Lifelong Coverage

Social Security was meant to offer peace of mind. In reality, it’s a patchwork of advantages, oversights, exemptions, and fine print. Most don’t learn the rules until they’ve lost money or their precious time.

Beyond Retirement Program

Your neighbor's 8-year-old daughter receives a monthly Social Security check. Sounds impossible, right? The truth is that it's not only possible—it happens to around 4.8 million children across America whose families depend on Social Security income, according to the SSA in May 2025.

Beyond Retirement Program (Cont.)

Most people think Social Security equals retirement, but that's like saying a smartphone is just for making calls. The program provides disability insurance to 90% of working Americans under 65, survivor benefits to families who've lost breadwinners, and spousal benefits as well.

Vitalii Vodolazskyi, Shutterstock

Vitalii Vodolazskyi, Shutterstock

Statement Error Epidemic

Imagine your Social Security statement shows zero earnings for three years, even though you were working full-time. A similar scenario potentially affects many Americans who have errors in their earnings records, based on GAO reports, eventually costing them thousands in retirement benefits.

Photo By: Kaboompics.com, Pexels

Photo By: Kaboompics.com, Pexels

Statement Error Epidemic (Cont.)

Your security benefits are calculated utilizing your highest 35 years of earnings, so missing or incorrect data directly impacts your monthly check. The Social Security Administration processes over 250 million earnings reports annually, and with that volume, mistakes happen more than you'd expect.

Overpayment Recovery Surge

July 2025 brought an unwelcome surprise for nearly 2 million Social Security recipients: the agency began withholding 50% of their monthly checks to recover overpayments. This dramatic increase from the previous 10% rate has left many seniors struggling to pay rent and buy groceries.

Overpayment Recovery Surge (Cont.)

The Social Security Administration paid out $72 billion in improper payments between 2015 and 2022, crafting a $23 billion recovery backlog by 2023. What makes this harsh is that 73% of overpayments result from agency errors, not recipient fraud. Beneficiaries must repay every dime.

Trust Fund Reality

Everyone's talking about Social Security "going broke" by 2034. Well, here’s what the headlines miss: even if the trust fund empties completely, you'd still receive 81% of your scheduled benefits. That's because Social Security operates on a pay-as-you-go system where current workers fund current retirees.

Trust Fund Reality (Cont.)

The trust fund peaked at $2.908 trillion in 2021 and has been declining since. It is currently at about $2.7 trillion. Apparently, the "crisis" stems from demographics, not financial mismanagement. As baby boomers retire en masse, we're shifting to just 2.8 workers per retiree today.

Benefit Withholding Changes

Here's a policy whiplash that would make your head spin. In March 2024, Social Security cut down overpayment recovery to a gentle 10% of monthly benefits. By March 2025, they'd cranked it back up to 100% for new cases, then "compromised" at 50% by summer.

Benefit Withholding Changes (Cont.)

This roller coaster mirrors broader political tensions about fiscal responsibility versus human compassion. Under the Trump administration's efficiency drive, Acting Commissioner Lee Dudek, working alongside Elon Musk's Department of Government Efficiency, justified the brutal recovery rates as necessary stewardship of taxpayer funds.

Social Security Administration, Wikimedia Commons

Social Security Administration, Wikimedia Commons

Staff Reduction Impact

Remember when you could call Social Security and actually reach a human being? Those days are swiftly disappearing as the agency prepares to slash its workforce from 57,000 to 50,000 employees through buyouts, retirements, and layoffs. Safe to say the cuts come at the worst possible time.

ANTONI SHKRABA production, Pexels

ANTONI SHKRABA production, Pexels

Staff Reduction Impact (Cont.)

Social Security's 74 million beneficiaries are already experiencing record wait times and service disruptions. The agency has quietly removed wait time information from phone systems and stripped down its online performance data, making it nearly impossible to track how bad the delays have become.

Early Claiming Costs

Deciding to start Social Security benefits at 62 out of eagerness to enjoy retirement could cost you approximately $300,000 (mid-range estimate). That, too, over your lifetime, compared to waiting until the full retirement age of 67. Early claiming permanently reduces your advantages by up to 30%.

Early Claiming Costs (Cont.)

That reduction follows you for life. If your entire retirement age benefit would be $2,000 per month, claiming at 62 reduces it to around $1,400—a $600 monthly difference that compounds over decades. The Social Security Administration's actuaries assume most people will live to around 84.

Service Access Decline

What if you had to spend four hours on hold trying to report a spouse's death to Social Security, only to have the call disconnected? Yes, that's terrible. When you finally get in touch three days later, you learn the delay will affect your survivor benefits processing time.

Service Access Decline (Cont.)

