Personal Finance: 20 Keys To Success

Financial success doesn’t happen overnight. It’s a long road to the top, but those who make the journey share certain financial habits in common. We’ve boiled them down to 20 key principles to follow. If you implement these 20 principles, it should be almost impossible not to meet your financial goals.

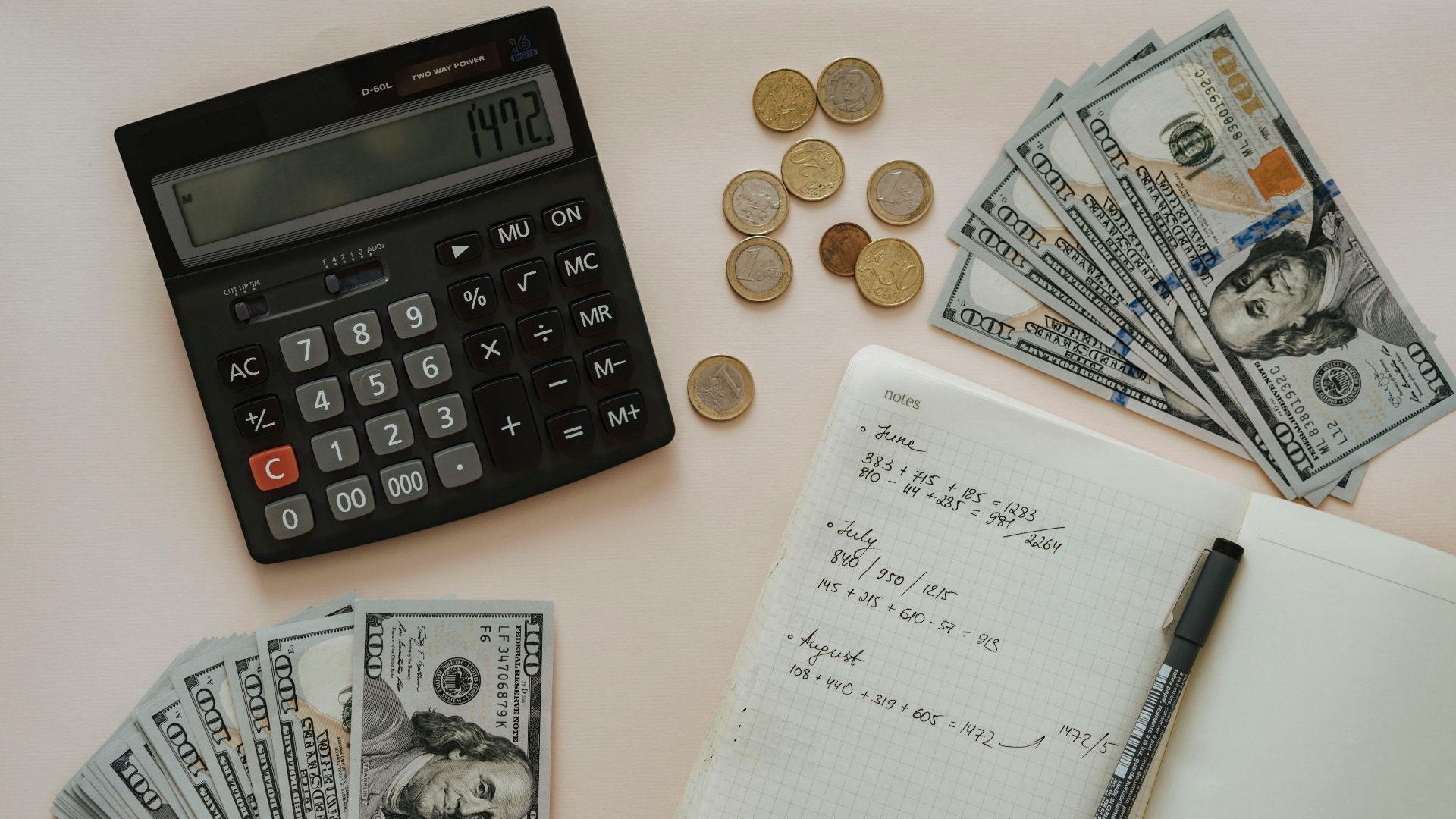

Keep A Budget

The key to financial health is self-discipline. A personal budget is the bedrock of that discipline. It’s hard to know exactly where all your money is going and how much unless you can keep your spending in line with your priorities. Keep a proper budget, and you’ll always be able to pinpoint where things are going wrong so you can make the necessary course correction.

