The Market Mood That Suddenly Turned Heavy

Lately, it feels like every risky corner of the market is sinking together. Crypto’s losing steam, and even the stocks can’t hold a rally irrespective of the market you trade in. The slide feels coordinated, and people are noticing.

The Double Crash Nobody Saw Coming

A rare moment hit the markets when crypto and stocks sank almost in sync. The usual separation between digital assets and traditional investments disappeared overnight. The combined decline made investors feel cornered, as typical safe zones didn’t offer much protection during this sudden slump.

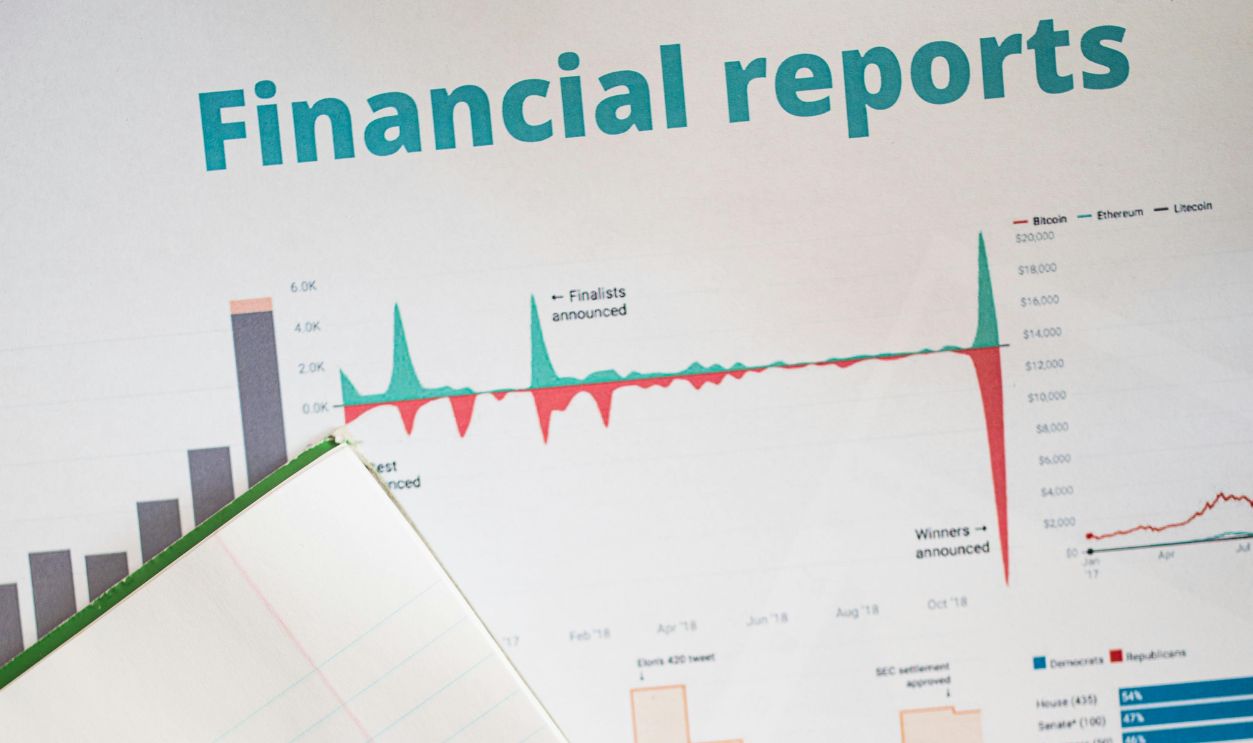

Bitcoin's Steep Decline

After reaching impressive highs, Bitcoin reversed course and fell hard. The drop erased billions in value and signaled that the rally had run ahead of reality. As selling accelerated, investors were forced to rethink how stable Bitcoin truly is during broader market uncertainty.

Ethereum And Altcoins Follow Suit

Ethereum and countless altcoins mirrored Bitcoin’s fall, though many experienced deeper losses. Prices collapsed quickly as traders abandoned riskier tokens first. Projects that were heavily promoted earlier in the year lost momentum almost overnight, showing how fragile enthusiasm can be in a shaky market.

Stock Market Indexes Take A Hit

What began as mild weakness turned into a tougher slide for major indexes. The Nasdaq and S&P 500 both dropped enough to spark concern among everyday investors. The sell-off spread across industries and signaled that confidence had weakened well beyond the crypto space.

