Smart Tax Tools

Tax season doesn’t have to mean frustration and confusion. Some platforms quietly outshine the rest by providing real simplicity and serious cost savings. If your current tool barely gets you across the finish line, there’s still hope.

TurboTax

With its step-by-step, question-based format, TurboTax simplifies even the most complex filings. W‑2s and 1099s can be imported with ease, while higher tiers grant access to deduction tracking and industry-specific guidance. The Self‑Employed option offers dependable tools for gig workers and includes consultations from live tax professionals for extra reassurance.

Jonathan Schilling, Wikimedia Commons

Jonathan Schilling, Wikimedia Commons

FreshBooks

Freelancers and independent contractors often favor FreshBooks for its simple interface and built-in tax basics. Users can track expenses, log hours, generate invoices, and organize deductible categories with ease. It isn’t a full tax prep solution, but it pairs well with external filing software and supports Schedule C export for smooth reporting.

FreshBooks, 2ndSite Inc., Wikimedia Commons

FreshBooks, 2ndSite Inc., Wikimedia Commons

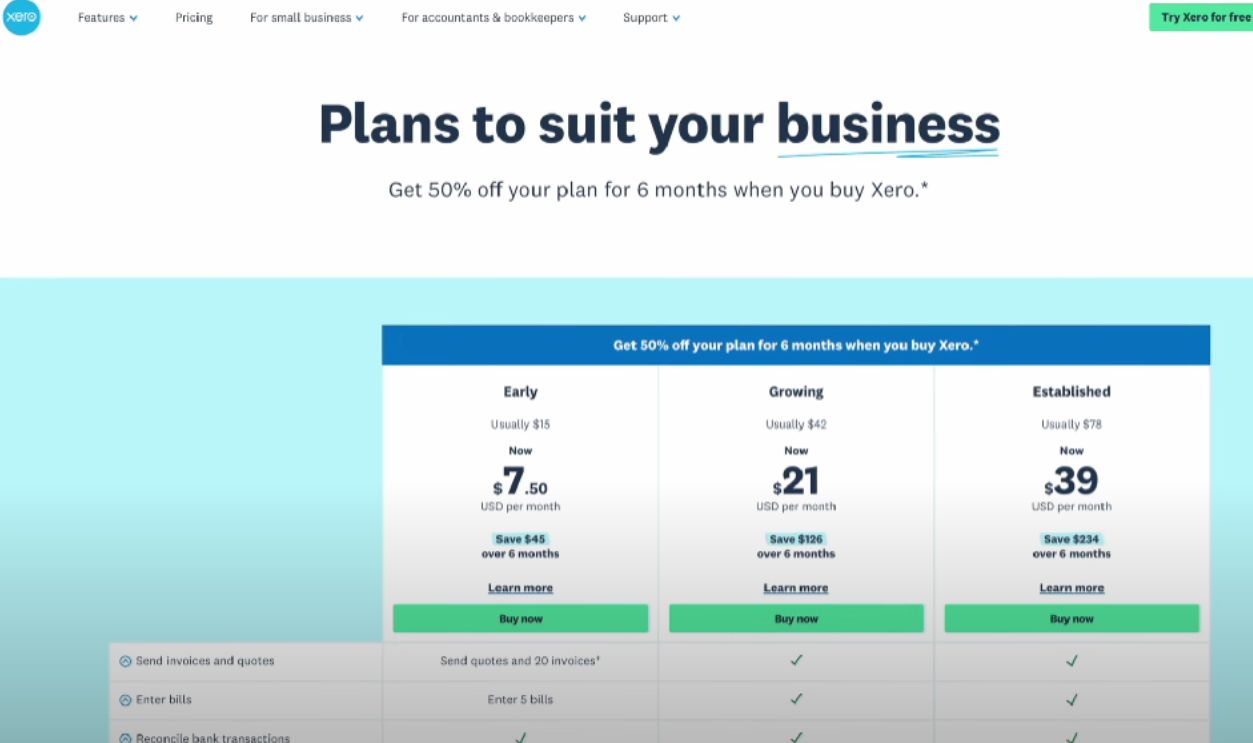

Xero

Xero combines cloud-based accounting with integrated tax features that streamline everything from invoicing to quarterly estimates. Its dashboard updates in real-time, syncing data from bank feeds and payroll systems. Built for small to mid-sized businesses, Xero also integrates with over 1,000 third-party apps for tax forecasting and reporting.

