The Wealth Circles Of American Dynasties

Generational wealth is about influence and strategy. Although in some cases, money fades after a generation or two, some families managed to multiply their cash and influence, as per data from Business Insider.

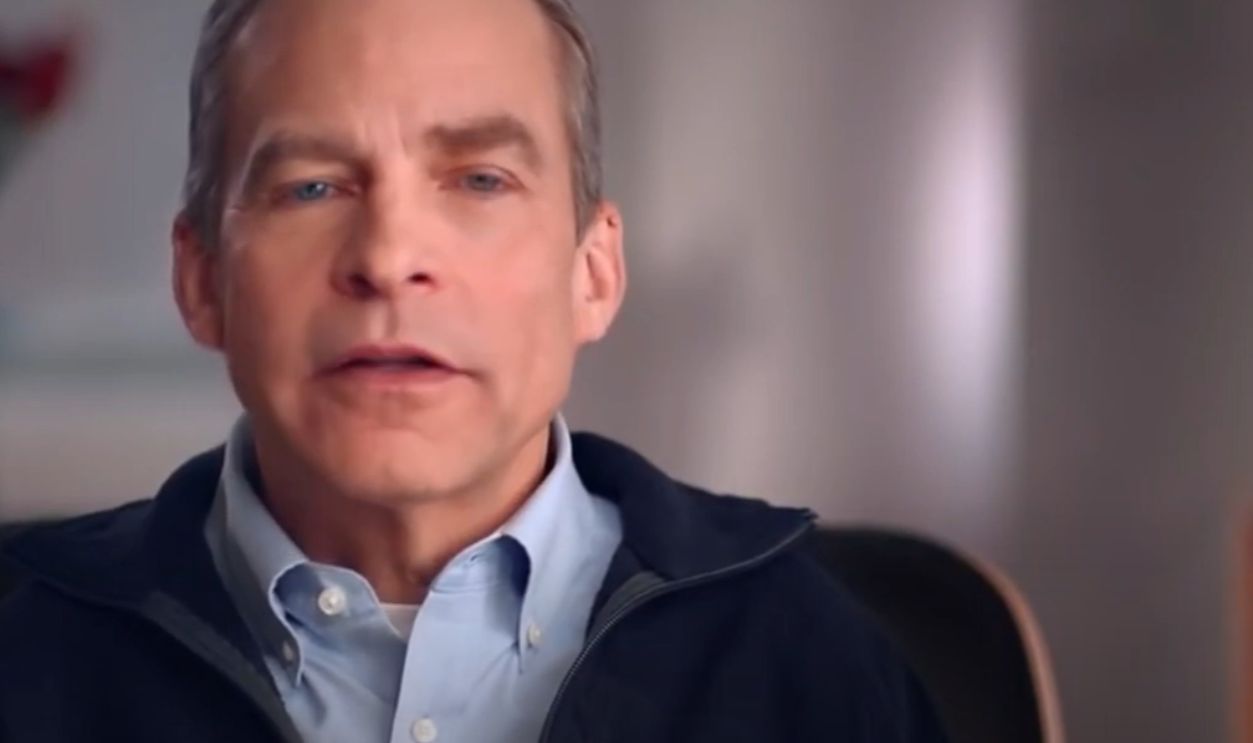

25. The Kohler Family ($16.2 B)

Known for premium bathroom fixtures and design innovation, the Kohler Family has operated its namesake company since 1873. Privately held and led by fourth-generation CEO David Kohler, their influence extends beyond plumbing into energy and hospitality. Their commitment to detail and legacy has kept them quietly powerful in American manufacturing for over a century.

KBDA - Mr. David Kohler, President & CEO, Kohler Co. by KOHLER India

KBDA - Mr. David Kohler, President & CEO, Kohler Co. by KOHLER India

24. The Brown Family ($16.5 B)

As the force behind Brown‑Forman, the Brown Family built an empire on iconic brands like Jack Daniel’s and Woodford Reserve. With roots in 19th-century Kentucky, this family remains actively involved in the boardroom. Their steady expansion into global markets underscores their staying power in one of America’s most enduring alcohol dynasties.

23. The Dorrance Family ($17 B)

The Dorrance fortune stems from condensed soup, and Campbell’s success is largely thanks to this founding family. John T Dorrance revolutionized food manufacturing with shelf-stable soups, turning a kitchen staple into a national icon. Today, heirs retain major stockholdings and board influence, as they maintain quiet control in one of America’s oldest food empires.

