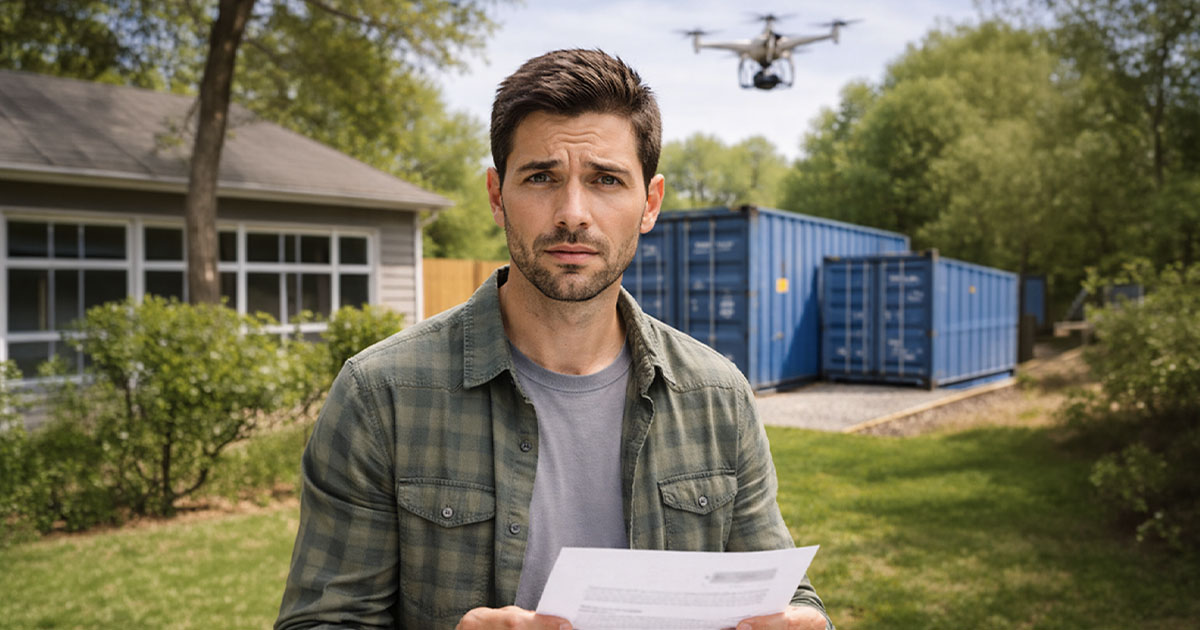

They Canceled You… Because of Google Earth?

You didn’t file a claim. You didn’t miss a payment. Then suddenly your home insurance policy gets canceled — and the reason? They saw sea containers on your property using Google Earth. It feels invasive and unfair. But can they actually do that? This guide explains when insurers can cancel policies, why sea containers can be a problem, and what you can do next.

Yes, Insurance Companies Use Satellite Images

This part surprises people, but it’s common. Insurers in both the US and Canada use aerial imagery (Google Earth, drones, satellite services) to assess property risk. They do it during underwriting, renewal reviews, and sometimes mid-policy if something flags your file.

They Don’t Need to Physically Inspect First

In most US states and Canadian provinces, insurers aren’t required to physically visit your property before making underwriting decisions. If something shows up in aerial photos that violates their guidelines, they can act on it.

When Can They Cancel Without Warning?

In the US, insurers can usually cancel a brand-new policy within the first 30–60 days for almost any underwriting reason. After that window, cancellation rules tighten and they typically must give written notice (often 10–30 days depending on the state).

In Canada, It’s Similar — But Regulated

Canadian insurers must provide written notice before cancellation (often 15 days for non-payment, 30 days for underwriting reasons). They can’t just cancel instantly without notice — but they can non-renew or terminate if the property no longer meets risk guidelines.

What Counts as a “Material Change in Risk”?

If you add something to your property that increases risk — even if you think it’s harmless — insurers may consider that a material change. Storage containers can fall into this category depending on how they’re used.

Why Sea Containers Raise Red Flags

Sea containers can trigger concerns about fire hazards, structural instability, illegal conversions, unpermitted dwellings, or business use. Insurers worry about what’s inside them — chemicals, tools, fuel, or even tenant occupancy.

Zoning and Municipal Rules Matter

In many US cities and Canadian municipalities, shipping containers are restricted or require permits. If they’re not approved structures, insurers may see them as a liability risk — especially if local bylaws prohibit long-term use.

Temporary vs. Permanent Placement Makes a Difference

A short-term container during renovations may be acceptable. A permanent container used for storage or conversion into a living space is a bigger issue. Duration and usage matter more than the container itself.

They May Not Be Insuring the Container — They’re Insuring the Risk

Even if you don’t want coverage for the container itself, insurers care about overall property risk. If something increases the chance of fire, injury, or liability claims, they can adjust or cancel coverage.

Business Use Is a Major Trigger

If those containers are used for business storage, tools, inventory, or rental units, your homeowner’s policy likely excludes that exposure. Insurers often cancel policies when they discover undisclosed business activity.

Fire Risk Is the #1 Concern

Containers are often used to store fuel, machinery, or flammable materials. From an insurer’s perspective, that changes your property’s fire risk profile — and fire risk is everything in home insurance pricing.

Could They Have Just Raised Your Premium Instead?

Sometimes yes — but insurers don’t always have a pricing tier for every risk scenario. If something falls outside their underwriting rules, cancellation is often the default response instead of adjusting your rate.

Did They Have to Warn You First?

In most cases, yes — they must send written notice before cancellation or non-renewal. But if you’re still within your policy’s initial underwriting period, they have broader discretion to terminate.

What If You Didn’t Know It Was a Problem?

Unfortunately, “I didn’t know” doesn’t usually change underwriting rules. Insurance contracts require you to disclose certain property changes. If they determine the risk wasn’t disclosed, they can act.

What You Should Do Immediately

First, confirm whether this is a cancellation or a non-renewal. Then ask for the specific underwriting reason in writing. The wording matters. It helps you fix the issue or shop for new coverage.

Can You Appeal the Decision?

Sometimes. If the container is temporary, permitted, or empty, you may be able to provide documentation and request reconsideration. Photos, permits, and written explanations can help.

Removing the Containers May Solve It

If you’re willing to remove them, ask if reinstatement is possible after proof of removal. Many insurers will reconsider once the risk is corrected.

Shop Around — Not All Insurers Think the Same

Some carriers have stricter guidelines than others. Especially in rural US areas and parts of Canada, certain insurers are more flexible about outbuildings and containers.

Be Honest With the Next Insurer

When applying for new coverage, disclose the containers upfront. Hiding them can lead to another cancellation later — or worse, a denied claim.

Final Takeaway: It Feels Harsh, But It’s Legal

In both the US and Canada, insurers are allowed to cancel or non-renew policies if your property no longer meets underwriting guidelines — including the presence of sea containers. It’s frustrating, especially when discovered via satellite, but you do have options. Clarify the reason, correct the issue if possible, and find a carrier that fits your property better.

You May Also Like:

My property taxes doubled this year and I can’t cover the increase. What are my options?

My apartment burned down. Even though I have tenant's insurance, my landlord secretly wasn't insured. What now?