Honesty In Business And The £500 Million Gaffe

As humans, we spend our entire lives walking a fine line between honesty and tact. We learn honesty first, tact second, and spend the rest of our lives trying to balance the two. If we’re lucky, we’re mostly successful, with a few inevitable failures here and there.

But few of us can say that our failure ever cost us £500 million. And that’s exactly how much the Ratners Group lost in value in 1991 following an extraordinary gaffe by its CEO, Gerald Ratner.

A Visionary

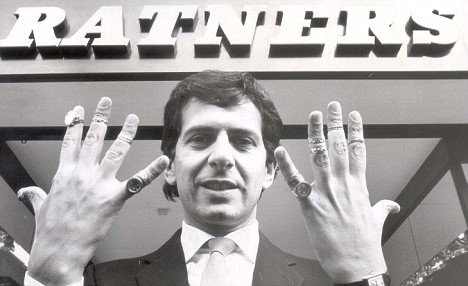

Gerald Ratner didn’t build Ratners Group from the ground up—but he did tear it down all by himself. Ratners Group was his family’s small jewelry business. He began to work there when he was just a teen in the 60s. Ratner eventually took over from his parents in the 80s, and he had a vision for the company.

He wanted Ratners to be the biggest jeweler in the world. Does biggest necessarily mean best? In Ratner’s world, certainly not.

This Is How I Win

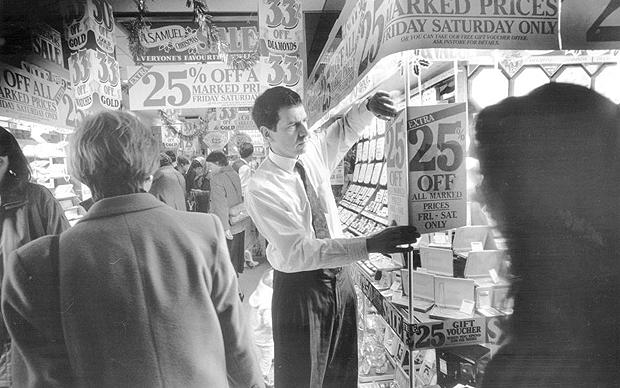

Ratner formally took over the business from his parents in 1984 and settled on a big and brash strategy for the company. He quickly made it into the Marks & Spencer of jewelry, with a Ratners store located on every “high street”—the retail hub of any British town. A handful of stores also popped up stateside. Ratner was on his way to the top.

Gerald Ratner didn’t do all this by offering rare and expensive jewels to an ultra-exclusive crowd. Instead, Ratner did it by bringing precious metals and gems to the masses. He gave working-class folk a reliable place to buy engagement and wedding rings, anniversary gifts, and more.

It was a taste of the finer things in life, but on a budget.

The Everyman's Jewelry

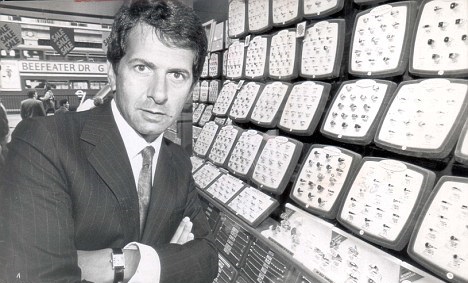

Ratners existed in a universe as far away as possible from the polished look of a Tiffany & Co. or Cartier. In fact, you could say that the exterior matched the product. Actually, that might flatter the exterior a bit too much. Ratners stores looked like a liquidation sale at a store in the lowest-rent mall in the dodgiest end of town.

Were it not for the Ratner name, customers going in might expect to be sold a chain made of tin instead of silver. Ratners could be spotted from miles away, with their utterly garish “SALE!!!” graphics on backgrounds of the most eye-searing orangey-red.