22. The Du Pont Family ($18.1 B)

Pioneers of American industry, the Du Pont Family began with explosives in the 1800s and became one of the largest chemical powerhouses. Founders of DuPont Co, their innovations shaped modern materials science. Despite dilution over generations, the family's legacy is still deeply embedded in both American infrastructure and corporate history.

Unknown authorUnknown author, Wikimedia Commons

Unknown authorUnknown author, Wikimedia Commons

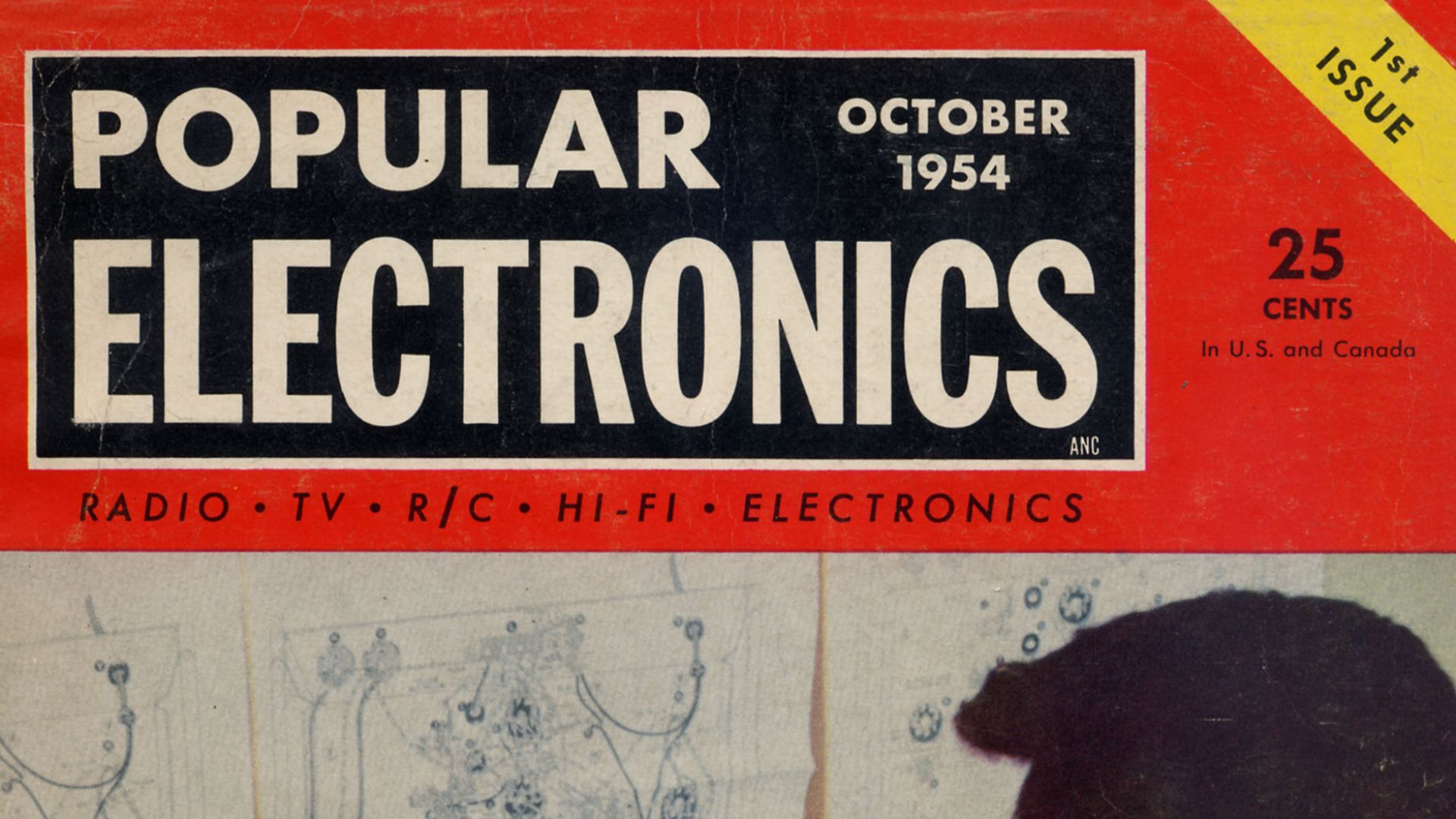

21. The Ziff Family ($18.5 B)

Originally publishers of Ziff Davis magazines like PC Magazine and Car and Driver, the Ziff Family strategically exited print media and pivoted to investment. The three brothers—Dirk, Robert, and Daniel—transformed their inheritance into a modern portfolio spanning tech and real estate, which shows how old media money can evolve for new-age power.

