Welcome to the Land of Shrinking Paychecks

Remember when you could afford groceries, gas, and a movie night without a panic attack? Let’s take a time machine back to the 1970s and see how everyday essentials have gone from normal to near-luxury in 2025.

Milk Money Madness

🍼 1970s: ~$0.60 per gallon

🥛 2025: ~$4.50 per gallon

That glass of milk you spilled as a kid? Worth a few gold coins today. Dairy’s soaring price makes oat milk suddenly look like a frugal genius move.

Mike Mozart from Funny YouTube, USA, Wikimedia Commons

Mike Mozart from Funny YouTube, USA, Wikimedia Commons

Filling Up = Emptying Out

⛽ 1970s: ~$0.36 per gallon

🚗 2025: ~$4.00–$6.00 per gallon (depending on state)

A full tank used to cost a few bucks and a smile. Now it's a budgeting event. Even hybrids are sweating at the pump.

Breakfast of Billionaires

🥣 1970s cereal box: ~$0.50

🥄 2025 cereal box: ~$5.50–$8.00

Your childhood bowl of Cap’n Crunch is now as valuable as a brunch entree. You’ll need to ration those Lucky Charms like survival food.

The $10 Lettuce

🥬 1970s: ~19 cents a head

🥗 2025: $3.00–$6.00 (depending on market)

Salads used to be for dieters. Now they’re for high rollers. That head of romaine has seen more markup than some tech stocks.

Raysonho @ Open Grid Scheduler / Grid Engine, Wikimedia Commons

Raysonho @ Open Grid Scheduler / Grid Engine, Wikimedia Commons

A Dozen Gold Nuggets

🥚 1970s: ~$0.60/dozen

🥚 2025: ~$4.00–$7.00/dozen

Eggs are no longer "the cheap protein." In 2025, you’re either baking a cake...or making a financial sacrifice.

Raysonho @ Open Grid Scheduler / Grid Engine, Wikimedia Commons

Raysonho @ Open Grid Scheduler / Grid Engine, Wikimedia Commons

Dining Out? Hope You Budgeted

🍔 Fast food meal, 1970s: ~$1.00

🍔 Fast food meal, 2025: ~$12.00+

What used to be pocket change for burgers and fries now looks like a casual sit-down splurge. "Dollar Menu" sounds like fantasy fiction.

Ismail guney belchicken, Wikimedia Commons

Ismail guney belchicken, Wikimedia Commons

Affordable Housing—Not in This Economy

🏡 1970s median home price: ~$23,000

🏡 2025 median home price: ~$400,000+

In the 70s, your home was affordable on one income. In 2025? It’s a multi-generational co-investment opportunity.

U.S. Dept. of Housing and Urban Development (HUD), Wikimedia Commons

U.S. Dept. of Housing and Urban Development (HUD), Wikimedia Commons

Rent Like It’s Rodeo Drive

🏠 Average rent, 1970s: ~$200/month

🏠 Average rent, 2025: ~$2,100+/month

Rent was once a line item. Now it’s a life decision. Welcome to Roommate Forever culture.

Architecturist, Wikimedia Commons

Architecturist, Wikimedia Commons

Movie Nights Are Box Office Breakers

🎬 1970s movie ticket: ~$1.55

🎟️ 2025 movie ticket: ~$14–$20

You used to get popcorn, a Coke, and a flick for under five bucks. Now? Just a ticket might cost you a car payment.

Going Out? Dress Rich

👖 Pair of jeans, 1970s: ~$15

👖 2025: ~$60–$150 for name brands

Denim has gone from workwear to wearable status symbol. Those ripped knees? Still full price.

ProjectManhattan, Wikimedia Commons

ProjectManhattan, Wikimedia Commons

The Great Coffee Uprising

☕ 1970s cup: ~$0.25

☕ 2025: ~$5–$8 (for specialty coffee) ~$3 (drip)

“Let’s grab a coffee” is now a shared luxury experience—best discussed over Venmo.

GoToVan from Vancouver, Canada, Wikimedia Commons

GoToVan from Vancouver, Canada, Wikimedia Commons

Air Travel Without the Flair

✈️ 1970s flight (domestic): ~$100–$150

✈️ 2025: ~$350–$600+ (and worse service)

Flying used to mean legroom and meals. Now you get sardine seating and surprise fees. Bring your own peanuts.