How to use XERO (2025) by Accounting Stuff

How to use XERO (2025) by Accounting Stuff

H&R Block Online

Unlike most platforms, H&R Block gives users the option to file online, get live help, or visit a nearby office. It supports a wide range of income sources and tax situations. Transparent pricing and seamless import features make it a trusted choice for new and returning filers.

Avalara

Avalara specializes in automating sales tax calculations across thousands of jurisdictions. Businesses selling across state or national lines can offload compliance tasks while ensuring up-to-date rate accuracy. It’s valuable for retailers and SaaS companies, thanks to its API that integrates with major eCommerce and accounting systems.

Set up tax calculation - AvaTax by Avalara University

Set up tax calculation - AvaTax by Avalara University

Cash App Taxes

Originally launched as Credit Karma Tax, Cash App Taxes stands out for its completely free federal and state filing. It includes audit defense and supports common forms like W‑2s, 1099s, and student loan interest. While best for straightforward returns, it impresses with a clean layout and mobile-friendly design.

TaxAct

Focusing on pricing clarity, TaxAct facilitates flat-fee filing that avoids hidden charges. It’s well-suited for itemized deductions and rental income. Users can track refunds in real-time and benefit from an interface that walks them through each form for accuracy without needing professional-level tax knowledge.

Jessidolmage, CC BY-SA 4.0, via Wikimedia Commons

Jessidolmage, CC BY-SA 4.0, via Wikimedia Commons

TurboTax Business

Business owners looking for intuitive filing will find TurboTax Business highly accessible. It supports partnerships, corporations, and LLCs and syncs easily with QuickBooks for seamless expense tracking. The interface guides users through entity-specific forms, which makes it ideal for those handling taxes without hiring a full-time accountant or outside firm.

TaxAct Business

TaxAct Business delivers a no-nonsense approach to business filing with its clean design and affordable flat-rate pricing. It supports various entity types with form-specific guidance without upselling unnecessary features. Ideal for small business owners who want control and convenience without committing to ongoing accounting software subscriptions.

