The Largest Class Action Lawsuits In History

Americans have a reputation for being litigious, and the frequency of class action lawsuits appears to be growing every year. In 2024, class action settlements were well over $40 billion, which is low compared to previous years. Here are some of the biggest class action lawsuit settlements of all time.

Remington ($73 Million)

In 2012, 20 young children and six adult staff members tragically lost their lives at a mass shooting at Sandy Hook Elementary School in Newtown, Connecticut. This resulted in a lawsuit against Remington, the manufacturer of the weapon used in the event.

Remington ($73 Million)

Remington and its insurers were ordered to pay $73 million to the victims’ families. Gun manufacturers have some protection against wrongful death in the United States, so the lawsuit was focused on how Remington marketed its weapons. This marketing emphasized the military qualities of the guns, and the plaintiffs obtained internal documents showing the company deliberately marketed to the militaristic fantasies of a segment of their customer base.

Google ($118 Million)

Google had been paying female employees $17,000 less than their male counterparts for similar roles. Over 15,000 women working for Google launched a class action lawsuit that was settled for $118 million. The plaintiffs had been denied promotions, were paid less than male employees, and highly-qualified women were placed in lower-paying roles.

TurboTax ($141 Million)

Accused of misleading customers by promising free tax-filing services, TurboTax was ordered to pay $141 million. They were required to pay 4.4 million taxpayers $30 for each year they were misled into using the paid version of TurboTax when they were eligible for the free version.

Coolcaesar at en.wikipedia, Wikimedia Commons

Coolcaesar at en.wikipedia, Wikimedia Commons

Bank Of America ($160 Million)

When Bank of America acquired Merrill Lynch in 2013, Merrill Lynch had already agreed to pay $160 million for a racial discrimination lawsuit brought by a longtime employee. Over 1,200 former and current Merrill Lynch employees were deemed eligible to receive a settlement. This was based on allegations that the company had created a segregated workforce.

Alex Proimos from Sydney, Australia, Wikimedia Commons

Alex Proimos from Sydney, Australia, Wikimedia Commons

Sterling Jewelers ($175 Million)

Sterling Jewelers, the parent company of Kay Jewelers, Jared, and Zales, was ordered to pay $175 million to settle discrimination and harassment claims. The claims had been ongoing for 15 years with 68,000 plaintiffs claiming that the company discriminated against women in compensation and promotions. The lawsuits were settled in 2022.

M.O. Stevens, Wikimedia Commons

M.O. Stevens, Wikimedia Commons

AmerisourceBergen, Cardinal Health, McKesson, And Teva Pharmaceutical ($260 Million)

In 2019, two Ohio counties reached a settlement with three drug distributors, AmerisourceBergen, Cardinal Health, and McKesson, and producer Teva Pharmaceutical for $260 million. This was for the companies’ involvement in the opioid crisis.

Vitaris ($264 Million)

A lawsuit contended that Vitaris attempted to block lower-priced generic versions of its EpiPen. The company, at the time known as Mylan, then raised EpiPen prices from $100 in 2008 to $500 in 2016. They were ordered to pay $264 million in damages.

Salomon Brothers ($290 Million)

The Salomon Brothers investment bank was ordered to pay $290 million in 1992 for submitting phony bids in treasury auctions. In the settlement, the government agreed to not file extra charges for the millions gained in the scheme.

Countrywide Financial ($335 Million)

Countrywide Financial, later to become the mortgage unit of Bank of America, was ordered to pay $335 million in 2008. Over 200,000 African American and Hispanic borrowers were charged higher fees and interest rates than white customers.

Country Financial, Wikimedia Commons

Country Financial, Wikimedia Commons

Google ($392 Million)

Google was ordered to pay $392 million for its location tracking practices which violated privacy laws. Google had used deceptive practices to obtain users’ location data and secretly record and sell user data.

Novartis ($678 Million)

Pharmaceutical company Novartis was ordered to pay $678 million in 2020 for bribing doctors to use its cardiovascular and diabetes treatments. They had presented speakers with dubious credentials in programs where no meaningful information was provided. Doctors were treated to expensive meals at high-end restaurants and were paid hundreds of thousands of dollars.