20. The Butt Family ($18.8 B)

Operating out of Texas, the Butt Family helms H-E-B, one of America’s largest privately owned supermarket chains. Founded in 1905, the company thrives under a tradition of local focus and philanthropic leadership. Known for disaster response and community investment, their grocery empire remains a gold standard in retail independence.

Unknown authorUnknown author, Wikimedia Commons

Unknown authorUnknown author, Wikimedia Commons

19. The Taylor Family ($19 B)

Few know the Taylor Family, but millions rent cars through their legacy: Enterprise Holdings. From a modest start in post-war Missouri, Jack Taylor built the world’s largest car rental business. Today, Enterprise, Alamo, and National operate under family oversight, which makes them quiet titans of transportation and logistics across the US.

18. The Millstone–Winter–Heyman Families ($19.2 B)

These intertwined families command Standard Industries, a global industrial giant specializing in roofing and materials science. Led by David Winter and David Millstone, their coordinated leadership has modernized legacy assets into high-tech infrastructure ventures. They represent the emerging generation of industrial capitalists who blend private equity discipline with global scale.

Adobe's Scott Belsky on the Future of Creativity | Standard Speaker Series by Standard Industries17. The Smith Family ($19.8 B)

Adobe's Scott Belsky on the Future of Creativity | Standard Speaker Series by Standard Industries17. The Smith Family ($19.8 B)

Anchored in Chicago, the Smith Family fortune traces back to major holdings in Illinois Tool Works and Northern Trust. Their diversified influence stretches from manufacturing to financial services. While low-profile publicly, their wealth management strategies and corporate governance roles illustrate how generational affluence can shape the backbone of the US industry.

Michael Barera, Wikimedia Commons

Michael Barera, Wikimedia Commons

16. The Reyes Family ($19.9 B)

From beer distribution to McDonald’s supply chains, the Reyes Family built a logistics empire through Reyes Holdings. Brothers Chris and Jude Reyes changed a modest business into one of the largest privately held companies in America. Their grip on food and beverage distribution is vast, and still expanding across continents.

Dirk Tussing from Chicago IL, United States, Wikimedia Commons

Dirk Tussing from Chicago IL, United States, Wikimedia Commons

15. The Busch Family ($20 B)

The Busch name is synonymous with American beer history. As the original stewards of Anheuser-Busch, the family created cultural staples like Budweiser and Michelob. Though they sold the company to InBev, their legacy endures through past market dominance and the complex family saga behind one of America’s best-known brands.

Why $20 Billion Couldn't Save The Family Who Founded Budweiser by Old Money Luxury

Why $20 Billion Couldn't Save The Family Who Founded Budweiser by Old Money Luxury

14. The Hearst Family ($22.4 B)

From yellow journalism to today’s media conglomerate, the Hearst Family has influenced American news consumption for over a century. Founded by William Randolph Hearst, their holdings now span newspapers and broadcast networks. As media continues to evolve, this family retains quiet control over one of the country’s most recognizable publishing empires.

