Shred It Or Regret It

Your trash might tell more about you than your social media. A single tossed document can quietly expose personal details, giving scammers just enough information to cause damage long before you realize anything has gone wrong.

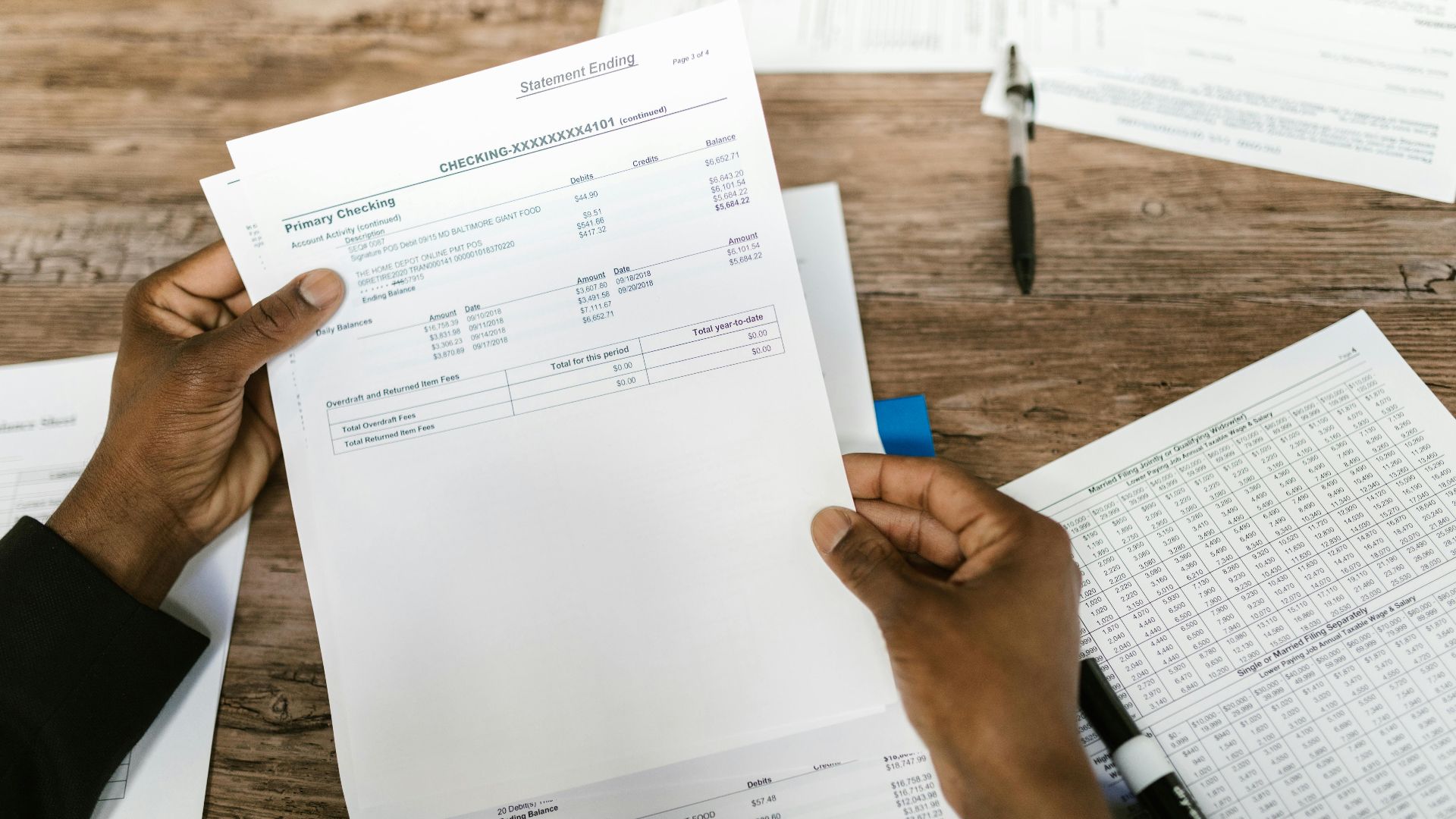

Bank Statements

Tossing old bank statements gives scammers an easy win. With just a few details, they can craft convincing identities or trigger phishing attacks. Instead of handing over your history, cut it off before it starts working against you.

