Between Patience And Panic

You can walk away now or hang on a little longer and see where the market goes. Both paths have trade-offs—no promise of calm or cash. Take your time and pick what feels right for you. Consult if you must!

Sell If Major Repairs Outpace Your Savings

Large-scale issues—like cracked foundations or compromised framing—can eat through savings faster than expected. Once repair bids start rivaling your emergency fund, it’s time to exit before your asset turns into an open-ended project with no clear financial ceiling.

Keep If Roof Replacement Strengthens Long-Term Value

A complete roof replacement might feel like a hit, but it safeguards your property’s reputation. The market prefers condos with completed repairs and no looming costs. Holding through the project can mean listing a safer, more desirable home when the dust clears.

Sell If Flood Damage Keeps Bringing New Assessments

Water intrusion never ends with one repair. Flood-prone condos face repeated waterproofing projects and skyrocketing insurance premiums. When you put the home on the market before another assessment is announced, you can save equity and avoid disclosure headaches.

Helena Jankovicova Kovacova, Pexels

Helena Jankovicova Kovacova, Pexels

Keep If Building Upgrades Improve Safety And Reliability

When your assessments fund critical updates—plumbing, wiring, or drainage—it’s an investment, not a setback. Completed work reduces liability and supports higher resale value. Waiting it out may turn short-term pain into lasting neighborhood credibility.

Sell If Market Prices Are Sliding Every Month

A steady drop in comparable sales can transform a mild loss into something far more severe. An early exit helps preserve remaining value before appraisals slide further. It serves as a calculated move—leaving on your own terms before the market deems the property “troubled”.

Keep If Assessments Are Stabilizing And Buyers Are Returning

After big projects finish, predictable dues restore confidence. If your condo’s location is strong—good schools or amenities—buyers reappear quickly. Holding through recovery can make temporary budget stress a future profit once the market regains balance.

SevenStorm JUHASZIMRUS, Pexels

SevenStorm JUHASZIMRUS, Pexels

Sell If Insurance Premiums Keep Rising Without End

Insurance hikes drain value. And they also shrink buyer pools. When master coverage costs double, mortgage approvals get tougher. Offload early, before the next premium spike. This may keep your sale price intact when others struggle to close deals.

Keep It If You Can Handle Short-Term Costs In Retirement

If your retirement income can handle a temporary spike, stay put—it could be smart. Once major repairs wrap, dues drop, and your budget breathes again. Waiting may preserve lifestyle stability—especially if selling would mean higher rent elsewhere.

Sell If New Condo Developments Are Stealing Buyers

Brand-new units nearby change expectations overnight. Shiny lobbies and incentives pull interest from older buildings. Sell before those projects flood the listings, as it lets you capture remaining demand while your property still feels competitive in the market.

Keep If HOA Problems Can Be Fixed From Within

Don’t run from a mess you can clean up. Rally your neighbours to replace a mismanaged board and restore order. Once accountability returns, assessments flatten, and your condo’s resale value recovers faster than if you’d sold in frustration.