Interest Rates Still Elevated

Despite market weakness, central banks didn’t ease up on high interest rates. Their message stayed firm: inflation had to cool before any relief would come. These conditions pushed investors toward safer options and made risk-heavy assets like crypto and growth stocks far less appealing.

The Liquidity Crunch Effect

Higher interest rates pulled money toward safer investments with guaranteed returns. As investors moved cash into bonds and treasury bills, less money flowed into riskier areas like crypto and growth stocks. This shift reduced buying power dramatically, which makes it harder for struggling assets to find support.

Tech Stocks Leading The Decline

The technology sector felt the downturn intensely as companies struggled with weaker demand and rising costs. Premium valuations lost support, which prompted heavy selling. As layoffs increased and earnings softened, tech stocks became a major source of downward pressure across the broader market.

Crypto's Regulatory Pressure Mounts

As crypto grew, regulators responded with tighter controls. Governments introduced rules requiring stronger consumer protections and verified reserves. These measures aimed to increase trust but also slowed industry growth. Furthermore, it raised concerns about how smaller projects would survive under stricter expectations.

Banking Sector Uncertainty

As banks reported rising stress in their balance sheets, investors grew nervous about hidden risks. Fears around commercial real-estate losses and liquidity issues triggered sharp reactions. The banking jitters added another layer of pressure to markets already struggling under rate and inflation concerns.

joneboi at English Wikipedia, Wikimedia Commons

joneboi at English Wikipedia, Wikimedia Commons

Institutional Investors Pull Back

Large investment firms began cutting exposure to anything considered unstable. Their shift toward safer assets drained momentum from crypto and tech almost immediately. Once these major players stepped aside, the market lost a key source of support and prices weakened across the board.