Austrian Airlines, Wikimedia Commons

Austrian Airlines, Wikimedia Commons

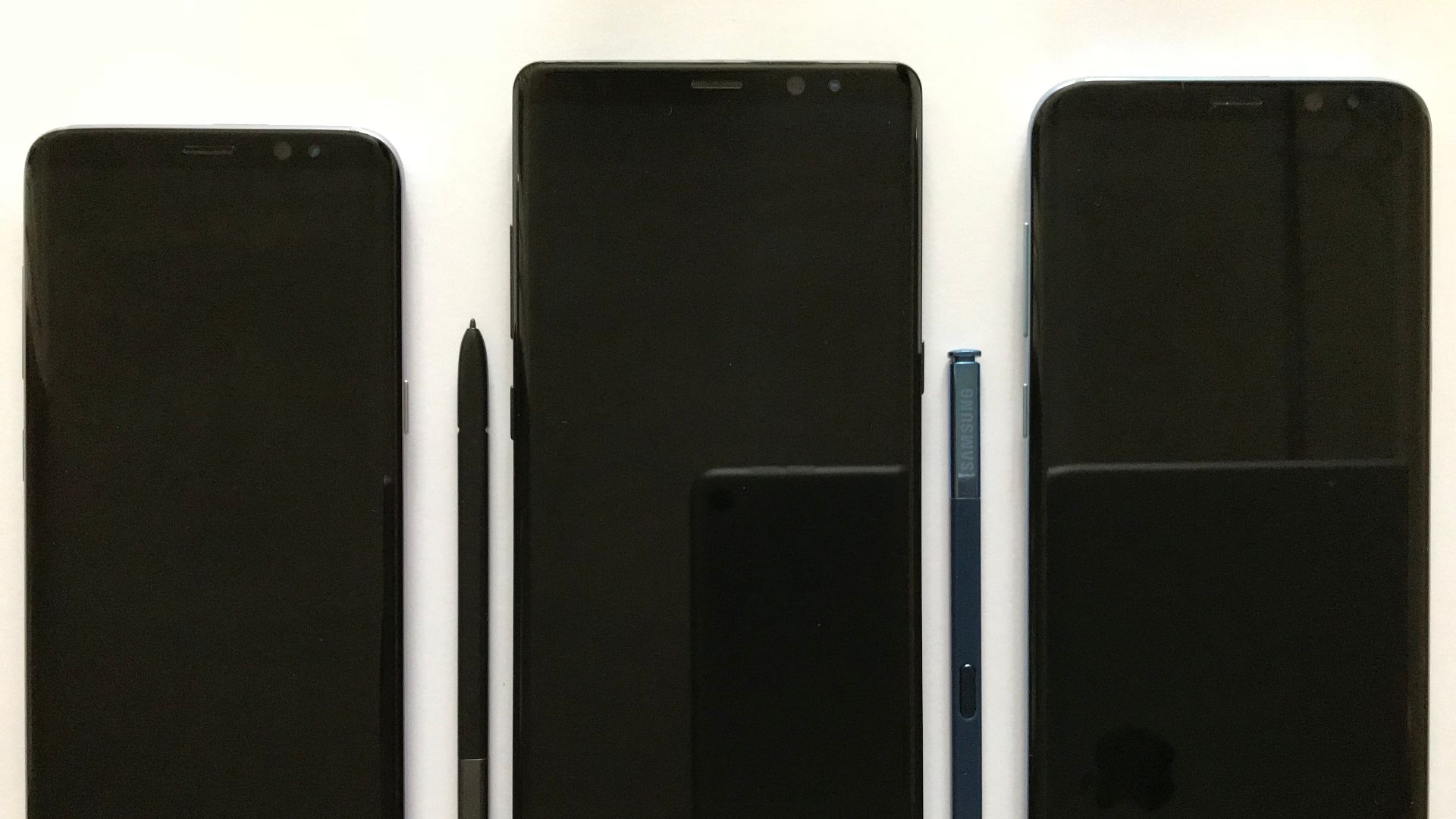

Phones Were a One-Time Buy

📞 Rotary phone, 1970s: ~$30–$50 (lasted decades)

📱 Smartphone, 2025: ~$800–$1,200 (replace every 3 years)

The price of a pocket computer now dwarfs old-school appliances. And don’t forget the $100/month plan.

