Money-Saving Moves That End Up Costing More

Small financial decisions often appear harmless, yet banks quietly profit when caution crosses into miscalculation. Overlooked details and misplaced loyalty can drain savings faster than most realize.

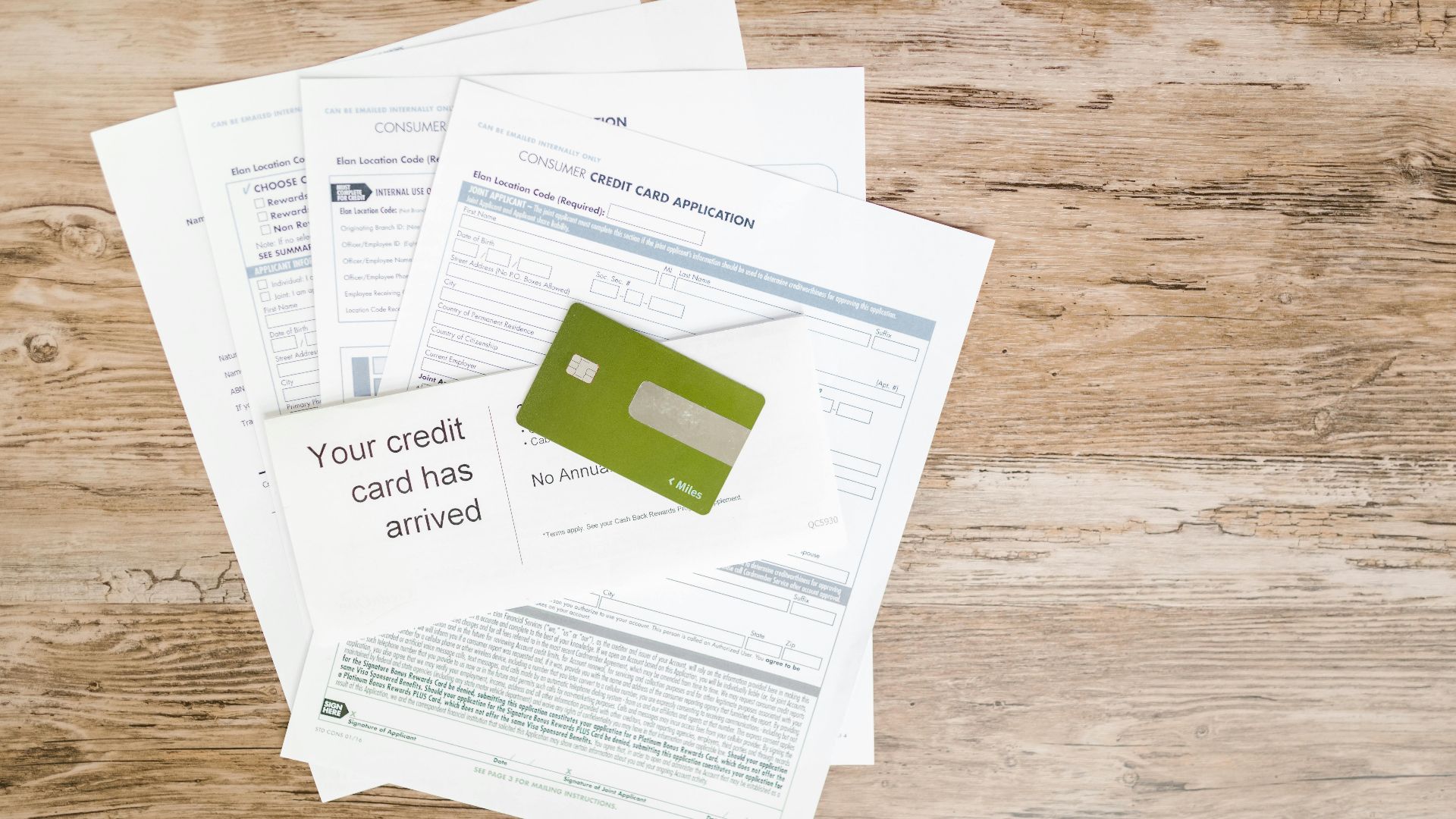

Avoiding Credit Cards Entirely

Relying only on debit cards may feel safer, but it leaves valuable perks untouched. Cashback, extended warranties, and fraud protections vanish without credit usage. Over time, the absence of a credit history blocks access to favorable loan terms.

