Hungry For Power

Tech giants are no longer just marketing gadgets and running your algorithm; they’re trying to overhaul the energy grid itself. Meta, Google, and Amazon are pouring billions of dollars into nuclear power. Why? Because powering AI, data centers, and cloud infrastructure depends on a massive supply of emissions-free electricity. Nuclear may be what people call old-school, but for Big Tech, it’s the backbone of tomorrow’s data-hungry world.

The Big Nuclear Pledge (2025)

In 2025, Meta, Google, Amazon and other mega-users signed a global pledge to help triple nuclear energy capacity by 2050. This commitment isn’t done out of casual interest, but a strategic high-stakes bet: nuclear isn’t fringe anymore, on the outside looking in; it’s pivotal to our future energy supply and long-term dreams of reaching global sustainability.

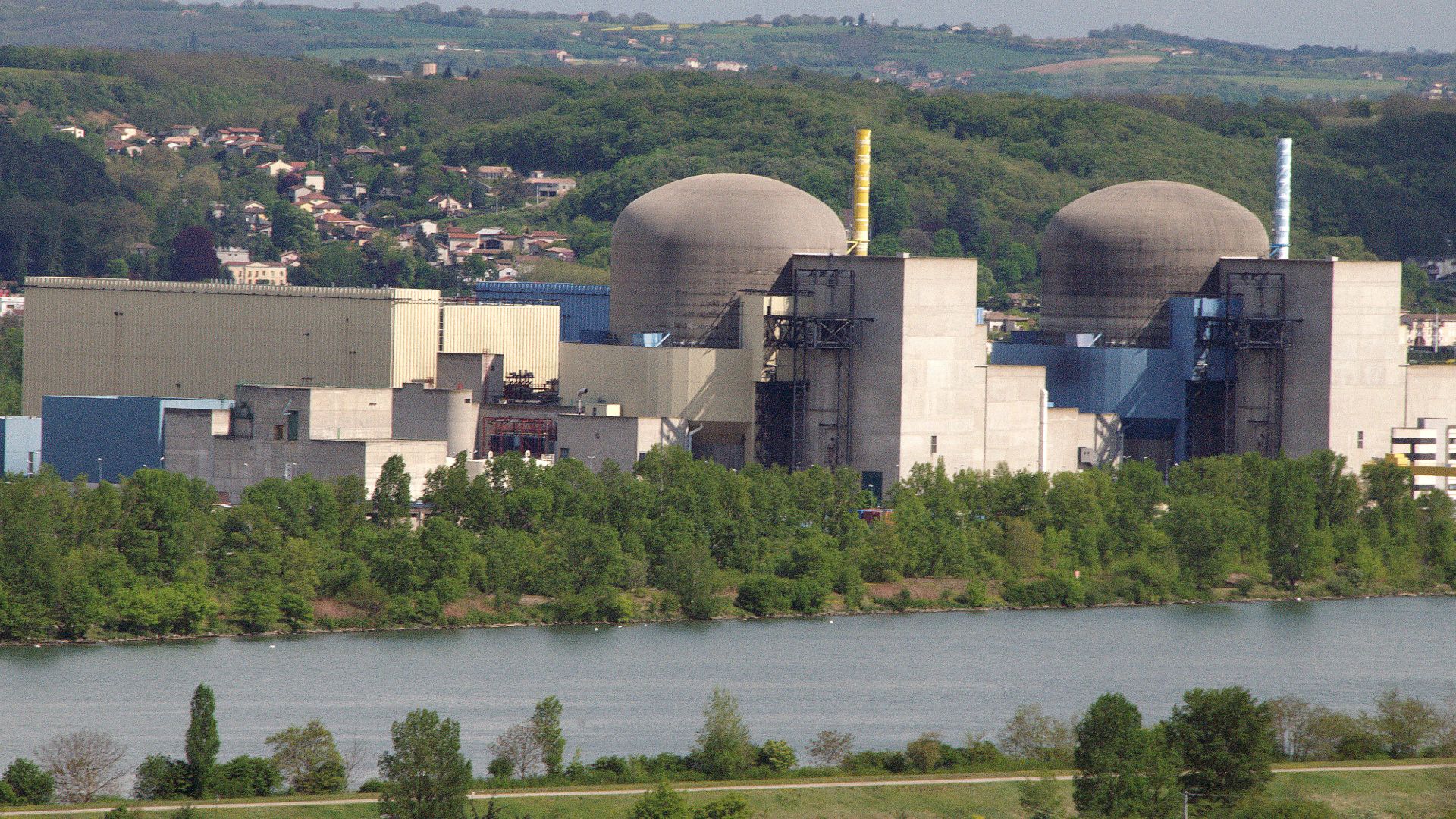

JD Lasica from Pleasanton, CA, US, Wikimedia Commons

JD Lasica from Pleasanton, CA, US, Wikimedia Commons

Data Centers Are Power Gluttons

Data centers need massive 24/7 power for cooling, computing, and storage. Solar and wind power simply don’t cut the mustard in terms of baseline reliability. Nuclear delivers constant baseline power that matches the insatiable nonstop requirements of global AI and all its associated cloud infrastructure, with no interruptions or energy gaps.

erwinboogert, Wikimedia Commons

erwinboogert, Wikimedia Commons

Going Nuclear Has Carbon Credibility

The big-tech companies are pushing net-zero carbon goals, and fossil fuels aren’t an option. Nuclear energy churns out huge power output with next to zero carbon emissions. It gives Big Tech a way to expand without breaking their sustainability commitments or carbon scorecards.

