Everyday money leaks

Financial stress doesn’t usually come from major purchases. As a matter of fact, it builds through routine spending that feels justified or even necessary when reality tells another story.

Daily Specialty Coffee Drinks

What harm could a cup of coffee do? A daily coffee run feels routine, but over a year, that habit can reach well into the thousands. Making coffee at home a few days a week preserves enjoyment while freeing money for savings or debt reduction.

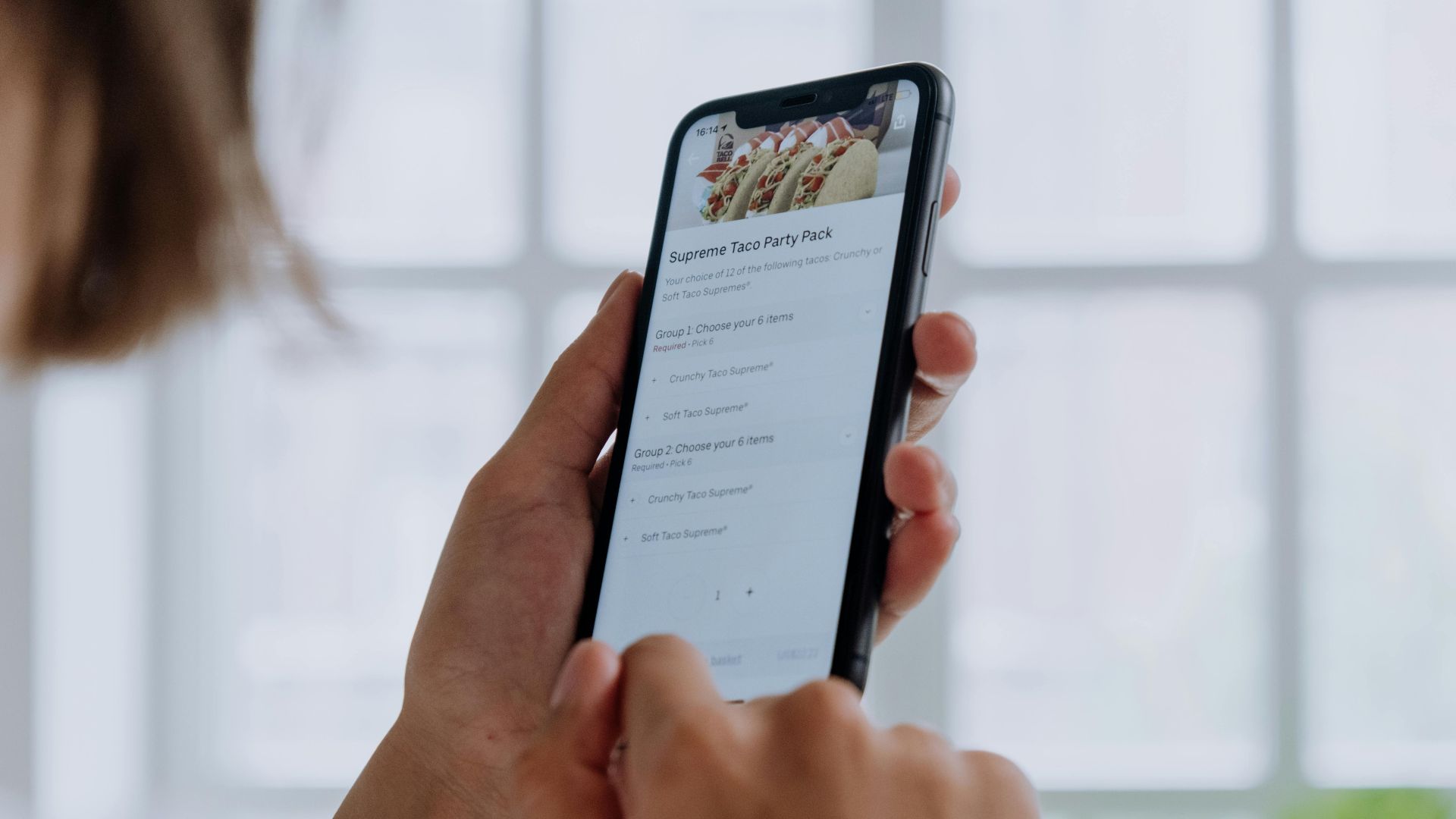

Food Delivery Apps

When you order food regularly, added service fees and tips can raise total costs by 30% or more, and these extras quietly strain budgets. Picking up orders or limiting delivery to busy days helps control spending without sacrificing flexibility.

Upgrading Smartphones Before They're Necessary

With all the social pressure, new smartphone releases tempt many to upgrade, even when their current devices function well. Annual upgrades can cost hundreds once financing, accessories, and higher insurance are included.

Buy Now, Pay Later Purchases

Buy now, pay later options make purchases feel painless by splitting costs into smaller payments. Research from the Consumer Financial Protection Bureau shows these plans encourage higher spending and missed payments. Used often, they complicate budgets, especially when multiple plans overlap monthly.

Unused Or Forgotten Subscriptions

Because subscriptions renew automatically, many go unnoticed for months. Streaming services, fitness apps, and digital tools often remain active despite little use. Reviewing bank statements and canceling unused plans can immediately recover money without affecting personal comfort.

