Small Homes, Big Absence

Starter homes once sat quietly at the beginning of the housing story. They were not impressive, yet they worked. Over time, those homes became harder to find without anyone announcing their disappearance. Rules shifted, costs stacked up, and priorities drifted. This article follows how that slow change happened and why it stuck. Keep reading. The answers are less dramatic than you expect, which makes them harder to ignore.

What A Starter Home Once Meant

For decades, a starter home meant something modest and temporary. Buyers expected fewer rooms, smaller yards, and basic finishes. Ownership mattered more than size. Back then, the goal focused on entry in the housing industry, not perfection. That understanding shaped how entire neighborhoods first took form.

The Postwar Housing Surge

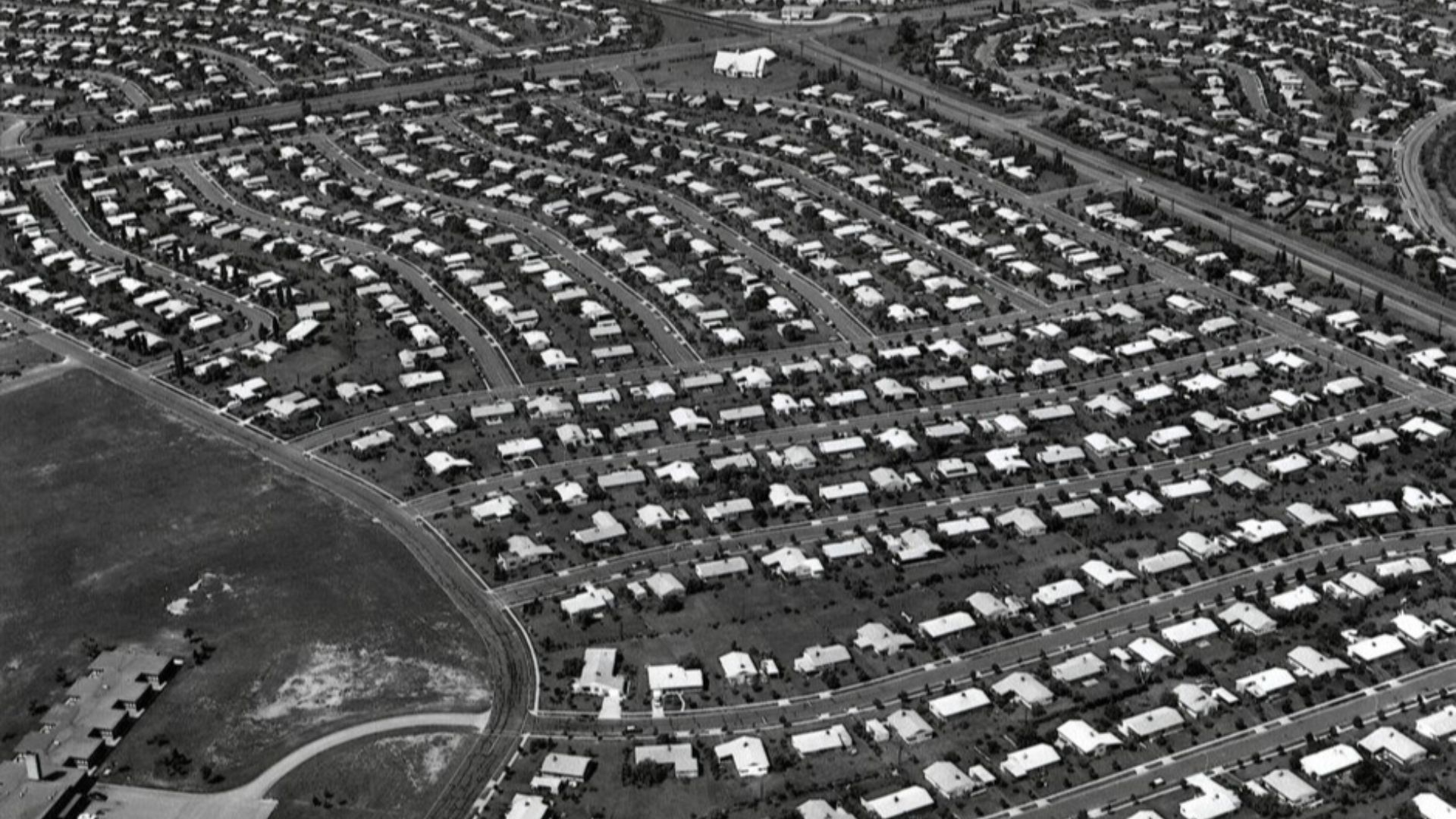

After World War II, demand for housing spiked sharply as millions returned home. Federal policy pushed speed and scale. Smaller homes also reduce material use and construction time. Because affordability drove approvals, compact designs became standard rather than a compromise within early suburban planning.