--Andrew Hecht, Wikimedia Commons

--Andrew Hecht, Wikimedia Commons

Abbott Laboratories ($1.5 Billion)

Abbott Laboratories was exposed for unlawful promotion of prescriptions for uses beyond those approved by the FDA. The company pleaded guilty and was ordered to pay $1.5 billion in 2012. Abbott Laboratories had misbranded the drug Depakote as a treatment for schizophrenia.

Abbott plant to import formula from Ireland, Click On Detroit | Local 4 | WDIV

Abbott plant to import formula from Ireland, Click On Detroit | Local 4 | WDIV

Navient ($1.85 Billion)

The student loan-servicing company Navient was ordered to pay $1.85 billion after being sued for unfair practices. The company had encouraged borrowers to take out long-term forbearance rather than low-cost repayment plans. This led to former students falling deep into debt with unreasonably high interest rates.

Johnson & Johnson ($2.2 Billion)

Health giant Johnson & Johnson was ordered to pay $2.2 billion in 2013 to settle claims against them. The company had promoted pharmaceuticals without pre-approval and had paid kickbacks to doctors and pharmacy companies.

ParentingPatch, Wikimedia Commons

ParentingPatch, Wikimedia Commons

Dow Corning ($2.3 Billion)

Dow Corning was the leading maker of silicone gel implants from 1964 to 1992. Those implants were removed from the market when it was shown that they caused health problems. The company was ordered to pay $2.3 billion for claims from 240,000 women leading to the company’s 1995 bankruptcy.

Dow Corning, Wikimedia Commons

Dow Corning, Wikimedia Commons

Pfizer ($2.3 Billion)

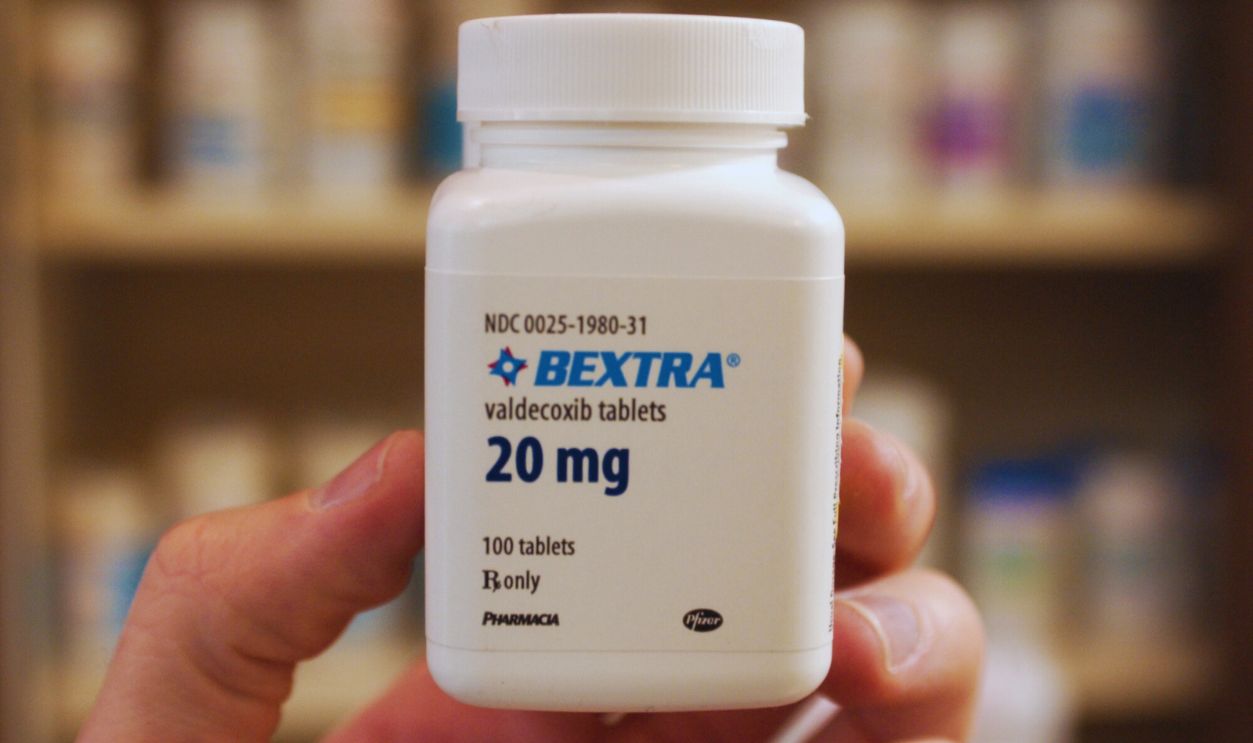

Pharmaceutical giant Pfizer was found guilty of fraud in 2009. It had promoted off-label uses for its painkiller Bextra and hadn’t received pre-approval by the Food and Drug Administration. The company was ordered to pay $2.3 billion for its unlawful activity including illegal marketing. This was, at the time, the largest fine of its kind.