This scene plays out daily as Social Security's customer service infrastructure continues to crumble. While officials tout their online portal's "0-minute wait time," nearly 40% of Social Security recipients are over 75, a demographic that often struggles with digital services.

Working While Claiming

The Social Security "earnings test" might sound scary, but it's actually a temporary benefit deferral that ultimately increases your lifetime payments. Many people tend to avoid working after claiming early benefits, not realizing they're missing out on additional income opportunities.

Working While Claiming (Cont.)

If you claim before your retirement age and earn over $23,400 annually (2025 limit), Social Security conceals $1 in benefits for every $2 you make above that threshold. Also, those "lost" benefits aren't actually lost—they're recalculated into higher monthly payments once you hit full retirement age.

Divorced Spouse Benefits

Did you know you can demand Social Security benefits based on your ex-spouse's earnings record? Even if they remarried and you remained single, it could boost your monthly income by hundreds of dollars. The key requirements are surprisingly simple.

Divorced Spouse Benefits (Cont.)

These include: your marriage lasted at least 10 years, you're currently unmarried, you're at least 62, and your ex-spouse is eligible for benefits (even if they haven't claimed yet). What's remarkable is that your ex-spouse never knows you're claiming on their record, and it doesn't affect their benefits.

Photo By: Kaboompics.com, Pexels

Photo By: Kaboompics.com, Pexels

Survivor Benefit Strategies

When your spouse dies, you don't automatically receive their full Social Security benefit. But, with the right strategy, you might end up with more money than either of you ever received individually. Understand that survivor benefits and your retirement benefits operate independently.

Survivor Benefit Strategies (Cont.)

Widows and widowers can claim reduced survivor payments as early as age 60 (or 50 if disabled), then switch to their own higher retirement benefit at 70 if it's larger. Alternatively, you can demand your own reduced benefit first and switch to the full survivor benefit later.

Do-Over Options

Social Security offers something almost unheard of in government programs: a complete do-over. If you claimed benefits early and later regret that decision, you have exactly 12 months to withdraw your application and start fresh as if you never claimed at all.

Do-Over Options (Cont.)

The catch is substantial. You must repay every dollar you received, including any spousal or dependent benefits paid on your record. However, for those who can afford it, this reset button can be worth tens of thousands of dollars in higher lifetime opportunities.

Photo By: Kaboompics.com, Pexels

Photo By: Kaboompics.com, Pexels

Benefits Are Taxable

Federal income tax may be applied to Social Security income, and since 1984, the thresholds have remained unchanged. Suppose your "combined income" crosses $25,000 as a single filer or $32,000 filing jointly, you'll owe taxes on up to 50% of your benefits.

Benefits Are Taxable (Cont.)

The taxation becomes even more punitive at higher income levels, exceeding $34,000 (single) or $44,000 (joint), and up to 85% of your benefits become taxable. These limits were never indexed for inflation, meaning middle-class retirees increasingly find themselves paying taxes on advantages they thought were tax-free.

State Tax Variations

Interestingly, moving to the right state could save you thousands per year on your Social Security benefits. As of 2025, only nine states still tax Social Security benefits, down from 13 just a few years ago, as states recognize the burden this places on retirees.

State Tax Variations (Cont.)

Kansas, Missouri, and Nebraska recently joined the majority of states that don't tax Social Security, while West Virginia plans to phase out its tax by 2026. The states still taxing benefits are Colorado, Connecticut, Minnesota, Montana, New Mexico, North Dakota, Rhode Island, Utah, and Vermont.