Living' It Up

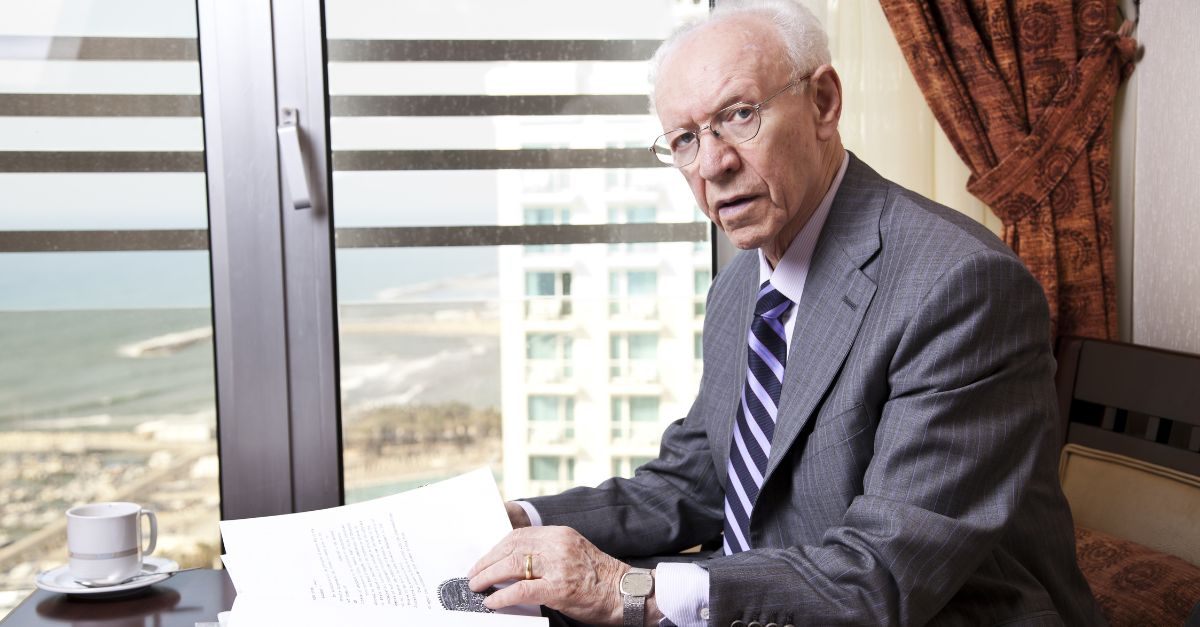

Within a few years of taking over, Gerald Ratner had built the family business into a multi-million-dollar empire. Like any self-respecting CEO, he had the lifestyle to match. Ratner loaded up on cars, boats, and one would assume, a couple of whatever the British versions of McMansions are.

