Do It Now Or Lose Later

Robert Kiyosaki, acclaimed for his financial wisdom, urges Boomers to brace for potential market turmoil by embracing practical strategies. He cuts through the noise with straightforward guidance that speaks directly to the concerns Boomers face today.

Who Is Robert Kiyosaki?

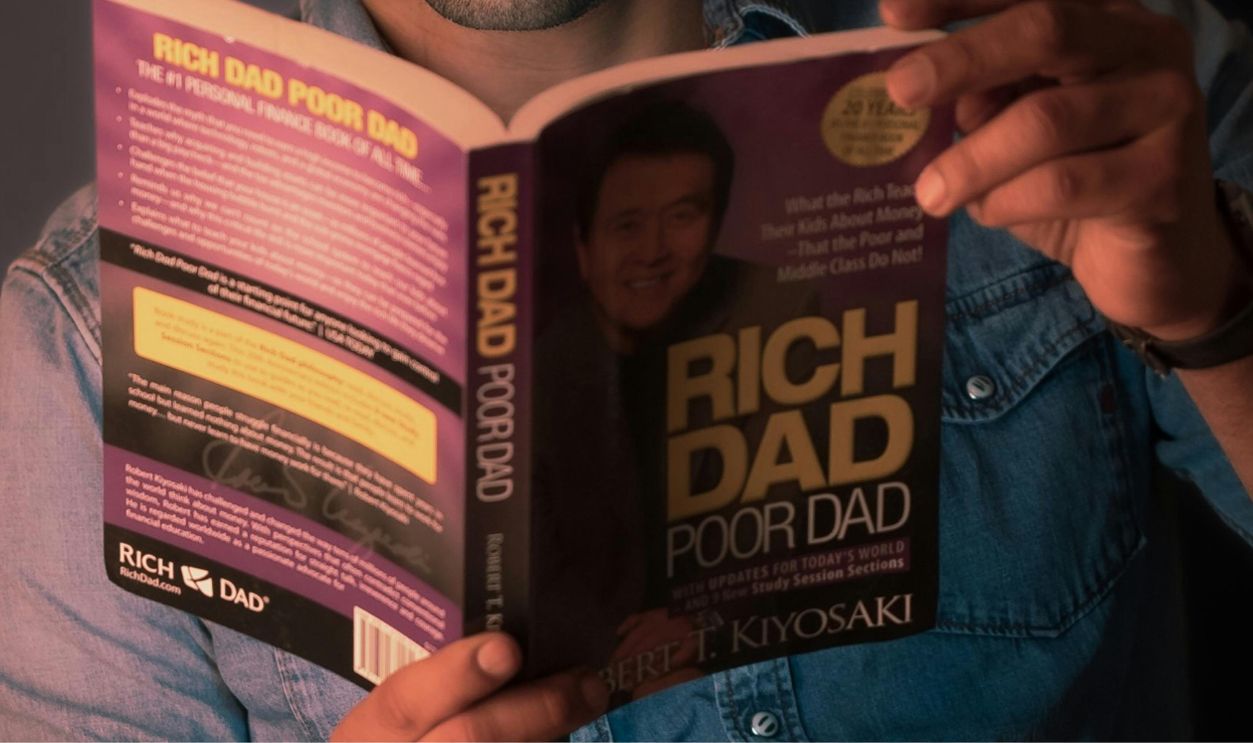

It is always best to know who is giving the advice, right? So, meet Robert Kiyosaki. He is an author and money guru who has had phenomenal success publishing the widely read book Rich Dad Poor Dad. Through his dynamic presence on X and other platforms, he champions financial education.

Gage Skidmore from Peoria, AZ, United States of America, Wikimedia Commons

Gage Skidmore from Peoria, AZ, United States of America, Wikimedia Commons

Why Kiyosaki Is Warning The Boomers

While Boomers have enjoyed a remarkable run of market prosperity, Kiyosaki's latest warning flips that rosy script on its head. The financial expert sees traditional buy-and-hold strategies becoming shakier ground, urging this lucky generation to reassess their portfolios before a major crash disrupts their income streams. What follows are his suggestions.

Diversify Your Income Sources

The traditional reliance on 401(k)s and IRAs has become increasingly precarious in today's volatile market environment, according to Kiyosaki. However, he sees this uncertainty as a gateway to opportunity. On this, he advocates that Boomers strategically diversify their income streams beyond conventional retirement vehicles into alternative asset classes.

Go The Real Estate Strategy Way

Many of us grow up dreaming of that perfect family home. Still, Kiyosaki urges a dramatic mindset shift: letting go of the emotional view that primary residences are the key to building wealth. His pragmatic approach champions cash-flowing rental properties as true investments, which challenges traditional assumptions about homeownership.

Let Go Of Overvalued Positions

Smart investors know when to let go, and Kiyosaki's advice to trim overvalued positions reflects this wisdom. By setting clear pivot rules instead of clinging to buy-and-hold strategies, his adaptable approach often startles traditionalists but offers a more responsive path to financial survival.

Accumulate Gold And Silver

When markets eventually falter and the dollar's strength wanes, those holding traditional paper assets may face severe losses. This scenario drives Robert Kiyosaki's urgent counsel to accumulate gold and silver—"real money" that historically weathers economic storms, providing a strategic hedge against inflation and financial instability.

Consider Bitcoin Allocation

The market turbulence always keeps investors on edge. And on this, Kiyosaki points to Bitcoin as a potential safe harbor. Its scarcity and independence from government control are his reasons to endorse Bitcoin. He particularly advises Baby Boomers to consider adding this non-sovereign asset to retirement portfolios.