Photo By: Kaboompics.com, Pexels

Photo By: Kaboompics.com, Pexels

Stockpile An Emergency Fund

Having three to six months of expenses in savings is a critical buffer zone protecting you from the possible cataclysm of job loss, illness, or unexpected bills. The emergency fund helps you land on your feet financially when life throws you a curveball.

Stay Away From High-Interest Debt

Carrying big credit card balances or payday loans is a recipe for disaster. This is the kind of debt that traps you in endless payments. Getting rid of high-interest debt frees up more of your money for saving and investing.

Keep Track Of Your Credit Score

Your credit score impacts your loan approvals, interest rates, and insurance costs. Keeping track of your score helps you identify errors, correct them, and improve your borrowing power.

Start Saving For Retirement Early

Compound interest rewards those who start saving early. Even small contributions to retirement accounts like 401(k)s or IRAs can grow significantly over decades, ensuring your long-term financial security.

Wild And Crazy Idea: Live Within Your Means!

Spending less than you earn is what helps you build wealth. Lifestyle inflation is one of the biggest things that eats into your savings potential. Keeping expenses under control guarantees that you’ll always have room to save and invest.

Photo By: Kaboompics.com, Pexels

Photo By: Kaboompics.com, Pexels

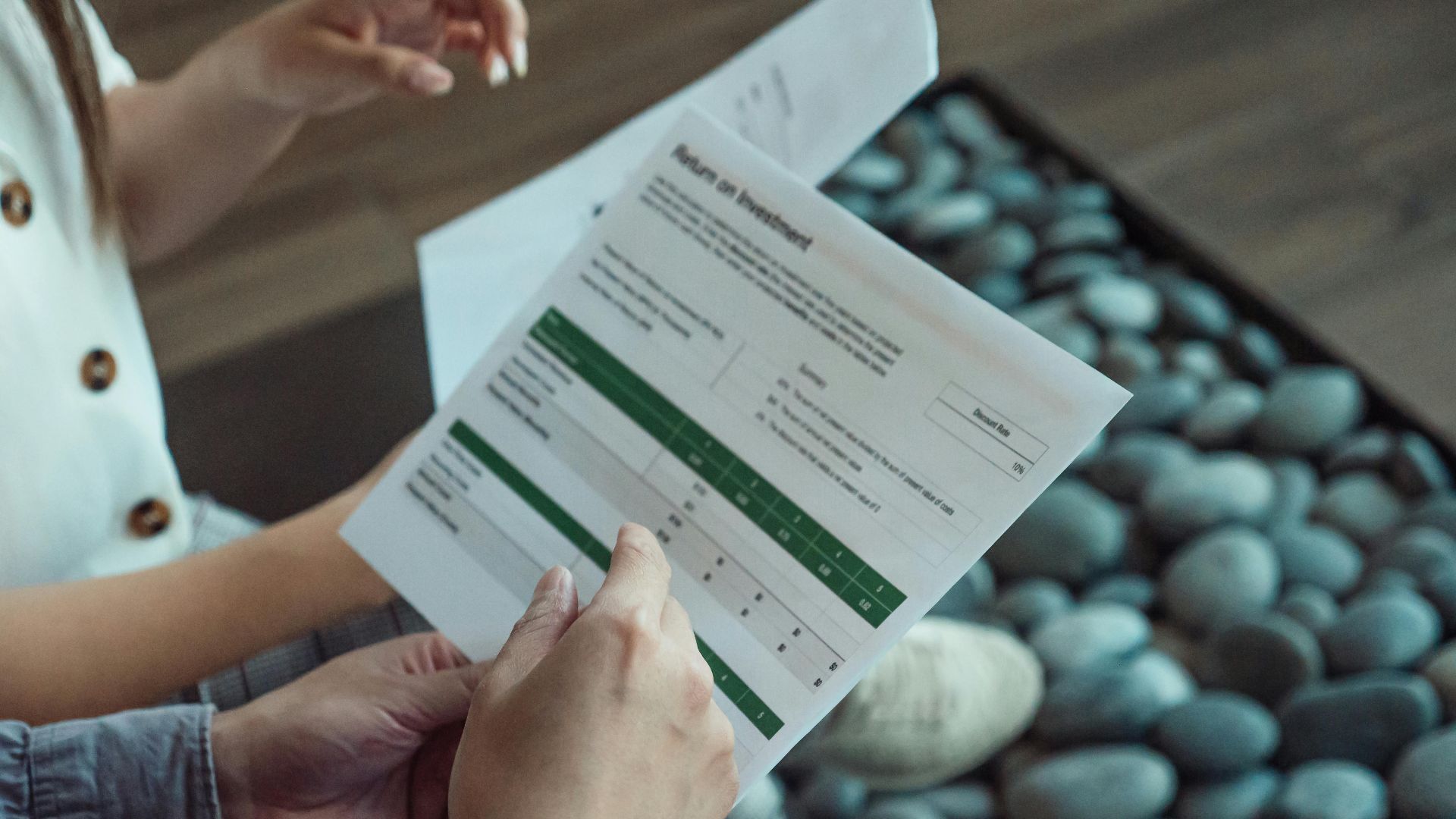

Diversify

This is a simple principle but it always bears repeating. Don’t put all your money in one place. Spreading investments across stocks, bonds, and other kinds of assets minimizes risk and gives you much better long-term growth potential.

Insure Against Big Risks

Health, life, disability, and property insurance are the defence shield for your financial future. Without coverage, a single accident or illness could wipe out years of progress. Make sure to review policies or consider changing providers to get a better deal.

Plan Ahead Of Time For Major Expenses

Saving for college, weddings, or a home purchase helps you avoid the need to take out a costly loan. Anticipating these kinds of big-ticket items will keep a lid on your debt and give you some peace of mind.

Photo By: Kaboompics.com, Pexels

Photo By: Kaboompics.com, Pexels

Know How Interest Rates Work

Interest has a massive impact on your savings and debt. High borrowing rates increase costs, while high savings rates grow wealth. Knowing the difference between the two will help you make better choices.

Photo By: Kaboompics.com, Pexels

Photo By: Kaboompics.com, Pexels

Automate Your Savings

Automating your savings is what helps you build discipline and consistency without even having to think about it. Transferring money directly into savings or retirement accounts always ensures you pay yourself first, before shelling out money on non-necessities.