Over-Reliance on Low-Interest Checking Accounts

High-yield savings consistently outperform standard checking, where returns remain minimal and maintenance fees often creep in. That lost compound growth represents real money slipping away, as cautious savers unintentionally shrink future wealth by parking funds in the wrong place.

Ignoring Bank Sign-Up Bonuses

Banks frequently hand out cash incentives to new customers, yet many frugal individuals skip these opportunities. Meeting simple requirements like initial deposits or transaction thresholds unlocks hundreds of dollars in free money. Overlooking these bonuses sacrifices straightforward, no-risk earnings.

How Bank Sign Up Bonuses Work: EASY $200/Week Side Hustle by Side Hustle Nation

How Bank Sign Up Bonuses Work: EASY $200/Week Side Hustle by Side Hustle Nation

Refusing to Switch Banks for Better Rates

Loyalty to one bank often backfires financially. Competing institutions constantly lure new customers with higher interest and cash rewards. By refusing to compare options or switch providers, savers leave money on the table instead of treating banking like any other competitive marketplace.

Simple Steps to Switch Banks by Money Talks News

Simple Steps to Switch Banks by Money Talks News

Skipping Overdraft Protection

Avoiding overdraft coverage to dodge small monthly fees creates bigger problems. Declined transactions snowball into multiple penalty charges, with each fee multiplying the damage. Predictable overdraft protection provides a controlled safeguard.

Overdrafts Explained | What is an Overdraft? by Two Teachers

Overdrafts Explained | What is an Overdraft? by Two Teachers

Missing Automatic Payment Setups

Manually tracking bill deadlines invites mistakes. One missed date damages credit and triggers late fees. Automatic payments eliminate these risks by ensuring bills are paid on time, while some banks even reward this practice.

Paying Only the Minimum on Credit Cards

Minimum payments create the illusion of progress, yet interest compounds silently in the background. With time, balances grow instead of shrinking, trapping borrowers in cycles of long-term debt. What begins as a manageable expense slowly transforms into an expensive financial burden.