MediaNews Group/Reading Eagle via Getty Images, Getty Images

MediaNews Group/Reading Eagle via Getty Images, Getty Images

Takeda ($2.4 Billion)

Takeda Pharmaceuticals was ordered to pay $2.4 billion for concealing the bladder cancer risks associated with its diabetes drug Actos. Takeda insisted that the benefits far outweighed the risks when taking Actos and when they settled, they denied liability or wrongdoing.

Bank Of America ($2.4 Billion)

Bank of America appears a few times on this list. In 2012, they were ordered to reimburse shareholders $2.43 billion. The company had concealed crucial information when it purchased Merrill Lynch & Co. during the financial crisis of 2008. Even after the crisis, Bank of America continued to lose money due to the mishandled acquisition.

AgnosticPreachersKid, Wikimedia Commons

AgnosticPreachersKid, Wikimedia Commons

Nortel Networks ($2.5 Billion)

The multinational telecommunications company was ordered to pay $2.47 billion to two plaintiffs for accounting discrepancies. The company agreed with the condition that the settlement did not contain an admission of wrongdoing. The payout of cash and reissued stocks resulted in Nortel's bankruptcy and dissolution in 2009.

Mw12310 at English Wikipedia, Wikimedia Commons

Mw12310 at English Wikipedia, Wikimedia Commons

AOL-Time Warner ($2.8 Billion)

Before they merged in 2001, both Time Warner and America Online engaged in accounting discrepancies, inflating advertising revenues, and defrauding 625,000 shareholders. The merged company was ordered to pay $2.8 billion to shareholders and institutions that lost money.

Cendant Mortgage ($2.83 Billion)

After being created from a merger in 1998, consumer services provider Cendant uncovered massive accounting discrepancies. At the time of a record settlement, Cendant was ordered to pay $2.83 billion to shareholders. In the 2000s, the company split into four separate companies.

Tyco International ($2.92 Billion)

Two former CEOs of Irish security systems company Tyco International were jailed in 2002 for the embezzlement of over $150 million. Found guilty of over 30 violations, they had inflated income by $5.8 billion. The company was ordered to pay $2.92 billion to settle investor lawsuits.

Raysonho @ Open Grid Scheduler / Grid Engine, Wikimedia Commons

Raysonho @ Open Grid Scheduler / Grid Engine, Wikimedia Commons

GlaxoSmithKline ($3 Billion)

A disturbing trend seems to be pharmaceutical companies using unlawful promotions of their products, something that has resulted in billions of dollars in lawsuits over the past few decades. GlaxoSmithKline was ordered to pay $3 billion in 2012, $2 billion of which was for civil charges under the False Claims Act. The additional $1 billion was for charges related to misbranding its products Paxil, Wellbutrin, and Avandia, as well as for lacking adequate safety reports.

American Home Products ($3.75 Billion)

The US pharmaceutical company American Home Products settled over 9,000 lawsuits that had been filed due to the diet drug fen-phen which caused fatal heart valve damage. In 1999, American Home Products agreed to pay $3.75 billion, up to $1.5 million per user.

James Heilman, MD, Wikimedia Commons

James Heilman, MD, Wikimedia Commons

WorldCom ($6.1 Billion)

Over a dozen investment banks and 830,000 individual investors were victims of an $11 billion accounting fraud at telecommunication company WorldCom that was exposed in 2002. One of the largest such cases in US history, this eventually led to the company’s bankruptcy.

WorldCom ($6.1 Billion)

WorldCom investors were ordered to pay $6.1 billion in a 2015 settlement. The investment banks had settled to avoid future liabilities and WorldCom’s chief executives Bernard Ebbers and Scott Sullivan were incarcerated for their crimes.

