The Cash Came With A Last Name

Banking started out on dusty trade routes and bets on markets nobody else dared to touch. Let’s break down the evolution of the most notable banks in the world.

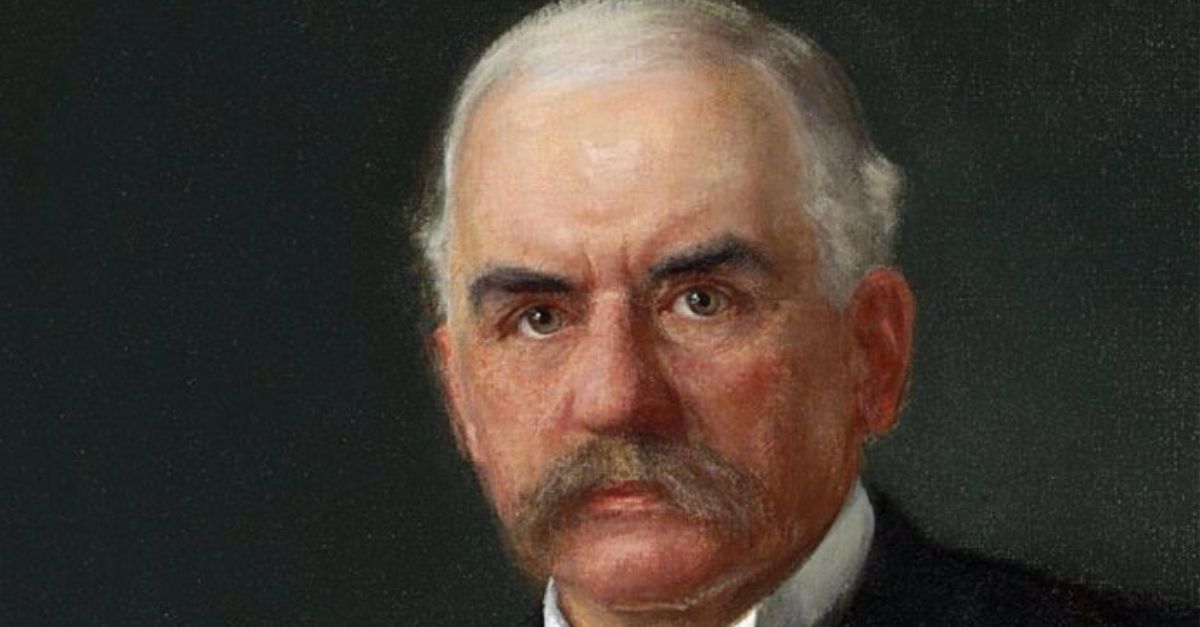

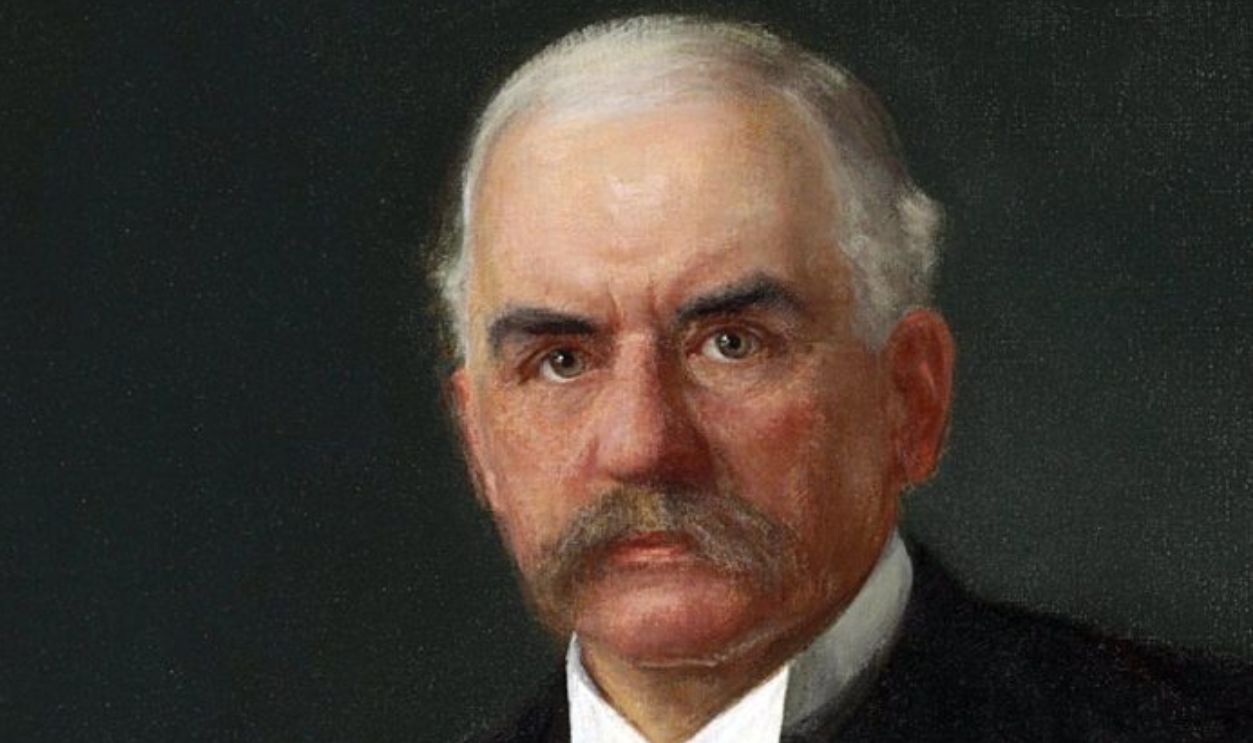

Morgan Family

Born in 1837, JP Morgan was groomed for finance by his banker father, Junius Morgan. Educated in Europe and fluent in money’s global language, he launched Pierpont Morgan & Co, linking transatlantic markets. This move seeded one of Wall Street’s most dominant dynasties.

The First Major Investment Was Railroads And Industrial Consolidation

Morgan’s defining moment came with the US railroads. He rescued them from collapse, stabilized their debt, and installed new management. Then, in 1901, he formed the US Steel—the first billion-dollar company. These feats crowned him “banker to the nation,” and he wielded unmatched control over America’s industrial arteries.

Steve Shook from Moscow, Idaho, USA, Wikimedia Commons

Steve Shook from Moscow, Idaho, USA, Wikimedia Commons

The Morgan Family’s Legacy

After calming panics and financing governments, Morgan reshaped capitalism itself. He backed Edison, formed General Electric, and his son curated an art trove now housed in the Morgan Library. His firm’s DNA lives on in JPMorgan Chase, still ruling modern finance from a Manhattan perch with global sway.