Credit Card Statements

Fraudsters don’t need your actual card—just one tossed statement can reveal enough to cause damage. Purchase history and account details help them blend in as you. That kind of access doesn’t belong in the trash.

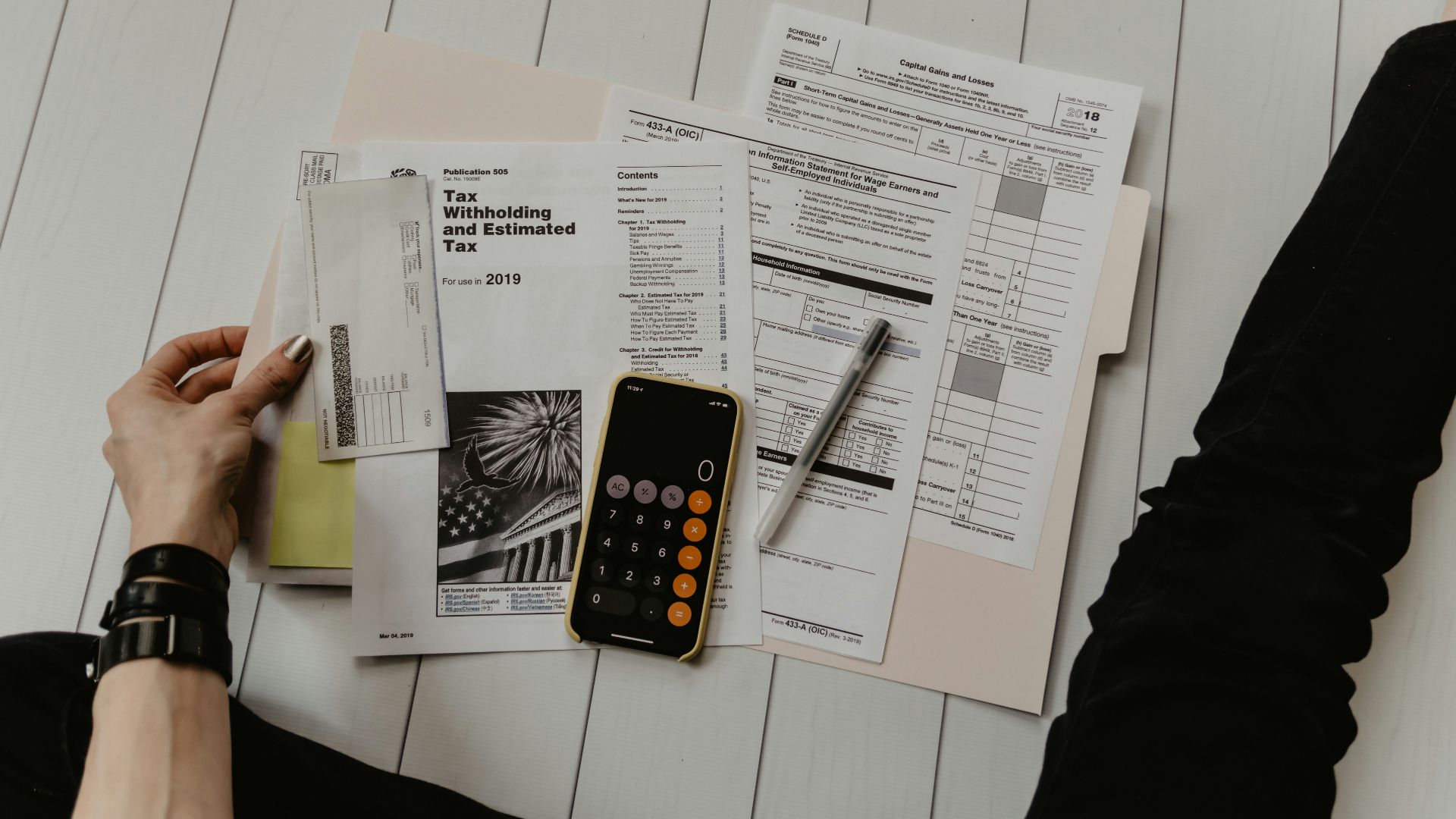

Tax Returns

Even years later, tax returns carry weight. A thief might use them to file fake claims or reroute your refund. These documents weren’t meant to survive beyond their purpose, especially not in someone else’s hands.