Fastfission~commonswiki, Wikimedia Commons

Fastfission~commonswiki, Wikimedia Commons

Firm Power, Not Intermittent Supply

Unlike renewables that are completely dependent on weather and sunlight, nuclear delivers continuous raw power. That predictability is critical when the streaming, cloud storage, AI models and global online services of millions are on the line. That’s the equivalent of turning reliability into a feature; and that feature is baked into the nuclear cake.

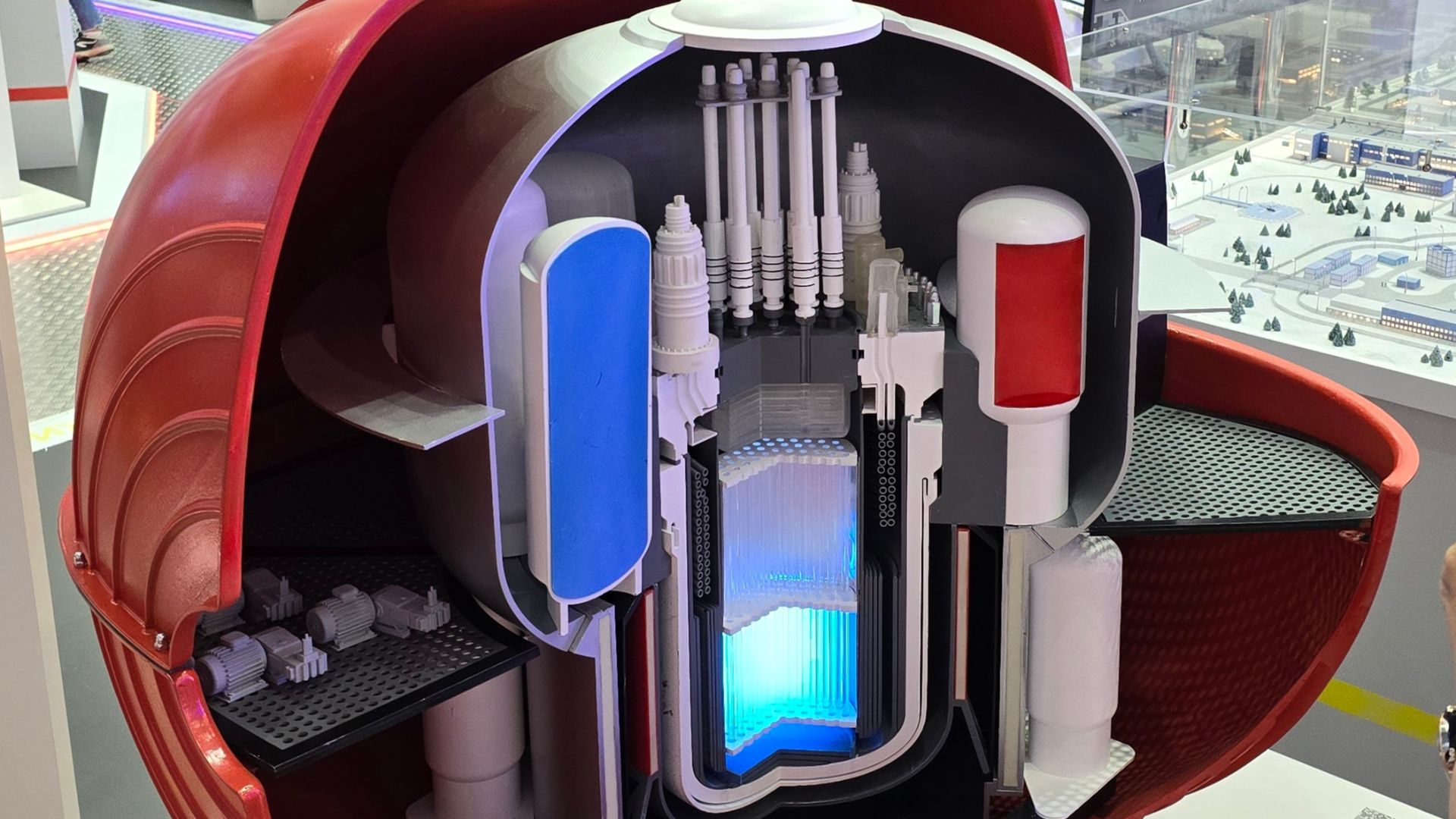

Investing In SMRs

Companies are taking a keen interest in next-gen small modular reactors (SMRs). This type of reactor is smaller, faster to build, and easier to place near big data hubs than the enormous complexes that we typically think of as nuclear plants. SMRs are nuclear plants redesigned for the speed and user profile of modern-day tech infrastructure.