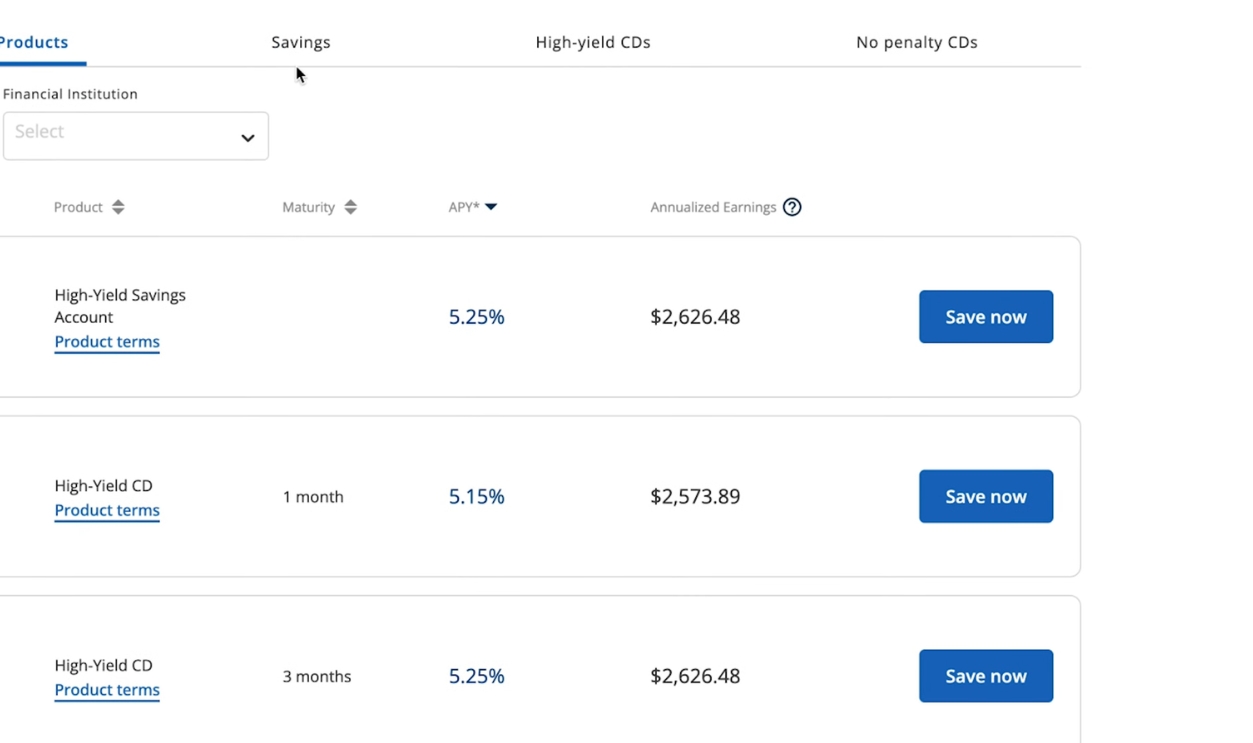

Avoiding Online Banks for Higher Yields

Traditional banks often pay minimal interest while charging regular fees. Online banks, by contrast, consistently offer higher savings rates and lower costs. Frugal consumers who avoid them miss out on significant growth potential.

Not Reviewing Monthly Statements

Monthly statements often reveal overlooked fees, errors, or lingering subscriptions that quietly drain accounts. A careful review combines technology with human vigilance, helping consumers spot problems early and prevent small, hidden charges from turning into costly financial setbacks.

Overlooking Banking Rewards Programs

Rewards programs often come at no cost, yet many savers avoid them unnecessarily. By opting out, they pass up cashback and discounts that could offset fees or build long-term savings. These unclaimed benefits accumulate into substantial missed opportunities for free financial growth.