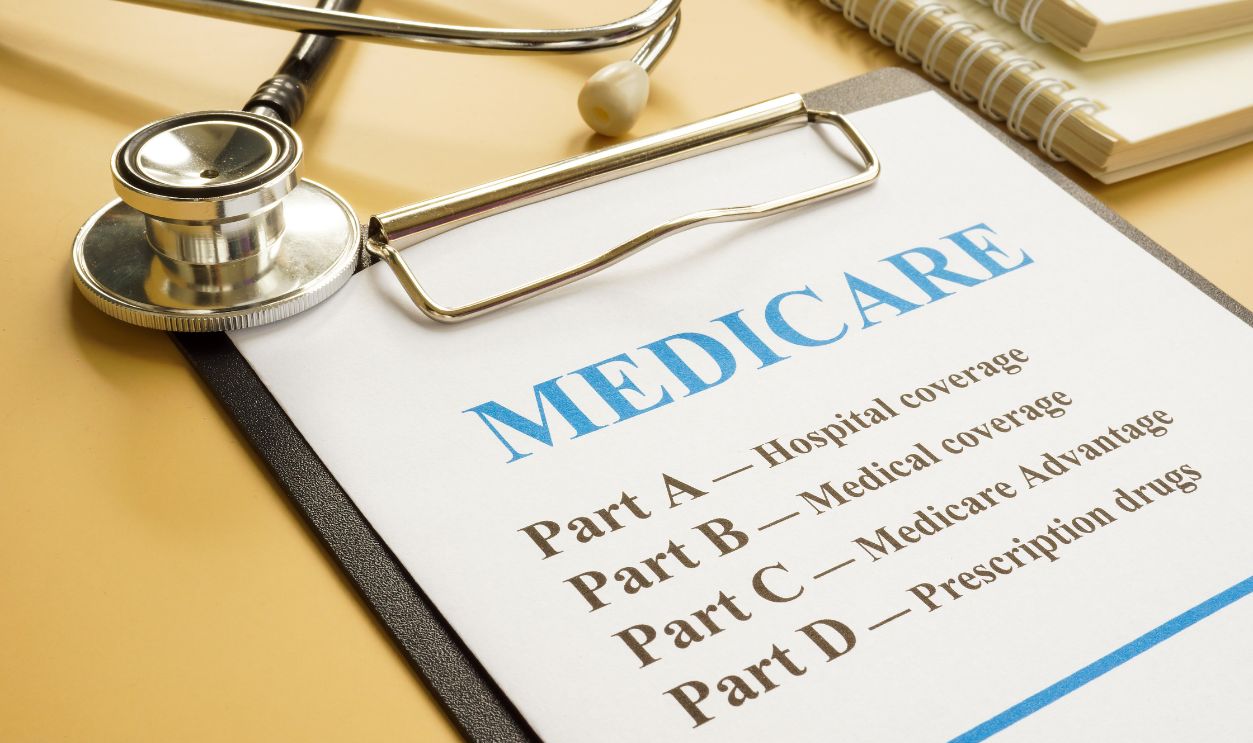

Medicare Premium Deduction

Your Social Security check might be smaller than you calculated because Medicare Part B premiums are automatically deducted before you even get to see any dollars. In 2025, the standard Part B premium is $185 monthly, which comes straight out of your Social Security benefit.

Vitalii Vodolazskyi, Shutterstock

Vitalii Vodolazskyi, Shutterstock

Medicare Premium Deduction (Cont.)

This automatic deduction can create a painful squeeze, especially when Medicare premiums increase faster than Social Security's cost-of-living adjustments. In some years, the entire amount increase gets eaten up by higher Medicare premiums, leaving beneficiaries with no net gain despite an official “raise”.

Maximum Benefit Cap

Even if you're a high earner, there's a ceiling on how much security you can receive. The maximum monthly support for an individual retiring at full retirement age in 2025 is $4,018. It doesn't matter how much you collected above the taxable wage cap throughout your career.

Maximum Benefit Cap (Cont.)

This cap exists because Social Security only taxes earnings up to $176,100 in 2025. Anything above that amount doesn't contribute to your future benefits. The system is structured to replace a higher percentage of income for lower earners, resulting in a lower return for high earners.

Adult Disability Benefits

Folks who become disabled before age 22 can receive these advantages for life based on their parents' work record, even if the parent is still working. These "disabled adult child" benefits continue indefinitely as long as the disability persists, providing financial support for families facing caregiving responsibilities.

Adult Disability Benefits (Cont.)

The program covers severe disabilities that began before the person's 22nd birthday and prevent substantial gainful activity. These advantages can start when the parent retires, becomes disabled, or dies—whichever comes first. The disabled adult child can even marry another disabled beneficiary without losing benefits.

Government Pension Offset

If you worked for a government employer and didn't pay Social Security taxes, your spousal or survivor Social Security benefits could be reduced or eliminated entirely through the Government Pension Offset (GPO). This rule reduces its benefits by two-thirds of your government pension amount.

Andrii Yalanskyi, Shutterstock

Andrii Yalanskyi, Shutterstock

Government Pension Offset (Cont.)

Imagine you receive a $1,500 monthly government pension, your Social Security spousal benefit would be reduced by $1,000 monthly. If your spousal benefit were $800, the GPO would cut it completely. This offset affects teachers, police officers, firefighters, and other public employees.

Remarriage Rules

Getting married after age 60 won't do anything to your survivor benefits, but remarrying earlier could cost you a lot in Social Security income. Sadly, this age-based rule gives rise to complex decisions for widows and widowers considering new relationships.

Remarriage Rules (Cont.)

If you remarry before age 60, you lose eligibility for survivor benefits from your deceased partner. However, you may still qualify for spousal benefits based on your new spouse's record. The survivor benefit might be higher, especially if that spouse was a high earner.