Take Advantage Of Employer Benefits

Many employers offer retirement matching, health savings accounts, or stock options. Making the most of these perks is like a free income stream toward your financial goals.

Review Your Budget Frequently

Budgets aren’t set-and-forget. Life changes, like income, expenses, and goals mean that you’ll have to update your budget from time to time to reflect the new reality. Regular checks mean that your spending plan should remain realistic and effective.

Shop Around For Major Purchases

From mortgages to insurance, comparison shopping will save you thousands of dollars. Getting multiple quotes before making a commitment is more likely to get you the best deal available.

Never Stop Learning About Money

Financial literacy is a lifelong journey. Reading, listening to podcasts, and taking courses keeps your knowledge-base up to date so that you can make a well-informed decision. You can pass on this hard-won knowledge to your children as well, making their financial journey that much easier.

Be Extremely Reluctant To Co-Sign Loans

Co-signing means you’re just as responsible for repaying a loan as the principal borrower. If the borrower defaults, now it’s your credit and finances taking a hit. Only co-sign if you’re absolutely sure you can afford it if things go sideways down the road.

Don’t Put Off Estate Planning

None of us truly know how much time we have left. Wills, powers of attorney, and beneficiaries are what minimize or prevent disputes, ensuring that your assets go where you want them to. Estate planning protects your loved ones from complicated and complex legal and financial difficulties after you’re gone.

Stay Away From Get-Rich-Quick Schemes

Promises of making a fast buck are very often nothing more than a scam. Building wealth the proper way requires patience, discipline, and steady investing. Scammers don’t have any of those qualities. That’s why you’re better than them. Outsmart the fast buck artists by avoiding shortcuts that put your money at risk.

Photo By: Kaboompics.com, Pexels

Photo By: Kaboompics.com, Pexels

Pay Attention To Inflation Rates

Prices rise over time, reducing your money’s value. Investing at least some of your money in growth assets like stocks can help you stay ahead of inflation and maintain your own long-term purchasing power.

Don’t Forget To Celebrate Your Progress

Financial discipline doesn’t have to mean denying yourself the good things in life. By all means celebrate hard-earned financial milestones like paying off debts or reaching savings goals. This enjoyment is what will help you stay motivated long-term to keep on track for the next financial goal.

You May Also Like:

40 Small and Easy Ways to Save Money

5 Factors Affecting the Value of the U.S. Dollar and What It Means for Your Investments