5 Things You Should Save Up For Before Turning 30

5 Things You Should Save Up For Before Turning 30

Generally speaking, 30 years old is the age when true adulthood really starts to happen. At that point, your teenage years are well beyond you, and your 20s—the decade you have for figuring things out—would be officially over. How well prepared are you for the next stage of your life? Check out this list of five things you should want to save up for before turning 30 as a general guideline:

Flickr

Flickr

#1 More education

Most people are done with school forever once they've obtained their bachelor's degree, but in this day and age, one of the only ways to stand out from the crowd and remain competitive in the job market is to pursue higher levels of education. Nowadays, it seems like everybody has a bachelor's degree, and having one no longer guarantees you a job as it used to back in the day. Take up a new course or further your studies in your field—invest in yourself and it will pay off your career.

Wikimedia Commons

Wikimedia Commons

#2 Your own place

There's absolutely nothing wrong with living with your parents until you're 30, or even older. Most people frown upon it, but everybody has different circumstances and it's really nothing to be ashamed of. That said, unfortunately, your parents aren't going to be around forever, as much as you might want them to be. You need to save up money to eventually move out into your own place. Establishing a savings account to start and eventually an income that can sustain monthly payments on a property would be ideal.

Flickr

Flickr

#3 A life-changing trip

30 years old is a tricky age. Time seems to move exponentially quicker at that point, so, while you're still young, you might as well get some of that travel bug out of your system. Contrary to popular belief, traveling is not a luxury—like education, it is an investment in oneself; a way to expand one's horizons and learn about the world. It's harder to travel when you're of older age, so before you turn 30, you should try to fit in at least one trip to a foreign country.

Wallpaper Flare

Wallpaper Flare

#4 Investments for the future

Many older people will tell you that one of their biggest regrets is not planning ahead for their futures while they still had the time to do so. It's always good to start planning as early as possible for when you will no longer be able to work. A good way to establish some financial security early on is by investing in financial products like stocks, bonds, and UITFs. Additionally, you're going to want to get life insurance and health insurance.

Pxhere

Pxhere

#5 A potential family

Starting a family isn't on everyone's wishlists, but for those who are looking to do just that, it would be a good idea to start saving early. This is especially crucial for those who have already been in long-term relationships and are almost certain that marriage and a family are the next steps they will be taking. Start thinking about wedding expenses, possible hospital bills, education plans, etc. A local bank representative may be able to advise you on such.

Wallpaper Flare

Wallpaper Flare

READ MORE

That safety net you worked so hard to build just disappeared. The reason doesn't matter right now. What really matters is having a game plan to get back on solid ground quickly.

The grocery list didn’t change overnight. A skipped item here, a second thought there—and suddenly, the usuals don’t feel so automatic. That quiet pullback? It’s more common than most people realize.

Nobody talks about the perks of growing older. Sure, there are challenges, but some things actually get better. Tax season becomes less painful when you know what advantages come your way.

Banking started out on dusty trade routes and bets on markets nobody else dared to touch. Let’s break down the evolution of the most notable banks in the world.

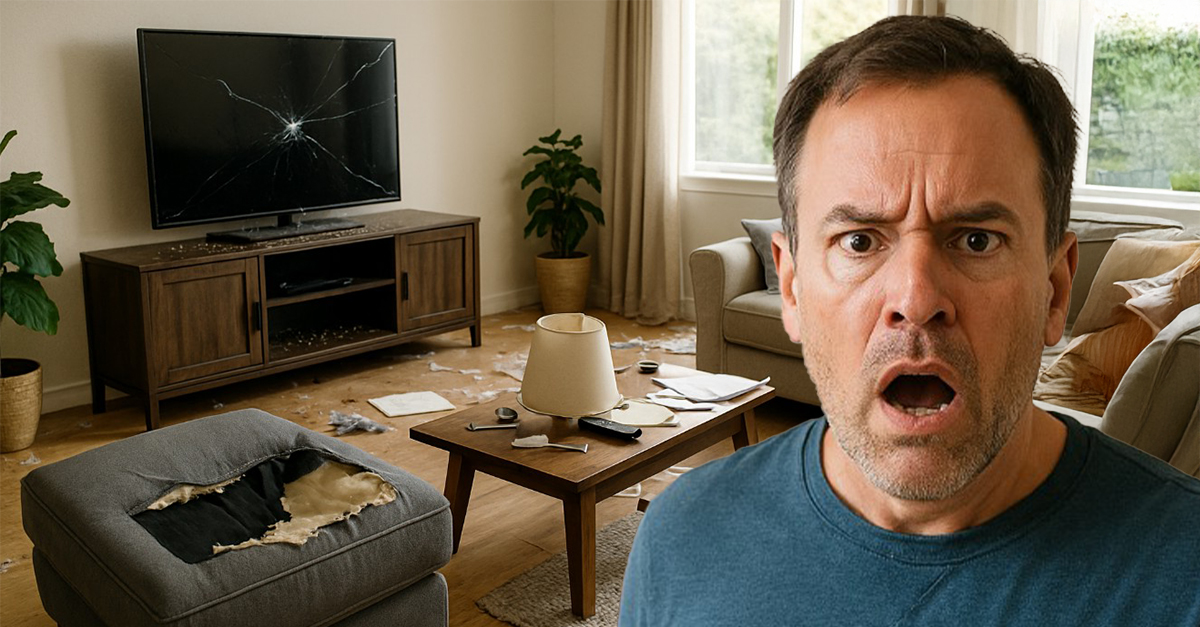

You just walked through your front door after a relaxing trip abroad, only to find your house in a state of disarray. You followed Airbnb’s guidelines, and are wondering how you can hold your guests accountable.

Your dad added you to his bank account—but now he’s gone, and the family is divided. Suspicion swirls, and emotions are louder than reason. You can’t rewrite the past, but you can choose how to respond to it. These steps will help you protect yourself and move forward clearly.

Disclaimer

The information on MoneyMade.com is intended to support financial literacy and should not be considered tax or legal advice. It is not meant to serve as a forecast, research report, or investment recommendation, nor should it be taken as an offer or solicitation to buy or sell any securities or adopt any particular investment strategy. All financial, tax, and legal decisions should be made with the help of a qualified professional. We do not guarantee the accuracy, timeliness, or outcomes associated with the use of this content.

Dear reader,

It’s true what they say: money makes the world go round. In order to succeed in this life, you need to have a good grasp of key financial concepts. That’s where Moneymade comes in. Our mission is to provide you with the best financial advice and information to help you navigate this ever-changing world. Sometimes, generating wealth just requires common sense. Don’t max out your credit card if you can’t afford the interest payments. Don’t overspend on Christmas shopping. When ordering gifts on Amazon, make sure you factor in taxes and shipping costs. If you need a new car, consider a model that’s easy to repair instead of an expensive BMW or Mercedes. Sometimes you dream vacation to Hawaii or the Bahamas just isn’t in the budget, but there may be more affordable all-inclusive hotels if you know where to look.

Looking for a new home? Make sure you get a mortgage rate that works for you. That means understanding the difference between fixed and variable interest rates. Whether you’re looking to learn how to make money, save money, or invest your money, our well-researched and insightful content will set you on the path to financial success. Passionate about mortgage rates, real estate, investing, saving, or anything money-related? Looking to learn how to generate wealth? Improve your life today with Moneymade. If you have any feedback for the MoneyMade team, please reach out to [email protected]. Thanks for your help!

Warmest regards,

The Moneymade team

Wallpaper Flare

Wallpaper Flare