Advance Your Financial Education

Misguided financial advice and poor decision-making create a threat to wealth building. But Kiyosaki's educational approach offers targeted solutions. Through Rich Dad Poor Dad and his ongoing teachings, he delivers essential financial literacy. Boomers should follow closely while also reading widely.

Think Beyond The 60/40 Mix

The investment world has long embraced the 60/40 stock-bond allocation as a fundamental truth in retirement planning. But Kiyosaki sees things differently. His experience challenges conventional wisdom to reveal how this once-golden standard now leaves portfolios vulnerable to modern market dynamics, necessitating more sophisticated approaches.

Eliminate Consumer Debt

Like chains that slowly rust away, high-interest consumer debt keeps countless people tethered to financial stagnation. The path to liberation here is to methodically eliminate these burdensome obligations to unlock precious cash flow, build resilience against market downturns, and ultimately seize emerging opportunities with newfound financial freedom.

Have A Working Cash Strategy

Watching your cash sit idle in a bank account? That's a recipe for losing value to inflation, warns Robert Kiyosaki. His strategic solution is to maintain only enough working capital for daily expenses while channeling surplus funds into value-preserving assets, such as real estate, precious metals, or Bitcoin.

Dive Into A Self-Directed IRA

While traditional retirement accounts confine investors to conventional market options, self-directed IRAs unlock a broader investment spectrum. Kiyosaki endorses these flexible vehicles specifically for their capacity to incorporate alternative assets, such as real estate and cryptocurrency, viewing this diversification as strategic armor against market volatility.

Look Into Social Security Projections

While many Boomers envision Social Security as their retirement bedrock, Kiyosaki exposes a starker reality: these anticipated benefits may prove dangerously inadequate. His analysis reveals how overreliance on government programs, without conservative planning and diverse income sources, leaves retirees vulnerable to market shifts and benefit shortfalls.

Consider Downsizing

When weighing the burden of maintaining an expansive lifestyle against Kiyosaki's downsizing strategy, the math becomes compelling. Reduced housing and living costs create a powerful domino effect, because they transform overhead expenses into liquid capital and convert financial constraints into dynamic investment possibilities.

Consider Trading Guardrails

Just as regular health screenings prevent medical emergencies, Kiyosaki prescribes proactive investment reviews and trading guardrails as preventive medicine against emotional decision-making. This disciplined approach helps Boomers maintain strategic clarity when market turbulence threatens to cloud their investment judgment.

Consider Real Asset Allocation

Constructing a deliberate allocation to real assets forms the cornerstone of Kiyosaki's investment framework. Through a balanced mix of gold, silver, Bitcoin, and income-generating real estate, this portfolio architecture delivers dual strategic advantages. It reduces government dependency and enhances resilience against geopolitical instability.

Have A Liquidity Reserve

The 2008 financial crisis revealed a timeless truth that shapes Kiyosaki's liquidity rule: those with ready cash reserves emerged as market victors. This pattern of opportunity amid chaos drives his emphasis on maintaining "dry powder"; liquid assets poised to seize plan-aligned possibilities during inevitable downturns.

Consider Income-First Investing

Monthly income streams form the bedrock of Kiyosaki's investment philosophy, building upward through his strategic hierarchy of income-producing assets. Such an approach is especially resonant for Boomers living through uncertain markets. It helps one prioritize steady cash flow over speculative gains.

Buy During Selloffs

Success in market downturns begins with strategic foresight: mastering asset fundamentals through diligent pre-vetting, then systematically converting traditional holdings like homes and stocks into cash during peak valuations. This methodical preparation enables decisive action when premium assets like gold become available during panic selloffs.

Hone In On Inflation Awareness

Inflation's "silent tax" systematically dissolves wealth while mounting government debt reshapes the economic landscape. Kiyosaki's analysis reveals how these forces are changing traditional money rules, and this leaves millions of savers exposed to unprecedented wealth erosion.

Photo By: Kaboompics.com, Pexels

Photo By: Kaboompics.com, Pexels

Factor In Pension Risk

Rampant inflation and systemic mismanagement have triggered devastating market instability to create what Kiyosaki identifies as an existential threat to pensions and 401(k)s. This cascading crisis demands strategic wealth protection through real assets, as retirement security faces unprecedented institutional pressures from both Wall Street and government actions.

Photo By: Kaboompics.com, Pexels

Photo By: Kaboompics.com, Pexels

Adopt A Capitalist Mindset

Just as Monopoly players learn to win through acquiring properties that generate steady rent, Kiyosaki teaches wealth-building through real-world cash-flowing assets like businesses and real estate. Through this, Boomers can transition away from traditional retirement accounts and opt for precious metals, Bitcoin, and income-producing investments.

Go Small Business Or Side Hustle

Drawing from his own success as an entrepreneur, Robert Kiyosaki emphasizes the power of business ownership in building wealth. His experience shapes his advice to Baby Boomers, strongly recommending they launch small businesses or side hustles to create additional income streams and protect against market uncertainties.

Always Take Opportunities In Crisis

Market analysis reveals a consistent pattern: economic crises create distinct investment opportunities. Testing this hypothesis, Kiyosaki's methodology speaks of proactive financial planning over reactive responses. The results demonstrate how prepared investors consistently emerge stronger, validating his principle that adapting to changing money rules determines success.

Don’t Ignore The Economic Emergency

In his prescient work Rich Dad's Prophecy, Robert Kiyosaki forewarned of impending economic turbulence that most remain blind to today. As this financial storm approaches, he stresses that Baby Boomers must urgently pivot toward income-generating assets to safeguard their wealth through a proactive portfolio.