Paying For Multiple Streaming Services At Once

Paying for several streaming platforms adds up quickly, even when each seems inexpensive alone. Many households regularly watch only one or two services, so rotating subscriptions or pausing them during busy periods maintains entertainment options without unnecessary monthly expenses.

Impulse Home Decor Or Organization Items

Impulse home decor and organization items promise instant improvement, but often solve temporary frustration. Decorative bins and gadgets accumulate unused. It’s recommended to pause before checkout and wait a day, as this can reduce clutter and spending.

Ordering Takeout Instead Of Cooking

On busy and long days, takeout often feels like a practical solution. Nevertheless, cooking regularly at home can save time and calories. Restaurant prices are inflated, and this weekly habit makes it harder to keep grocery budgets and long-term savings on track.

Extended Warranties And Protection Plans

Marketed as peace of mind, several consumer studies show that most extended warranties are never used. Many products already include manufacturer coverage or credit card protections. Skipping these add-ons can save money without increasing risk, especially for lower-cost electronics and household items.

Frequent Car Washes Or Detailing Upgrades

Taking care of your vehicle matters, but regular car washes and detailing packages often exceed practical needs. Moreover, monthly plans encourage frequent use regardless of condition. Over time, these upgrades add hundreds annually, competing with essential expenses like fuel and routine maintenance.

Using Ride-Hailing For Short, Routine Trips

Ride-hailing apps provide speed and comfort, but frequent use for short trips quickly outpaces public transit or driving costs. Fares fluctuate with demand, adding unpredictability. Reserving rides for late nights or emergencies helps reduce transportation spending without sacrificing safety over time for many households.

Premium Cable Or Channel Add-Ons

Adding a sports or movies package to your cable or channel subscriptions is usually forgotten, and most of these add-ons go unwatched after the initial excitement. These incremental upgrades quietly raise monthly bills, sometimes rivaling full streaming subscriptions, without delivering consistent value.

Convenience Store Snacks And Drinks

Snacks seem inexpensive, yet single servings carry significant markups compared with grocery prices. Frequent stops for drinks or packaged foods can quietly rival a weekly grocery bill. Keeping snacks on hand or buying multipacks reduces impulse spending and supports more predictable daily budgeting.

In-App Purchases And Microtransactions

Games and apps often rely on microtransactions designed to feel trivial. Individually small charges add up, especially when purchases bypass deliberate decision-making. Setting spending limits or disabling in-app payments helps users regain control without abandoning digital entertainment entirely for adults and children alike.

Frequent Fast Fashion Impulse Buys

Fast fashion brands offer trendy clothing at affordable prices, encouraging frequent impulse purchases. While each item seems affordable, quality often limits wear. Replacing clothes repeatedly increases annual spending. Buying fewer, better-made pieces can lower costs and reduce closet clutter over time for budget-conscious shoppers.

Coffee Shop Add-Ons Like Pastries Or Upgrades

Coffee shop add-ons like pastries and size upgrades often double the final bill. These extras might seem minor in the moment, but they repeat daily. Skipping add-ons occasionally or setting a weekly treat budget keeps spending intentional without removing small pleasures entirely today.

Premium Versions Of Free Apps

Many free apps frequently offer paid upgrades that promise efficiency or extra features. While useful for some, many premium plans duplicate tools users already have. Reviewing actual usage before subscribing prevents recurring charges for features that provide little everyday benefit.

Unused Gym Memberships

Most people pay for gym memberships with good intentions, but attend sporadically. Monthly fees continue regardless of use. Choosing pay-per-visit classes, at-home workouts, or pausing memberships during busy periods helps align fitness costs with realistic habits.

Frequent Small Amazon Purchases

Online shopping makes small purchases feel effortless, but frequent orders accumulate quickly. Free shipping thresholds and saved payment details reduce spending friction. Tracking monthly totals or batching orders encourages more intentional buying while still benefiting from convenience and competitive pricing.

Choosing Brand-Name Groceries Over Generics

Despite similar ingredients, brand-name groceries often cost more than store brands. Over time, consistently choosing familiar labels raises grocery bills without improving quality. Comparing unit prices and trying generics on staple items like rice, pasta, detergents, and canned goods can deliver noticeable savings.

Regular Salon Add-Ons

Routine grooming upgrades, such as frequent manicures or premium hair services, can quietly become fixed monthly expenses. Spacing appointments, choosing basic services, or learning simple maintenance at home helps preserve confidence while easing financial pressure.

Credit Card Interest On Small Rolling Balances

Carrying small credit card balances feels manageable, but interest charges accumulate monthly. Even modest amounts rolled over repeatedly cost far more than expected. Paying statements in full whenever possible prevents everyday purchases from becoming long-term financial drains.

Work-From-Home Meal And Drink Deliveries

Those who work from home don’t pay for commuting, but some don’t notice how this setup increases food spending. Frequent delivery of coffee, lunch, or snacks replaces packed meals with marked-up convenience. These habits blur work and home boundaries, quietly raising monthly expenses.

Replacing Items Instead Of Repairing Them

Many believe that replacing electronics or household items is often easier than repairing them. However, small repair costs are frequently far lower than replacement prices. Choosing fixes over replacements extends product life and reduces repeated expenditure.

Online Courses That Are Never Completed

Online courses promise skill growth and career progress, which makes enrollment feel productive. However, many purchases go unfinished as schedules shift or motivation fades. Paying for unused education ties up money in unrealized potential.