Urgent Tax Questions? | TaxAct by TaxAct

Urgent Tax Questions? | TaxAct by TaxAct

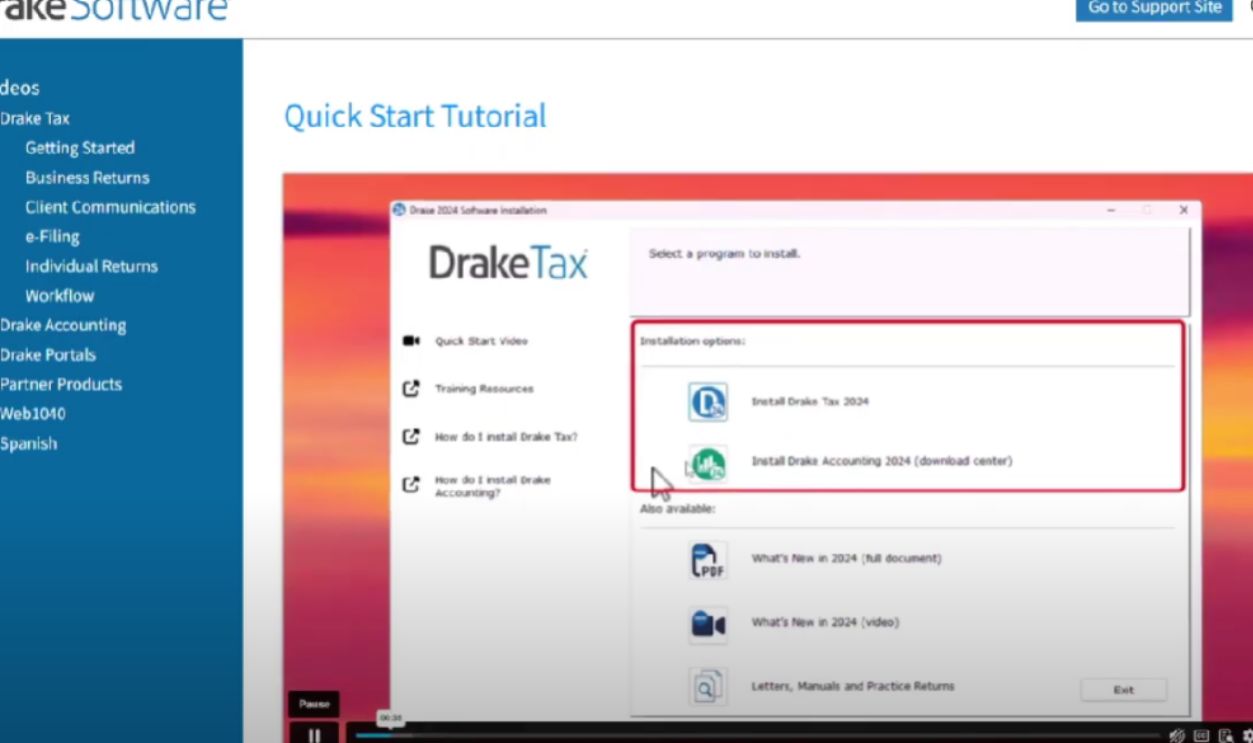

Drake Tax

Built for professionals but usable by experienced business filers, Drake Tax offers powerful desktop and cloud solutions. Its speed and excellent customer support make it a favorite among tax preparers. Users can batch-process returns and customize reporting while relying on detailed diagnostics. It’s incredibly efficient for high-volume tasks.