Peng Jiajie, Wikimedia Commons

Peng Jiajie, Wikimedia Commons

Healthcare—If You Can Afford to Care

💉 1970s doctor visit: ~$25–$50

🏥 2025 visit: $200–$300+ (without insurance)

Seeing a doctor was once routine. Now it’s a privilege, a risk, and potentially a second mortgage.

https://pixabay.com/en/users/DarkoStojanovic-638422/, Wikimedia Commons

https://pixabay.com/en/users/DarkoStojanovic-638422/, Wikimedia Commons

College Costs: From “Huh” to “HELP”

🎓 1970s annual tuition (public): ~$500

🎓 2025: ~$10,000–$25,000/year (public); $60,000+ (private)

An entire four-year degree used to cost less than a used car. Now? It’s more than a starter home.

Amanda Lucidon, Wikimedia Commons

Amanda Lucidon, Wikimedia Commons

Childcare—The Hidden Mortgage

🧸 1970s average: Low-to-no cost (many stay-at-home parents)

👶 2025: ~$10,000–$20,000/year per child

Good childcare is now harder to find than a rent-controlled apartment—and about as expensive.

Airman 1st Class Hunter Brady, Wikimedia Commons

Airman 1st Class Hunter Brady, Wikimedia Commons

Owning a Car: Drive Now, Cry Later

🚗 1970s new car: ~$3,500

🚗 2025: ~$48,000 (average new vehicle)

What used to be a one-income purchase now competes with your retirement fund. Enjoy that monthly payment.

Helgi Halldórsson from Reykjavík, Iceland, Wikimedia Commons

Helgi Halldórsson from Reykjavík, Iceland, Wikimedia Commons

The Death of the Starter Pack

🛋️ 1970s starter home + car + college + wedding: ~$50,000

💸 2025: Nearly $500,000

What used to symbolize adulthood is now a fantasy bundle for influencers and lottery winners.

Hloom Templates, Wikimedia Commons

Hloom Templates, Wikimedia Commons

Owning Pets: A Fluffy Financial Burden

🐾 1970s annual cost: ~$100

🐕 2025 annual cost: ~$1,000–$3,000

Vet bills, premium food, pet insurance—owning a dog or cat in 2025 is a luxury hobby, not a norm.

Nenad Stojkovic, Wikimedia Commons

Nenad Stojkovic, Wikimedia Commons

Water, Water Everywhere... But at What Cost?

🚰 1970s water utility: ~$5/month

💧 2025: ~$80–$150/month in some areas

Even H2O has joined the luxury club. Droughts, surcharges, and infrastructure costs mean showers now come with guilt.

JovanCormac, Wikimedia Commons

JovanCormac, Wikimedia Commons

Privacy Has a Subscription Fee

🔒 1970s: Free—you just closed the door

🛡️ 2025: VPNs, ad blockers, encrypted apps = $$$

Maintaining privacy in 2025 is a tech-savvy investment. Every click costs.

mikemacmarketing, Wikimedia Commons

mikemacmarketing, Wikimedia Commons

The Rise of DIY Everything

🛠️ 1970s: Professionals handled it

📦 2025: YouTube, kits, and good luck

Calling a plumber or hiring a mover is practically an indulgence. In 2025, "figure it out" is the new motto.

Wille Öhgren, Wikimedia Commons

Wille Öhgren, Wikimedia Commons

The Luxury of Leisure

🕰️ 1970s work-life balance: Real weekends, real time off

😓 2025: Hustle culture, side gigs, and burnout

Free time is the new wealth. PTO feels like a myth—and weekends are just unpaid admin days.

Microbiz Mag, Wikimedia Commons

Microbiz Mag, Wikimedia Commons

Yesterday’s Ordinary, Today’s Extraordinary

From buttered toast to basic housing, everyday life in the 70s now feels like a curated luxury collection. If you're surviving 2025, congrats—you’re living the deluxe edition of adulthood.

i_hate_sult, Wikimedia Commons

i_hate_sult, Wikimedia Commons