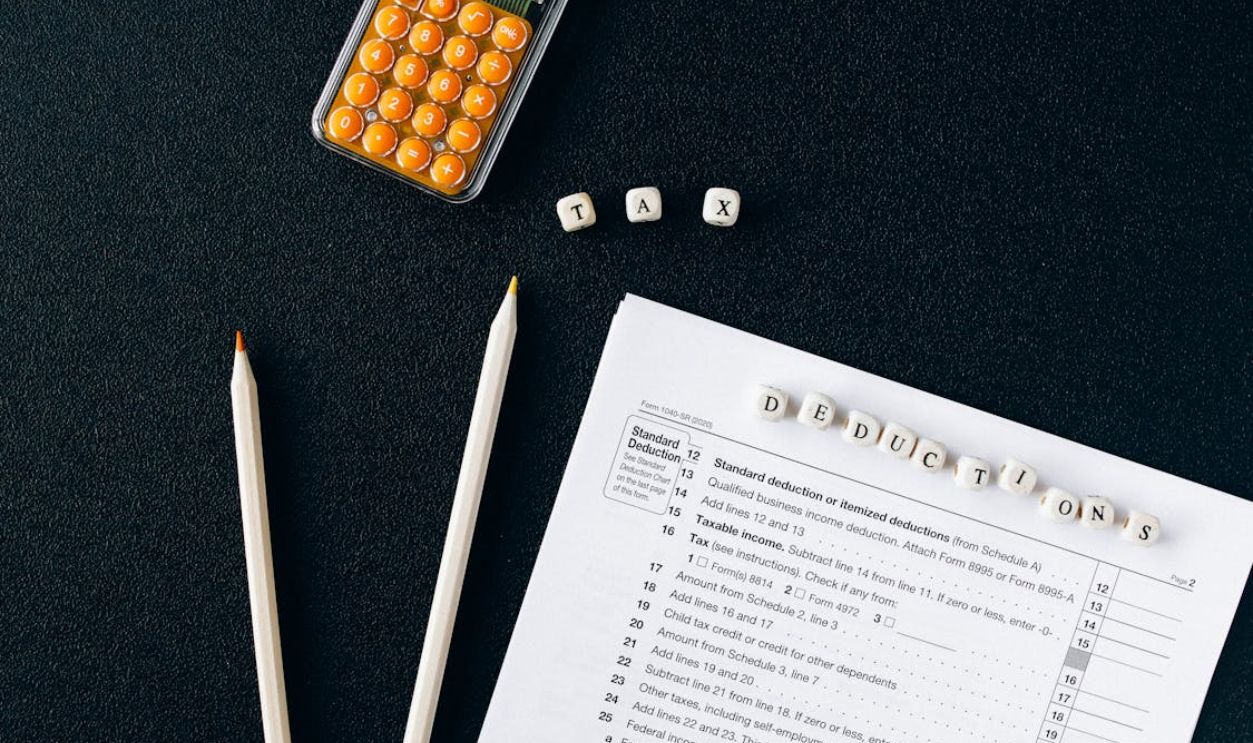

Karolina Grabowska www.kaboompics.com, Pexels

Karolina Grabowska www.kaboompics.com, Pexels

Non-Deductible Items

Not everything on your property tax bill qualifies as a deduction. Charges for specific services like trash collection, water, sewer, or street cleaning aren't taxes even if billed by your municipality. Special assessments for new sidewalks, street paving, or sewer line installations increase your home's value.

Assessment Exceptions

However, ongoing maintenance assessments do qualify. If your city charges for repairing existing sidewalks, maintaining current sewer systems, or paying interest on bonds for completed infrastructure, those portions are deductible. The distinction hinges on whether the charge creates new value or maintains existing infrastructure.

HOA Fees

Homeowners association fees never qualify as property tax deductions, even when they feel just as mandatory. The IRS treats HOA dues as payments for private services. However, if your HOA assessment statement includes a line item for actual property taxes paid on common areas, that specific portion may be deductible.

Closing Costs

Sellers typically prepay property taxes covering the full year, but you're reimbursing them for the period you'll own the property. That reimbursement counts as property taxes you paid, deductible immediately, even though the seller actually sent money to the tax authority months earlier.

State Variations

Texas has no state income tax but astronomical property taxes, making the SALT cap particularly punishing. California's Proposition 13 caps assessment increases at two percent annually, keeping longtime homeowners' taxes artificially low. New Jersey and Illinois residents face some of the nation's highest effective rates.

Maximizing Savings

Strategic timing can optimize deductions, though the IRS limits this tactic. If you're borderline between itemizing and taking the standard deduction, bunching deductions into alternate years makes sense. Some folks pay two years of property taxes in one year (January and December installments), then skip paying in the following January.