Enron ($7.2 Billion)

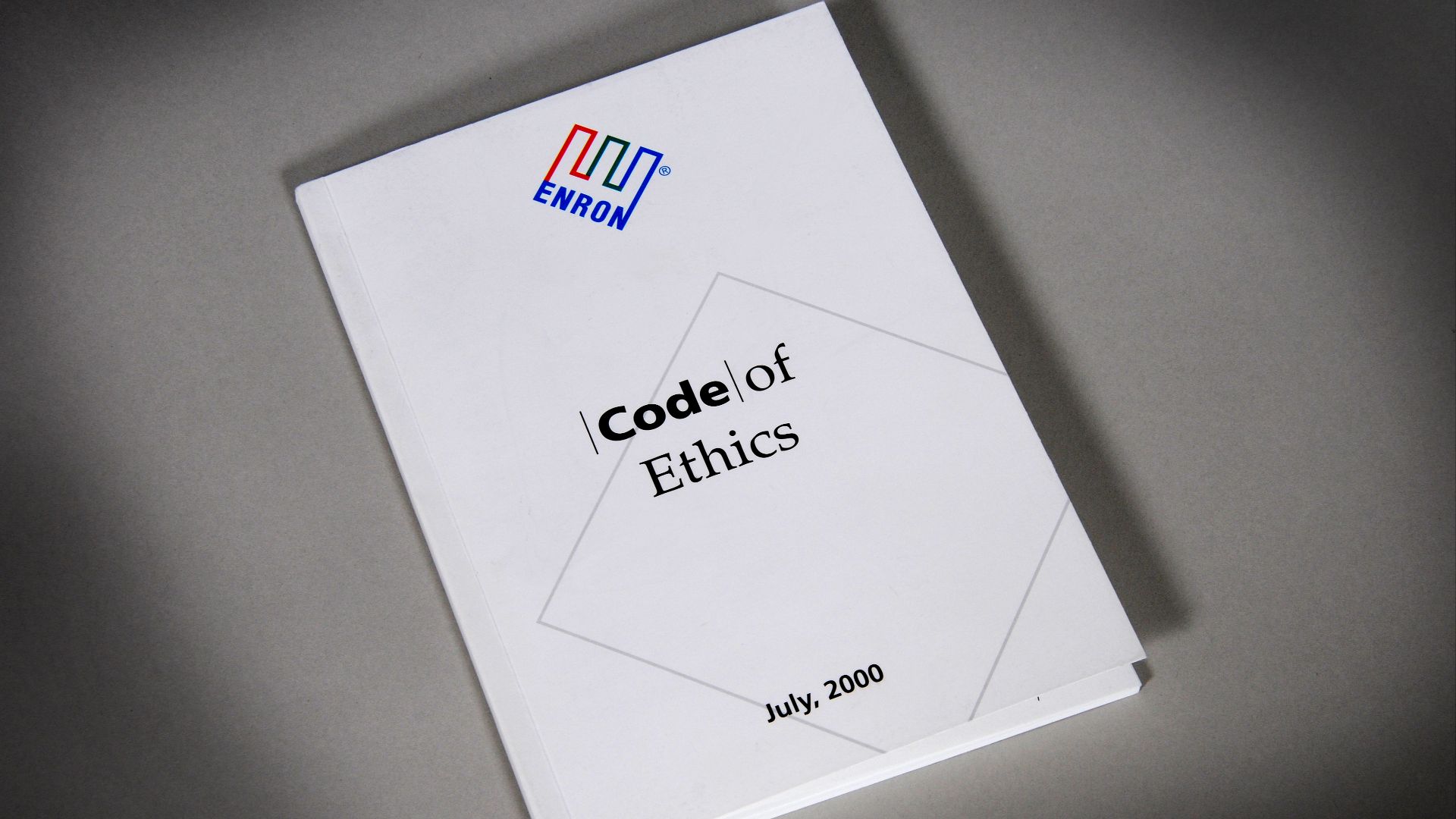

Enron was a publicly traded commodities and natural gas company formed in 1985. The company’s stock rose dramatically throughout the 1990s. The company was, in fact, billions of dollars in debt which was hidden using misleading financial reporting.