Appeal Rights

Social Security decisions aren't final, even though they often feel that way. You have 60 days to appeal any decision about your benefits, disability determination, or overpayment notice. Remember, the appeals process has multiple levels that can overturn initial choices. The first one is reconsideration.

Appeal Rights (Cont.)

Here, a different examiner reviews your case. If that fails, you can ask for a hearing before an administrative law judge, where approval rates are often much higher than initial decisions. Beyond that, you can appeal to the Appeals Council and eventually the federal court.

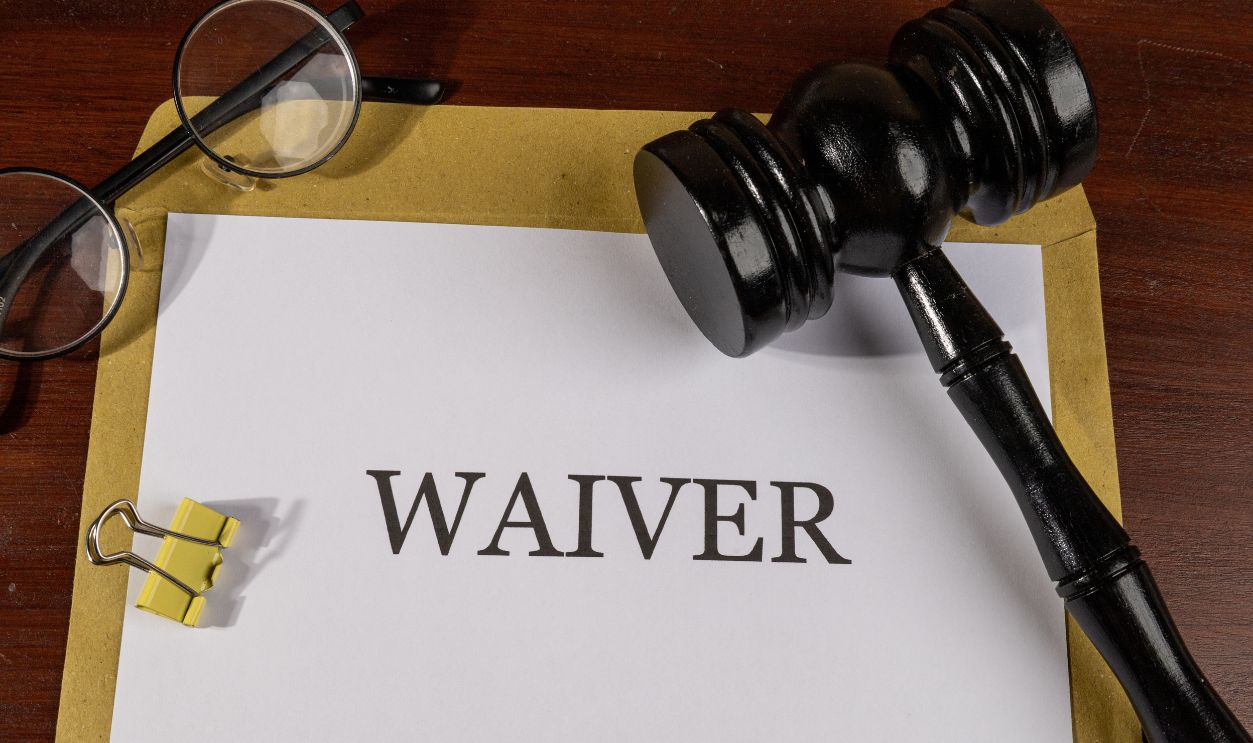

Waiver Options

Drowning in a Social Security overpayment notice when the mistake wasn't your fault? You might not have to pay back anything through the agency's waiver program. That's only if you can prove the overpayment resulted from agency error and repaying would cause financial hardship.

Waiver Options (Cont.)

The key is to act quickly and provide thorough documentation that will be accepted. For overpayments under $2,000, you can even request a waiver by phone at 1-800-772-1213. Success rates vary, but many people don't even know this option exists and simply accept repayment plans.

Future Funding Crisis

Congressional inaction guarantees a 19% benefit cut across the board in 2034—a mathematical certainty that politicians prefer to ignore rather than address. The Social Security trustees' latest report confirms this timeline, making it the most predictable crisis in American government history.

U.S. House of Representatives, Wikimedia Commons

U.S. House of Representatives, Wikimedia Commons

Future Funding Crisis (Cont.)

Politicians have four basic options: raise taxes, cut benefits, increase the retirement age, or eliminate the payroll tax cap on high earners. Each solution poll differs depending on who gets hurt, creating political paralysis. Meanwhile, current beneficiaries face uncertainty about their primary source of income.