WhisperToMe, Wikimedia Commons

WhisperToMe, Wikimedia Commons

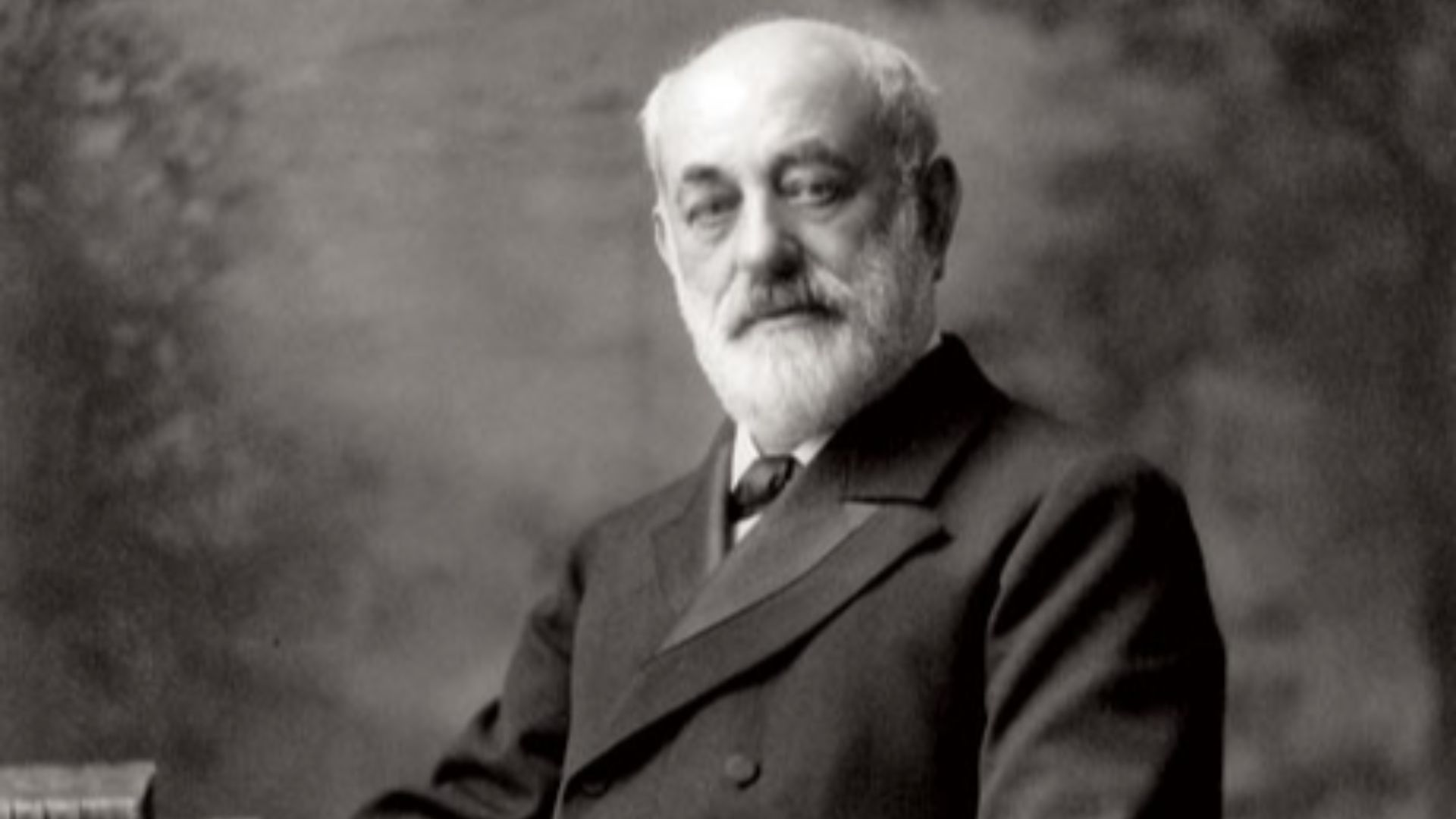

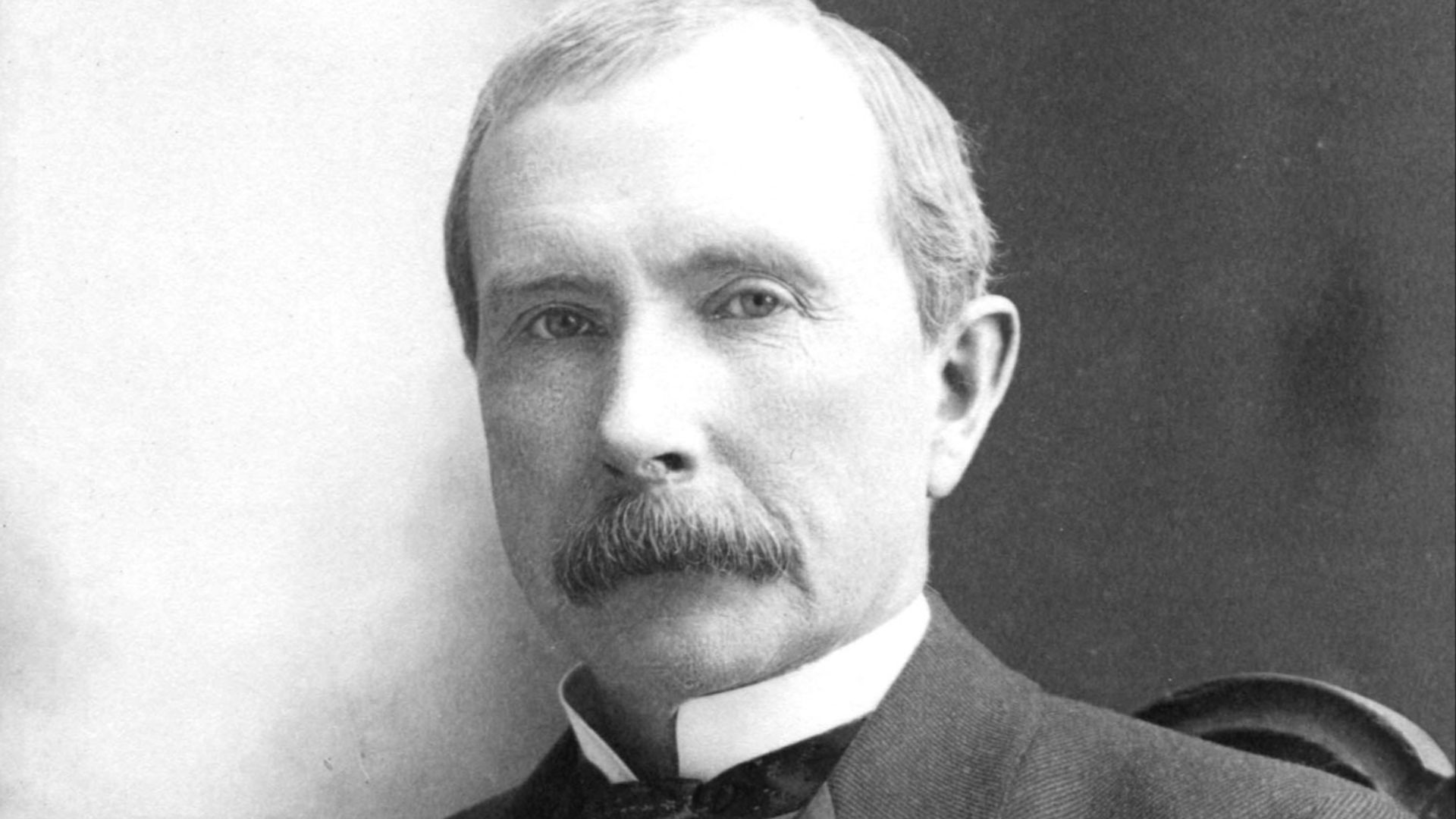

Rockefeller Family

John D Rockefeller Sr amassed legendary wealth through Standard Oil, pioneering the modern corporate structure. But his family’s eye turned to banking in the 20th century. While David Rockefeller was pivotal, Chase’s growth involved multiple leaders and complex mergers (e.g., with Chemical Bank and JPMorgan).