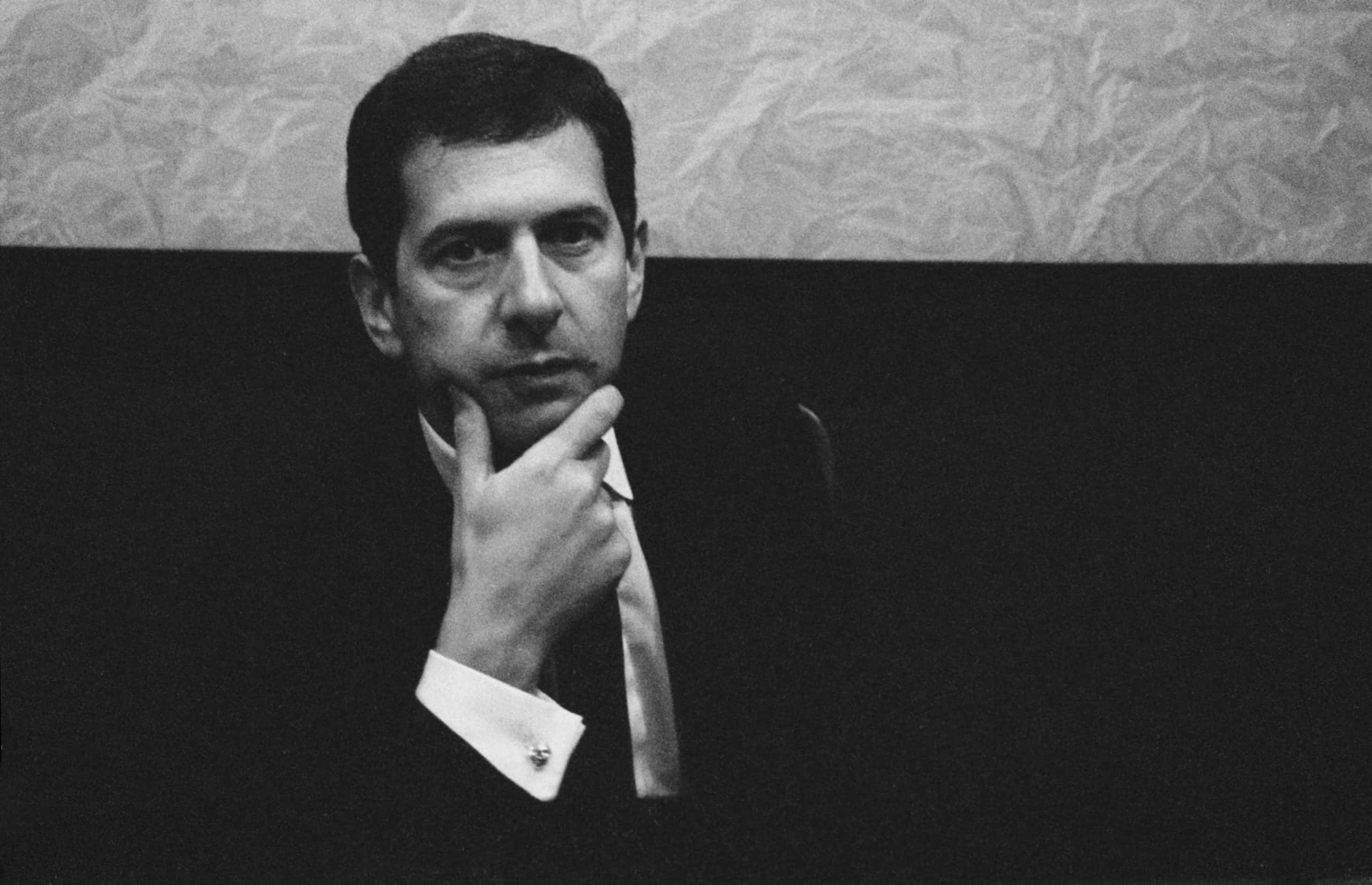

But then, in 1991, he got an invite to make a speech at the Institute of Directors in front of a group of fellow business leaders. That speech would usher in the downfall of Ratner's empire.

“Radical” Honesty

Considering what a debacle it turned into, it’s surprising that Ratner’s speech that day wasn’t just off the cuff. But according to his wife, he was honored by the invitation and took it extremely seriously. Ratner prepared for the event for months, even enlisting the help of a Member of Parliament.

That fateful evening, just a few minutes into his speech, Ratner began to talk about the product at his stores and the concept of value. What he said next would go down in history:

“Ratners doesn’t represent prosperity—and come to think of it, it had very little to do with quality as well. We do cut-glass sherry decanters complete with six glasses on a silver-plated tray that your butler can serve you drinks on, all for £4.95. People say, ‘How can you sell this for such a low price?’ I say, because it’s total cr*p.”

Keep On Digging

If you can believe it, he didn’t stop there. Oh no. It must have been like watching a car crash. He then went on about how Ratners “sold a pair of earrings for under a pound, which is cheaper than a shrimp sandwich from Marks & Spencer, but probably wouldn’t last as long.”

