Years of keeping a card can do a lot

Many people don’t remember the first credit card they received, although, sitting in a drawer, it can carry more influence than expected. Long-standing accounts influence more than most people realize, as they affect trust and future options.

The Credit Card You Forgot About

Most individuals open their first credit card in their early 20s, use it briefly, then stop thinking about it. Years later, that same account still appears on their credit report, building history and influencing how lenders evaluate risk and long-term reliability.

Why First Credit Cards Tend To Stick Around

First, credit cards tend to stay open because they feel familiar and harmless. Many have no annual fee, no pressure to cancel, and a vague sense that older accounts help credit, even if cardholders can’t fully explain why that original line still matters.

What Credit Age Actually Means In Real Life

Credit age describes how long your accounts have existed, not how often you swipe a card. Lenders review your oldest account and average account age to assess experience and how long you have managed to borrow money without serious trouble over many years successfully overall.

It Slowly Strengthens Your Credit Profile

Time strengthens your credit profile when accounts remain open, and payments stay on schedule. Each year adds context and shows lenders you can manage credit through job changes and personal milestones without repeated closures or damaging payment lapses.

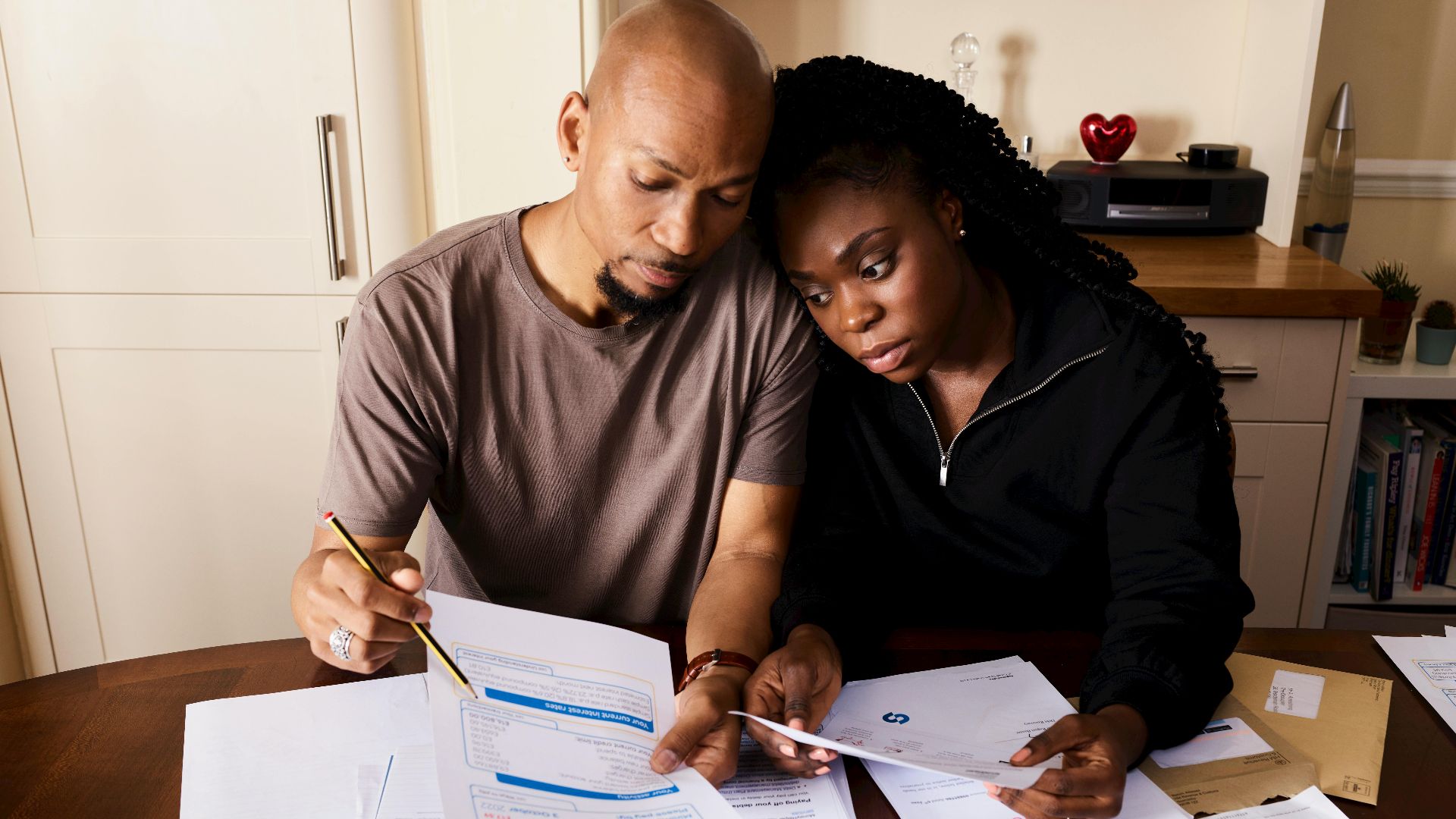

Long-Standing Accounts Signal Stability To Lenders

Having a long-standing account suggests stability because it reflects behavior across many financial seasons. Lenders see evidence of responsibility during growth, setbacks, and recovery, which reduces perceived risk. A lengthy, well-managed history often balances occasional mistakes better than a shorter record.