Drake Tax Software Review (2025) by EasyInternet

Drake Tax Software Review (2025) by EasyInternet

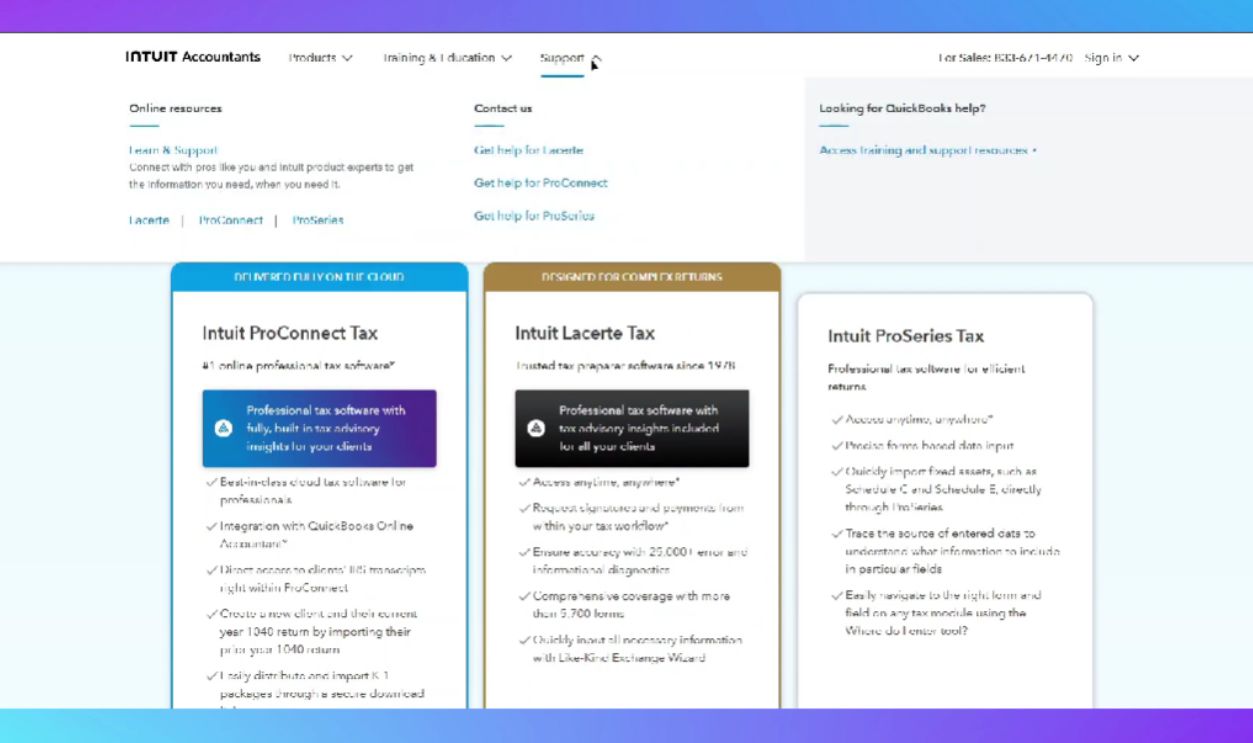

Intuit Lacerte

Lacerte is geared toward accounting firms and serious tax professionals managing complex business returns. Despite its advanced capabilities, it features a streamlined interface that saves time on prep and review. Integration with Intuit products and deep support for niche industries make it a go-to platform for high-end tax handling.