Published by Scientific American Compiling Dep't, New York. 1907., Wikimedia Commons

Published by Scientific American Compiling Dep't, New York. 1907., Wikimedia Commons

They Established Chase Manhattan Bank

David Rockefeller engineered the 1955 merger to form Chase Manhattan Bank. His leadership extended far beyond banking, as he advised presidents and shaped foreign policy. Under his watch, Chase expanded globally to redefine American banking influence. His suave diplomacy blended finance with statecraft, and this made him a financial statesman.

G. Edward Johnson, Wikimedia Commons

G. Edward Johnson, Wikimedia Commons

The Rockefeller’s Legacy Is Chase Bank

JPMorgan Chase, rooted in Rockefeller’s ambition, stands as the largest US bank. Beyond numbers, the family shaped philanthropy: founding the Rockefeller Foundation, funding the UN HQ, and backing medical research. Their empire morphed into a machine of money and meaning, lasting generations beyond oil.

LPulecio-WMF, Wikimedia Commons

LPulecio-WMF, Wikimedia Commons

Goldman And Sachs Families

Marcus Goldman opened shop in 1869, and he dealt in commercial paper in bustling New York. With his son-in-law Samuel Sachs onboard, they built a reputation for reliability and innovation. This immigrant duo pioneered modern investment banking, their firm eventually outgrowing Wall Street to command global boardrooms.

They Pioneered IPOs

In 1999, Goldman Sachs transitioned from a private partnership to a public company through an initial public offering (IPO) and raised $3.66 billion by selling 69 million shares—approximately 15% of the firm. This marked a major strategic shift, reinforcing its global dominance in investment banking.

2211473abhijithsaravanan, Wikimedia Commons

2211473abhijithsaravanan, Wikimedia Commons

Goldman And Sachs Families’s Influence

From dot-com booms to global crises, Goldman Sachs danced at every edge of finance. Known for talent, risk, and ruthlessness, they weathered scandals and scrutiny. Today, with divisions in asset management and consumer banking, they continue defining how Wall Street flexes its muscle globally.

Kuhn And Loeb Families

The founders were Abraham Kuhn and Solomon Loeb, cousins, and German immigrants. This group started in Cincinnati’s dry goods scene. By 1867, they launched Kuhn, Loeb & Co in New York, fusing trust with a tight-knit culture. Their discretion and deep client networks quietly built them into Wall Street royalty.

Unknown authorUnknown author, Wikimedia Commons

Unknown authorUnknown author, Wikimedia Commons

This Family Fueled America’s Steel Veins

The firm bankrolled massive railroad ventures, such as the Union Pacific, which laid steel skeletons across a growing nation. Under Jacob Schiff’s sharp leadership, they even challenged Morgan’s dominance. Schiff famously refused to fund Russia, using finance to protest antisemitism—a rare moral stand in moneyed halls.

Andrew J. Russell / Adam Cuerden, Wikimedia Commons

Andrew J. Russell / Adam Cuerden, Wikimedia Commons

The Kuhn And Loeb Business Eventually Merged

Kuhn, Loeb eventually merged with Lehman Brothers, but its mark lingered. Known for ethical standards and old-world manners, the firm trained generations of Wall Street leaders. Though the name faded, its playbook—diligence, conservatism, and private-client loyalty—became a blueprint many modern firms still imitate.

Unknown authorUnknown author, Wikimedia Commons

Unknown authorUnknown author, Wikimedia Commons

Rothschild Family

In the 1760s, Mayer Amschel Rothschild established a banking business in Frankfurt’s Jewish quarter. His five sons expanded the enterprise across Europe, founding branches in London, Paris, Vienna, Naples, and Frankfurt, thereby creating an unparalleled international banking network.

Moritz Daniel Oppenheim, Wikimedia Commons

Moritz Daniel Oppenheim, Wikimedia Commons

Their Major Investment Was War

The Rothschilds gained prominence by financing both British and allied forces during the Napoleonic Wars. Their efficient communication and courier systems allowed them to transfer funds swiftly across borders, and this solidified their reputation as reliable financiers.

The Rothschild Family Today

Today, the Rothschild family’s influence endures through Rothschild & Co, a global financial advisory firm. Their legacy includes contributions to banking, philanthropy, and the arts, where they maintain a presence in major financial centers worldwide.