Nickel nitride, Wikimedia Commons

Nickel nitride, Wikimedia Commons

Nuclear Powers An AI Explosion

With AI workloads ballooning and data usage spiraling out of control, power demands could triple in the next few years. Nuclear gives companies a solid foundation for scaling without destabilizing the grid or the very climate of Planet Earth itself.

Nuclear Regulatory Commission, Wikimedia Commons

Nuclear Regulatory Commission, Wikimedia Commons

Long-Term Deals, Not Experiments

These contracts aren’t mere test projects as part of an idle fantasy. Big Tech is going for broke by signing serious long-term nuclear contracts and financing reactor development. That gives them decades of energy stability rather than relying on volatile energy markets or the regulatory shifts of fickle government administrations.

Spurring On A Nuclear Renaissance

When trillion-dollar companies back nuclear energy with words and then back it up with big bucks, policy and finance are soon to follow. Big-tech backing pressures regulators to streamline approvals and encourages investors to treat nuclear as mainstream infrastructure instead of the high-risk, high-cost gamble it’s been viewed as in recent decades.

Los Angeles Air Force Base Space and Missile System Center, Wikimedia Commons

Los Angeles Air Force Base Space and Missile System Center, Wikimedia Commons

Smaller Carbon Footprint

Pairing energy-voracious data centers with low-carbon nuclear sharply reduces greenhouse-gas emissions. It’s one of the fastest ways the tech industry can make a meaningful reduction to emissions without slowing economic growth.

Baseload Stability Beats Renewables

Renewables often need the storage to back up their reliability. Nuclear already delivers stable baseload power without the need for giant battery farms. For hyperscale digital operations, nuclear complements renewables rather than replacing them.

Sandia National Laboratories, Wikimedia Commons

Sandia National Laboratories, Wikimedia Commons

SMRs Mean Flexibility

SMRs can be built closer to the data hubs, cutting down on transmission loss and improving over-all system resilience. They offer implementation speed and location flexibility that the old 20th-century mega-reactors can’t match.

Financial Incentives Align

Government incentives and regulatory reforms are lowering the cost and risk of the impending nuclear future. For Big Tech, the ROI (return on investment) becomes more predictable and infrastructure planning is much simpler.

Carol M. Highsmith, Wikimedia Commons

Carol M. Highsmith, Wikimedia Commons

All In On A High Stakes Bet

Nuclear power still carries safety concerns, waste issues, public skepticism, and high initial costs. Some critics warn that letting Amazon or Google privatize power would create an energy system driven by corporate priorities rather than public needs. Big Tech has no shortage of critics. But the upside of reliable power and carbon reduction is simply too much to ignore, and outweighs the risks for companies dedicated to long-term digital expansion.

The Pancake of Heaven!, Wikimedia Commons

The Pancake of Heaven!, Wikimedia Commons

Nuclear Strengthens Energy Security

Consistent baseload nuclear power reduces our dependence on fossil fuels, stabilizes energy prices and supply chains, and supports strategic energy resilience at the national level. By implementing this vision, big tech has gone beyond our screens and is shaping macro energy policy.

Public Debate Is Shifting

Big Tech's wholehearted endorsement makes nuclear more mainstream. The corporate messaging alone drives nuclear out of its cubbyhole and onto center stage. This entire phenomenon will redefine how the public sees clean energy and climate strategy.

Data Centers Leading A Transition

Growth isn’t about silicon chips anymore, but about electricity: lots of it. As data centers expand, they’ll serve as the anchor customers for the nuclear plants sprouting up like mushrooms after a spring shower. At the risk of sounding overly optimistic, this will accelerate the deployment of clean power infrastructure worldwide.

Impact On Carbon Emissions

If nuclear replaces coal and gas in powering data centers, downstream carbon emissions are set to fall dramatically. Big Tech has the capacity to cut enormous amounts of CO₂ simply by changing where its electricity comes from.

Ripple Effects On The Grid

Nuclear could alleviate the pressure on local grids and reduce the risks of power outages. It creates a more balanced energy landscape where renewables, nuclear, and storage systems work together and not against each other.

The New Power Providers

Meta, Google, and Amazon are no longer just tech companies, but energy infrastructure companies. Their nuclear investments will bridge data ambition with climate obligation and long-term power security. Like a poker player pushing a mountain of chips into the middle of the table, the tech companies are making their boldest move yet. If the wager pays off, they could reshape the energy economy and accelerate a worldwide transition to nuclear power.

InvadingInvader, Wikimedia Commons

InvadingInvader, Wikimedia Commons

You May Also Like:

Data Centers: The High Cost Of AI

The Growing Synthetic Diamond Industry Could Spell The End Of Diamond Mining