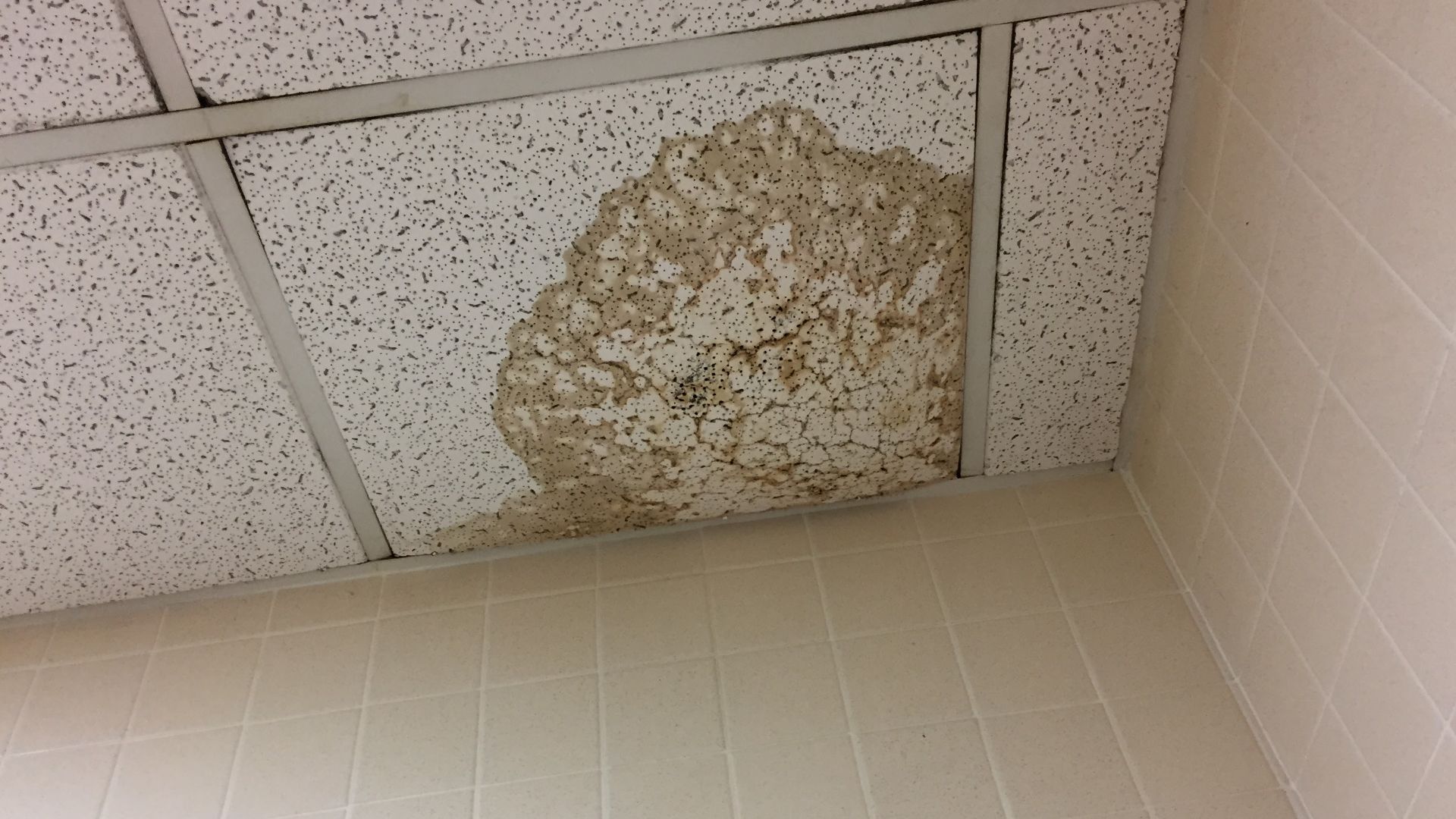

Sell If Deferred Maintenance Is Turning Into Endless Assessments

When your condo’s repair list keeps growing, it’s a red flag for future costs. Roof leaks, foundation damage, cracked parking lots, and aging wiring seldom remain minor concerns. Early awareness of such problems keeps repair costs contained and shields finances from the gradual erosion that follows repeated assessments.

Atomicdragon136, Wikimedia Commons

Atomicdragon136, Wikimedia Commons

Keep, If Refinancing Will Become Easier After Improvements

If your condo’s value is recovering post-upgrades, holding on could unlock better refinancing terms. Lenders reward well-maintained properties with lower rates and higher appraisals. When you wait through final repairs, you can position yourself for better equity access rather than taking a loss too soon.

Sell If Monthly Dues Rival Rent Elsewhere

Once HOA costs approach what you’d pay for a larger rental, ownership loses its edge. Letting go of the home in this stage can keep your finances balanced while buyers still view the property as manageable—before it crosses into “too costly to carry”.

Keep If Health Or Safety Repairs Restore Buyer Confidence

Suppose your assessments target repairs that are absolutely necessary. Keep the condo! These include mold cleanup, fire (or earthquake) safety, or plumbing overhauls; patience might pay off. Once hazards are cleared, buyers reappear because of the lowered insurance premiums.

Sell If Legal Disputes Are Tanking The HOA’s Reputation

Litigation scares lenders. In cases where your HOA faces lawsuits over any issue, note that resale value plummets. The best way may be to sell before the case worsens. This may preserve what’s left of your equity—and keep you out of collective liability headaches.

Keep If High Dues Are Temporary And Value Will Normalize

Big jumps in dues don’t always last forever. When repairs wrap and the community stabilizes, fees often drop. If management is transparent and finances look steady, wait it out, as this could possibly convert painful assessments into proof of a responsible, fully funded association.

Nicholas Gemini, Wikimedia Commons

Nicholas Gemini, Wikimedia Commons

Sell If Investors Are Dumping Units At Discount Prices

After bulk owners pull out, values often nosedive, leaving individual owners stuck with depreciated assets. An early exit prevents being trapped as listings surge and prices sink. Holding firm too long risks converting a manageable setback into a drawn-out decline toward bank-owned status.

Keep If High Interest Rates Are Scaring Away Buyers Temporarily

Interest rate spikes can stall sales across the board. And so, if your area’s demand remains strong but credit costs are high, hold your ground. When rates ease, sidelined buyers flood back, and assessed condos gain traction again—especially those with completed repairs and updated amenities.

Keep If Assessments Fund Energy Upgrades That Boost Value

Projects like new insulation, solar panels, or efficient HVAC systems can attract eco-minded buyers later. Why? These upgrades lower long-term operating costs, making your condo more appealing once the work is complete. By staying invested in sustainability improvements, one can yield returns long after completion.

Sell If Structural Flaws Scare Lenders Away

Visible foundation cracks or unstable load-bearing walls signal risk to banks as much as buyers. A condo marked “structurally deficient” limits financing options, and this dramatically shrinks your buyer pool. Offloading early preserves equity while lending restrictions haven’t taken full hold.

Keep If Staying Through Repairs Strengthens The Property’s Future Value

Once major repairs are done, your building stands on solid ground—literally. Staying means enjoying the benefit when resale confidence returns. Buyers pay more for properties with documented structural fixes already completed.

Sell If The Daily Strain Outweighs Financial Hope

Constant HOA emails, rising fees, and mounting debt take a toll. Listing because of this resets your peace of mind and your finances. This offloading can protect mental health while preserving cash for a property that won’t keep demanding more.

Keep If HOA Lawsuits Are Near Resolution

Pending lawsuits scare off buyers, but once they’re settled, values rebound. If your HOA’s case is nearly over, the reserves will recover; wait it out because the final stretch could pay off. A clean legal slate always boosts resale strength once the dust settles.

Sell If Neighbor Defaults Threaten The Budget

Unpaid assessments from other owners create ripple effects—forcing emergency fees to fill the gap. Now, if you decide to stay during that slide, it means sharing others’s financial fallout. Sell before delinquency spreads to safeguard your own credit.

Vanessa Garcia, Pexels

Vanessa Garcia, Pexels

Sell If Constant System Failures Ruin Buyer Confidence

Plumbing leaks, HVAC failures, or electrical shorts. Whenever these keep recurring, reputation collapses. Buyers fear money pits as such, and so, selling before another costly round of assessments begins can save you from owning what everyone now calls the complex that never stops breaking.