Adrian Welch, Wikimedia Commons

Adrian Welch, Wikimedia Commons

Baring Family

Established in 1762 by Francis Baring, the Baring family transitioned from wool merchants in Exeter to prominent bankers in London. Barings Bank became a key player in international finance, and they advised governments and financed major projects.

Lafayette studio, London, Wikimedia Commons

Lafayette studio, London, Wikimedia Commons

They Were Part Of The Louisiana Purchase Financing

Barings Bank played a pivotal role in financing the Louisiana Purchase in 1803, which facilitated the US acquisition of vast territories from France. This deal significantly expanded American territory and showcased Barings’s international financial influence.

Ambrose McEvoy, Wikimedia Commons

Ambrose McEvoy, Wikimedia Commons

What Remains Of The Baring’s

Despite this banking family’s enterprise collapse in 1995 due to unauthorized trading losses, Barings’s legacy persists. The bank’s history reflects both the heights of financial success and the risks inherent in global banking operations. Something every other bank ought to remember.

Stephen Craven, Wikimedia Commons

Stephen Craven, Wikimedia Commons

Oppenheim Family

Salomon Oppenheim founded Sal Oppenheim in 1789 in Cologne, and he also went on to establish it as one of Europe’s largest private banks. From then on, the family became synonymous with prudent banking and financial innovation in Germany.

Template:CJoseph Weber, Wikimedia Commons

Template:CJoseph Weber, Wikimedia Commons

Sal Oppenheim Took On Industrial And Infrastructure Financing

Sal Oppenheim financed significant industrial and infrastructure projects that went on to contribute to Germany’s economic development. Their investments supported railways, manufacturing, and urban development during the 19th century.

What The Oppenheim Family Leaves Behind As A Legacy

Sal Oppenheim’s legacy, even after its 2009 acquisition by Deutsche Bank, continues to echo through German banking. Known for its discretion and aristocratic clientele, the bank once managed elite European fortunes. Its integration reflects how legacy wealth adapts to survive in modern institutional finance.

Patrik Meyer, Wikimedia Commons

Patrik Meyer, Wikimedia Commons

Warburg Family

The Warburg family traces its lineage back to Venice before settling in Germany. By 1798, they established MM Warburg & Co in Hamburg. Their disciplined, low-profile style—and ties to European royalty and Jewish philanthropic circles—cemented their status as discreet powerbrokers behind Europe’s financial rise.

Claus-Joachim Dickow, Wikimedia Commons

Claus-Joachim Dickow, Wikimedia Commons

Their Major Contribution Was Founding Of The US Federal Reserve

Paul Warburg, freshly arrived in America, stunned Wall Street with his calls for centralized monetary policy. Dismissed at first, his quiet persistence led to the Federal Reserve Act of 1913. His design still guides the Fed today, embedding European banking wisdom in America’s economic engine.

National Photo Company Collection, Wikimedia Commons

National Photo Company Collection, Wikimedia Commons

They Stabilized Europe Post-War

Though scattered by wars and persecution, the Warburg name endures. Their institutions helped stabilize post-war Europe and back Israeli statehood. MM Warburg & Co remains active in Hamburg, while their legacy shapes US central banking—a dual continental footprint rooted in vision, caution, and reform.

Lazard Family

In 1848, three French-Jewish brothers opened a dry goods store in New Orleans. Instead of cotton, they chased capital, shifting operations to Paris, San Francisco, and London. Lazard Freres became a transatlantic investment bank before most knew the term, and this pivoted them from peddlers to international financial tastemakers.

Unknown authorUnknown author, Wikimedia Commons

Unknown authorUnknown author, Wikimedia Commons

They Advised Governments And Corporations

From restructuring French debt post-WWII to brokering billion-dollar mergers, Lazard carved out a niche as the “advisor’s advisor.” Their style? Intellectual rigor with European finesse. Their involvement in Chrysler’s bailout and European privatizations shows how deeply they are embedded into global financial lifelines.

Jack Downey, U.S. Office of War Information, Wikimedia Commons

Jack Downey, U.S. Office of War Information, Wikimedia Commons

The Lazard Family Today

Lazard today balances its investment banking with asset management. With offices in over 40 countries, it remains fiercely independent, rare in an age of megabank mergers. The firm’s reputation for quiet influence and strategy-focused counsel keeps it indispensable to governments and boardrooms worldwide.

Press Service of the President of the Republic of Azerbaijan , Wikimedia Commons

Press Service of the President of the Republic of Azerbaijan , Wikimedia Commons

Schroder Family

Back in 1818, Johann Heinrich Schroder launched J Henry Schroder & Co in London after departing Hamburg’s mercantile world. By straddling two financial capitals, the Schroders catered to a rising class of international investors, where they mixed German thrift with British banking muscle to craft a uniquely global house.