Bain News Service, publisher, Wikimedia Commons

Bain News Service, publisher, Wikimedia Commons

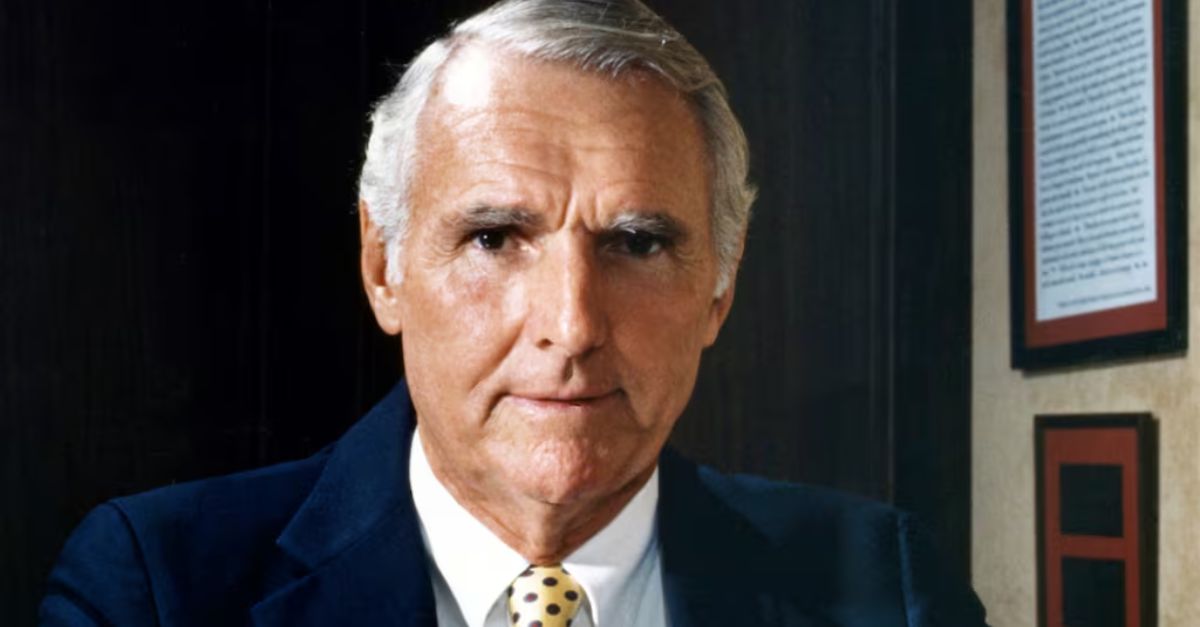

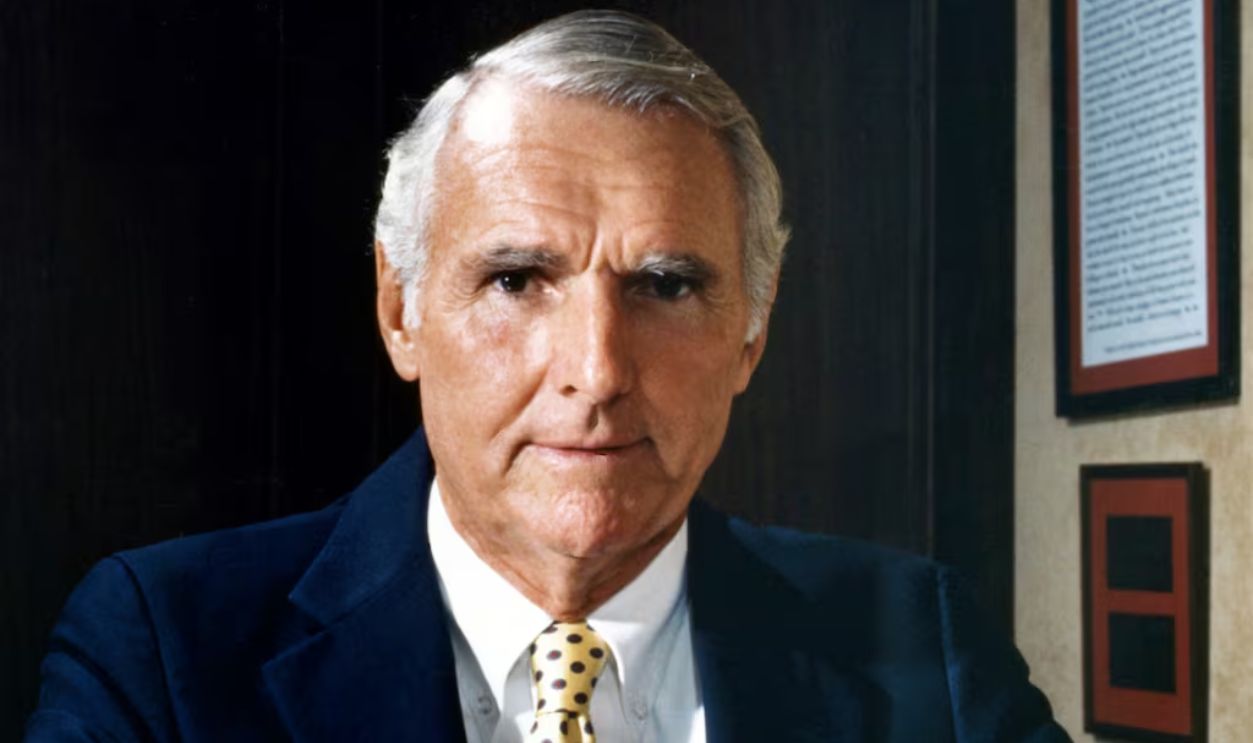

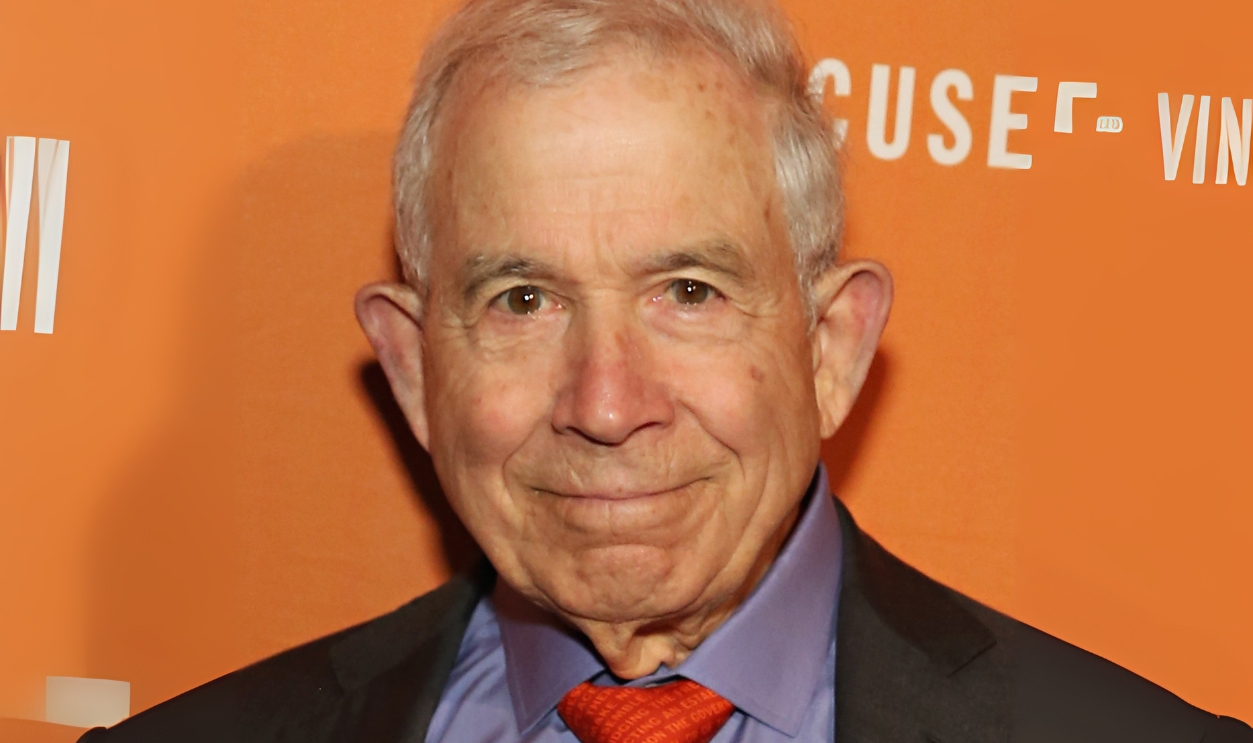

13. The Newhouse Family ($24.1 B)

Once behind a vast magazine empire that included Vogue, The Newhouse Family still holds Advance Publications, which owns stakes in Conde Nast and Reddit. Their transition from print to digital investment reflects adaptability and foresight. Despite fading from the spotlight, they remain quietly powerful in both legacy and digital media worlds.

Cindy Ord, Getty Images12. The Hunt Family ($24.8 B)

Cindy Ord, Getty Images12. The Hunt Family ($24.8 B)

Built by oil tycoon H L Hunt, the Hunt Family’s wealth grew from Texas crude to sprawling investments in energy, real estate, and sports. Known for founding the AFL’s Kansas City Chiefs and major oil companies, the Hunts represent a uniquely American combination of old-money oil wealth and entrepreneurial reinvention.