Gottscho-Schleisner Collection, Wikimedia Commons

Gottscho-Schleisner Collection, Wikimedia Commons

When Mass Production Took Over

Builders soon realized repetition solved more problems than creativity. Standardized layouts lowered labor time and reduced waste, while buyers accepted fewer choices in exchange for access. Comfort felt secondary then. Stability came first, and speed mattered more than extra space or features.

Riverview Homes Inc, Wikimedia Commons

Riverview Homes Inc, Wikimedia Commons

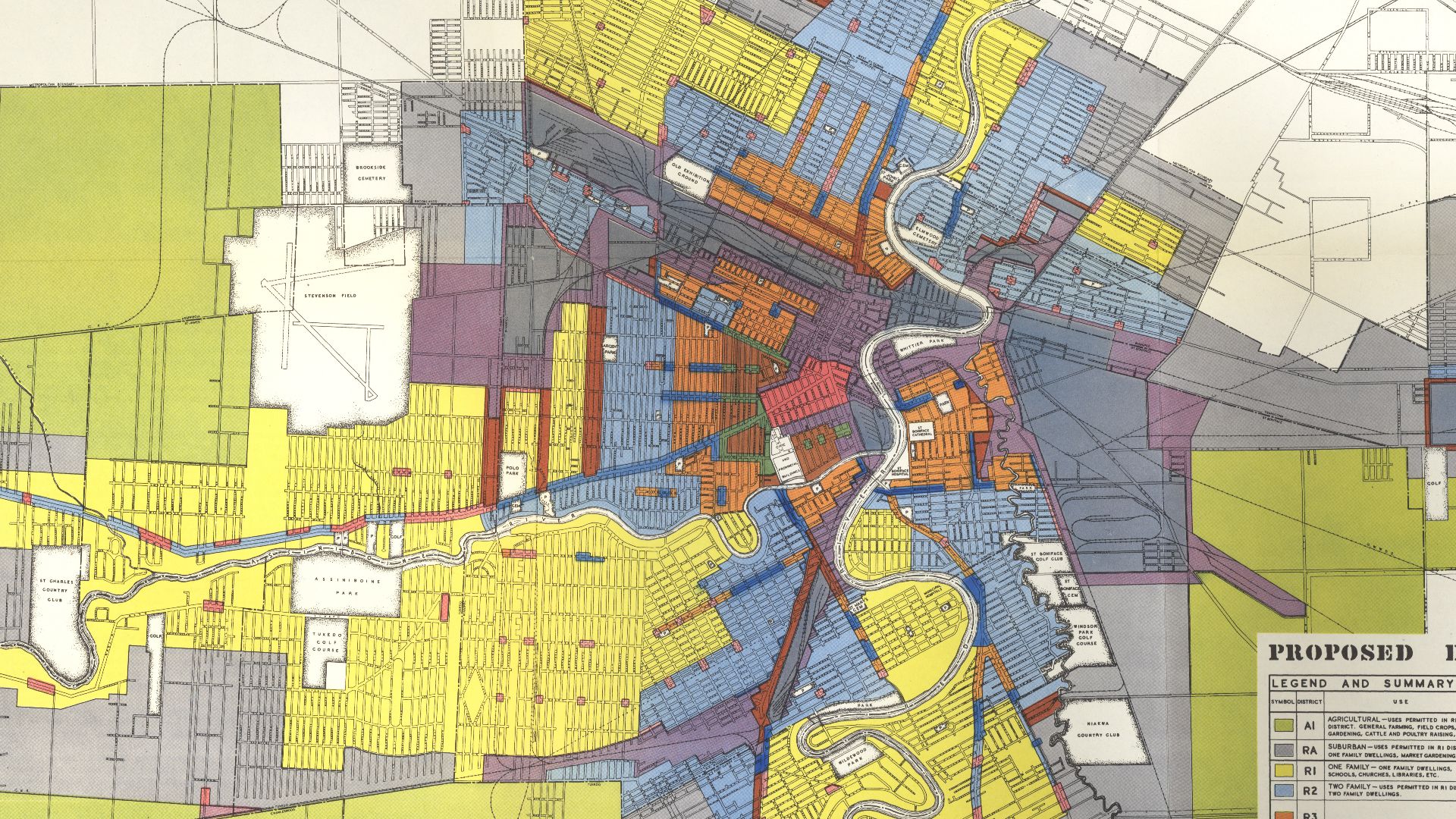

Zoning Began To Shift The Math

Local zoning rules changed gradually as early suburbs filled in. Minimum lot sizes increased, density limits followed, and approvals slowed. Because land costs applied regardless of house size, smaller homes lost their economic advantage, even though demand for them never fully disappeared.

