Panic Mode Activated: Taxes Due Tomorrow?!

It’s the night before Tax Day. You finally sit down, coffee in hand, ready to e-file… and boom: the IRS website is down. Refresh. Refresh again. Nothing. Your heart rate spikes, Google searches get darker, and the big question looms: Am I about to get fined for something that’s not even my fault? Take a breath. You’re not the first person this has happened to—and you definitely won’t be the last. Let’s walk through what actually happens when the IRS site crashes at the worst possible moment.

First Things First: You’re Not Alone

Every year, millions of Americans wait until the final hours to file. Some procrastinate, some are waiting on last-minute forms, and others just really don’t enjoy paperwork. When the IRS system goes down on deadline day, it affects a lot of people at once. The IRS knows this. They track outages, system errors, and traffic overloads very closely—especially on Tax Day.

What Happens When The IRS Website Goes Down?

When IRS e-file systems experience widespread outages, the agency usually documents the incident internally. If the issue is significant and impacts many taxpayers, the IRS often provides automatic relief—meaning penalties related to late filing may be waived without you having to do anything special. In other words, they know when it’s their fault.

Carol M. Highsmith, Wikimedia Commons

Carol M. Highsmith, Wikimedia Commons

Filing Late vs. Paying Late: Important Difference

Here’s a key distinction many people miss: filing your tax return late and paying your taxes late are two separate things. The penalties are different, the rates are different, and the IRS treats them differently. Even if you can’t file your return tonight, making a payment can still matter a lot.

The Late Filing Penalty Explained

The late filing penalty is the scary one. It’s generally 5% of the unpaid taxes per month, capped at 25%. That sounds brutal—but it usually only applies if you fail to file without reasonable cause. An IRS system outage on the due date often qualifies as reasonable cause, especially if you file as soon as systems are back up.

The Late Payment Penalty Explained

The late payment penalty is much smaller: 0.5% of unpaid taxes per month, also capped at 25%. This penalty can apply even if the filing delay wasn’t your fault. That’s why, if you owe taxes and can’t file tonight, it’s often smart to at least make a payment.

So… Am I Automatically Getting Fined?

Short answer: probably not for filing late due to an outage. If the IRS website is truly down and you attempt to file promptly once it’s back up, penalties for late filing are commonly waived. This is especially true if the outage is widespread and well-documented, not just a problem with your own internet connection.

Does The IRS Actually Waive Penalties?

Yes—and more often than people think. The IRS has a “reasonable cause” standard, and system outages, natural disasters, and widespread technical failures usually qualify. In some cases, the IRS announces penalty relief publicly. In others, it’s applied automatically behind the scenes when returns are processed.

What If The Website Comes Back Up After Midnight?

If the system comes back online shortly after the deadline and you file immediately, you’re generally fine. The IRS timestamps electronic filings, and when outages occur, they often treat submissions made shortly afterward as timely. Don’t wait days—file as soon as humanly possible.