Pay Stubs

They may look like scraps, but pay stubs expose income details and employer connections that scammers can twist into fake credentials. If they start stacking up, so does your risk. One quick decision can protect your job profile.

Medical Bills

Details like treatments, providers, and account numbers can fall into the wrong hands fast. Some scammers use them to create fake patients or rack up costs under your name. Those pages should never outlast the care they describe.

Insurance Policy Documents

If someone gets hold of your policy paperwork, they can forge claims or redirect benefits. Even outdated versions carry weight for scammers. Leaving them intact in the trash creates openings that your insurance provider won’t see coming.

Utility Bills

A bill for lights or water might not seem risky, but your address and account info say more than you think. Over time, these papers build a profile that strangers could use to cause serious disruptions behind the scenes.

Prescription Records

What looks like a scrap of pharmacy info could lead to blackmail, fake refills, or account takeovers. These pages hold deeply personal details that fetch attention in all the wrong places. You don’t want anyone else holding that kind of insight.

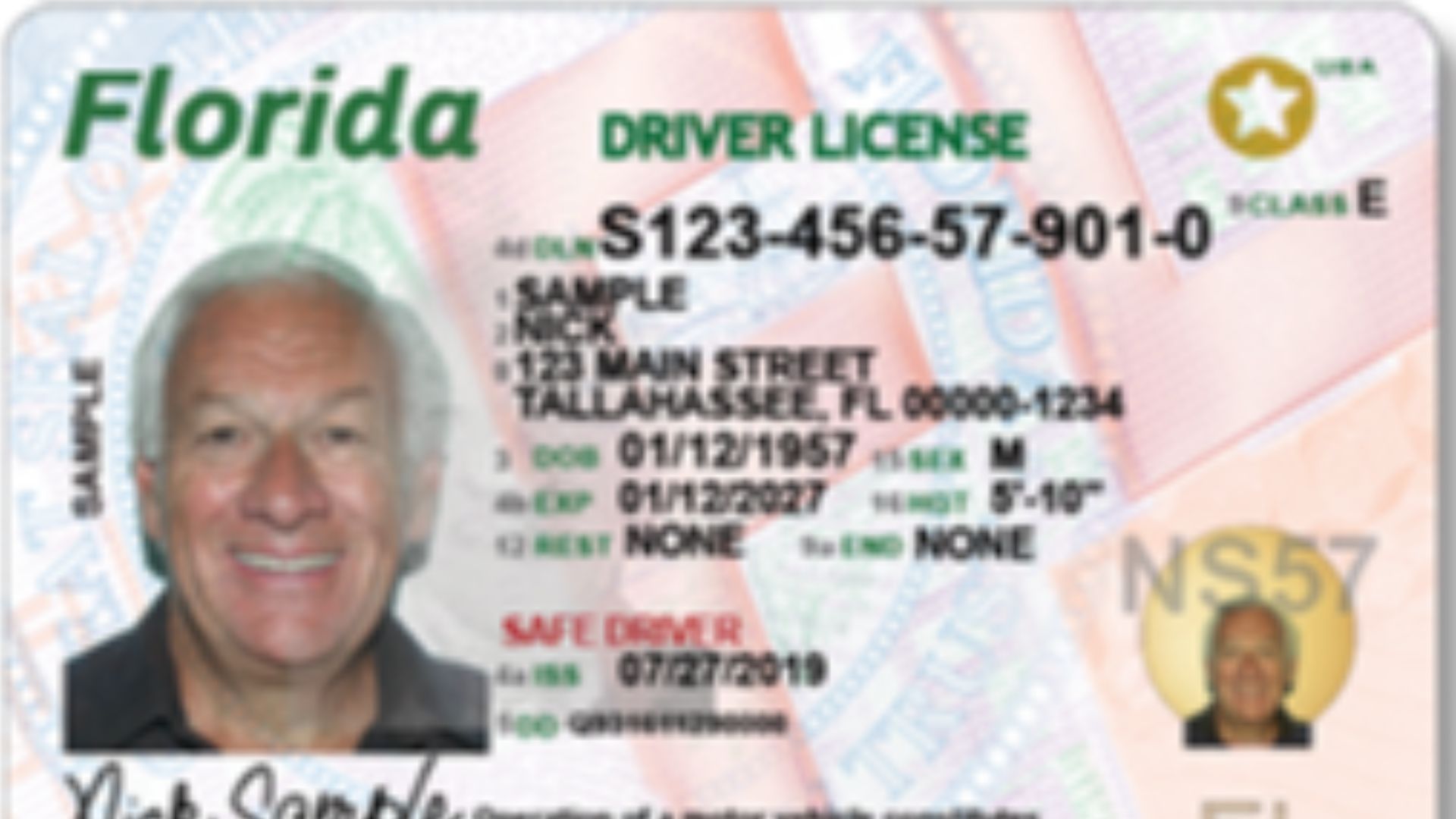

Expired Driver’s Licenses

Even voided IDs contain enough to rebuild a version of you. When left unshredded, they open doors to fake identity schemes or shady rentals. It takes just one careless toss to put your name on something you didn’t sign up for.

Florida Department of Highway Safety and Motor Vehicles, Wikimedia Commons

Florida Department of Highway Safety and Motor Vehicles, Wikimedia Commons

Old Passport Copies

Copies might feel safer than originals, but they’re still packed with sensitive data. Identity thieves see them as gold. Numbers, photos, and stamps give them a head start—and that could mean international trouble before you even pack a bag.

Global Residence Index, Unsplash

Global Residence Index, Unsplash

Investment Account Statements

Scammers don’t need to guess your finances if you leave these lying around. Old statements reveal holdings and broker details, along with other financial habits they can use to bait you. Once they know where the money sits, they know where to strike.