Intuit Lacerte Tax Software Review - Usage Experience by Wise Explainer

Intuit Lacerte Tax Software Review - Usage Experience by Wise Explainer

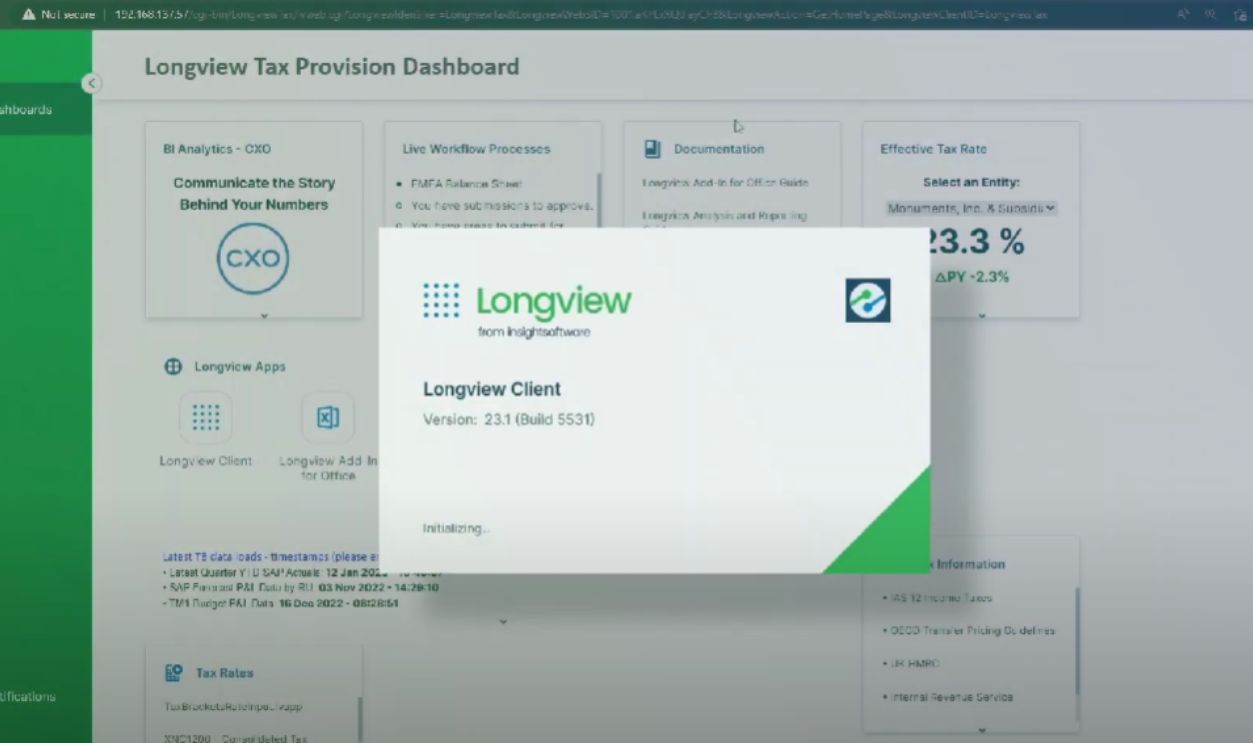

Longview Tax

Designed for enterprises with intricate operations, Longview Tax excels at managing multi-entity, multi-jurisdiction tax calculations. It supports consolidation and reporting within a centralized platform. Organizations with layered structures and global footprints benefit from its scalability, which makes it a strategic asset for in-house finance teams tackling detailed compliance needs.

Longview Tax: BEPS Pillar 2 Demo by insightsoftware

Longview Tax: BEPS Pillar 2 Demo by insightsoftware

Thomson Reuters GoSystem Tax RS

GoSystem Tax RS is a cloud-based solution used by large corporations and accounting firms. It handles consolidated returns and high-volume data with precision. Its customizable workflows and integration with other Thomson Reuters platforms support extensive audit trails, which suit heavily regulated and high-risk environments.

FreeTaxUSA

Straightforward and budget-friendly, FreeTaxUSA allows free federal returns with optional state filing for around $15. It covers the most common forms, including self-employment and itemized deductions. Users get data encryption and prior-year import. It’s a smart choice for confident filers who don’t need bells, whistles, or live help.

FreeTaxUSA efile income tax for refund. Federal is Free. State is $14.99 by Katie St Ores CFP

FreeTaxUSA efile income tax for refund. Federal is Free. State is $14.99 by Katie St Ores CFP

Jackson Hewitt Online

What sets Jackson Hewitt apart is its single-price model—roughly $25 covers everything, regardless of return complexity. The platform offers both digital filing and in-person office access. Its easy-to-follow workflow and access to local tax professionals make it ideal for users seeking flexibility and dependable customer support.

MinMinSparrow, Wikimedia Commons

MinMinSparrow, Wikimedia Commons

IRS Free File

Created through a public-private partnership, IRS Free File offers no-cost federal returns for those earning below a set income threshold (typically around $84,000 for 2024). Participating software providers handle the digital filing, but eligibility varies. It’s a useful option for qualified filers who want professional-level software without the associated fees.