Manitoba Historical Maps, Wikimedia Commons

Manitoba Historical Maps, Wikimedia Commons

Profit Started Choosing The Floor Plan

Developers did not abandon small homes out of principle. Economics made the decision. Larger houses generated higher returns on the same parcels of land, while fewer units reduced financial exposure. Over time, square footage expanded quietly, and starter homes slipped out of reach.

Fees Quietly Changed The Equation

Local governments added infrastructure and impact fees to fund growth. These charges applied per home, not per square foot. As a result, starter homes absorbed proportionally higher costs. Even modest houses carried the same financial burdens as much larger builds.

Land Became The Real Obstacle

As metropolitan areas expanded, land values rose faster than construction costs. Because land expenses stayed fixed regardless of house size, builders faced pressure to spread that cost across larger homes. Eventually, small houses stopped making financial sense on increasingly expensive parcels.

Small Builders Fell Behind

Earlier starter homes often came from small, local builders who worked lean. Over time, rising regulatory complexity favored larger firms with legal teams and capital reserves. Soon, many of those smaller operators exited the market or were consolidated into larger firms, taking flexible building practices with them and narrowing what could be built profitably

Unknown authorUnknown author, Wikimedia Commons

Unknown authorUnknown author, Wikimedia Commons

Expectations Started To Shift

Buyers slowly adjusted to what the market offered. Extra bedrooms felt normal. Larger kitchens became standard. Starter homes also began to feel like compromises rather than beginnings. Meanwhile, marketing reinforced the idea that skipping small meant success rather than excess.