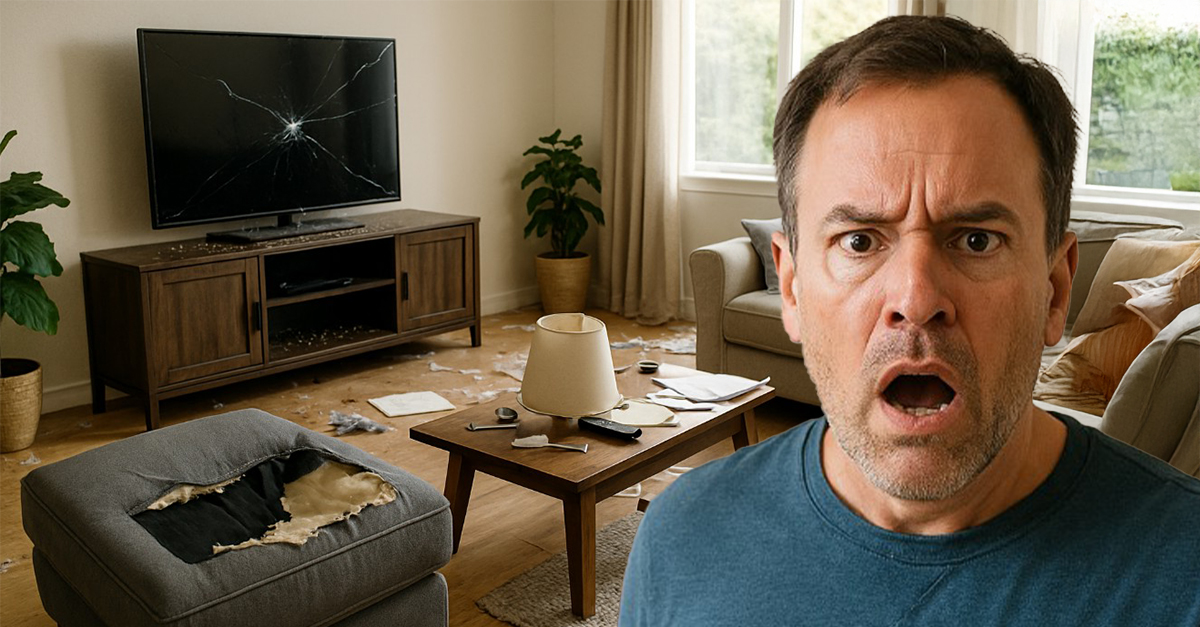

By the next morning, his remarks had been splashed across the tabloids, and the decline was rapid.

The Customer Is Always Right

Ratners' customers no longer had any interest in shopping at a place where the CEO looked down on them, so they stayed away. Within weeks, Ratner Group had lost £500 million of its market value.

The following year, the company sacked Gerald Ratner. The year after that, they removed the Ratner name in order to become the Signet Group, leaving the negative connotations of the old name behind.

A Poor Legacy

Gerald Ratner had taken the business from 130 stores to 2,500, but it was all taken away in an instant. It became a textbook “what not to do” for just about anyone in business, a running joke, and a cultural touchstone. There’s a reason Adam Sandler’s Uncut Gems character is named Howard Ratner.

Both ended up with a cruddy product, in a sense, but more importantly, both characters just couldn’t help but step in it.

All That Glitters Is Not Gold

It’s easy to imagine why Ratner’s remarks sparked such a furor. When shopping, consumers are buying the branding and image of a thing as much as the thing itself. In that moment, Ratner broke the illusion of perceived value that these factors come together to create.

Currently, 91% of consumers say that they value honesty when it comes to the companies they get goods and services from. While many things have changed, one could presume that many consumers in 1991 felt the same way.

But wasn’t Gerald Ratner just being honest with what he said?

The Grand Illusion

Ratner was honest, but not tactful—and his customers didn’t necessarily want that sort of honesty. After all, if he thinks so little of the items he sells, what must he think about the people who buy them? But there’s some cognitive dissonance here.

Can people really think that the CEOs of the companies they give their money to value them as individuals?

The illusion of choice under capitalism makes the consumer believe that it actually matters where their dollar goes, but a few parent companies own most of the brands in the world, and there are only a handful of billionaires out there—so it’s mostly going to them.

Under the confusing and exploitative conditions of capitalism, it’s not the consumers' fault that they think they want one thing when they really want another.

It’s rare that someone in power pays the price when that dissonance was exposed, but that’s precisely what happened to Gerald Ratner.