Old Cards Support Credit Utilization

Moreover, old credit cards often carry unused credit limits that quietly help your utilization ratio. Credit scoring models favor borrowers who use only a small portion of their available credit. Keeping older accounts open can lower overall utilization without changing spending habits.

Why Closing A Long-Held Card Can Hurt More Than Help

Retiring an old credit card can decrease your total available credit and shorten your average account age. That combination may temporarily lower your score, even if you paid the card responsibly. The impact surprises many people who assume unused accounts are irrelevant.

Keeping An Old Card Requires Almost No Effort

If an old card has no annual fee, keeping it open often requires minimal attention. A small recurring charge, like a streaming subscription, can keep the account active. Automatic payments help avoid missed bills while preserving the card’s long-term credit benefits.

When Does An Old Card Stop Fitting Your Life?

An old card may stop making sense when it no longer matches how you spend money. Low rewards or outdated benefits can limit value. While credit history still matters, practicality eventually becomes part of the decision to keep or rethink the account.

Your Spending Habits Evolve Over The Years

Spending patterns often change with income and lifestyle. Expenses that once centered on basics may shift toward travel or healthcare. Cards designed for earlier stages may no longer reward what you actually spend money on now.

Better Rewards Often Come Later In Life

As credit scores improve, access to stronger rewards typically expands. Higher-tier cards offer better cash back and protections. These options are often unavailable early on, which is why many people layer newer cards on top of older ones.

Adding New Cards Without Erasing Old Credit History

Opening new credit cards does not erase existing history. Many people keep older cards open for age, while using newer ones for rewards. When balances stay manageable, and payments remain on time, this approach can support both credit growth and everyday value.

What Happens When Your Card Changes Without You

Credit card issuers sometimes change benefits or terms automatically. You may receive a notice saying your account has been converted to a different card. While your credit history usually stays intact, the new features or fees may not align with your needs.

Issuers Transition Accounts Behind The Scenes

Banks periodically retire older cards and migrate customers to updated versions. This process rarely affects your credit score, but it can alter rewards structures or add fees. Reading issuer notices helps you catch changes early and avoid surprises.

Annual Fees Can Start Working Against You

An annual fee becomes a problem when rewards no longer outweigh the cost. Paying for benefits you rarely use erodes value over time. If a card’s perks do not offset the fee, keeping it open may no longer make financial sense.

How Can You Decide If An Old Card Is Still Worth Keeping?

Evaluating an old card means comparing its costs and protections against your current spending. If it helps your credit and costs nothing, it often deserves a place. However, if it creates friction, alternatives may be better long-term options.

The Right Way To Close A Card With Minimal Impact

Closing a card carefully can limit credit score disruption. Pay the balance in full, redeem rewards, and confirm the closure with the issuer. Nevertheless, careful planning is required if you want to apply for new credit soon afterward.

Timing Matters More Than The Closure Itself

Closing a card during a strong credit period reduces potential impact. When utilization is low and other accounts are well established, score changes tend to be smaller. Strategic timing helps ensure one decision does not affect larger financial plans.

Common Long-Term Credit Card Mistakes To Avoid

Common mistakes include ignoring fees and letting accounts close from inactivity. Others close old cards too quickly after opening new ones. Paying attention to these details helps preserve credit history while avoiding unnecessary costs or credit score fluctuations.

Vodafone x Rankin everyone.connected, Pexels

Vodafone x Rankin everyone.connected, Pexels

How Many Credit Cards Is Actually Reasonable?

There is no single ideal number of credit cards. What matters is manageability and payment consistency. Many Americans hold multiple cards without issues, as long as balances stay low, due dates are tracked, and each account serves a clear purpose.

Simple Ways To Keep Old Cards Active Safely

Keeping an old card active does not require heavy spending. Small, predictable charges work well when paired with automatic payments. This approach reduces the risk of missed bills or account closures caused by long periods of inactivity.

The Long-Term Strategy Behind Strong Credit Scores

Strong credit scores are built gradually through steady behavior, not quick fixes. Long account history and consistent payments carry more weight over time than short-term tactics. Patience and routine often outperform frequent changes or aggressive credit moves.

Credit Success Is Built On Consistency

Consistency shows lenders that your financial habits are reliable. Paying on time and avoiding unnecessary account changes create a predictable credit profile. Over the years, this stability would help offset occasional setbacks that nearly everyone experiences at some point.

Letting Time Work In Your Favor Instead Of Against You

Time can strengthen or weaken credit depending on how accounts are managed. Keeping useful cards open and monitoring changes while making thoughtful adjustments allows history to compound positively. With occasional check-ins, long-term credit becomes a quiet advantage rather than a concern.