Probably Friedrich Carl Groger, Wikimedia Commons

Probably Friedrich Carl Groger, Wikimedia Commons

The Family Majored In Financing Global Trade

Schroders facilitated global commerce by underwriting trade finance, especially during the Industrial Revolution. Their controversial backing of the Confederacy showed how profit often trumped politics. Yet their long-standing relationships with colonial enterprises and European royalty helped entrench them in every key trade corridor.

beareye2010, Wikimedia Commons

beareye2010, Wikimedia Commons

What Schroders Stand Today

Schroders now runs over $900 billion in assets, led by family descendants—a rarity in modern finance. Their quiet, conservative approach and resilience through wars, crises, and financial upheaval show why they remain one of Britain’s most enduring financial dynasties.

Henning Schlottmann (User:H-stt), Wikimedia Commons

Henning Schlottmann (User:H-stt), Wikimedia Commons

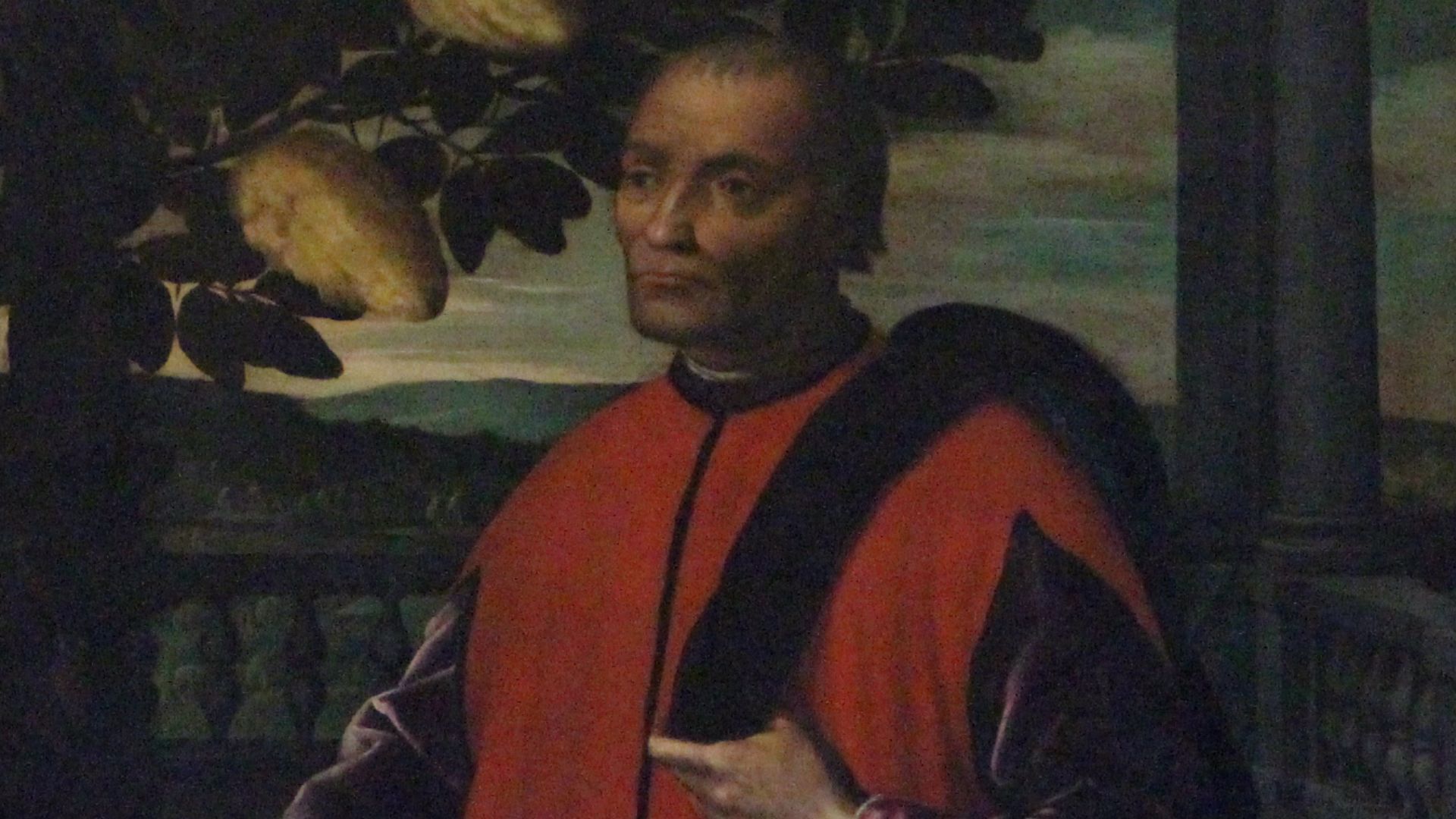

Medici Family

Giovanni di Bicci de’ Medici founded a bank in 1397 in Florence that would change the course of history. Unlike rivals, the Medici Bank thrived on merchant trust, papal connections, and double-entry bookkeeping. Their vaults backed popes, kings, and painters, and for this, they laid the Renaissance’s financial foundation.