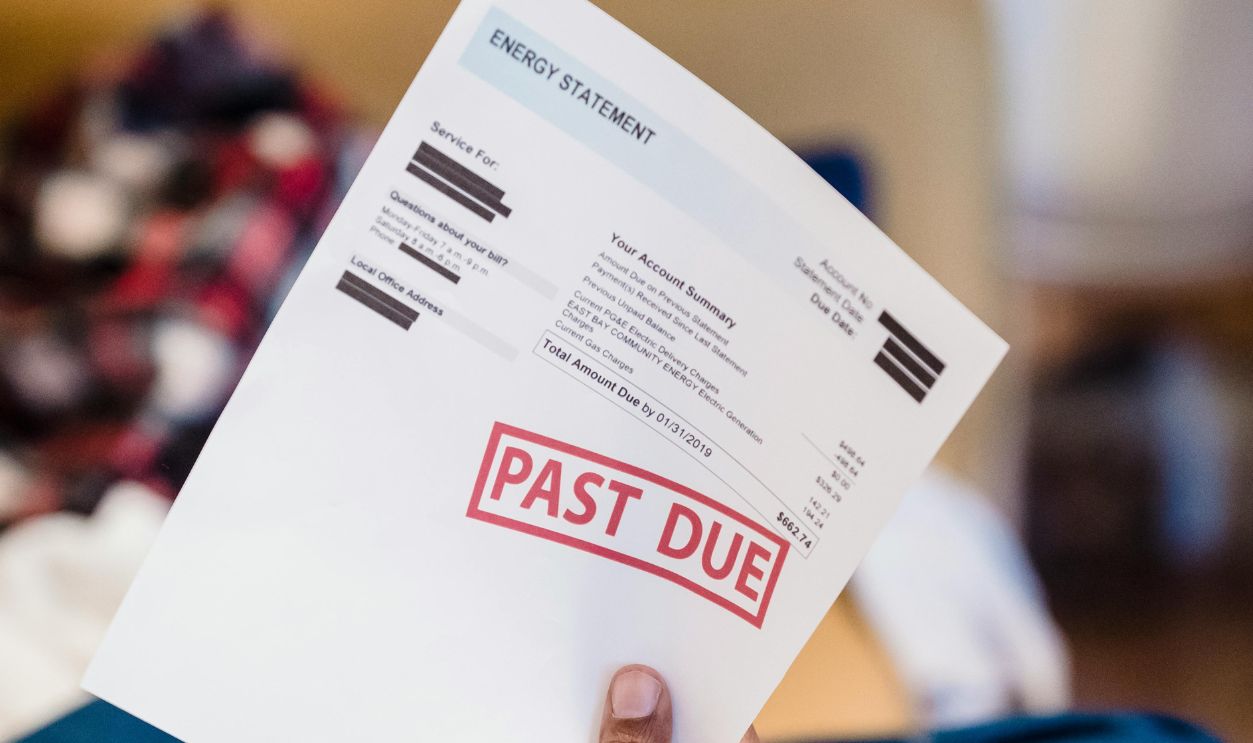

Retail Traders Face Heavy Losses

Everyday traders who joined markets during the boom years faced steep declines once prices reversed. Many held assets that were already fragile, and the downturn exposed that vulnerability instantly. The emotional shift from excitement to fear pushed many into rushed, poorly timed exits.

The Leverage Liquidation Cascade

As prices fell, leveraged accounts started hitting margin limits. Platforms moved quickly to close those positions, which removed massive amounts of capital from the market. The chain of liquidations created an intense drop that went far beyond what normal selling would have caused.

Stablecoin Concerns Resurface

Fresh doubts emerged around the true reserves behind major stablecoins. A few smaller tokens slipped below their dollar value, raising fears about transparency. These episodes revived old debates about whether every stablecoin can withstand large withdrawals or sudden stress in the broader market.

Exchange Platform Vulnerabilities

Past scandals resurfaced as investors evaluated whether exchanges were properly handling customer funds. Transparency became a central demand, and platforms that failed to offer detailed verification drew immediate suspicion. The heightened scrutiny added stress to a market already dealing with falling prices.

Correlation Between Crypto And Stocks

Crypto, once promoted as independent from traditional markets, began moving almost identically to tech stocks. As risk sentiment weakened, both sectors fell together. This rising correlation challenged earlier ideas about diversification and showed that digital assets were behaving as high-risk market plays rather than hedges.

Geopolitical Tensions Add Pressure

International disputes and shifting alliances created unpredictable conditions for markets. Threats of new trade restrictions and conflict-driven disruptions forced investors to reassess exposure to vulnerable sectors. The lack of global stability pushed risk appetite lower and contributed to deeper market swings.

Corporate Earnings Disappoint

Earnings season delivered a series of negative surprises as many firms failed to meet projected targets. Investors reacted quickly to reports of falling demand and tighter budgets. The disappointing results confirmed that businesses were facing tougher conditions than earlier forecasts suggested.

Mining Operations Under Stress

Crypto miners faced rising electricity costs and lower token prices to squeeze profitability. Many struggled to cover expenses, which led to reduced mining activity. This pressure affected blockchain networks and contributed to market unease, as mining health is often seen as a reflection of broader ecosystem stability.

Dollar Strength Pressures Crypto

A stronger U.S. dollar has pulled global capital toward safer assets. As currency values shift, investors move money into treasuries and away from riskier plays like crypto. The dollar’s rise directly squeezes liquidity in digital assets, making downturns sharper and recoveries harder to sustain.

Venture Capital Funding Dries Up

Funding rounds that once closed quickly began to stall as investors stepped back from risky ideas. Startups struggled to secure fresh capital, and valuations fell across the board. The pullback signaled a shift toward caution, especially for younger companies still chasing profitability.

Consumer Spending Patterns Shift

Economic uncertainty changed how people allocated their money, with households prioritizing essentials over discretionary spending. Lower consumer confidence affected corporate revenues and overall market sentiment. As people became more cautious with purchases, businesses and investors felt the ripple effects across sectors.

Margin Calls Force Selling

As asset prices fell, more investors were required to add collateral or sell holdings to meet margin requirements. These forced sales created sudden downward pressure in fast-moving markets like crypto. The cycle repeated as falling prices triggered even more margin calls.

Safe Haven Assets Gain Appeal

Investors shifted money into assets known for stability, such as government bonds and gold. These options offered steady returns without the turbulence of riskier markets. As more people sought safety, crypto and tech saw even less support, deepening their ongoing declines.

Recovery Timeline Remains Uncertain

Market analysts continue to offer conflicting views on when stability might return. Some expect a slow climb, while others warn that volatility could stretch much longer. No clear direction has emerged, leaving investors waiting for stronger economic signals before trusting any sign of recovery.

What Investors Are Watching Next

Investors want clarity from upcoming inflation numbers, rate decisions, and corporate guidance. These factors will help them judge whether conditions are improving or worsening. With so much uncertainty still in play, each new piece of information carries extra weight.