Enron ($7.2 Billion)

In 2001, the corruption within Enron was exposed. A number of other financial institutions, including Bank of America, Citigroup, and JPMorgan Chase were accused of participating in the scheme and were ordered to pay $7.2 billion to the company's investors and shareholders.

Federal Bureau of Investigation (FBI), Wikimedia Commons

Federal Bureau of Investigation (FBI), Wikimedia Commons

CVS And Walgreens ($10.7 Billion)

The opioid crisis, sometimes referred to as an epidemic, is the overuse of opioids, including fentanyl, resulting in thousands of deaths in the US since the 1990s (100,000 people lose their lives each year globally due to opioid use). US pharmacy chains CVS and Walgreens agreed to pay $5 billion and $5.7 billion respectively over 15 years. Neither CVS nor Walgreens actually admitted to any wrongdoing for their involvement in the crisis.

hattiesburgmemory, Wikimedia Commons

hattiesburgmemory, Wikimedia Commons

Bayer ($10.9 Billion)

Pharmaceutical giant Bayer’s subsidiary Monsanto produced the weed-killer Roundup. Consumers claimed they developed cancer due to the product. Three previous cases against Bayer-Monsanto resulted in over $2.3 billion in settlements but those were appealed.

Karen Eliot, Wikimedia Commons

Karen Eliot, Wikimedia Commons

Bayer ($10.9 Billion)

In 2020, an $11 billion settlement was reached with over 100,000 lawsuits filed by consumers. At this time, 25,000 cases remain unsettled. Unlike the previous cases under appeal, Bayer has agreed to pay this settlement to consumers.

Michielverbeek, Wikimedia Commons

Michielverbeek, Wikimedia Commons

Volkswagen ($14.7 Billion)

The Dieselgate emissions scandal involved German automaker Volkswagen and accusations of cheating on emissions tests. Secretly installed software was used to alter the results of diesel emissions tests in 475,000 VW vehicles.

Mariordo Mario Roberto Duran Ortiz, Wikimedia Commons

Mariordo Mario Roberto Duran Ortiz, Wikimedia Commons

Volkswagen ($14.7 Billion)

In 2016, a US judge approved the settlement between Volkswagen and the owners of those cars. Volkswagen bought back those affected cars which had permitted 40 times the legally allowed pollution levels. The car owners were also awarded up to $10,000 in additional compensation.

John Biehler from Port Coquitlam, Canada, Wikimedia Commons

John Biehler from Port Coquitlam, Canada, Wikimedia Commons

Bank Of America ($16.65 Billion)

The financial crash of 2008 resulted in major lawsuits against Bank of America, the second largest bank in the United States and the second largest in the world. The settlement was announced in 2014, and it was the largest against a single company in US history. The funds went towards investigations into the sales of thousands of questionable mortgage securities.

BP ($20 Billion)

The largest marine oil spill took place in April 2010, when BP’s Deepwater Horizon oil rig in the Gulf of Mexico sank after an explosion. An estimated 4.9 million barrels (205.8 million gallons) were released into the Gulf.

Unknown Author, Wikimedia Commons

Unknown Author, Wikimedia Commons

BP ($20 Billion)

Six years later, a federal judge in New Orleans approved a settlement against BP, who was ordered to pay $20 billion, covering fines levied from the Clean Water Act plus the environmental damages. Although cleanup had begun right after the disaster, which had also killed 11 oil rig workers, the environmental impact was enormous.

Green Fire Productions, Wikimedia Commons

Green Fire Productions, Wikimedia Commons

Philip Morris, RJ Reynolds, Brown & Williamson, And Lorillard ($206 Billion)

When it comes to class action lawsuits, settlements against Big Tobacco are the Holy Grail. This was the largest civil litigation settlement in US history. In 1998, attorneys general for 46 states, Washington DC, and several US territories sat down with representatives of the four largest tobacco companies.

Philip Morris, R.J. Reynolds, Brown & Williamson, And Lorillard ($206 Billion)

After years of litigation, the companies agreed to reduce their marketing campaigns, as well as their significant lobbying efforts. The main thrust of the settlement was $206 billion to be paid over 25 years to the states and territories. This was to fund medical care for people with related illnesses and for anti-smoking campaigns.

You May Also Like:

McDonald's Has Another Lawsuit Over A Hot Coffee Spill Decades After The First

PR Disasters So Bad, They Made History