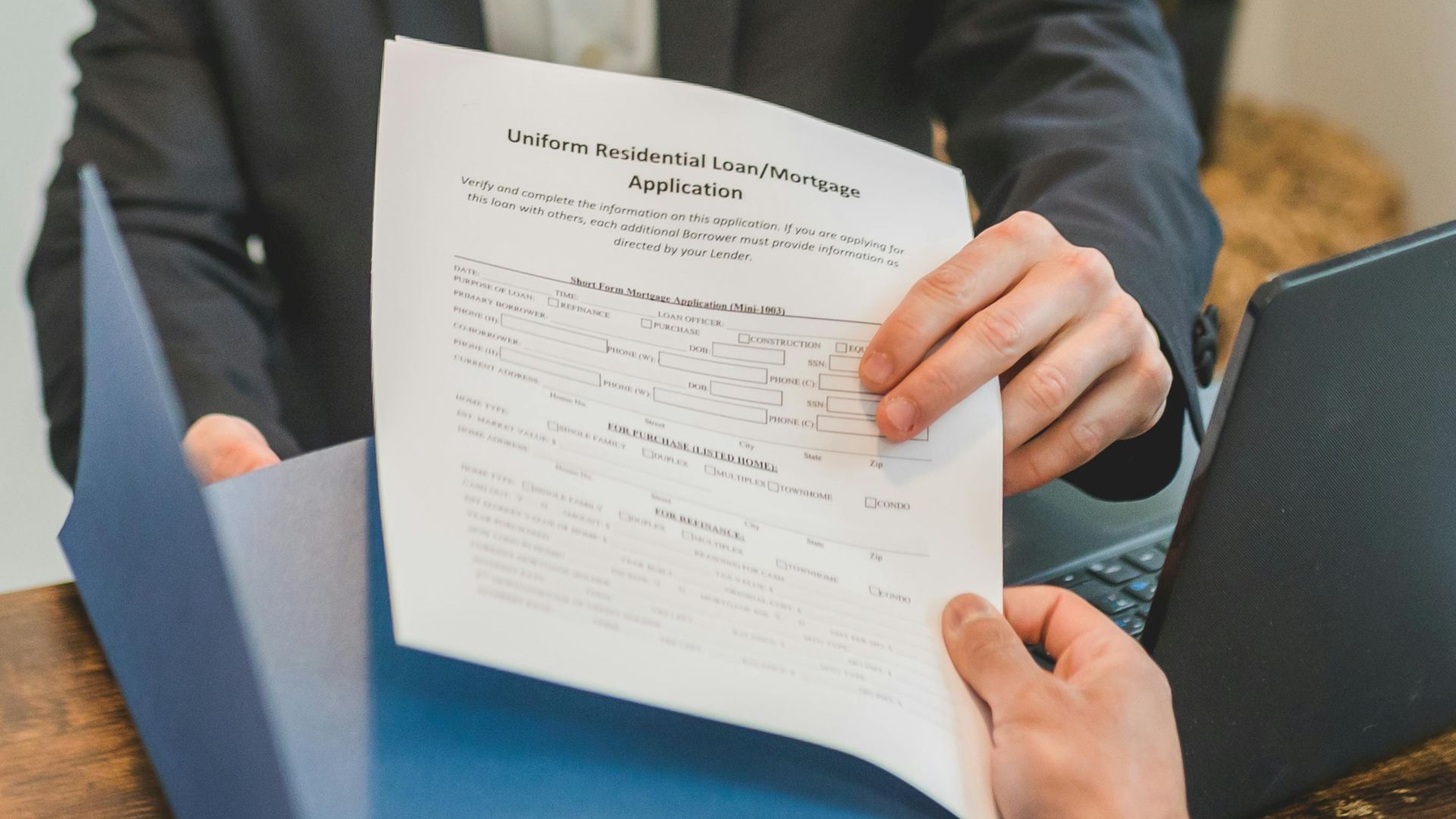

Mortgage Closing Documents

These papers don’t lose value when the loan ends. They hold property details and Social Security Numbers that criminals can use to sell your home behind your back. Once they piece it together, your signature might not even be needed.

Loan Application Forms

Rejected or approved, loan forms carry your income, credit profile, and references. In the wrong hands, that’s enough to stack fake applications or run financial plays in your name. Trash can’t defend you once the forms hit the bottom.

Performance Review Forms

Feedback meant for HR can become ammo in the wrong hands. These forms often include sensitive notes that reveal weaknesses or personal conflicts. Tossing them intact makes it easy for someone to exploit what was never meant to leave the office.

W-2 Forms

Your W-2 tells more than just your wages. With a Social Security Number and an employer ID on it, this form becomes a prime target for tax fraud. One careless move can make your refund disappear before you even file.

Lease Agreements

Rental paperwork often lists deposits, pet details, and even vehicles tied to your name. That’s plenty for a fraudster to stage break-ins or file bogus claims. One bad actor with access could turn your old lease into a current problem.

