Portfolio Longevity

Retirement planning has undergone a serious upgrade recently. That famous 4% withdrawal rule everyone swears by? It's officially outdated. The new safe number is 4.7%, and it changes everything.

Historical Context

The early 1990s marked a retirement crisis. Traditional pensions vanished, replaced by 401(k) plans, shifting responsibility to individuals. Baby boomers approached retirement without guidance on safe withdrawal rates. Financial advisors also lacked concrete research. They often recommended arbitrary 5% withdrawals.

Bengen's Discovery

Using spreadsheets and market data from 1926 to 1976, William Bengen tested every possible 30-year retirement period. His October 1994 Journal of Financial Planning publication showed that a 4% initial withdrawal rate, adjusted annually for inflation, could survive history's worst economic conditions for a 30-year period.

William Bengen

This man is a highly influential figure in the field of retirement planning. Bengen was born in 1947 in Brooklyn, New York. He earned a Bachelor of Science degree in aeronautics and astronautics from MIT in 1969, and later obtained a master's degree in financial planning.

Bogleheads® Conference 2024 The History of Safe Withdrawal Rates with William Bengen by Bogleheads

Bogleheads® Conference 2024 The History of Safe Withdrawal Rates with William Bengen by Bogleheads

Trinity Study

Trinity University professors Philip Cooley, Carl Hubbard, and Daniel Walz validated Bengen's work in 1998. Their paper, “Retirement Savings: Choosing a Withdrawal Rate That Is Sustainable," used corporate bonds instead of government bonds. This comprehensive validation turned academic research into the widely accepted “4% rule”.

Anh-Viet Dinh \\ Trinity University, Wikimedia Commons

Anh-Viet Dinh \\ Trinity University, Wikimedia Commons

Portfolio Assumptions

Bengen's formula assumed the withdrawals would last exactly 30 years with a zero ending balance. The recommended 60% stocks, 40% bonds allocation, rebalanced annually, wasn't arbitrary. These parameters represented an optimal balance between growth and stability, tested against every economic scenario from the Great Depression through 1970s inflation.

Episode 195: The 4% Rule and Beyond: Retirement Strategies with Bill Bengen by Retire With Style

Episode 195: The 4% Rule and Beyond: Retirement Strategies with Bill Bengen by Retire With Style

Market Analysis

His 4% rule was based on analyzing the performance of a 50% stock/50% bond portfolio across all 30-year rolling periods starting from 1926. The worst historical outcome occurred with a start date in May 1965. Immediate bear markets followed by devastating inflation in the 1970s.

Success Rates

Trinity Study results were remarkable: 95–96% success rates over 30-year periods. Only 4–5 out of 100 retirees following this strategy would deplete their portfolios. Additionally, successful retirees typically end with substantial wealth, often exceeding initial values, and rare "failures" lasted 25–29 years.

Inflation Impact

Bengen calls inflation retirees' "greatest enemy" due to permanent, compounding effects. Early retirement inflation proves devastating as each percentage point permanently increases future withdrawals. 2022's 8.9% peak led to dramatic increases that persist despite moderation, permanently elevating spending levels and reducing portfolio longevity.

Economic Evolution

Economic conditions have changed dramatically since 1994. Interest rates plummeted to historic lows, bond yields became negligible, and life expectancy increased beyond 30-year horizons. Traditional 60/40 performance also deteriorated as bonds provided minimal returns, while equity valuations reached extreme levels.

Research Updates

Competing methodologies emerged questioning the 4% rule's relevance. Morningstar's forward-looking analysis suggested conservative 3.3–3.7% rates given current valuations. Their research emphasized differences between historical analysis and economic forecasting. Meanwhile, Bengen refined his methodology, exploring whether enhanced diversification could support higher withdrawal rates.