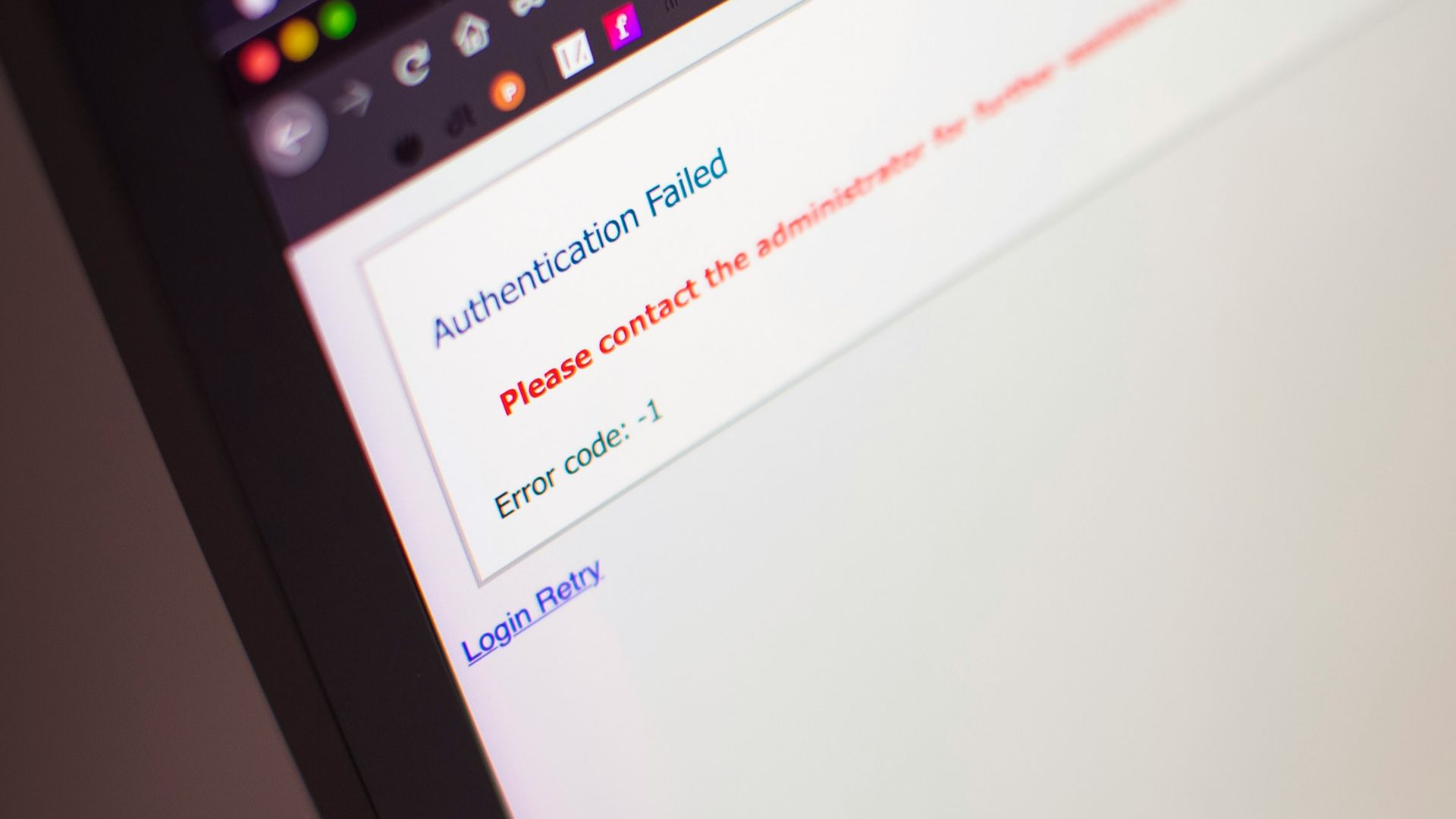

Should I Take Screenshots as Proof?

Absolutely. If you’re seeing error messages, outage notices, or endless loading screens, take screenshots. Save timestamps. Bookmark any IRS status pages. You may never need them—but if you do, having documentation makes penalty abatement requests much easier.

What If I Still Haven’t Finished My Taxes?

If the site is down and your return isn’t ready, this might be your cue to pivot. Filing an extension gives you six extra months to file your return. It does not give you extra time to pay—but it can protect you from late filing penalties.

Can I Still File An Extension If The IRS Site Is Down?

Sometimes, yes—through third-party tax software that submits extensions electronically once systems are restored. If that’s not possible, mailing a paper extension is technically an option, though it’s risky this late unless you can prove timely mailing.

Paying Now, Filing Later: A Smart Move

If you owe taxes and can’t file, making an estimated payment by the deadline is often the safest play. Paying online (once systems are available), via IRS Direct Pay, or even through certain third-party services can reduce or eliminate late payment penalties—even if the return itself comes later.

What If I Can’t Pay Everything I Owe?

The IRS is far less scary when you communicate. Partial payments reduce penalties. Payment plans are common. And the IRS is much more forgiving with people who file and pay something than with those who disappear entirely.

How The IRS Knows It’s Not Your Fault

The IRS doesn’t rely solely on your word. They have system logs showing outages, server overloads, and failed transmissions. If thousands of filings failed during the same window, your return isn’t going to raise eyebrows.

Will I Get A Nasty Letter In The Mail?

Sometimes, yes—but don’t panic. IRS notices are often automated. If you receive a penalty notice later, you can respond with a request for penalty abatement citing the system outage. Many of these penalties are removed quickly once reviewed.

How To Request Penalty Abatement (If Needed)

If penalties do show up, you can request abatement by mail or phone. You’ll explain that you attempted to file on time, the IRS system was unavailable, and you filed as soon as possible afterward. Including screenshots or outage confirmations helps speed things up.

What About Interest?

Interest is separate from penalties and accrues daily on unpaid balances. Even if penalties are waived, interest may still apply to unpaid taxes. That’s another reason why paying sooner—even partially—can save you money.

Does This Affect My Refund If I’m Owed Money?

Good news: if you’re owed a refund, there’s no late filing penalty at all. Seriously. If the IRS owes you, being late doesn’t trigger penalties. You still should file, of course—but there’s no fine just for missing the deadline.