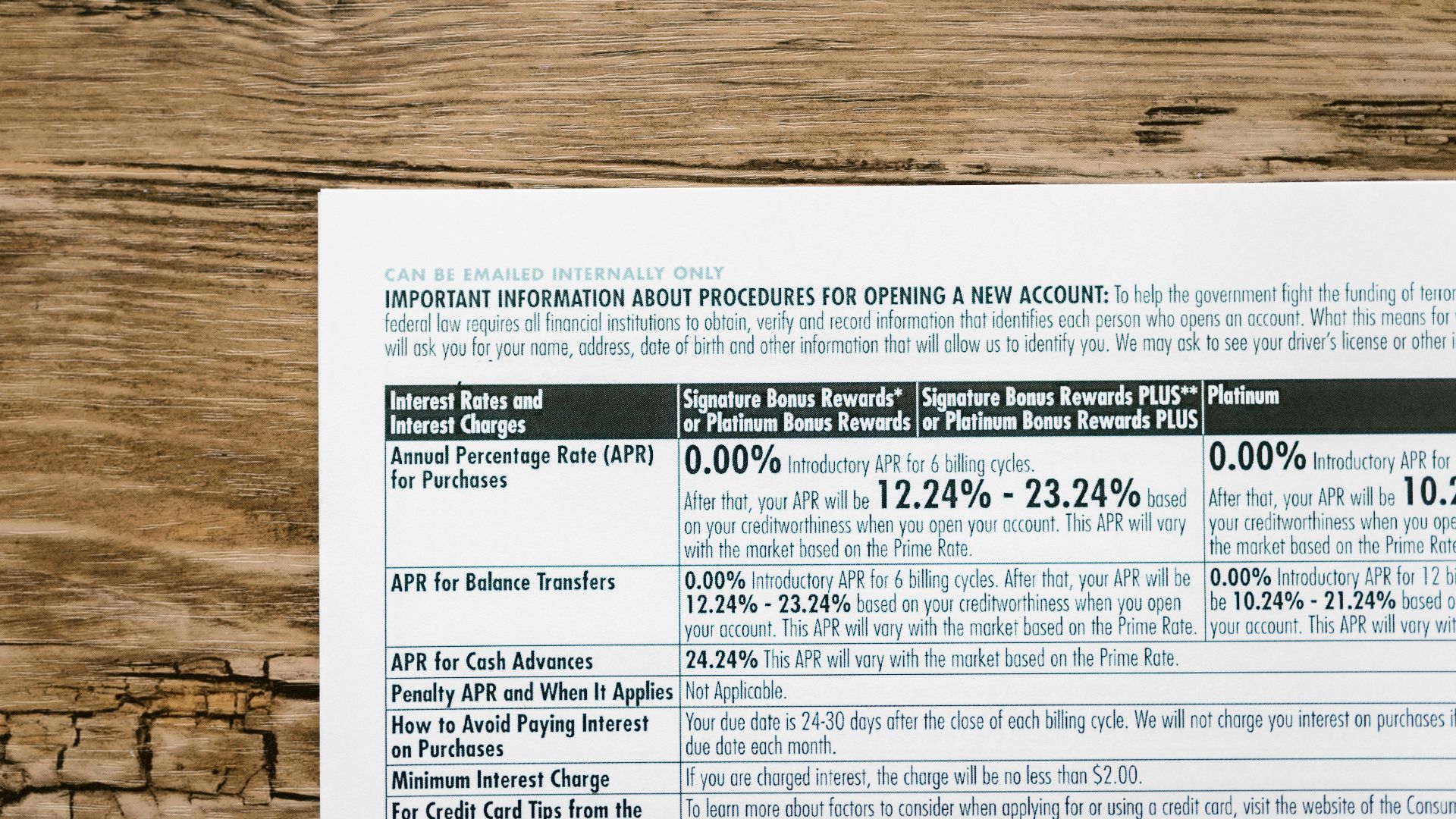

Avoiding CDs Or Fixed Deposits

Savings left in low-rate accounts steadily lose value compared to certificates of deposit. CDs offer stronger returns, while a laddering strategy balances growth and accessibility. Ignoring this tool means missing out on consistent interest gains and leaving careful savers with weaker long-term results.

Certificate of Deposits (CDs) For Beginners | The Ultimate Guide by Danny Sully

Certificate of Deposits (CDs) For Beginners | The Ultimate Guide by Danny Sully

Failing to Consolidate Accounts

Scattered accounts create unnecessary complications. Forgotten balances, extra fees, and missed interest opportunities all stem from holding multiple bank accounts. By consolidating, savers streamline finances and reduce oversight mistakes.

Relying Only on Cash and Missing Cashback

Paying strictly in cash eliminates transaction records and complicates budgeting. More importantly, it bypasses valuable credit card rewards. Although it appears to be disciplined money management, it becomes an expensive mistake.

Photo By: Kaboompics.com, Pexels

Photo By: Kaboompics.com, Pexels

Avoiding Mobile Fraud Protections

Skipping mobile security features saves seconds but exposes accounts. Two-factor authentication, instant card freezes, and real-time alerts provide essential defenses against fraud. Without them, unauthorized access can drain funds before issues are detected.

Not Negotiating Bank Fees or Interest Rates

Many people challenge grocery prices yet accept banking fees without question. Banks often reduce charges or lower loan rates for loyal customers—if asked. By neglecting negotiation, consumers surrender potential savings and pay more than necessary.

Avoiding Joint Accounts With Better Terms

Joint accounts frequently outperform individual accounts with higher interest and easier shared expense management. By refusing to consider them, people may pay more for less. For disciplined partners, combining resources under favorable account terms delivers stronger returns and greater efficiency.

Ignoring Bank Alerts and Notifications

Banks provide free alerts for low balances, unusual activity, and upcoming bills. Choosing to ignore these tools leaves accounts unmonitored and makes consumers vulnerable to overdrafts and fraud. These notifications ensure problems are caught early and unnecessary fees or losses are prevented altogether.

Failing to Update Personal Information

Outdated contact details can block vital communication. Missed alerts and disrupted account access often stem from neglected updates. Keeping personal information current guarantees smooth banking interactions and timely warnings.

Avoiding Small Loans That Build Credit History

A blank credit file leads to higher borrowing costs and restricted access to financial products. Small loans, especially structured credit-builder programs, offer a safe path toward establishing a history. By rejecting them, consumers miss opportunities to qualify for lower interest rates.

Skipping the Fine Print on Banking Products

Unexpected fees and sudden term changes often hide in fine print. Banks rarely highlight these conditions, leaving customers surprised. Careful review before opening accounts, along with periodic checks, prevents costly missteps and ensures expectations align with reality.