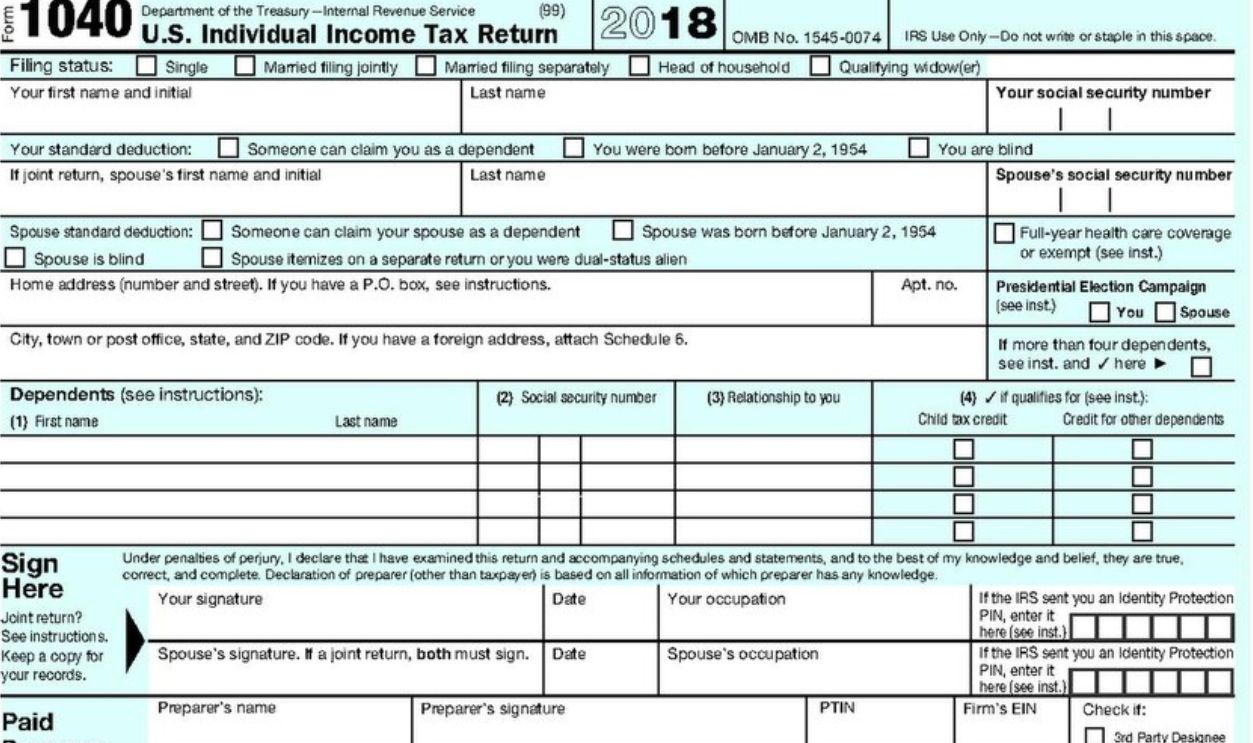

IRS Free File Fillable Forms

This official IRS tool provides electronic versions of standard federal forms—without handholding or step-by-step guidance. Best for confident filers with a strong grasp of tax terminology, Fillable Forms allow direct input and e-filing. It’s free and ideal for those who don’t need explanations or automated suggestions.

United States Federal Government, Wikimedia Commons

United States Federal Government, Wikimedia Commons

April

April is an emerging fintech platform that uses AI to help users with their tax returns. Embedded within some banking apps, it auto-fills key data and claims to simplify decisions. While still new, it aims to reduce friction in filing, but accuracy and audit support remain key considerations.

SecarikKertas, CC BY-SA 4.0, Wikimedia Commons

SecarikKertas, CC BY-SA 4.0, Wikimedia Commons

Wave

At no cost, Wave offers a surprisingly comprehensive accounting suite. Its features include double-entry bookkeeping and basic tax report generation with automatic transaction syncing. Ideal for sole proprietors and startups, Wave’s free tools help users stay organized during the year and make it easier to file taxes when deadlines approach.

TronnaRob, CC BY-SA 4.0, Wikimedia Commons

TronnaRob, CC BY-SA 4.0, Wikimedia Commons

InDinero

InDinero combines outsourced bookkeeping with tax preparation, catering to growing businesses that need hands-off financial management. It handles payroll, compliance, forecasting, and year-end tax filing. Businesses get access to financial experts and CPAs in a practical solution for startups and small firms without dedicated internal accounting teams.

inDinero Brand Overview by inDinero

inDinero Brand Overview by inDinero

Aplos

Specifically tailored for nonprofits and churches, Aplos simplifies fund accounting while meeting IRS compliance requirements. It supports donation tracking and Form 990 preparation. The software’s built-in tax tools address sector-specific challenges and ensure financial transparency and tax readiness for organizations with restricted funds or multiple funding streams.

Aplos Accounting Software for Churches & Nonprofits | Full Review by Meru Accounting

Aplos Accounting Software for Churches & Nonprofits | Full Review by Meru Accounting

Trolley

Trolley simplifies global tax compliance for companies paying international contractors and creators. It automates W-8 and W-9 form collection and handles withholding in multiple jurisdictions. Designed for scale, Trolley is ideal for marketplaces and firms with growing global teams and evolving regulatory needs.

San Diego Metropolitan Transit System, Wikimedia Commons

San Diego Metropolitan Transit System, Wikimedia Commons

TaxSlayer

Many freelancers and side hustlers gravitate toward TaxSlayer for its low-cost tiers and form flexibility. The platform offers prior-year return imports and guidance for self-employment taxes. Premium users also receive priority tech support and audit assistance, which makes it a well-rounded tool without the steep price tag.