11. The Lauder Family ($25.9 B)

With the founding of Estee Lauder Companies in 1946, the Lauder Family redefined global beauty. From department stores to digital platforms, their prestige brands span continents. Heirs like Leonard and Aerin Lauder have expanded the business while maintaining its heritage, blending leadership with smart innovation in skincare and cosmetics.

Bert Morgan, Wikimedia Commons

Bert Morgan, Wikimedia Commons

10. The Cox Family ($26.8 B)

The Cox Family fortune began with newspapers but now includes broadband, automotive services, and media. Founded by James M Cox, the Atlanta-based conglomerate is still privately held and run by descendants. Their diversified empire, including Cox Communications and Autotrader, reflects a rare ability to pivot amid constant shifts in media technology.

Unknown; from records of the U.S. Information Agency, Wikimedia Commons

Unknown; from records of the U.S. Information Agency, Wikimedia Commons

9. The Duncan Family ($30 B)

Enterprise Products Partners, a massive natural gas and petrochemical pipeline company, powers the Duncan Family fortune. Spearheaded by Dan Duncan until 2010, his heirs inherited both the business and substantial energy-sector clout. Their low-key profile belies their central role in transporting and storing the fuels that energize the US economy.

Staff photographer, Wikimedia Commons

Staff photographer, Wikimedia Commons

8. The Cathy Family ($33.6 B)

Built on fried chicken and Sunday closures, the Cathy Family created Chick-fil-A, one of America’s most profitable fast-food chains per store. Founded by S Truett Cathy in Georgia, the company remains privately held and deeply values-driven. The family’s distinct blend of business acumen and faith-based leadership has attracted both loyalty and scrutiny.

7. The S C Johnson Family ($38.5 B)

Makers of household staples like Windex and Raid, the S C Johnson Family oversees one of the world’s most trusted consumer brands. Based in Racine, Wisconsin, the company remains family-owned after five generations. Their long-standing sustainability efforts and global reach underscore the power of private ownership in consumer goods.

How The SC Johnson And Son Family Spend Their Millions by Opulence

How The SC Johnson And Son Family Spend Their Millions by Opulence

6. The Pritzker Family ($41.6 B)

Founders of the Hyatt hotel chain, the Pritzker Family, have long intertwined business and politics. With numerous heirs managing trusts and family offices, they’ve expanded into investments and public service. Notably, J B Pritzker serves as Governor of Illinois, further amplifying the family's influence beyond boardrooms into governance and civic leadership.

5. The Edward Johnson Family ($44.8 B)

The Edward Johnson Family controls one of the world’s largest asset management firms: Fidelity Investments. Founded by Edward C Johnson II in 1946, the company remains under family control through Abigail Johnson, CEO since 2014. Their discreet wealth stems from managing trillions in client assets, which reinforces their dominance in global finance.

Village Global, Wikimedia Commons

Village Global, Wikimedia Commons

4. The Cargill–MacMillan Family ($60.6 B)

As heirs to agribusiness titan Cargill, the Cargill–MacMillan Family controls the largest privately held company in the US. Operating across food, commodities, and agriculture logistics, they impact what billions eat. Despite minimal public exposure, their quiet authority over supply chains and food security makes them indispensable to the global economy.

Asher Heimermann, Wikimedia Commons

Asher Heimermann, Wikimedia Commons

3. The Koch Family ($116 B)

The Koch Family built one of the most powerful industrial conglomerates in the world. Koch Industries spans energy, chemicals, finance, and electronics. Founded by Fred Koch, it flourished under Charles and the late David Koch. Their political activism and philanthropic reach have helped shape American industry and ideology for over four decades.

Gavin Peters, Wikimedia Commons

Gavin Peters, Wikimedia Commons

2. The Mars Family ($117 B)

A single candy bar launched what would become one of the most expansive family-owned empires in the world. The Mars Family now oversees a vast portfolio spanning pet care and snack foods. Mars, Inc stays privately controlled, preserving brand strength while influencing how millions shop and eat.

1. The Walton Family ($267 B)

Atop America’s wealth hierarchy stands the Walton Family, founders and heirs of Walmart. Their retail empire, launched by Sam Walton in 1962, revolutionized global shopping. Holding nearly half of Walmart’s stock through trusts and family members, they maintain control while funding education and community development through the Walton Foundation.

Unknown author., Wikimedia Commons

Unknown author., Wikimedia Commons