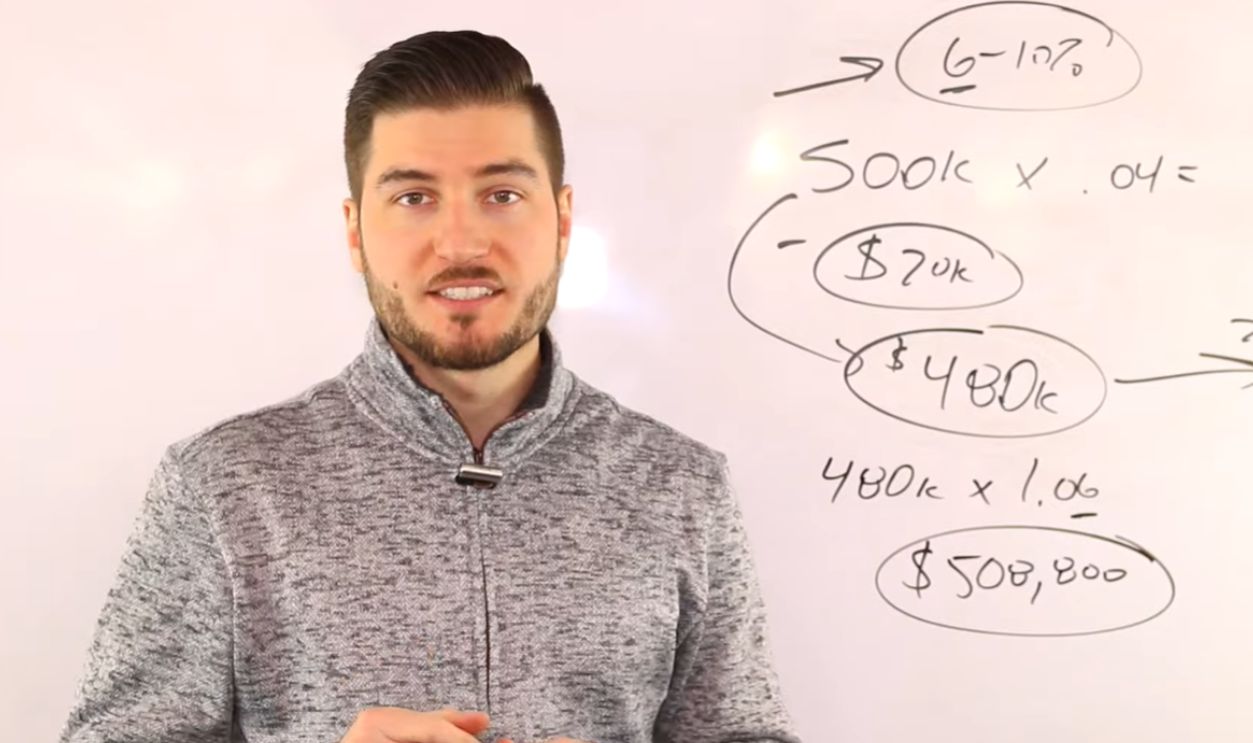

4.7% Emergence

After years of meticulous number-crunching, Bengen unveiled his stunning conclusion: retirees can now safely withdraw 4.7% initially. He calls this the "Universal SAFEMAX"—the highest withdrawal rate that survived every single worst-case scenario in American market history. This was a 17.5% increase over the original rule.

Can YOU Afford Retirement? | 4% Rule Explained | Safe Withdrawal Rate by Marko - WhiteBoard Finance

Can YOU Afford Retirement? | 4% Rule Explained | Safe Withdrawal Rate by Marko - WhiteBoard Finance

Real-World Testing

Well, he didn’t just run computer simulations. Rather, he tested the new rule against every actual 30-year retirement period since 1926. From this, he concluded that a 4% initial withdrawal rate, adjusted annually for inflation, was the safest sustainable approach across all historical scenarios.

Methodology Changes

Bengen's updated approach became far more sophisticated than his original research. He now incorporates the Shiller CAPE ratio to measure stock market valuations and analyzes different inflation environments at the onset of retirement. This two-factor model moves beyond one-size-fits-all percentages toward personalized guidance.

Sequence Protection

The 4.7% rule provides superior protection against sequence-of-returns risk. Enhanced diversification means that when stocks plummet early in retirement, you're not forced to sell everything at fire-sale prices to fund withdrawals. Instead, you can tap stable assets like Treasury bills or bonds while waiting for stock recovery.

Risk Factors

Modern retirees face four major threats to their financial security. Sequence-of-returns risk arises when markets crash early in retirement, causing portfolios to deplete faster than they can recover. Longevity risk is about the possibility of outliving your money, as people often live past 90.

Monte Carlo

Financial planners increasingly use Monte Carlo simulations—computer models that test thousands of possible market scenarios for your retirement plan. While these tools offer impressive flexibility for complex situations, they depend entirely on the economic assumptions programmed into them. When those assumptions prove wrong, the results become meaningless.

Current Environment

Today's retirement scenario presents unique challenges and opportunities. Stock market valuations hover near historic highs while inflation concerns persist after recent spikes. However, rising interest rates now support meaningful returns from Treasury Inflation-Protected Securities and other conservative investments.

Practical Implications

The jump from 4% to 4.7% means real money in your pocket. A $1 million portfolio now supports $47,000 in initial annual withdrawals instead of $40,000—that's an extra $7,000 yearly for travel, hobbies, or peace of mind.

Flexibility Needs

Rigid adherence to any withdrawal percentage often backfires during volatile markets. Smart retirees adopt flexible strategies that adjust spending based on portfolio performance and market conditions. Some use "guardrails" that allow spending between 3% and 6% depending on circumstances. Others reduce withdrawals during bear markets.

Implementation Strategies

Successfully applying the 4.7% rule requires careful planning that extends beyond simply selecting a percentage. You must choose how to time withdrawals, decide which accounts to tap first, consider tax implications, and plan for legacy goals. Portfolio rebalancing frequency and withdrawal scheduling significantly impact your results.

Professional Perspectives

Financial advisors generally opt for 4.7% as a conservative floor rather than a rigid ceiling. Many suggest current retirees could safely withdraw 5.25% to 5.5% given favorable market conditions and improved planning tools. However, they emphasize that cookie-cutter approaches rarely work perfectly.

Alternative Approaches

Smart retirees don't rely solely on percentage-based withdrawal rules. Guardrails strategies automatically adjust spending up or down based on portfolio performance, preventing both overspending during market crashes and underspending during boom years. Treasury Inflation-Protected Securities (TIPS) ladders provide guaranteed inflation-adjusted income streams.

Alexandros Chatzidimos, Pexels

Alexandros Chatzidimos, Pexels

Action Steps

Always start by evaluating your current withdrawal rate against updated guidelines. Next, assess whether your portfolio includes sufficient diversification across multiple asset classes. Review your spending flexibility during market downturns and establish clear monitoring systems for portfolio performance.

Final Recommendations

The 4.7% rule highlights genuine progress in retirement security through better research and enhanced portfolio construction, and not reckless encouragement to overspend. Success still requires ongoing monitoring, spending flexibility, and professional guidance when needed. Remember that prudent implementation and personal responsibility remain essential.