Francesco Bini, Wikimedia Commons

Francesco Bini, Wikimedia Commons

They Were The Patronage Of The Arts And Politics

Rather than just hoarding coins, the Medici poured riches into Renaissance art and power. They funded Brunelleschi’s dome, Michelangelo’s hands, and the Vatican’s dreams. Meanwhile, their money helped elect Medici popes and secure ducal titles, turning credit into canvas and coin into crowns.

Vyacheslav Argenberg, Wikimedia Commons

Vyacheslav Argenberg, Wikimedia Commons

The Medici’s Enduring Name

Though the Medici Bank eventually failed by 1494, their name became eternal. The family’s blend of commerce, culture, and politics defined Florence and shaped Western civilization. Their influence lives in the galleries they built, the architecture they paid for, and the dynasties they inspired.

sconosciuto, Wikimedia Commons

sconosciuto, Wikimedia Commons

Mocatta Family

Founded in 1671, Mocatta & Goldsmid began brokering precious metals in London’s glittering finance hub. They became official bullion dealers to the Bank of England, handling gold shipments that backed currencies and settled empires’ debts. Their name shimmered in the shadows of global gold flows.

acediscovery, Wikimedia Commons

acediscovery, Wikimedia Commons

Their Major Investment Was Precious Metals Trading

Mocatta helped structure the global gold standard, establishing trading conventions still used today. They organized daily London gold price fixings, guiding global markets with quiet authority. Their relationships with mines, banks, and governments gave them command over metal worth more than monarchies.

ArchaiOptix, Wikimedia Commons

ArchaiOptix, Wikimedia Commons

Gone, But Still Remembered

Though absorbed into Scotiabank in the 1990s, Mocatta’s DNA still pulses through bullion markets. Their practices set benchmarks in the precious metal trade, while their archives detail centuries of economic power hidden in vaults and shipping logs. They were alchemists of financial certainty.

Sassoon Family

This is a rags-to-riches tale. In 1832, David Sassoon fled persecution in Baghdad and rebuilt in Bombay. With contracts and cunning, he founded a textile and opium empire stretching from India to China. Fluent in Arabic, Hebrew, and trade, he became “the merchant prince” of the British East.

Unknown photographer, mid-19th century, Wikimedia Commons

Unknown photographer, mid-19th century, Wikimedia Commons

The Sassoon Firms Went Into Opium Trade And Infrastructure

Sassoon firms dominated the 19th-century opium trade. The Sassoons reinvested profits into schools, synagogues, and hospitals across Asia. Later generations entered British politics, publishing, and real estate. Despite fading from finance, their legacy remains etched into the skylines and institutions of Bombay, Hong Kong, and London alike.