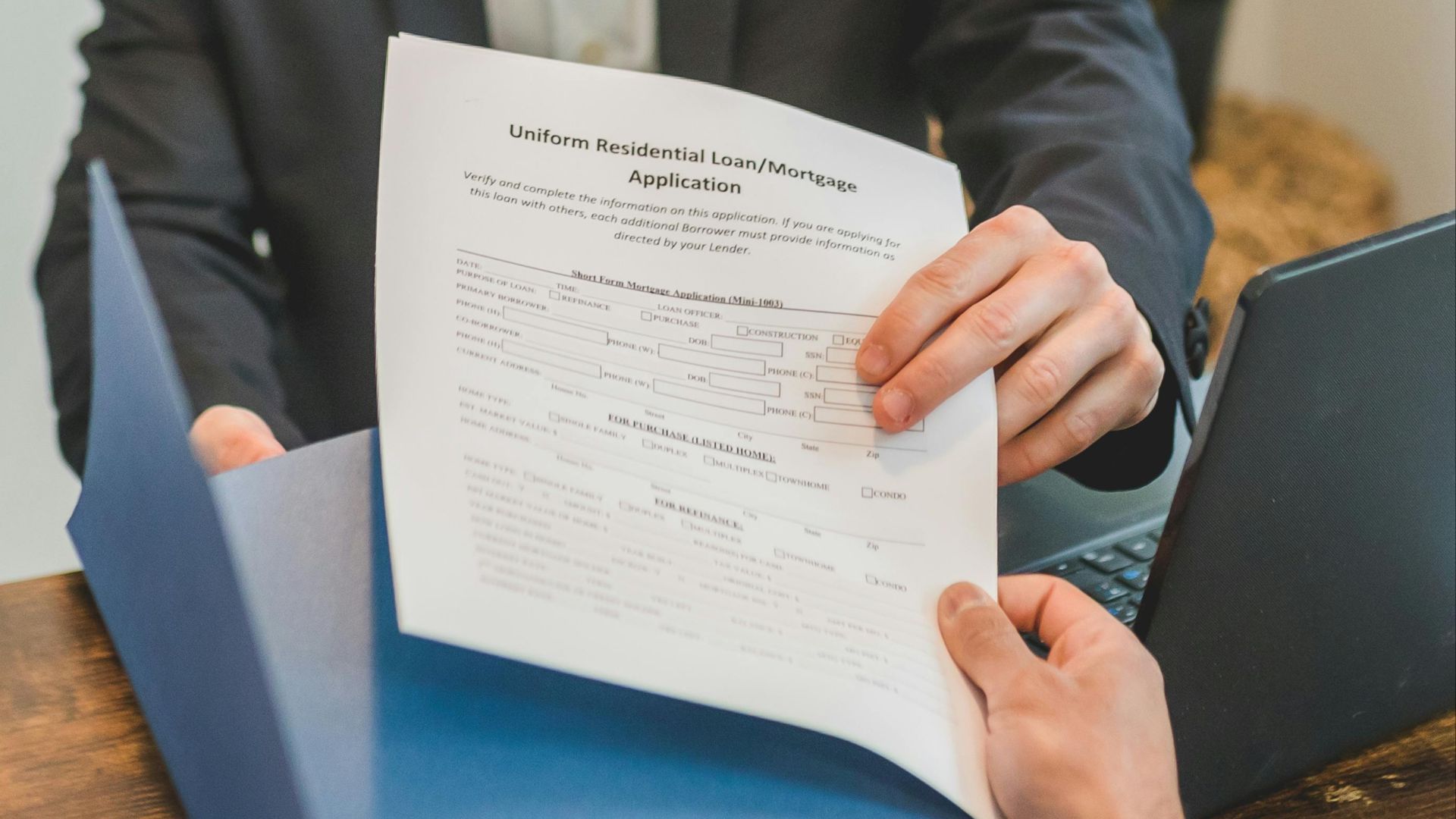

Bigger Loans Looked Better On Paper

Lenders rarely disliked starter homes. They simply preferred larger mortgages. Processing costs stayed similar, while returns increased with loan size. Naturally, financing flowed toward bigger houses. The market followed incentives, and modest homes found themselves politely ignored.

Inflation Rewrote Affordability

During the 1970s, inflation pushed mortgage rates sharply upward, which reshaped buying power overnight. Even modest homes became harder to finance as monthly payments climbed. Because affordability shrank faster than prices, many first-time buyers stalled, and builders adjusted toward higher-margin homes.

Rules Raised The Floor On Cost

Energy efficiency standards, safety requirements, and material regulations increased baseline construction costs. These rules applied evenly across all homes. As a result, smaller houses carried similar compliance expenses as larger ones, quietly erasing the price advantage that once defined starter housing.

Parking Took Up More Space

Mandatory parking requirements expanded the lot needs and construction costs. Even small homes often required multiple spaces. Because parking consumed land and money without adding living space, compact houses became harder to justify, especially in growing suburbs where every square foot already carried a premium.

Neighbors Became Gatekeepers

As neighborhoods aged, residents gained influence over local approvals. Smaller homes raised concerns about density and property values. Over time, opposition shaped zoning decisions. Protection of existing investments mattered more than creating new entry points for future buyers.

The Missing Middle Faded Quietly

Duplexes, townhomes, and small detached houses once filled the gap between renting and upgrading. Zoning changes restricted those options. Without that middle layer, buyers faced a sharper jump into ownership, while builders lost an entire category of practical, attainable housing.

Boys in Bristol Photography, Pexels

Boys in Bristol Photography, Pexels

Lending Quietly Tilted The Field

Mortgage markets also shifted toward efficiency and scale. Smaller loans generated similar administrative work with lower returns. Because of that imbalance, lenders favored larger mortgages. Credit access followed profitability, which gradually narrowed financing pathways for buyers seeking modest first homes.

Federal Housing Lost Its Urgency

After the early postwar decades, national housing goals faded as priorities changed. Federal policy moved away from direct affordability targets. Local governments gained control instead. Without a shared mandate to support entry-level housing, starter homes stopped receiving coordinated policy attention.

The Crash That Cleared The Board

The 2008 housing collapse wiped out builders who specialized in smaller projects. Credit froze, and demand vanished. When construction resumed, surviving firms focused on safer, higher-priced homes. Skills, plans, and supply chains tied to starter housing have not fully recovered in the mass market.

Investors Stepped Into The Gap

As construction lagged, investors moved quickly into entry-level housing. Modest homes offered reliable rental returns. Competition also intensified. First-time buyers found themselves bidding against capital, not families, which further reduced ownership access at the lowest price tiers.

Condos Became The Stand-In

Cities often allowed condominiums where small houses faced resistance. Density goals stayed intact. Ownership technically remained possible. Yet buyers traded yards and autonomy for fees and rules. The starter home survived in name only, reshaped to fit regulatory comfort.

Regional Rules Still Shape Outcomes

Starter homes never vanished everywhere. Regions with flexible zoning and smaller lot allowances continued building modest houses. Elsewhere, restrictive rules shut that door entirely. These differences reveal policy choice, not buyer preference, as the main driver behind uneven access to entry-level ownership.

Millennials Inherited The Shortage

By the time millennials reached buying age, the supply had already collapsed. Prices rose faster than wages. Entry-level options barely existed. Many skipped ownership or delayed it for years, not from disinterest, but because the first rung of the ladder was missing.

Demand Never Actually Left

Smaller households, aging populations, and first-time buyers continue to seek modest homes. Surveys show consistent interest. Yet construction rarely responds. The gap between what people want and what gets built exposes a market shaped more by constraint than demand.

Why The Starter Home Still Matters

Starter homes once offered stability without excess. Their absence reshaped wealth building and access to ownership. Restoring them would not fix everything. Still, bringing back that first step could rebalance a system that now asks too much at the beginning.

What Would Have To Change

Zoning reform, fee adjustments, and flexible parking rules could reopen space for starter homes. Financing models would need recalibration. None of this requires new technology. It requires permission to build smaller again and acceptance that modest can still mean valuable.