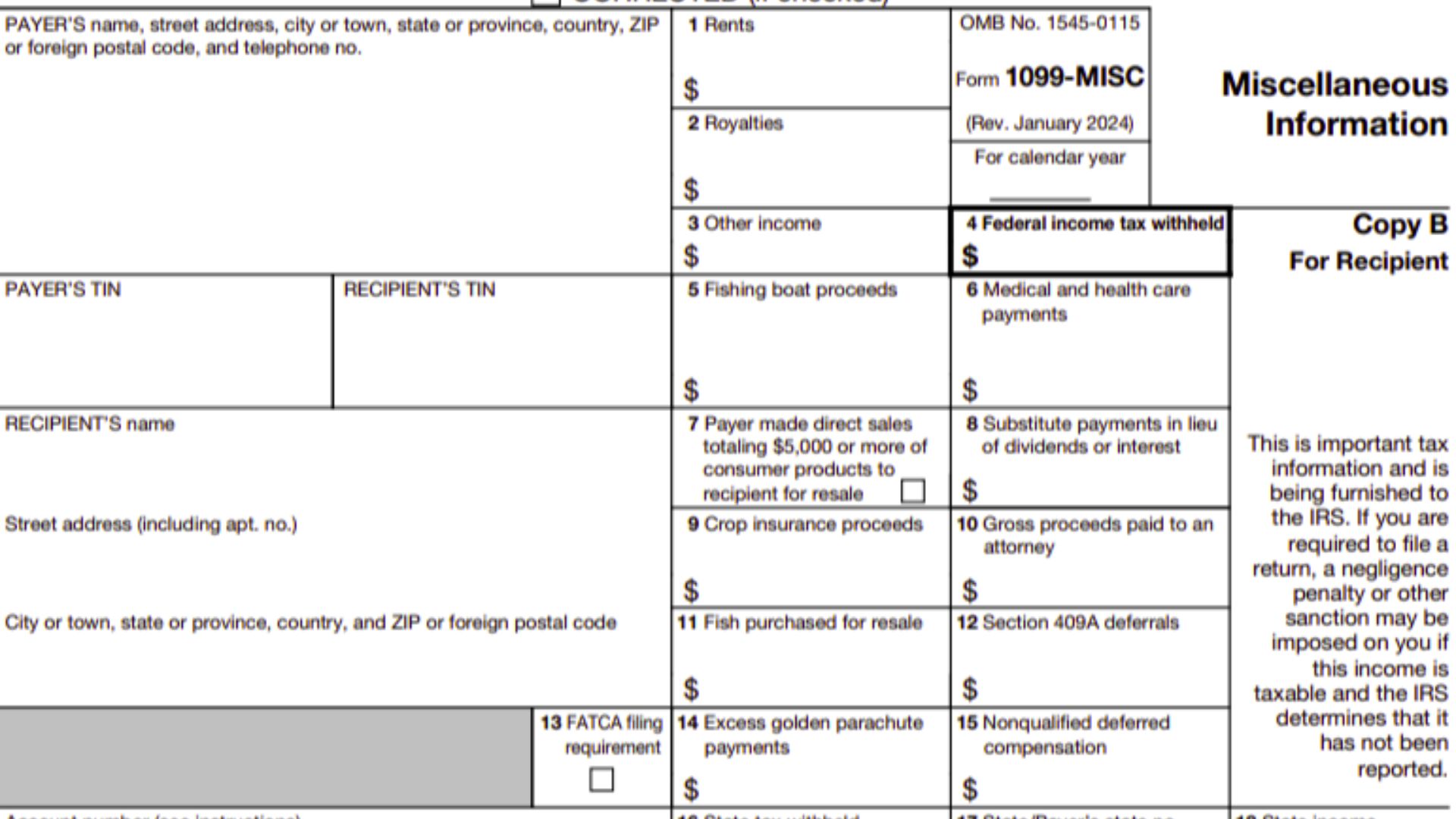

1099 Forms

Freelancers and gig workers face a unique risk. 1099s show income and client details that scammers can twist into fake audit notices or refund claims. You might think they’re just old records, but fraudsters see open opportunities.

United States Department of Treasury - Internal Revenue Service, Wikimedia Commons

United States Department of Treasury - Internal Revenue Service, Wikimedia Commons

Credit Reports

A printed credit report gives thieves a full picture of your financial life. That one document holds more risk than most people realize. They can trace account activity, dig into your credit behavior, and use that data for serious fraud.

ATM Receipts

Don’t underestimate the value of those little slips. Each one carries just enough detail—like partial card numbers or balances—to help a scammer piece together your activity. Tossing them casually can lead to bigger problems in the future.

Boarding Passes

A used boarding pass doesn’t stop being useful after your flight. It could end up being a ticket to much deeper trouble. Thieves can scan the data to access travel accounts or harvest personal information.

Global Residence Index, Unsplash

Global Residence Index, Unsplash

Hotel Folios

What looks like a simple receipt might reveal your travel routines, payment information, or the length of your stay. Criminals use this data to track patterns or target future scams. Leaving it behind gives them more access than you'd think.

Rental Car Contracts

A discarded contract can expose far more than rental details. Thieves often use license numbers and vehicle information to commit auto fraud or impersonate drivers. When that paper slips into the wrong hands, it can set off trouble tied directly to you.

Employment Offer Letters

These letters don’t just confirm a new job—they reveal private terms and sensitive workplace details. If intercepted, they can lead to impersonation or sabotage. What feels like paperwork could quietly become a tool for someone else’s gain.

Jury Duty Summons

Official-looking papers like these carry legal identifiers and court information that scammers can manipulate. Someone could use them to impersonate authority or tamper with records. It may feel routine, but careless disposal invites drama far outside the courtroom.

mike epp from bensalem, pa, usa, Wikimedia Commons

mike epp from bensalem, pa, usa, Wikimedia Commons

Canceled Checks

Even if voided, checks still show account numbers, signatures, and routing details that thieves can copy. Check washing schemes don’t need active bank activity—just access. Tossing one unshredded sets the stage for funds to vanish unexpectedly.