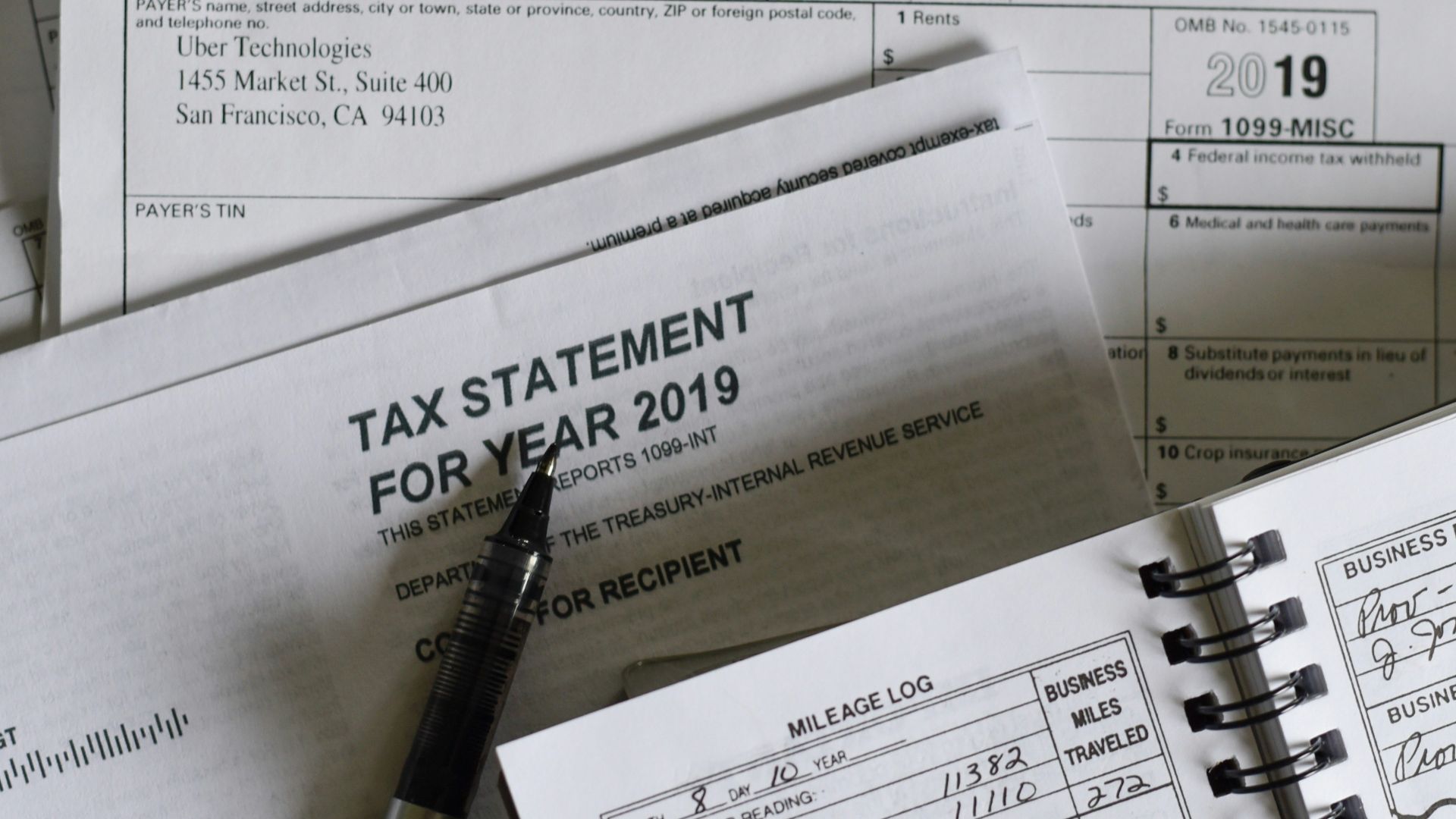

What If I’m Self-Employed?

Self-employed filers face the same filing rules but often owe more in taxes. The same outage relief generally applies, but making a payment is especially important since balances tend to be larger and interest adds up faster.

Third-Party Tax Software: Helpful Or Not?

Sometimes IRS systems are down while third-party software still works—or vice versa. It’s worth checking multiple platforms. Just remember: if the IRS can’t accept transmissions, the software can’t force it through.

Why This Keeps Happening Every Year

Tax Day traffic is intense. Millions of last-minute filers hit the system at once, and even modern infrastructure can buckle. The IRS has improved over the years, but deadline day is still a digital stampede.

What Not To Do Right Now

Don’t ignore the situation. Don’t assume “the IRS will figure it out” if you don’t file for weeks. Don’t panic-file incorrect information just to beat the clock. Accuracy still matters more than speed.

The Best Possible Next Steps Tonight

Try periodically. Document errors. If you owe taxes, prepare to make a payment as soon as possible. File immediately once systems are back. If you truly can’t file, prepare an extension. Doing something is always better than doing nothing.

Will This Hurt Me Long-Term?

Almost certainly not. The IRS is focused on chronic non-filers and intentional tax avoidance—not people caught in a system outage once a year. Handle it promptly and responsibly, and this will be a minor blip, not a lasting problem.

MBisanz talk, Wikimedia Commons

MBisanz talk, Wikimedia Commons

A Calm Ending To A Stressful Night

It feels dramatic now, but IRS outages on Tax Day are a known issue, and relief is common. You’re not doomed, you’re not alone, and you’re probably not getting fined just because a government website decided to take the night off. Take a breath, keep records, act as soon as you can—and maybe next year, file a tiny bit earlier.

You May Also Like:

Popular Tax Deductions That The IRS Is Getting Rid Of In 2026