DesignVZ, CC BY-SA 4.0, Wikimedia Commons

DesignVZ, CC BY-SA 4.0, Wikimedia Commons

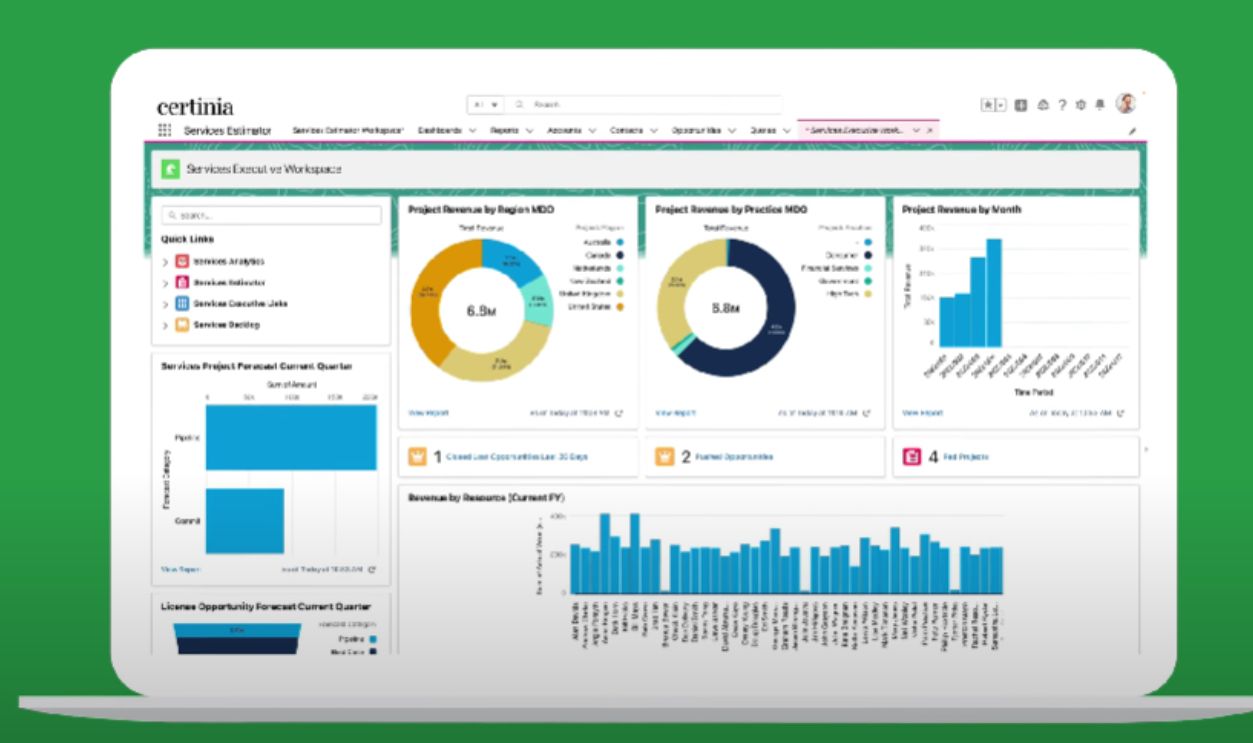

Certinia

Built on the Salesforce platform, Certinia integrates tax compliance into enterprise resource planning (ERP) workflows. It supports real-time visibility across revenue and tax functions. Organizations benefit from unified financial data and configurable tax logic, which make Certinia an efficient solution for enterprises needing operational accuracy and audit readiness at scale.

Intro to Certinia PS Cloud for Professional Services Automation (PSA) by Certinia

Intro to Certinia PS Cloud for Professional Services Automation (PSA) by Certinia

ezTaxReturn

ezTaxReturn is a full-featured platform that provides free federal and low-cost state filing, with options for free e-filing depending on income. Its interface is straightforward, and it supports W‑2 and itemized deductions. While not flashy, EZTax appeals to filers who want clarity and minimal distractions.