George Chernilevsky, Wikimedia Commons

George Chernilevsky, Wikimedia Commons

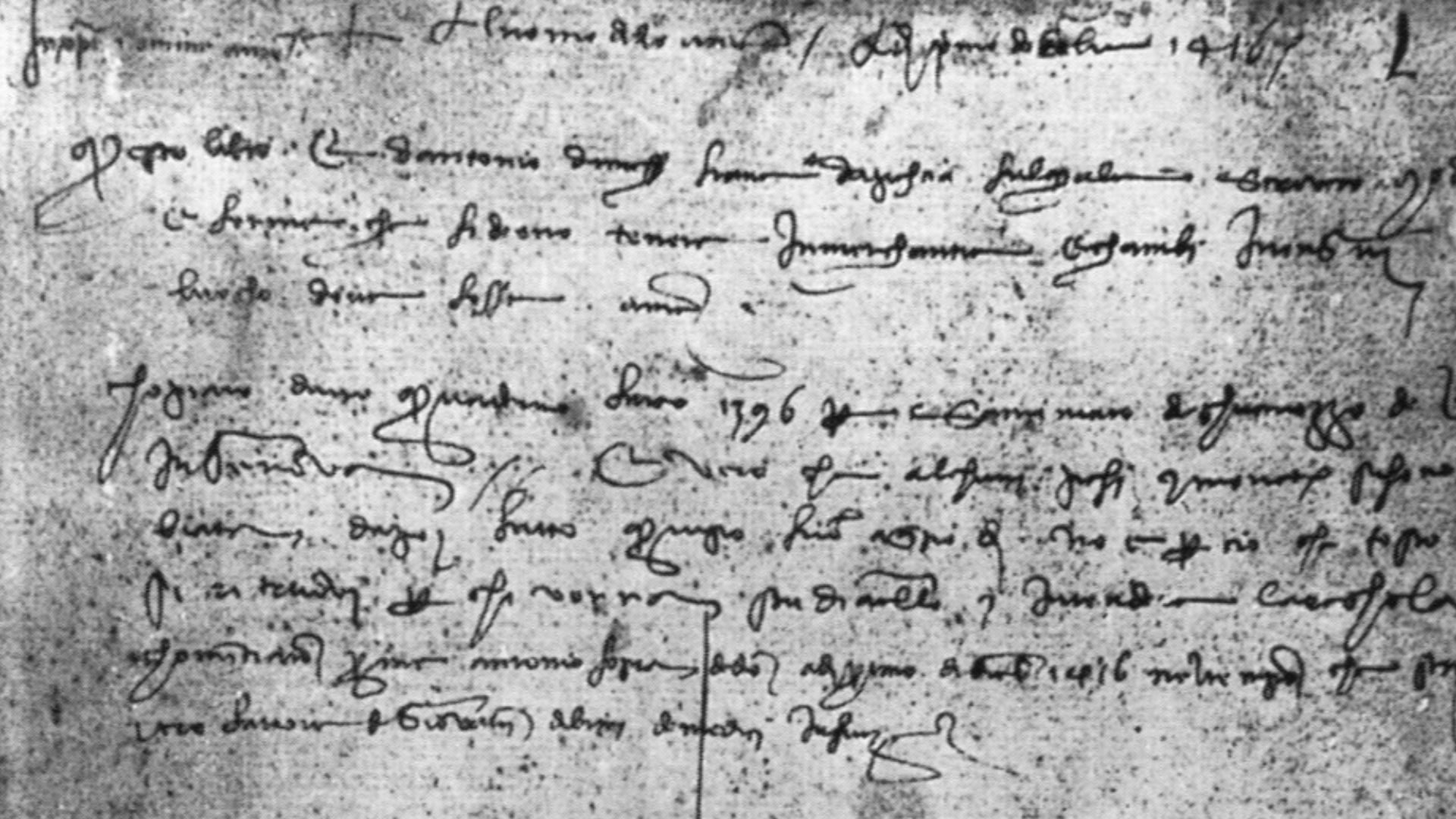

Fugger Family

Jakob Fugger, born in 1459, turned his family’s cloth business into a continental banking empire from Augsburg. He funded the Holy Roman Emperors, papal elections, and Spanish wars. His firm controlled copper and silver across Europe—earning him the name “Jakob the Rich,” and it wasn’t a joke.

Possibly Hans Burgkmair the Elder, Wikimedia Commons

Possibly Hans Burgkmair the Elder, Wikimedia Commons

Their Major Investment Was Mining And Imperial Power

Fugger’s wealth came from Alpine mines. In return for funding Charles V’s rise to power, he received exclusive rights to Austrian copper and Tyrolean silver. This vertical monopoly tied Europe’s largest bank to imperial ambitions—and ensured the Fuggers wrote history’s checks for decades.

Formerly attributed to Titian / Attributed to Lambert Sustris, Wikimedia Commons

Formerly attributed to Titian / Attributed to Lambert Sustris, Wikimedia Commons

Hottinger Family

In 1786, Jean-Conrad Hottinger founded Banque Hottinguer in Paris after honing his craft in Geneva’s financial circles 1786. His Swiss-Protestant roots emphasized privacy, precision, and stewardship. The family weathered the French Revolution and Napoleonic era by prioritizing discretion and sound judgment—traits that defined Swiss-style private banking for centuries.

Louis-Léopold Boilly, Wikimedia Commons

Louis-Léopold Boilly, Wikimedia Commons

Today, Here’s Where Their Legacy Stands

Over seven generations, the Hottingers influenced everything from industrial finance to European reconstruction post-Napoleon. Their name quietly opened doors in Paris, Zurich, and beyond. Though Banque Hottinguer was absorbed into larger institutions in the 21st century, the family’s legacy still whispers in corridors of high-finance tradition.

Unknown authorUnknown author, Wikimedia Commons

Unknown authorUnknown author, Wikimedia Commons

Hambros Family

Carl Joachim Hambro, a Danish merchant with English flair, established Hambros Bank in London in 1839. Fluent in finance and diplomacy, he built trust across Europe. His bank specialized in merchant finance, trade credits, and cross-border operations—serving monarchs and major rail and shipping enterprises alike.

Atelier Rude / Oslo Museum, Wikimedia Commons

Atelier Rude / Oslo Museum, Wikimedia Commons

The Hambro’s Influence

Hambros played a vital role in financing British trade and imperial expansion through the 19th century. Despite merging with Societe Generale in 1998, its history remains embedded in the architecture of London’s merchant banking past. Hambros’s legacy lives in archives and every whispered tale of old Mayfair deals.

Arthur Weidmann, Wikimedia Commons

Arthur Weidmann, Wikimedia Commons