Choosing Banks Based Only On Location

Selecting a bank based on neighborhood convenience feels practical but limits options. Digital institutions now offer superior interest rates and lower fees. By staying tied to geography, consumers skip modern features and stronger financial returns.

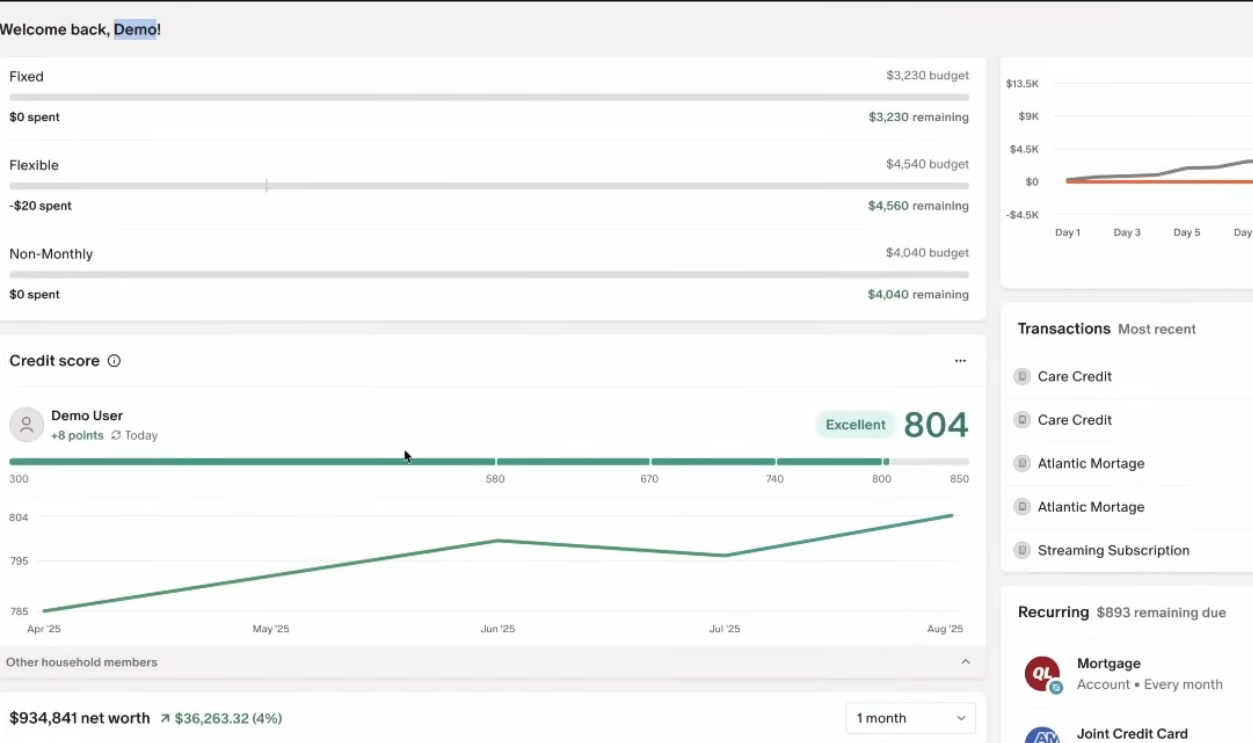

Ignoring Financial Apps That Save Money

Digital tools streamline money management, yet many people still resist them. Financial apps now deliver automated savings and fee monitoring—powerful aids that prevent errors and build wealth. Skipping these technologies leaves valuable resources untapped.

The 3 Finance Apps I Use Every Day by Rob Berger

The 3 Finance Apps I Use Every Day by Rob Berger

Paying Out-Of-Network ATM Fees

Withdrawing cash from the wrong ATM carries charges of $2 to $5 per use, adding up to hundreds annually. Banking apps easily locate fee-free machines, while some institutions even refund surcharges.

Closing Old Credit Accounts Prematurely

Canceling long-standing, fee-free accounts shortens credit history and raises utilization ratios—two factors central to credit scores. These changes often reduce borrowing power and lead to higher loan costs.

Using Savings To Cover Bills Instead Of Budgeting

Tapping savings for routine expenses steadily erodes emergency funds. Without a budget, withdrawals become habitual, leaving little protection when unexpected costs arise. This approach often results in borrowing at a higher interest rate later.